Trading Studies

This set of studies provides the Order Display study (indications on a chart for filled and working orders), open trade equity, current position, and profit and loss account statistics.

Study parameters are used to change display or calculation behavior. Parameters allow you to choose between all accounts or a single account and between the current instrument or all instruments. Studies respect account mapping when a specific account is used.

These studies, when applied to spreads, display the last value for the current bar only.

These studies can be applied to charts that offer an association of a bar with a specific bar time. They cannot be applied to the Market Profile chart. They do not support continuation mode and cannot be overlaid on a chart.

Access to trading studies requires an enablement.

*Market Profile is a registered trademark of CME

Order Display

This study offers a visualization to compare trading decisions with subsequent market action by marking executed trades on the price chart.

The study places symbols on a chart for any executed orders and plots horizontal lines for any working orders. The executed trade symbols are placed on the intraday bar the trade occurred during and at the price of the fill.

The plot for indicating a working order is a horizontal line. The line's starting point is the time the order was placed. The line displays the size of the working order. The working order can be canceled by right-clicking on the horizontal line and choosing cancel order from the menu.

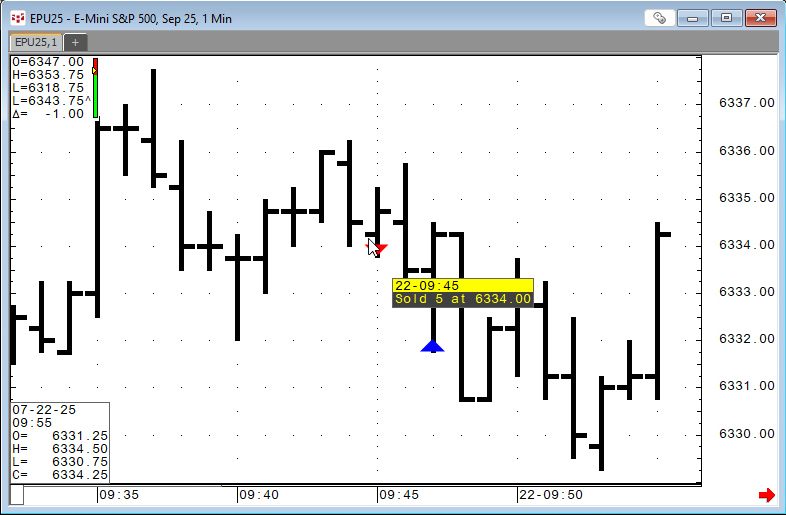

Rolling the mouse over the order display symbol on the chart opens a tooltip window detailing the date, time, bought or sold, and size of the filled order. The working order tooltip includes the same information and the type of working order.

Charts of synthetically traded spreads will display executed trade symbols and working orders on both the chart of the spread and the charts for the outright contracts. Charts of exchange traded spreads will only display the symbols on the chart for the exchange traded spread, not the outright legs.

If the Drag to Modify parameter is turned on, you can modify the working order price from the chart. A working order is displayed on the chart with its quantity. In this example, the working order quantity is 5:

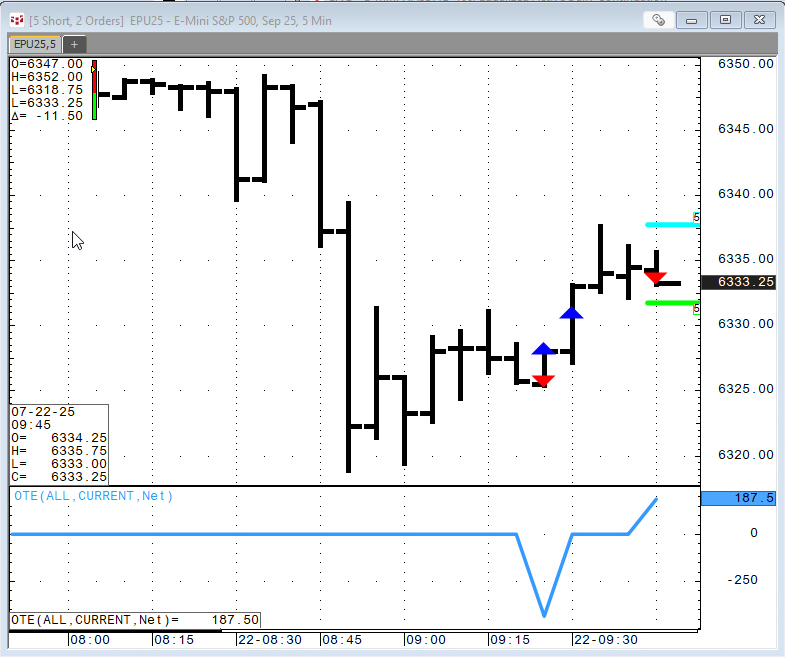

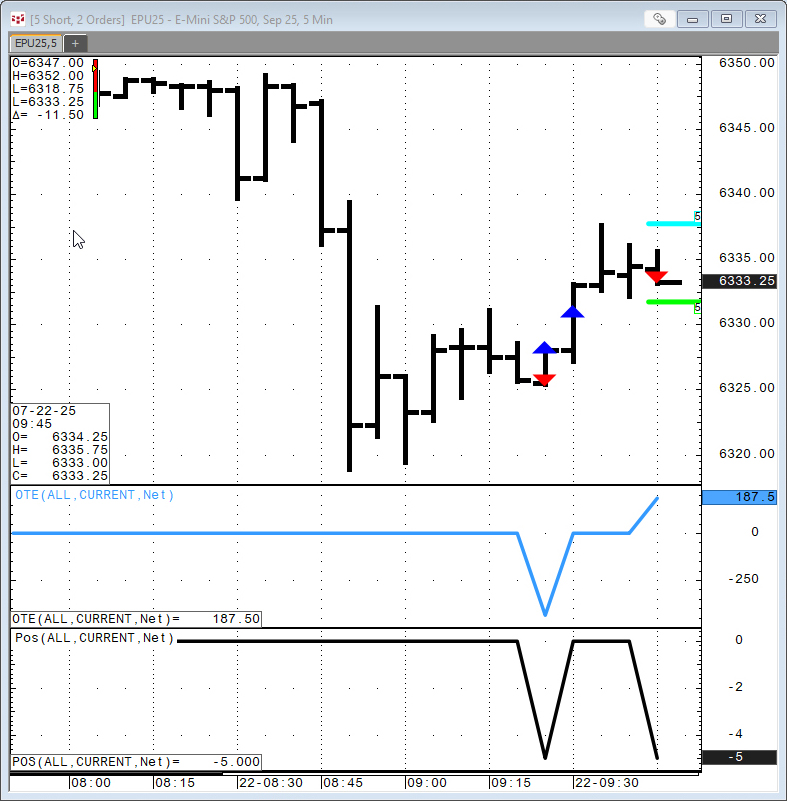

Open Trade Equity (OTE)

The OTE study has a single output representing OTE of the open position. For options, output represents MVO.

Currency is determined by contract and account:

- For a specific contract, the currency of the contract is used.

- For a specific account and all contracts, the reporting currency of the specified account is used. If it is not specified, USD is used.

- For all accounts and all contracts, USD is used.

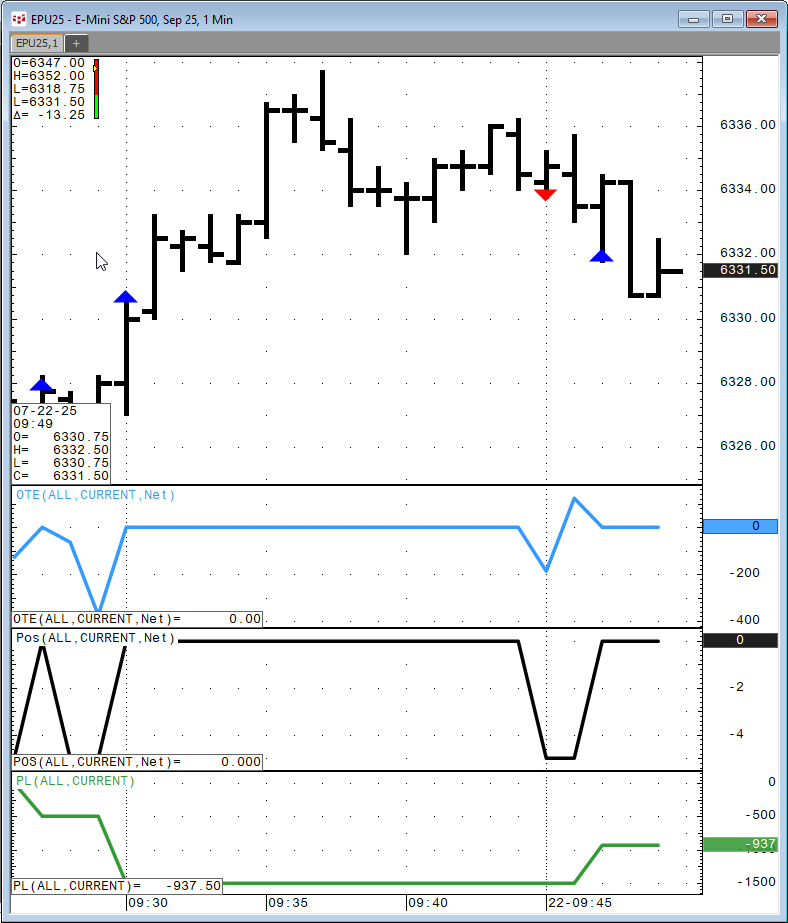

Position (Pos)

The Position study has a single output representing open position. Long positions have a positive value, while short positions have a negative value.

For the current trading day, position is calculated for the bar time.

Profit & Loss (P&L)

The Profit & Loss study is one of several trading studies. It has a single output representing profit and loss.

Currency is determined by contract and account:

- For a specific contract, the currency of the contract is used.

- For a specific account and all contracts, the reporting currency of the specified account is used. If it is not specified, USD is used.

- For all accounts and all contracts, USD is used.

For the current trading day, P&L is calculated for the bar time.

This set of studies can be helpful for recognizing how the market behaves following placing trades. The trades last for just two days.

Requires CQG Integrated Client or CQG QTrader.