This post presents an Excel dashboard for tracking the constituents of the Industrial Select Sector SPDR® Fund. So far, during 2025 the top performing sector is the Industrials Sector (up 17.63%) followed by the Technology Sector (up 12.67%). Here is a sector performance table:

| 2025 %NC as of 7/25/2025 | ||

|---|---|---|

| S.XLI | Industrial Select Sector SPDR | 17.63% |

| S.XLK | Technology Sector SPDR Fund | 12.67% |

| S.XLU | Utilities Select Sector SPDR | 11.67% |

| S.XLC | Communication Services Select Sector SPDR | 11.17% |

| S.XLF | Financial Select Sector SPDR | 10.57% |

| S.XLB | Materials Select Sector SPDR | 9.78% |

| S.XLRE | Real Estate Select Sector SPDR | 5.21% |

| S.XLP | Consumer Staples Select Sector SPDR | 3.68% |

| S.XLE | Energy Select Sector SPDR | 1.68% |

| S.XLY | Consumer Discretionary Select Sector SPDR | 0.23% |

| S.XLV | Health Care Select Sector SPDR | -0.79% |

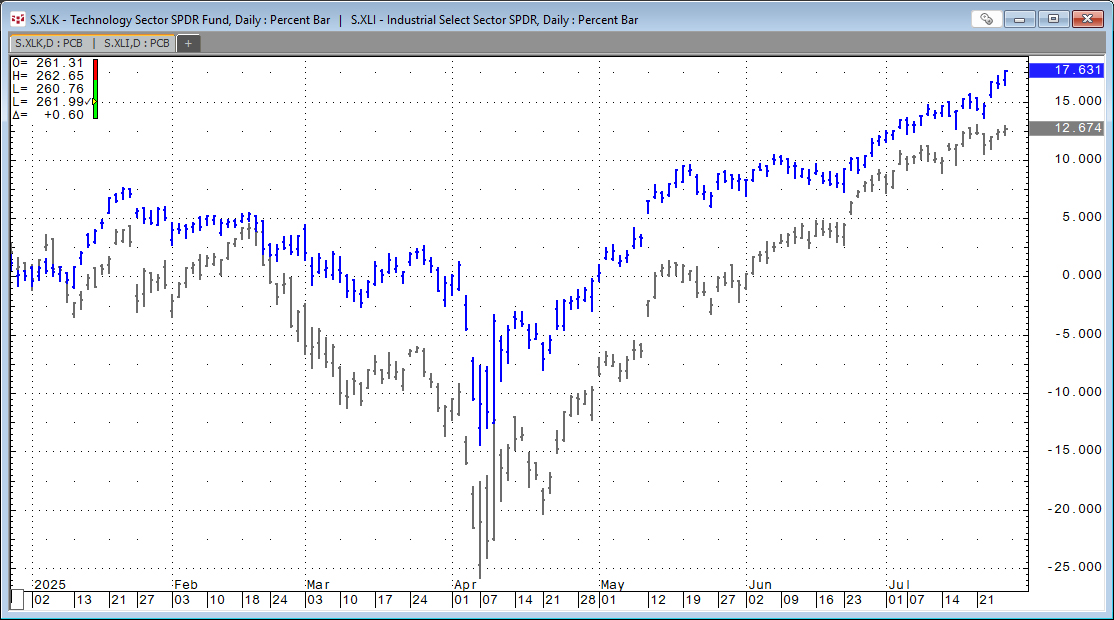

The chart below highlights the performance of the top two sectors using Industrial Select Sector SPDR ETF (Symbol: XLI, in blue) and the Technology Select Sector SPDR ETF (Symbol: XLI, in green).

XLK was down of 25% in April and XLI was down just less than 15% in April.

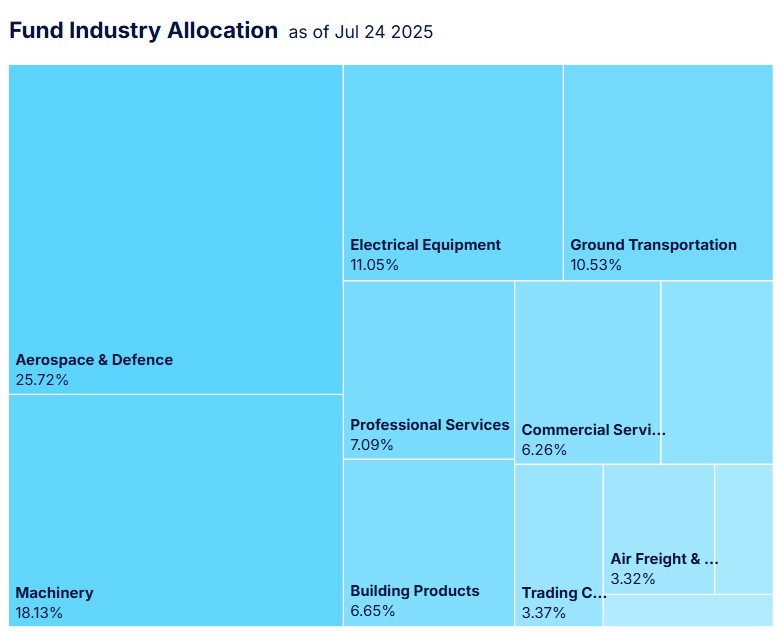

This diagram and table detail the ETF's breakdown by industry.

| Industry, as of 7/24/2025 | Weight |

|---|---|

| Aerospace & Defense | 25.72% |

| Machinery | 18.13% |

| Electrical Equipment | 11.05% |

| Ground Transportation | 10.53% |

| Professional Services | 7.09% |

| Building Products | 6.65% |

| Commercial Services & Supplies | 6.26% |

| Industrial Conglomerates | 4.79% |

| Trading Companies & Distributors | 3.37% |

| Air Freight & Logistics | 3.32% |

| Airlines | 1.79% |

| Construction & Engineering | 1.29% |

This table details the top ten performing constituents by percentage net change so far for 2025.

| Symbol | Description | Industry | 2025 %NC |

|---|---|---|---|

| GEV | GE Vernova Inc. | Energy | 95.79% |

| HWM | Howmet Aerospace Inc. | Aerospace | 73.28% |

| GE | General Electric Co | Conglomerate | 62.83% |

| UBER | Uber Technologies, Inc. | Transportation | 49.65% |

| JCI | Johnson Controls International plc | Conglomerate | 40.33% |

| HII | Huntington Ingalls Industries | Defense | 38.55% |

| RTX | RTX Corporation | Aerospace | 34.12% |

| PWR | Quanta Services Inc | Construction | 32.24% |

| FAST | Fastenal Co | Conglomerate | 31.85% |

| BA | Boeing Company | Aerospace | 30.80% |

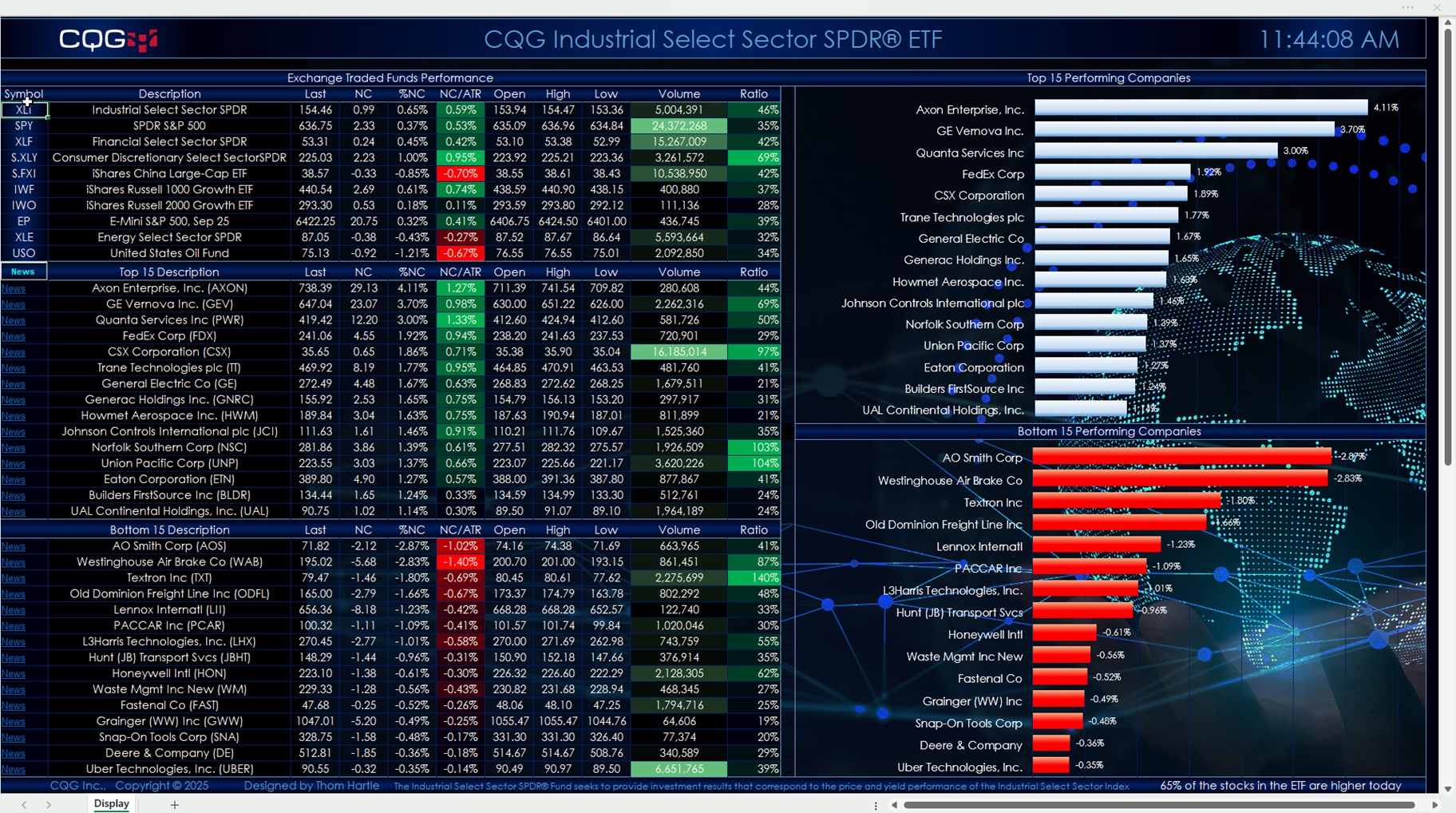

Below is an image of the downloadable Excel Dashboard. During the trading session, the Excel dashboard dynamically ranks the individual stocks. The Excel dashboard displayed below shows the top and bottom fifteen performers as histogram bar charts, along with their respective net percent change for today's trading session.

The quotes portion of the display is divided into three sections: The first section allows you to enter your own symbols. The second section displays the top fifteen performers. The third section displays the bottom fifteen performers.

Quote data includes today's net change as a ratio to the 21-day Average True Range study. Next to today's traded volume is a column that calculates the ratio of today's volume versus the 21-day average of the volume. This ratio column gives you a sense of how active today's trading is. Readings of 100% and higher indicate active trading.

A key feature is next to each company name is a link to Yahoo Finance. Clicking the News link will take you to the Yahoo page for that symbol. Note that this could take approximately 30 seconds to open in a browser. Turning off Extensions in your browser will make this happen faster.

If you open another Excel spreadsheet, then this dashboard will no longer be the active spreadsheet. The macro that updates the links and ranks the stocks by performance will stop. To start the macro, simply click the News toolbar button in the first column.

Make sure to lower your Excel Realtime Data (RTD) throttle to 50 milliseconds or lower. Learn how to do that here.

Two dashboards are available: One has a solid black background, and one has an industrial image background.

Downloads

Requires CQG Integrated Client or CQG QTrader, data enablements for the NYSE and Nasdaq stocks, and Excel 2016 or more recent.