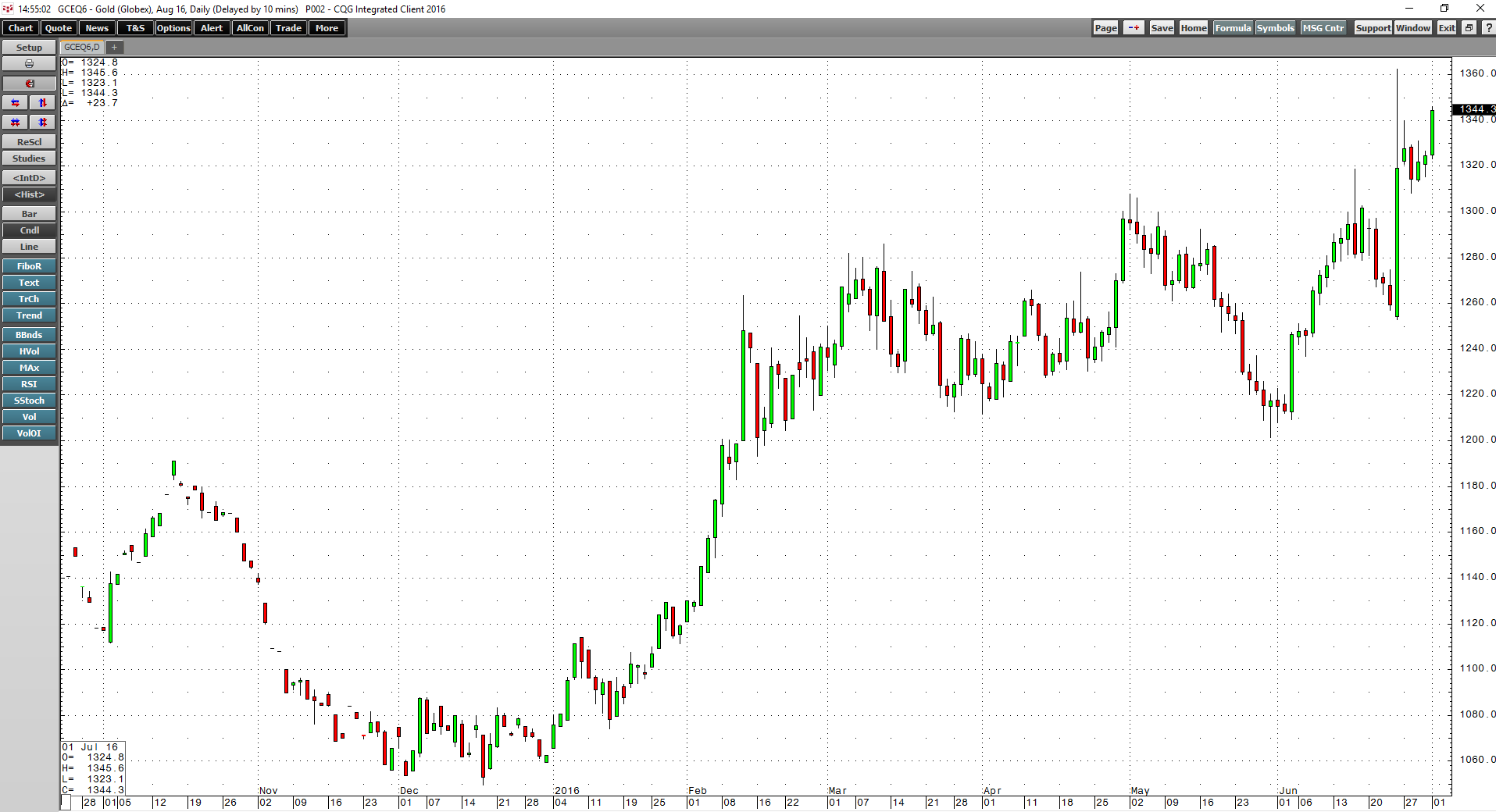

COMEX gold futures reached a record high in 2011 at $1,911.60. After a four-year correction, the price reached a bottom at $1046.20 in late 2015. In August 2020, the price eclipsed the 2011 high,… more

Andrew Hecht

The raw material markets moved lower in Q2 but were still higher than the level at the end of 2021. The commodity asset class consisting of 29 primary commodities that trade on US and UK exchanges… more

Gold and silver are the oldest means of exchange, far outdating dollars, euros, pounds, and all current traditional fiat and cryptocurrencies. The Bible’s old testament makes many references to… more

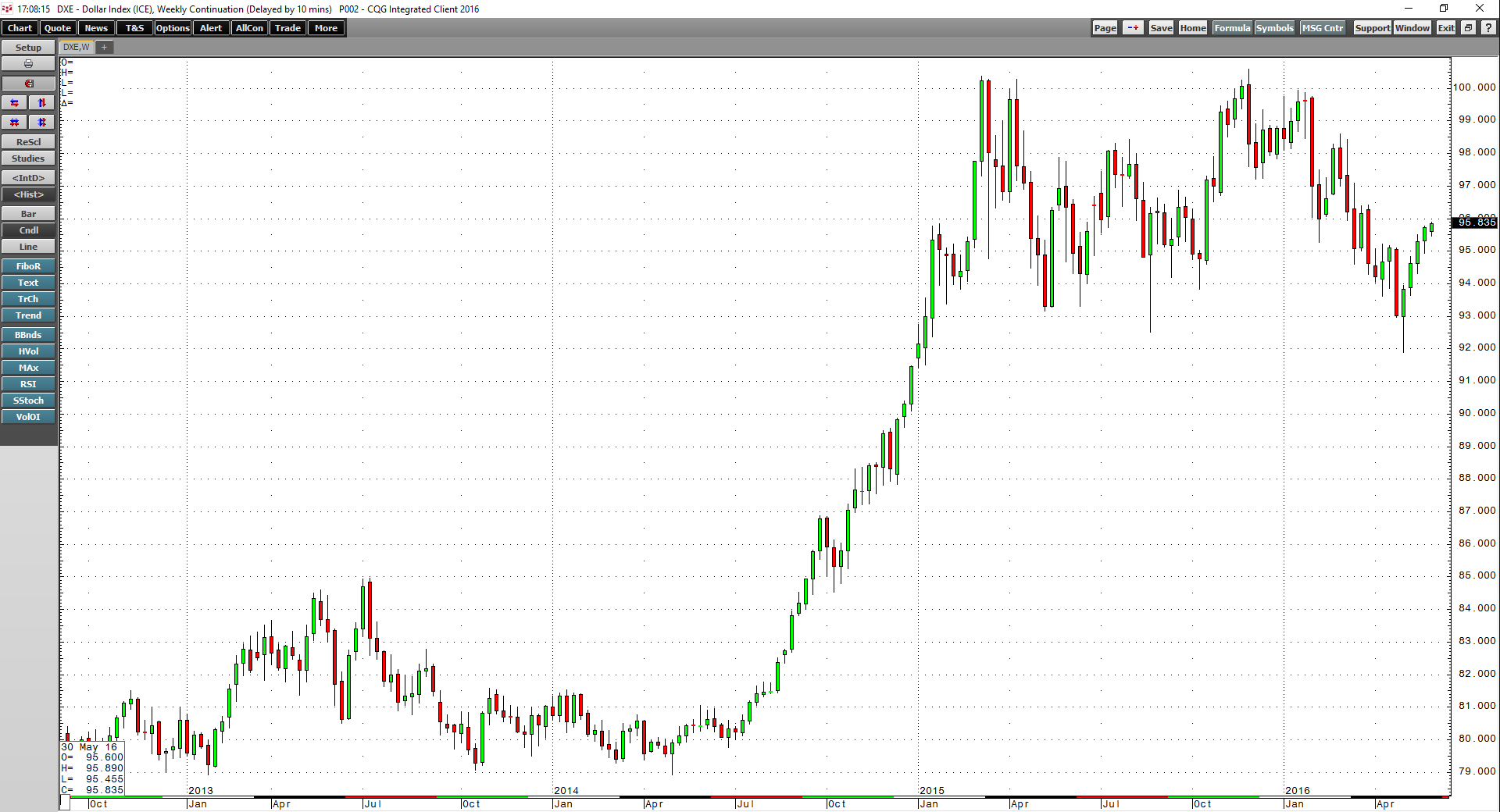

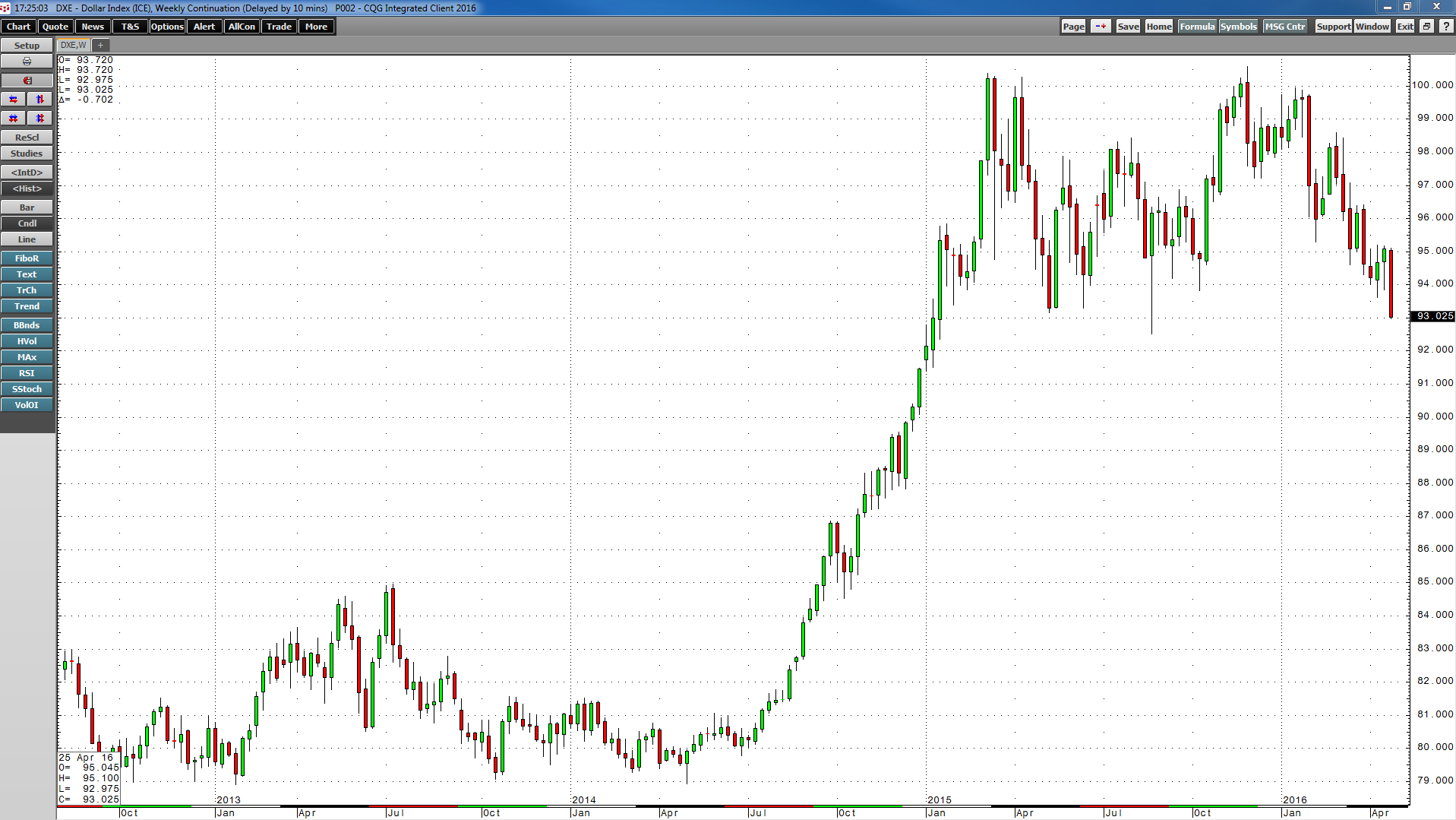

The dollar index exploded higher by 7.23% in Q4 2016, but most raw material prices ignored the greenback. The principal raw materials traded on US and UK futures exchanges rose by 3.75% in Q4. The… more

These upcoming events will impact commodities:

Election Day on November 8 OPEC meeting on November 30 Fed Funds rate decision in mid-DecemberIt has been a busy year, beginning… more

The second quarter of 2016 is now in the books. It was a quarter of fear of uncertainty, volatility, and gains for commodities. Overall, a composite of the 29 primary commodities that trade on… more

The US economy is the world’s largest. The US dollar has been the world’s most stable currency, and it is universally accepted as the reserve currency around the globe. The dollar is the benchmark… more

The 2012 drought sent grain prices to dizzying heights. Soybeans reached almost $18 while corn traded to highs of almost $8.50 and wheat moved above $9.45 per bushel. Since then, grain prices… more

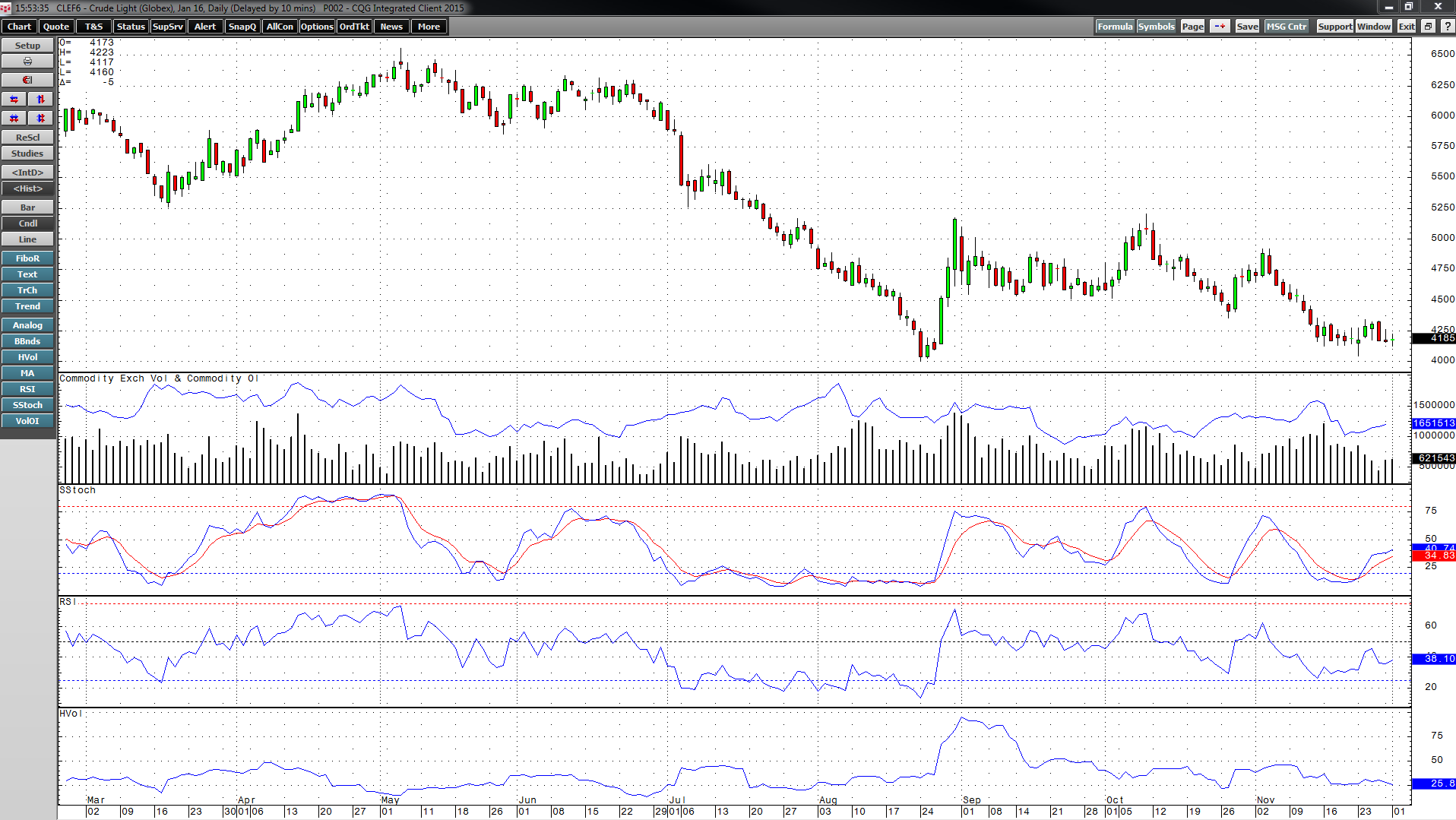

It has been a rough ride for crude oil since June of 2014 when the price of active month NYMEX crude was trading above $107 per barrel. Since then, the price has been making lower highs and lower… more

The price of active month NYMEX natural gas futures closed on September 30, 2015 at $2.524 per mmBtu. The fourth and first quarters are generally a positive seasonal period for the energy… more