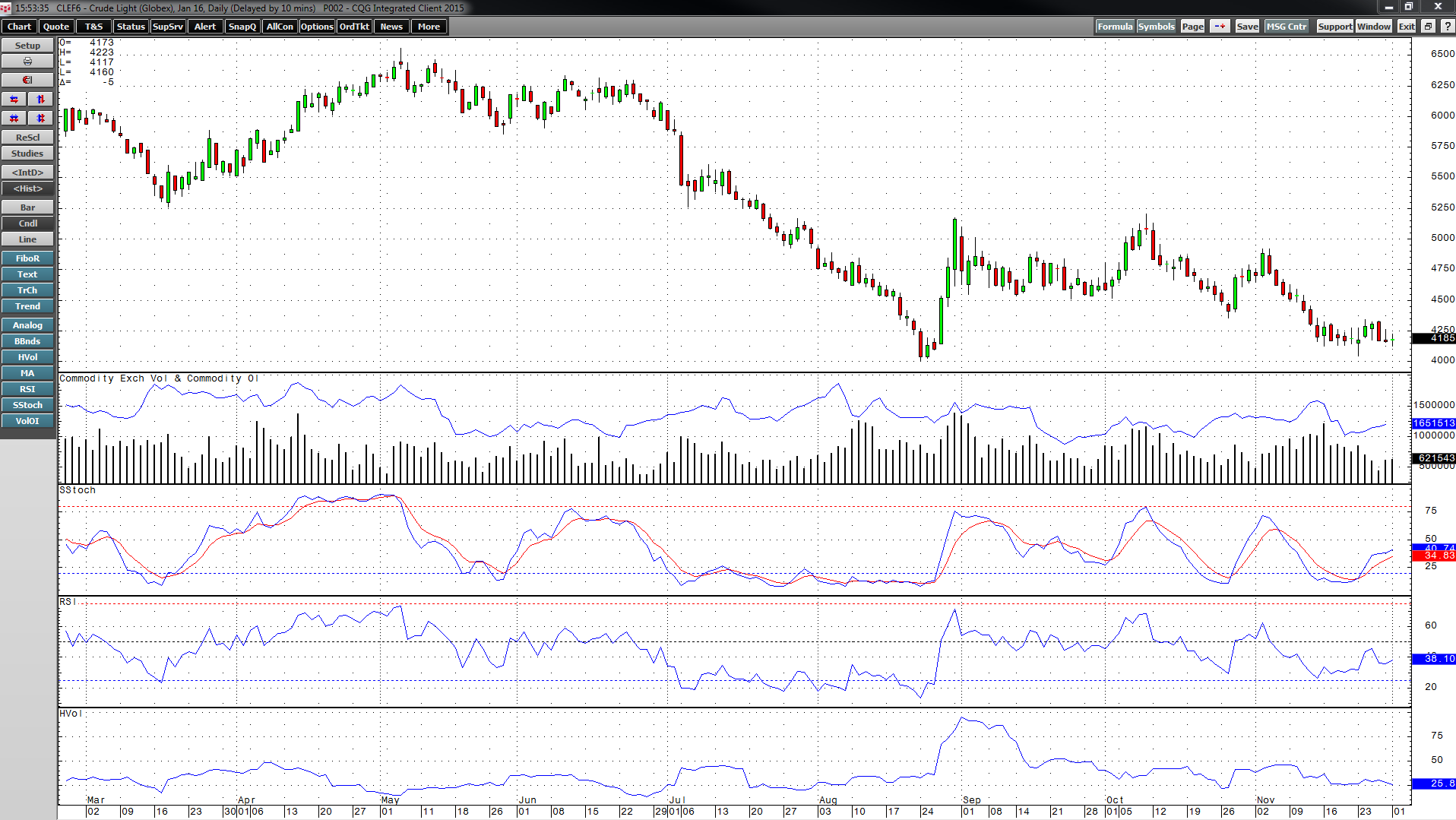

It has been a rough ride for crude oil since June of 2014 when the price of active month NYMEX crude was trading above $107 per barrel. Since then, the price has been making lower highs and lower lows. The energy commodity closed the month of November at $41.65 on the active month January futures contract.

As the daily chart highlights, January crude oil futures have been trading in a range between $40.41 and $43.46 since mid-November. Daily historical volatility, which traded up to almost 95% in early September, has collapsed to just over 22%, and while crude oil is technically in a range, fundamentals are mostly bearish.

Not a Pretty Supply-and-Demand Picture, but One Bright Spot

The fundamental state of the crude oil market at this time continues to be ugly and foster a lower price. While oil rig counts in the United States have dropped dramatically, oil production continues to flow. The latest report from Baker Hughes on November 25 told us that there are 555 oil rigs currently in operation compared with 1,572 last year at this time. However, oil production has not slowed commensurate with rigs in the US perhaps because producers are going after lower hanging fruit, low-cost production.

Meanwhile, Russia continues to produce over 10 million barrels of crude oil each day and OPEC is producing around 32.1 million barrels per day even though their stated ceiling is 30 million. The supply glut is apparent when looking at the one-year term structure in crude oil.

The daily chart of this spread highlights that the NYMEX January 2016 versus January 2017 spread was trading at $7.07 per barrel on December 1, which is a contango of roughly 16.9%. The same Brent oil spread closed at the same level. The wide contango is a validation of huge inventories of crude oil. Moreover, the Brent premium over WTI crude oil has moved to around $2.60 due to the prospects of increasing Iranian crude oil sales in the weeks ahead.

When it comes to assessing the fundamentals for crude oil, crack or processing spreads often offer important clues. Consumers do not buy raw crude oil, they buy oil products; therefore, demand for the energy commodity generally shows up in the product markets first.

The heating oil crack spread at $17 per barrel on the January contract on NYMEX is at the lowest level in years. The heating oil contract is also a proxy for diesel fuel. Last year this processing spread traded to lows of around $22. This tells us that demand for heating oil and diesel is weak - the spread has not been at $17 at this time of year since 2011. The only bright spot is the processing spread for gasoline, which at the $15 level, is $4 per barrel above last year's highs. The strength in gasoline is due to increasing driving because of low nominal gasoline prices, which is putting a strain on inventories at this time of year when demand tends to be the lowest of the year.

While there are some divergences in the world of crude oil these days, the majority of data is bearish. On Friday, December 4, the international oil cartel, OPEC, will sit down to discuss policy at a particularly stressful time for producers.

OPEC Meets at an Important Time

When OPEC met last November, the price was at the $75 per barrel level. Although crude oil had declined significantly from the June 2014 price, the oil ministers decided that they would leave production unchanged. They figured that lower prices might hurt them initially, but that would be worth the long-term benefits. The theory was that lower prices would force higher cost production from the market. This would increase market share for the members of the cartel and provide them with more control in terms of the international consumer markets for petroleum and petroleum products.

What the cartel members did not count on was the weak economic conditions around the world and the strength of production that would increase supplies and decrease demand in the months ahead. After the meeting one year ago, the price of crude oil went lower than OPEC had hoped.

When the cartel members reconvened in late spring, the price had rebounded to the $60 per barrel level. Once again, they left the production ceiling at the 30 million barrel per day level. Subsequent to that meeting, the price plunged, falling below $40 per barrel by late summer.

An OPEC Surprise is Highly Unlikely

The ministers face the same issues that they did at the last two meetings; however, this time the price is much lower. The oil ministers will be discussing the lowest oil price that they have seen in years when they sit down in Vienna on December 4. Weaker members of the cartel have been pressuring the stronger members to shoulder the burden of production cuts. The stronger members want no part of that.

On November 17, the OPEC board of governors announced that they could not agree on a "long-term strategy plan" to submit to the membership on December 4. The issues preventing them from agreement center on production quotas, curtailing output, and methods of maximizing member profits. The internal strife between members is a clear indication that the group will have problems agreeing on anything at this meeting. In any case, the OPEC meeting is always a source of uncertainty for the oil market and right now, all eyes are on the ministers and policy statement that will come out at 4:00 p.m. Vienna time on Friday, December 4 as to what they will or will not do.

The Bottom Line

Chances are that OPEC will leave their daily production ceiling unchanged and continue to sell more than that level. Meanwhile, the market expects nothing less from this meeting, but there is always the chance of surprise. The most interesting thing about crude oil today, to me, is the drop in daily historical volatility. Since volatility is the chief determinate of option prices, this means options are cheap. Options may be the best way to play the oil market going into the meeting of the cartel. After all, when you buy an option all you can lose is the premium that you pay.