The 2012 drought sent grain prices to dizzying heights. Soybeans reached almost $18 while corn traded to highs of almost $8.50 and wheat moved above $9.45 per bushel. Since then, grain prices entered a prolonged bear market. These essential commodities experienced a perfect bearish storm.

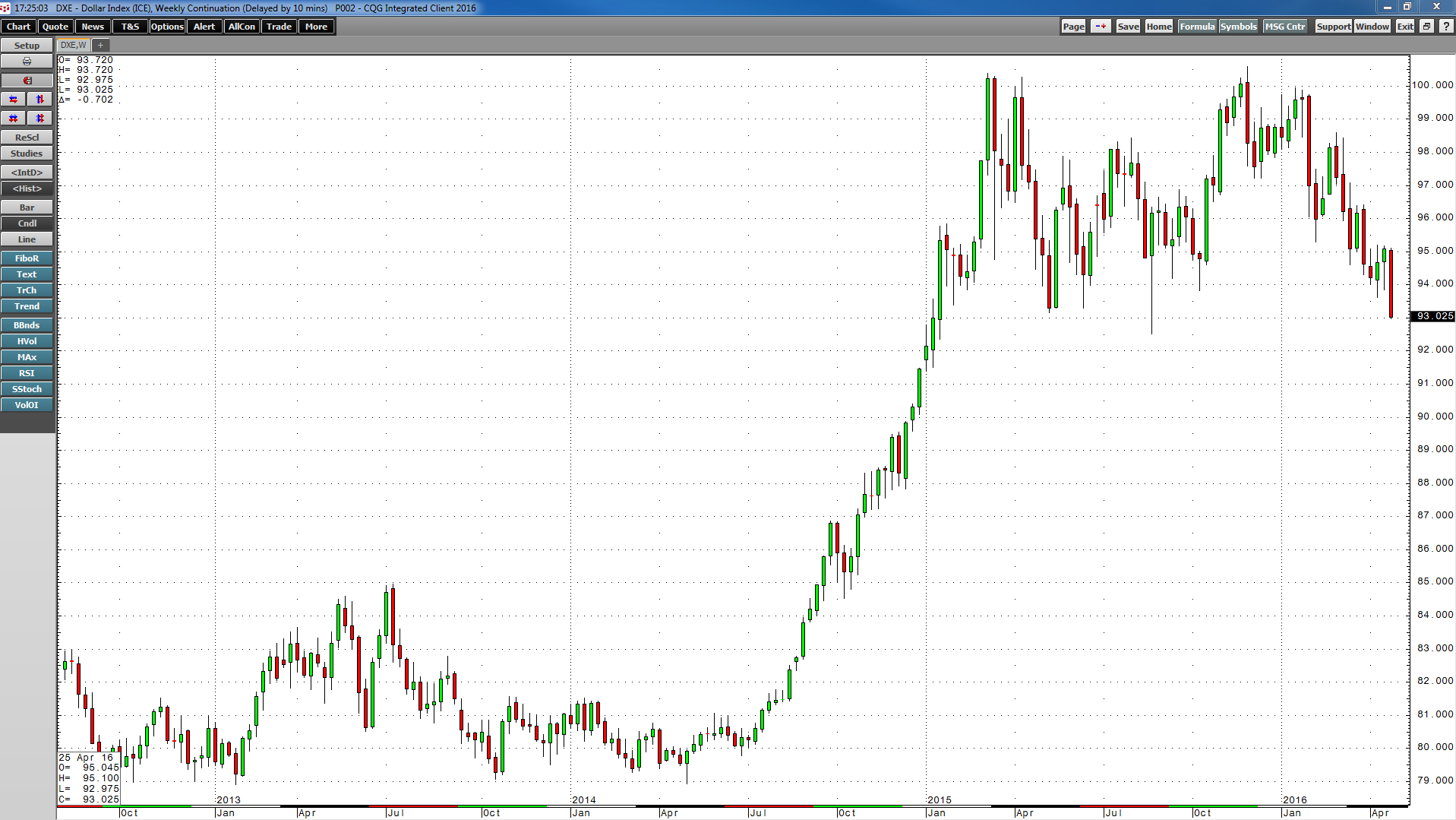

Three straight years of bumper crops led to oversupply in all of the major grains. Mother Nature, the ultimate arbiter of crop yields, blessed the world with almost perfect weather conditions for crop growth. At the same time, the US dollar appreciated against other world currencies. As the US economy began to grow, the prospects for interest rate hikes caused the currency to rally from under 80 in 2014 to over 100 in 2015.

As the weekly chart of the US dollar index highlights, the dollar rose by over 27% from May 2014 to March 2015. The dollar is the world’s reserve currency; therefore, it is the benchmark pricing mechanism for most commodity prices. The US is the world’s leading producer of corn and soybeans and the top exporter of those grains, as well as wheat. A stronger dollar made US crops less competitive on world markets. Bumper crop production and a rising dollar combined to push the prices of corn, soybeans, and wheat lower during the 2013-2015 period. The prices of these major grains halved in value.

While the supply side of the fundamental equation for grains turned uber-bearish, demand continues to flourish around the world. Demographic trends such as rising population and rising wealth in emerging market nations combine to present the world with more mouths to feed each year. Therefore, the world has become accustomed to bumper grain crops. We witnessed the effect of poor crop yields in 2012, but over the years that followed, those memories faded in the rearview mirror of the markets.

As we head into the 2016 planting, growing, and harvest seasons, we are starting to see some action in the grain sector for the first time since 2012. Much of that early season action is the result of the strongest El Niño since 1997. It all started in Asia this year as poor weather affected the palm oil crop. Increasing demand for soybean oil lifted the price of the soybean product.

As the weekly chart shows, the price of soybean oil began rallying in August 2015; since then, it has been making higher highs and lower lows. At the end of February 2016, soybean meal made an important low, and since then the price has appreciated dramatically.

The weekly soybean meal chart illustrates the recovery in this product of the soybean crush. With both soybean products rallying, it was only a matter of time until raw soybeans joined the bullish party.

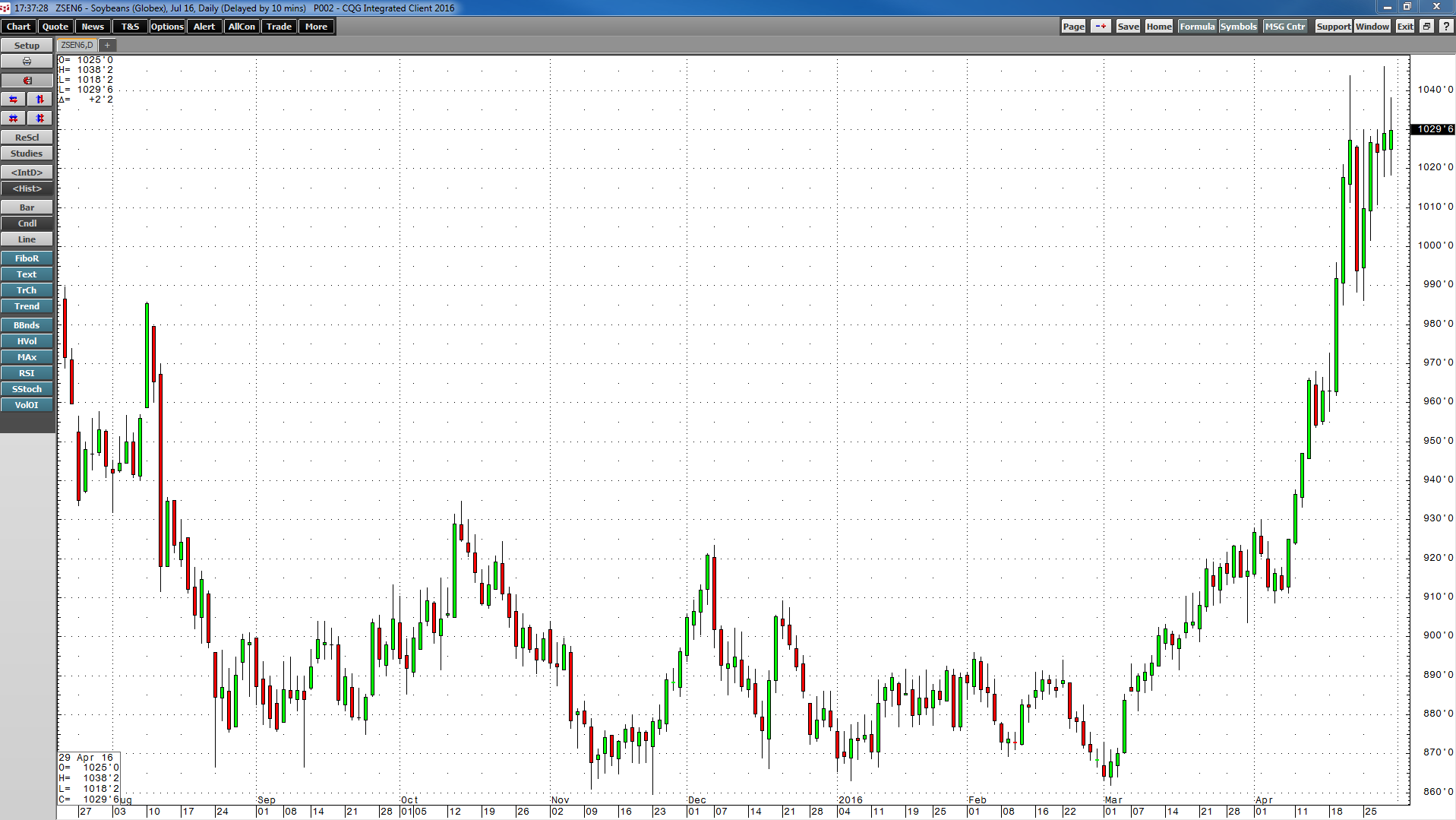

Beginning in early March, the price of soybeans followed its processed products, rising from $8.62 per bushel on the now-active month CBOT July futures contract to highs of $10.4625 on April 28, 2016 – an increase of over 21% in two months. Weather conditions in South America added to the bullish fervor as a drought in Brazil and floods in Argentina decreased the size of the soybean crop this year. At the same time, the dollar declined as the Fed has held off on promised interest rate hikes, adding to the bullish market action in beans.

While soybeans have been the best performing grain over recent weeks, we have also seen signs of life in the corn and wheat markets.

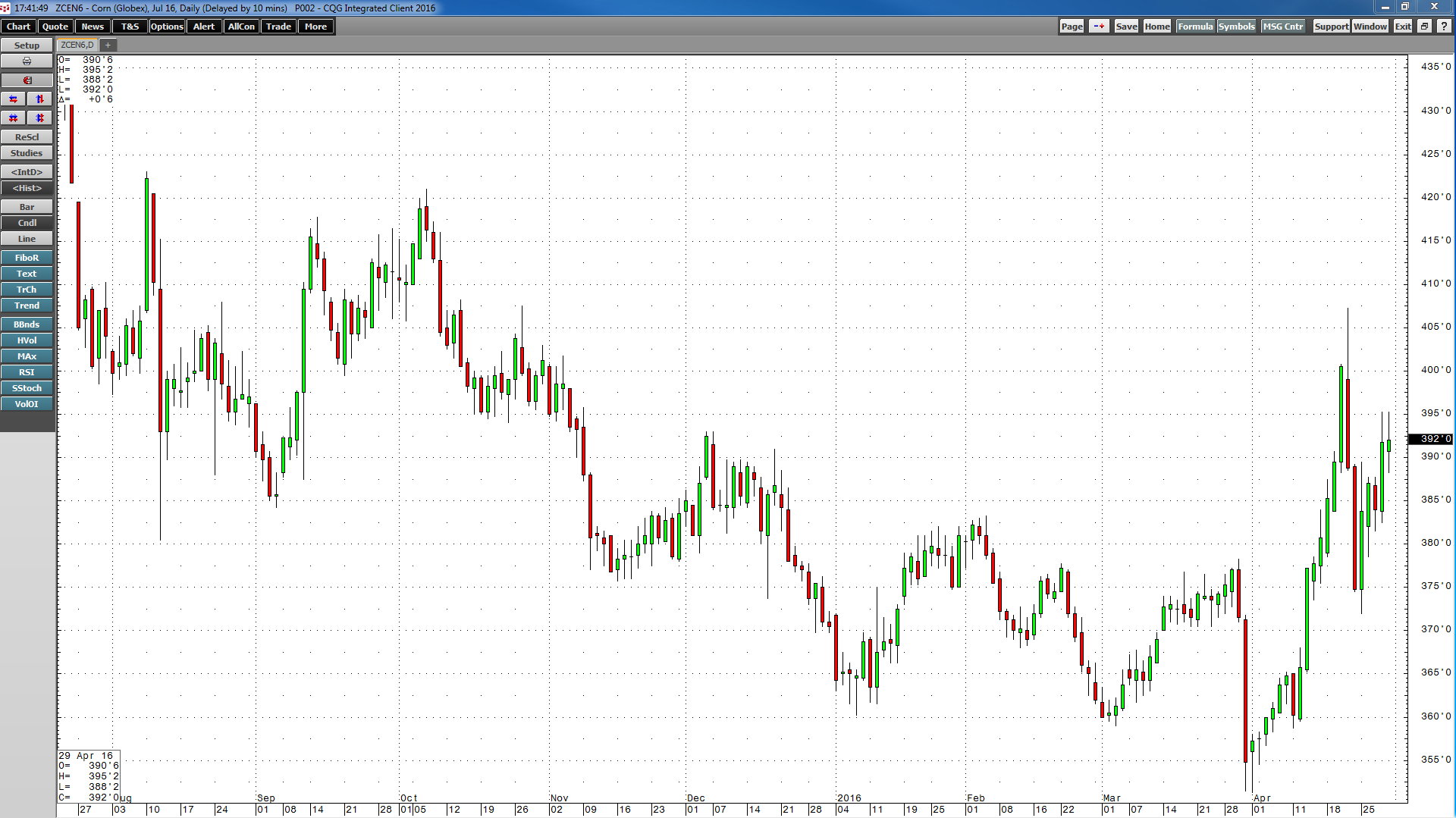

As the daily CBOT July corn futures chart shows, corn dropped like a stone on the final day of March, losing more than 4% of its value and turning a winning quarter into a losing one for the grain. However, since then corn has recovered by over 11.6%, closing on the last trading day of April at $3.92 per bushel. Corn traded to highs of $4.0725 per bushel on April 21 on short covering. Strength in corn came from the increase in gasoline prices that supported the price of ethanol. In the US, ethanol is a processed product of corn. Higher demand for ethanol is likely to eat away at corn inventories. Additionally, the new crop corn-soybean spread moved higher, indicating that late season planting would likely favor the rallying soybeans, thus decreasing this year’s corn crop below initial market expectations. Finally, weakness in the dollar has provided support for the price of corn as has the weather in South America.

Even the price of wheat got into the action as July CBOT wheat futures rallied from $4.4950 per bushel at the beginning of March to highs of $5.1850 on April 21 before falling back to close on April 29 at $4.8825, 8.6% above the early March lows.

Each year is a new adventure in the grain markets as the weather is the ultimate determinate of the path of least resistance for prices. While the weather this growing season is still in question, the dollar provided support for grain prices in April. Expect volatility in grain markets over the coming weeks and months. While the past three growing seasons have pushed prices progressively lower, the 2016 seasons is starting out to look like a completely different story.