The price of active month NYMEX natural gas futures closed on September 30, 2015 at $2.524 per mmBtu. The fourth and first quarters are generally a positive seasonal period for the energy commodity that is very sensitive to heating demand. The winter season is a period of historical price strength.

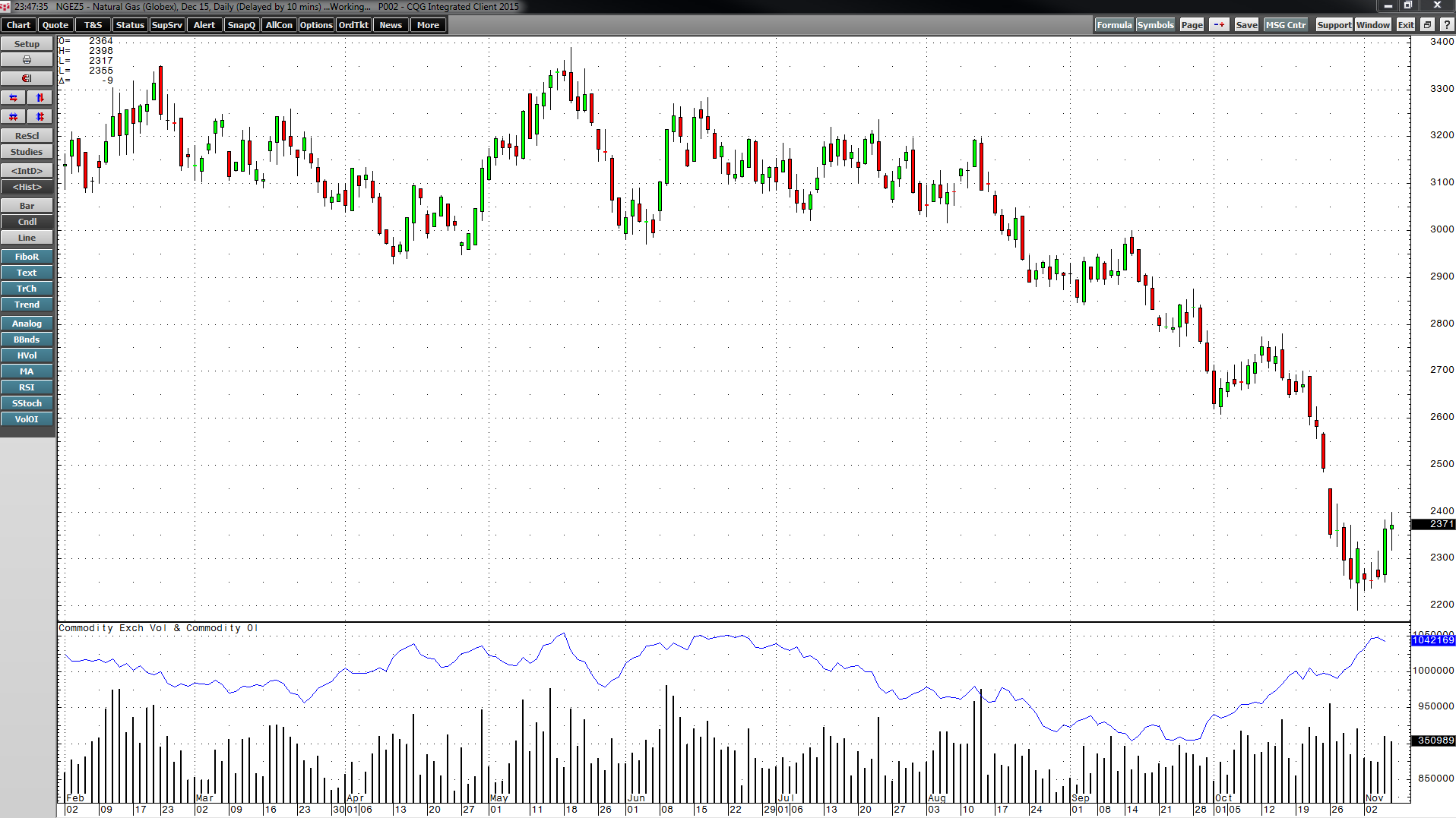

As the weekly chart highlights, a frigid winter in 2014 took prices quickly to almost $6.50 per mmBtu in February of that year. After the first few days of this fourth quarter, the price of natural gas started to fall. By the end of October, things got downright ugly. As the November contract came to expiration, the price of the energy commodity plunged to lows of $1.948. Key support is at the April 2012 lows of $1.902, and below there you have to go all the way back to 2001. The lows that year were only pennies lower at $1.8750. At the recent lows, natural gas was down over 22% in less than one month.

Fundamentals Look Bearish

As November futures expired and rolled to December, the contango took the active month price back above the $2 level. The lows on the December contract are now $2.1880. Enormous reserves of low-cost natural gas in the Marcellus and Utica Shale regions of the United States weigh on prices.

This year, inventories in natural gas are at very high levels according to the Energy Information Administration. As of October 30, inventories stood at 10.4% above last year's level and 3.9% above the five-year average for this time of the year. Stockpiles are at 3.929 trillion cubic feet, which is exactly equal to the all-time highs reported in November 2012. With a few more weeks of injections into inventories before the winter withdrawal season commences, it is a good bet that we will set all-time records for natural gas stockpiles in 2015.

Moreover, due to El Nino this year, meteorologists are calling for a warm winter in the US, which means heating demand will be lower than normal and stockpiles will not see the normal winter rate of depletion. All this is negative news for the energy commodity.

The Trend is Lower and Shorts are Hopping on Board

Given recent price action, the trend is certainly lower in natural gas. The price action was bearish since mid October. Both open interest and volume climbed as the price moved progressively lower. Rising volume and open interest that accompanies lower prices is a confirmation of the trend and a bearish signal for price. On November 5 and 6, a relief rally took natural gas back up to the $2.371 level, which is over 40 cents above the continuous contract lows on October 30, just a week before.

Along with the price action, the increase in open interest has been dramatic in the natural gas futures contracts. On September 28, it stood at just under 905,000 contracts and by November 6, it rose to over 1,042,000. The huge increase as the price moved lower means that many shorts jumped on the bearish bandwagon.

Not So Fast

There are a number of important things to consider regarding natural gas. First, although the forecasts are for a mild winter, weather prediction is a tricky business and meteorologists often get it wrong. A cold winter at a time when prices are historically low could launch prices quickly. Second, the long-term support for this commodity is the April 2012 lows at $1.902. April is after the winter season and a time for price weakness; right now we are entering the period of seasonal strength. Third, the rising number of speculative short positions may be a dangerous sign for this market considering the price is low. The profit margin for production is slipping fast and producers are likely to adjust production in order to provide more economic returns. Finally, natural gas is one of the most volatile commodities that trade on futures exchanges. The commodity is combustible and so is its price. This commodity tends to hand out the most pain when the market gets loaded on the short or long side. With the current level of open interest and price action, there is a significant number of shorts in the market.