Petroleum prices continued to rise this week, increasing for the fourth week in six and fifth in nine. US Gasoline

prices set historic highs, closing on Friday at 3.759 per gallon. US… more

Energy

Petroleum prices increased for a third week in five and fourth in eight as the end of April marked the fifth consecutive month of price increases, the largest such streak since 2018. Prices… more

Petroleum prices fell for the second week in four and fourth in seven. A decidedly mixed number of influences

resulted in the appearance of prices meandering at various points through the… more

Petroleum prices increased for the first week in three and second in six in a holiday shortened week. Prices surged

despite a sizable Crude release from the Strategic Petroleum Reserve as… more

Petroleum prices fell for a second consecutive week and fourth in five, driven primarily by details of a release of more than 180 MB from the US Strategic Petroleum Reserve that will be done in… more

Petroleum prices fell for a third week in four, experiencing their largest weekly drop in terms of percentage of value in the last two years. A massive release from the US Strategic Petroleum… more

Petroleum prices rose for the first week in three amid persistent volatility and ongoing reduction in open interest. A missile attack on a Saudi Arabian oil installation by Iranian-backed Houthi… more

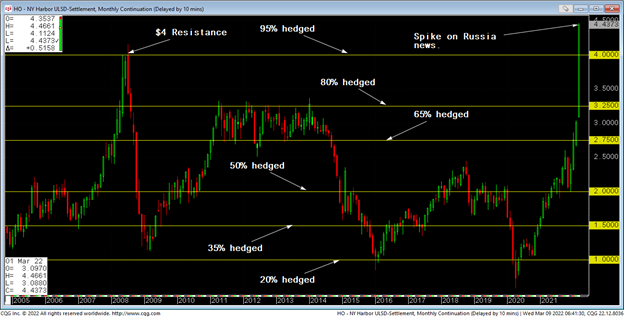

I have always believed that every active hedge strategy needs to answer the following three-part question:

Percentage hedged Duration of the hedge Derivative instrument(s) used to hedge… more

Volatility exacerbated by a liquidity crunch that intensified price swings was a key characteristic of petroleum markets which fell for a second consecutive week after having reached 14 month… more

Profound volatility was the primary feature of petroleum markets which had their first weekly loss since Russia’s invasion of Ukraine. Prices fell sharply after reaching historic highs on Monday.… more