CQG offers an Implied Volatility (ImpVol) study that allows you to pull in historical implied volatility data onto a chart. ImpVol is not the implied volatility of one particular option. CQG uses the outright contract symbol from the chart and initially starts with a baseline of 3 at-the-money contracts for each month for calls and puts, then several filters are run to eliminate series which would distort the implied volatility calculation. More information about the Implied Volatility study can be found here.

This study can be applied to both an outright contract or to an individual option, but the data returned will be the same. The study includes open, high, low, and close bar charts. You can view implied volatility of the calls and puts or merged calls and puts.

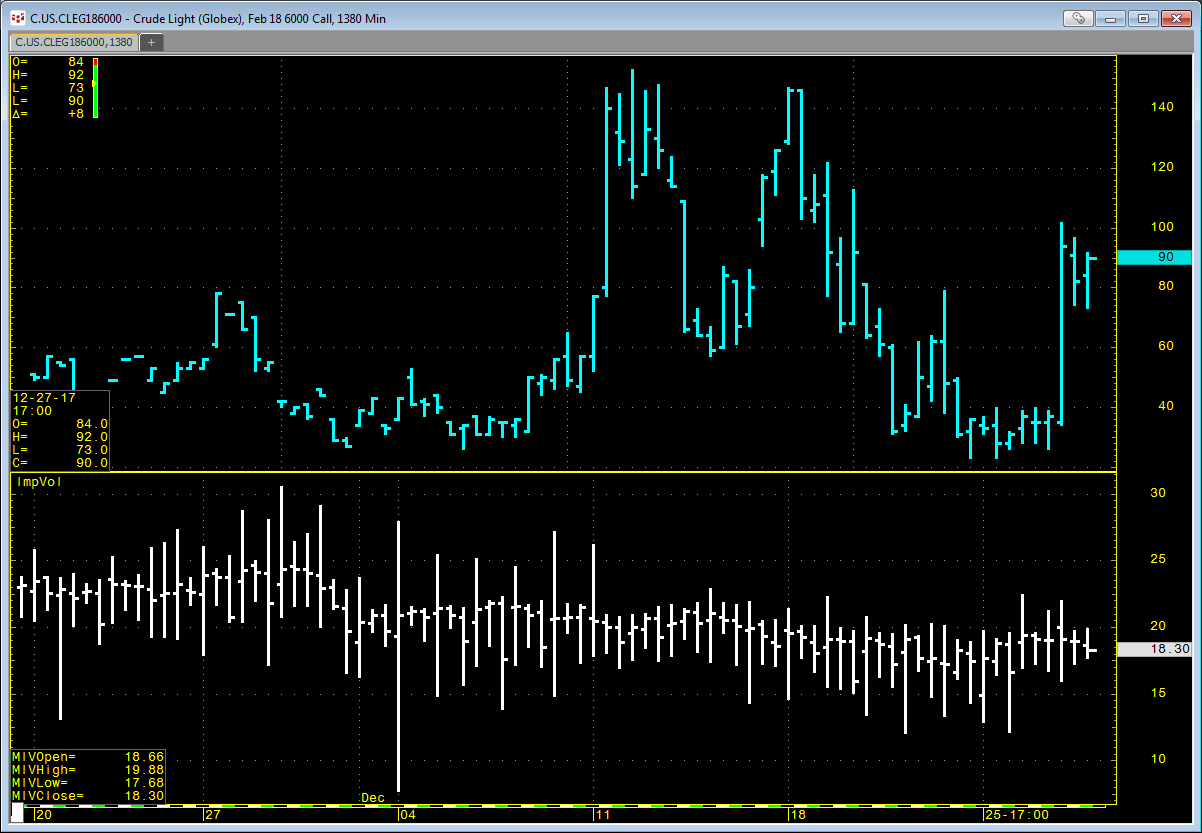

If you were to pull up a daily chart of the at-the-money call for the front month crude oil contract, you would see just three daily bars. In CQG, you can set the daily charts to be built from intraday data, but that may create resource issues depending on how many charts you have open. An easy solution is to simply use the number of minutes for the session. For example, the Globex crude oil market is open from 7:00 p.m. to 6:00 p.m., which is 1380 minutes. Use that for the time frame of the chart and you can now see historical option data.

Here is the RTD formula for the merged (both calls and puts) ImpVol study using 1380 minutes:

= RTD("cqg.rtd",,"StudyData","MIVCLose(CLE)", "Bar", "","Close","1380","0","ALL","",,"False","T")

A downloadable spreadsheet is available. It pulls historical option prices and implied volatility study values. For other markets, you will need to change the symbol and chart time frame