CQG Product Specialist Stan Yabroff designed a CQG page for customers to track and analyze a market’s implied volatility and historical volatility. This post details the features and functionality… more

Volatility

As markets head into the final month of 2022, market participants continue to face uncertainty as the war in Ukraine continues, the Fed is battling the highest inflation in decades, gridlock in… more

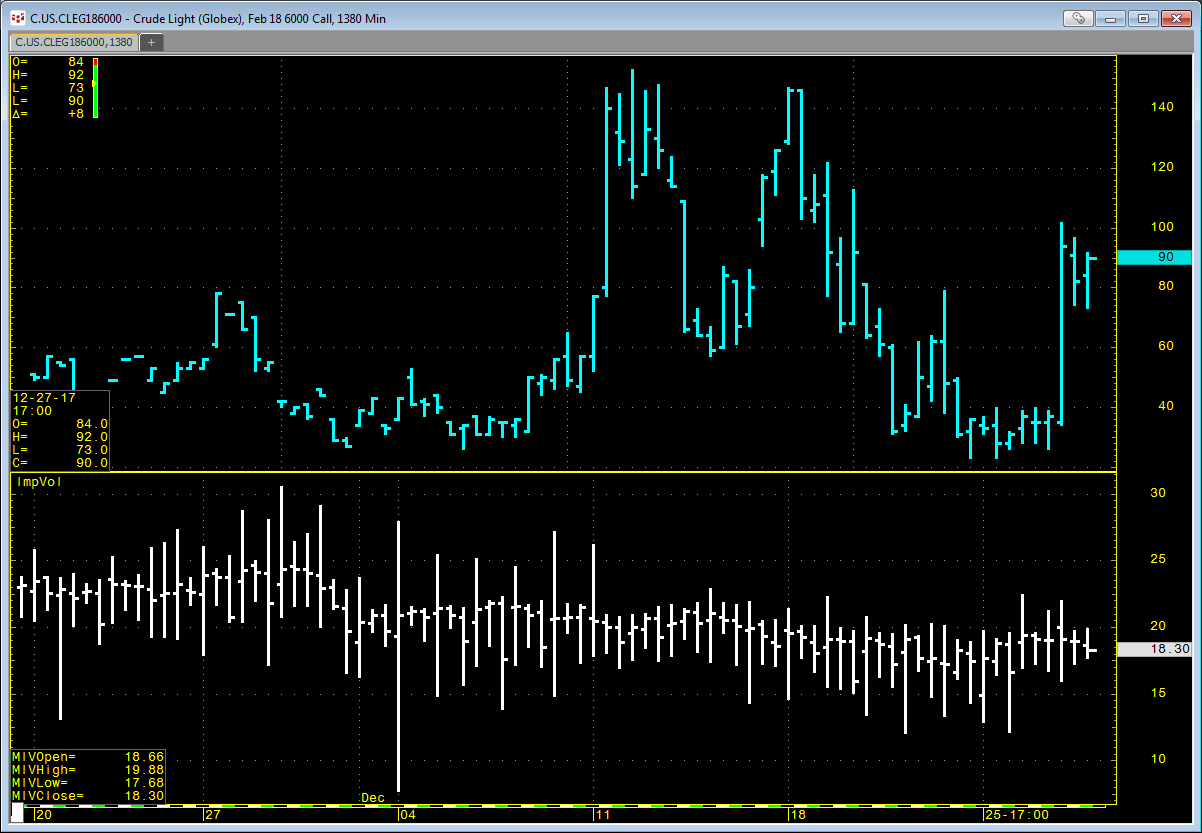

CQG offers an Implied Volatility (ImpVol) study that allows you to pull in historical implied volatility data onto a chart. ImpVol is not the implied volatility of one particular option.… more

Customers using our flagship product, CQG Integrated Client (CQG IC), have access to a new study called Algo Orders. Using a proprietary algorithm, this indicator of trading activity detects and… more

This Microsoft Excel® dashboard displays a depth-of-market (DOM) view of CBOE Volatility Index futures weekly reverse calendar spreads. The exchange quotes these markets as negative numbers for… more

Customers using our flagship product, CQG Integrated Client (CQG IC), have access to a new study called Algo Orders. Using a proprietary algorithm, this indicator of trading activity detects and… more

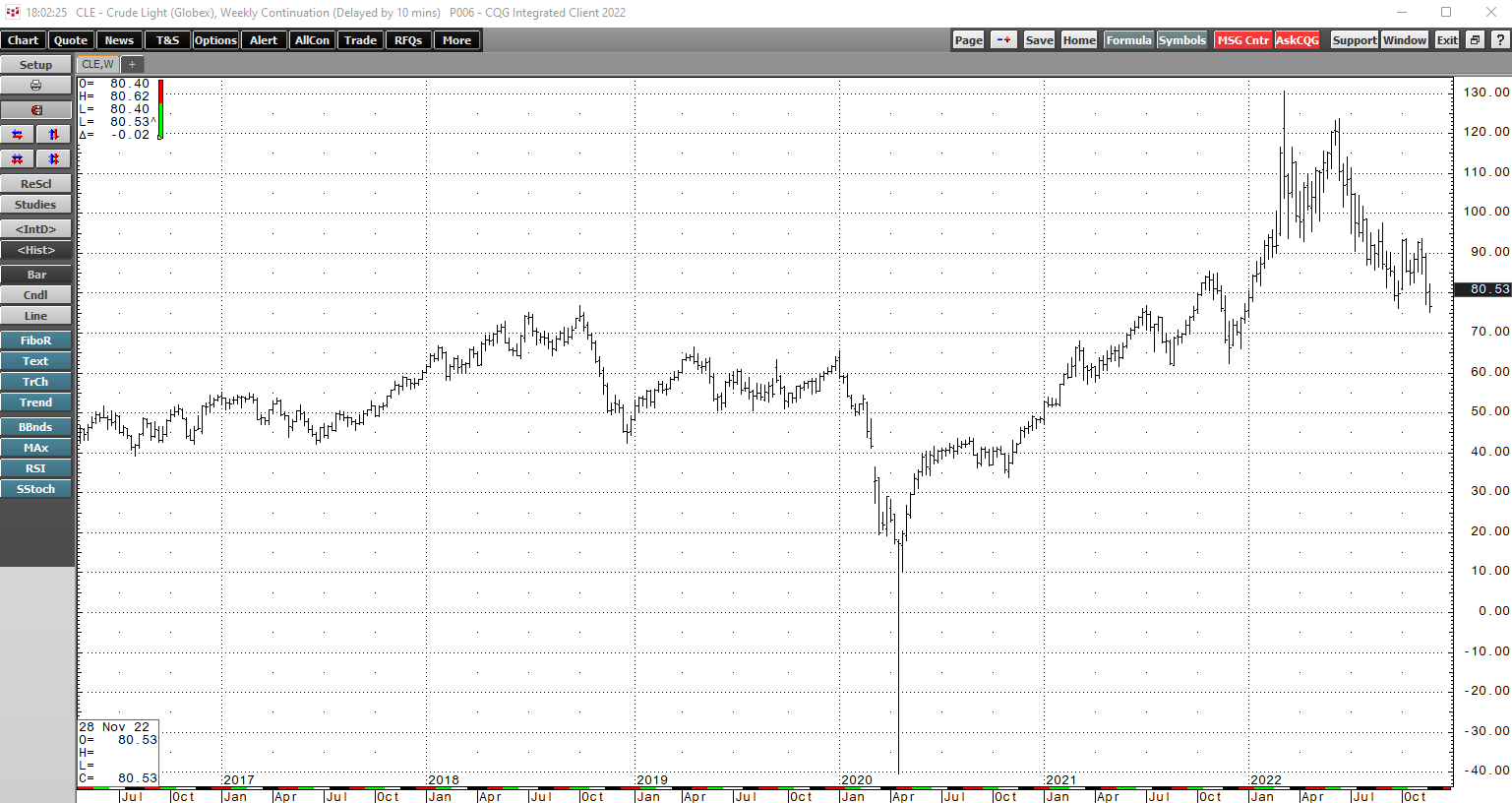

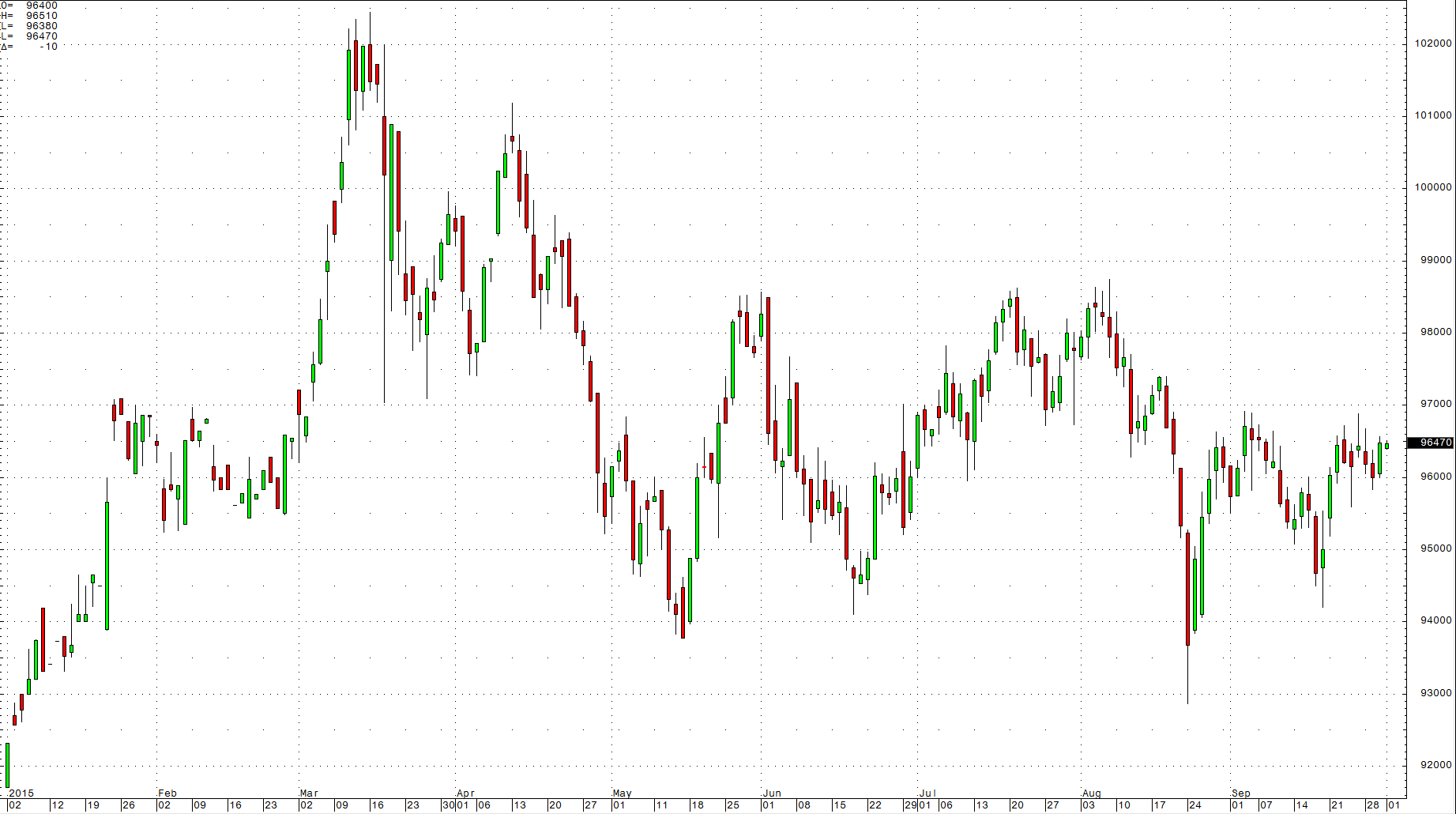

Third quarter of 2015 is now in the books, and the results were not pretty for commodity bulls. Overall, a composite of over thirty futures-market-traded commodities moved lower, making the last… more

If you use RTD formulas for data from the options markets, then Excel will pull data using your settings in CQG, such as the options model you have selected. An RTD formula for implied volatility… more

This Microsoft Excel® spreadsheet presents frequency distribution analysis of historical implied volatility (IV) data.

CQG offers its own historical options implied volatility index for… more

This Microsoft Excel® dashboard displays current market data and five-minute, fifteen-minute, thirty-minute, and sixty-minute measurements of volatility. Volatility is defined as the upper twenty-… more