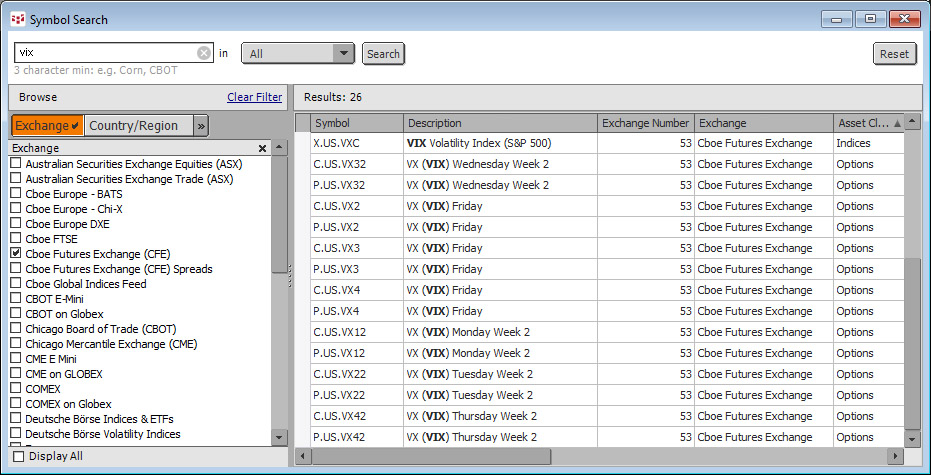

October 14, 2024, the Cboe launched weekly options on the Cboe VIX futures. To find the symbols in IC or QTrader, open the Symbol Search, select Cboe Futures Exchange (CFE), sort the Asset column. The symbol lists the week and the day of the expiration. For example, symbol C.US.VX32 the 32 which is Wednesday, Week 2.

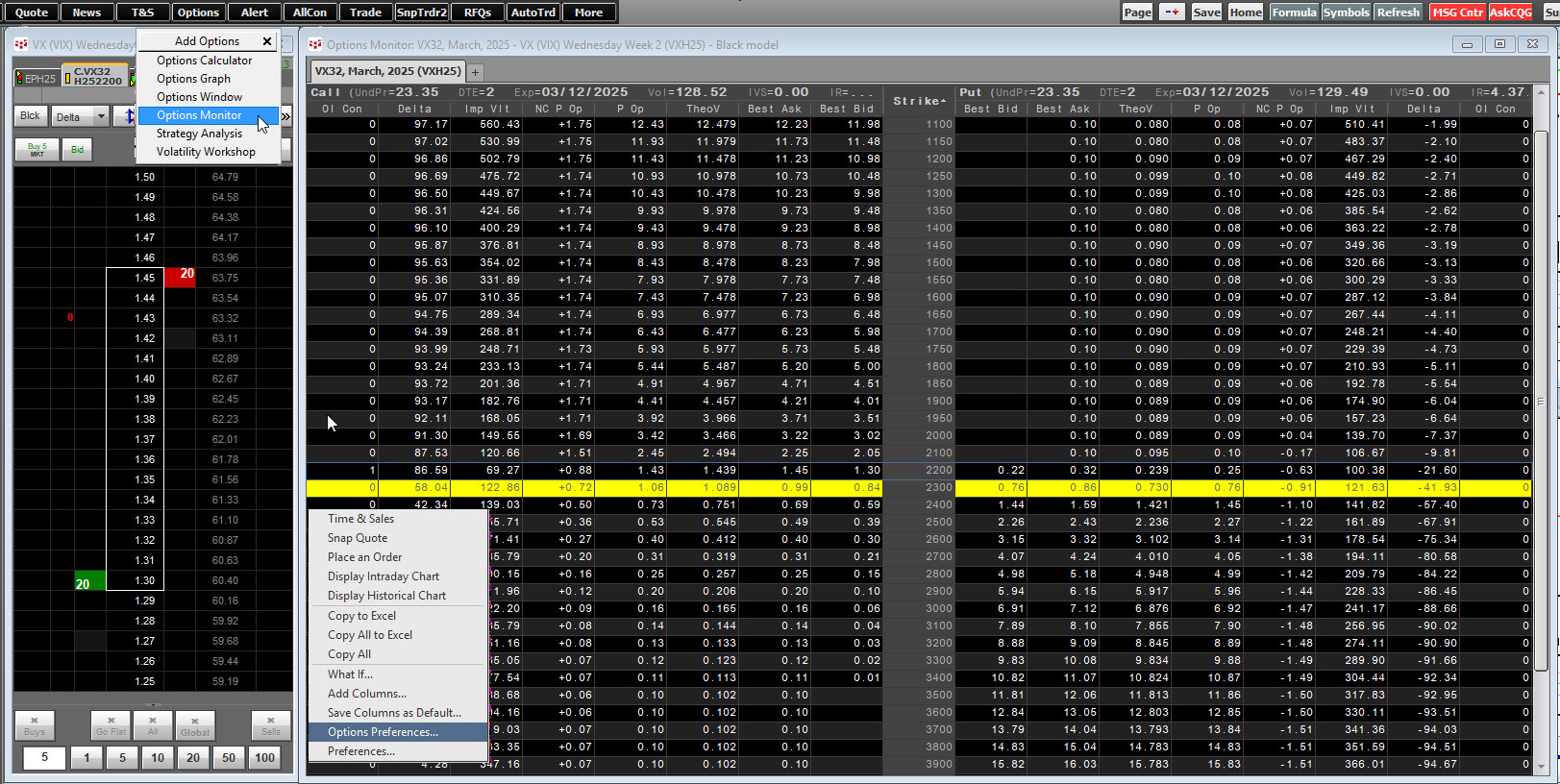

The option's market data and Greeks can be watched by clicking on the Options toolbar button and select Options Monitor. Click on the monitor and enter the symbol. You can right-click and a menu opens for more functionality such as open a chart, export to Excel, setting preferences and more.

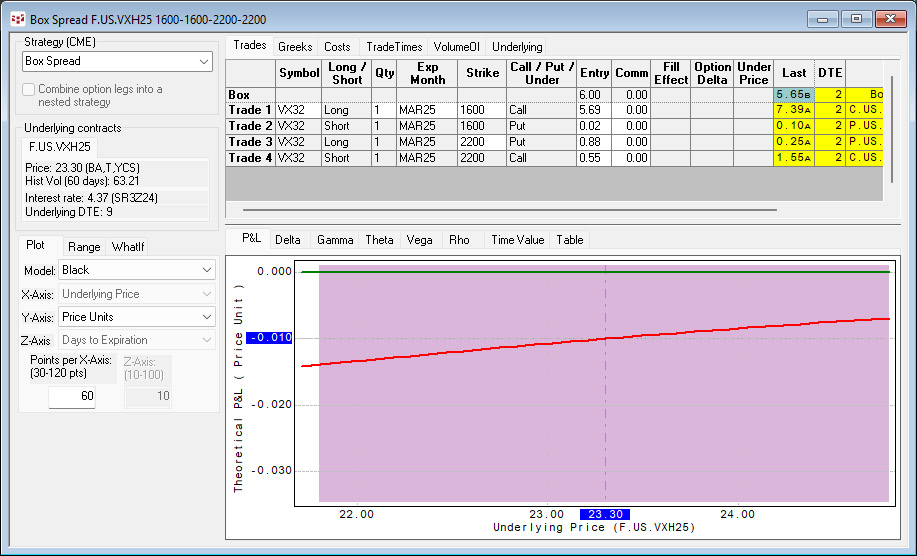

Other CQG Option analytics are available, such as Strategy Analysis.

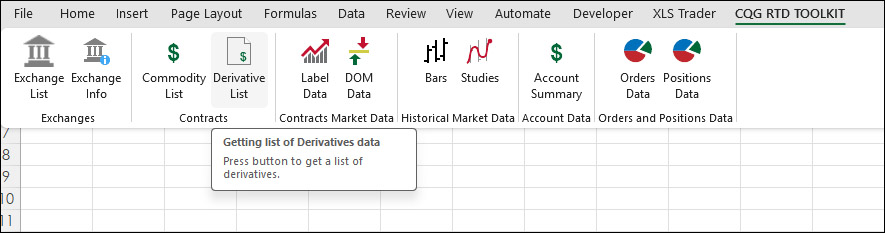

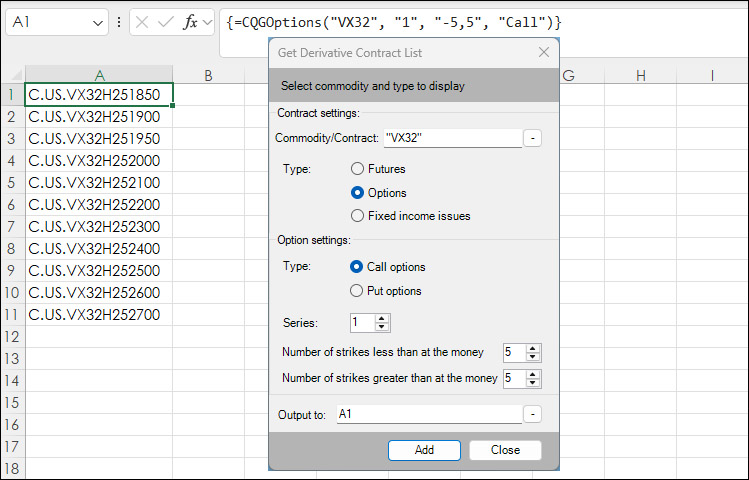

Excel users can pull in RTD formulas directly from the Options Monitor. The CQG RTD Toolkit can be used to pull in symbols and market data. Select the CQG RTD Toolkit and then Derivatives List.

Enter the option symbol, select Options, select Call or Put, the series, and the number of strikes less than the "at the money" and the number of strikes greater than the "at the money". The data comes in as an array and a single cell cannot be edited. Also, if the "at the money strike" changes the list of symbols will update to use the new at the money strike.

More choices to manage directional views and manage equity market volatility exposure are available using the options on Cboe Volatility Index® Futures. However, as of this writing the volume is very low.