Most of the media is focused on artificial intelligence, which makes sense with all the positive predictions. There is another renaissance occurring: The administration's emphasis on reducing regulations to aid the Nuclear Power Industry's ability to come online. This is an important development as it can provide sustainable clean energy, which is needed to power the AI Industry. This post offers a simple overview of the regulatory changes and one ETF that holds Nuclear Power companies.

According to https://www.perplexity.ai/

| Change | Impact |

|---|---|

| NRC deadlines for licensing reactors | Faster deployment, less regulatory delay |

| Science-based radiation limits | Streamlined safety evaluations |

| Streamlined advanced reactor, microreactor licensing | Increased innovation and deployment |

| Defense/military procurement for nuclear tech | Support for microreactors and advanced designs |

| Deregulation emphasis and export support | Stronger domestic supply chain, global leadership |

| Strategic realignment of NRC | Faster approvals, more focus on economic benefits |

These regulatory changes represent one of the most ambitious pushes for nuclear energy in U.S. history, emphasizing deployment, innovation, and less regulatory burden while maintaining basic safety standards.

One ETF focusing on the Nuclear Power is VanEck Uranium + Nuclear Energy ETF (symbol: NLR).

NLR offers diversified exposure to the entire nuclear supply chain. It invests in uranium miners, companies building nuclear plants and reactors, utilities generating nuclear electricity, and nuclear technology firms.

This table details NLR Holdings (Company Name, Ticker, Exchange, as of 9/24/2025)

| Name | Ticker | Exchange | |

|---|---|---|---|

| 1 | Oklo Inc | OKLO | NYSE (U.S.) |

| 2 | Constellation Energy Corp | CEG | NASDAQ (U.S.) |

| 3 | Cameco Corp | CCJ | NYSE (U.S.) / TSX (Canada) |

| 4 | BWX Technologies Inc | BWXT | NYSE (U.S.) |

| 5 | Centrus Energy Corp | LEU | NYSE American (U.S.) |

| 6 | NuScale Power Corp | SMR | NYSE (U.S.) |

| 7 | Denison Mines Corp | DNN | NYSE American (U.S.) / TSX (Canada) |

| 8 | Public Service Enterprise Group Inc | PEG | NYSE (U.S.) |

| 9 | NexGen Energy Ltd | NXE | NYSE (U.S.) / TSX (Canada) |

| 10 | Uranium Energy Corp | UEC | NYSE American (U.S.) |

| 11 | NAC Kazatomprom JSC | KAP | London Stock Exchange (LSE), GDRs |

| 12 | PG&E Corporation | PCG | NYSE (U.S.) |

| 13 | CGN Power Co Ltd | 1816 | Hong Kong Stock Exchange (HKEX) |

| 14 | Energy Fuels Inc | UUUU | NYSE American (U.S.) / TSX (Canada) |

| 15 | Paladin Energy Ltd | PDN | Australian Securities Exchange (ASX) |

| 16 | Nano Nuclear Energy Inc | NNE | NASDAQ (U.S.) |

| 17 | ČEZ a.s. | CEZ | Prague Stock Exchange |

| 18 | Yellow Cake Plc | YCA | London Stock Exchange (LSE) |

| 19 | Fortum Oyj | FORTUM | Nasdaq Helsinki (Finland) |

| 20 | Kepco E&C (Korea) | 52690 | Korea Exchange (KRX) |

| 21 | CGN Mining Co Ltd | 1164 | Hong Kong Stock Exchange (HKEX) |

| 22 | Deep Yellow Ltd | DYL | Australian Securities Exchange (ASX) |

| 23 | Silex Systems Ltd | SLX | Australian Securities Exchange (ASX) |

| 24 | Encore Energy Corp | EU | NASDAQ (U.S.) |

| 25 | Boss Energy Ltd | BOE | Australian Securities Exchange (ASX) |

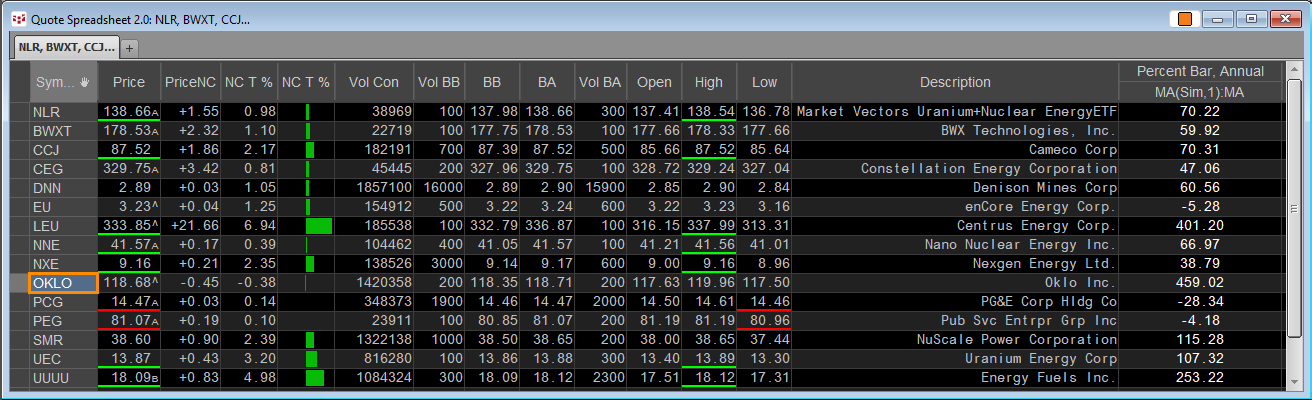

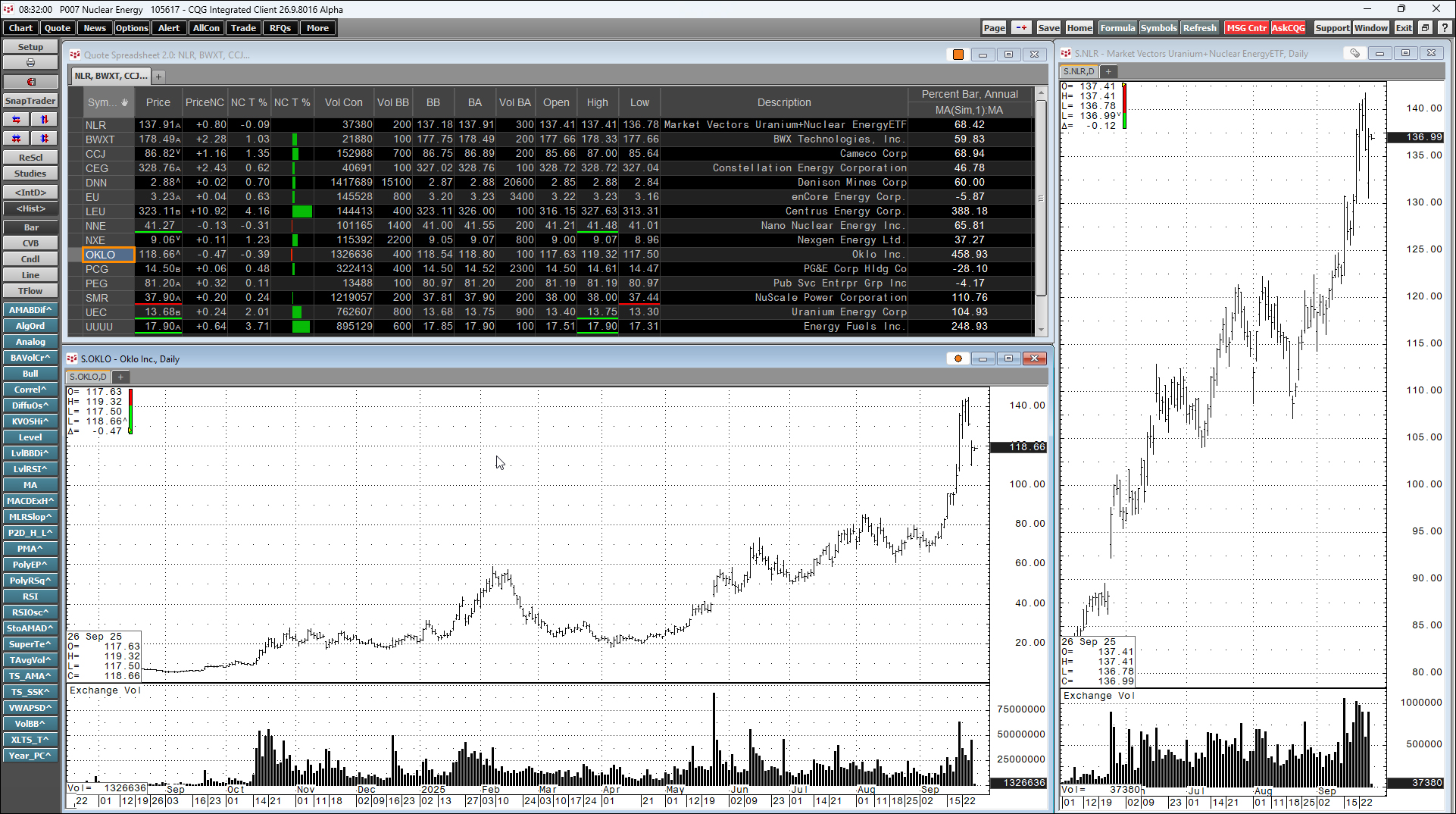

At the end of this post is a downloadable CQG PAC that installs a page in CQG IC or QTrader. The page displays a Quote Spreadsheet V2 that lists the stocks traded on U.S. Exchanges. Fourteen of the twenty-five stocks trade on U.S. Exchanges. Customers with additional enablements can add the symbols to the QSS V2.

The page has a linked chart to the QSS V2 and a freestanding chart of NLR.

The QSS V2 has a column showing the percentage change for the year. One company really stands out: Oklo Inc (symbol: OKLO). It is up nearly 500% for the year.

Requires CQG Integrated Client or CQG QTrader, data enablements for the NYSE and Nasdaq stocks.

This post was assisted by AI and reviewed by Thom Hartle.