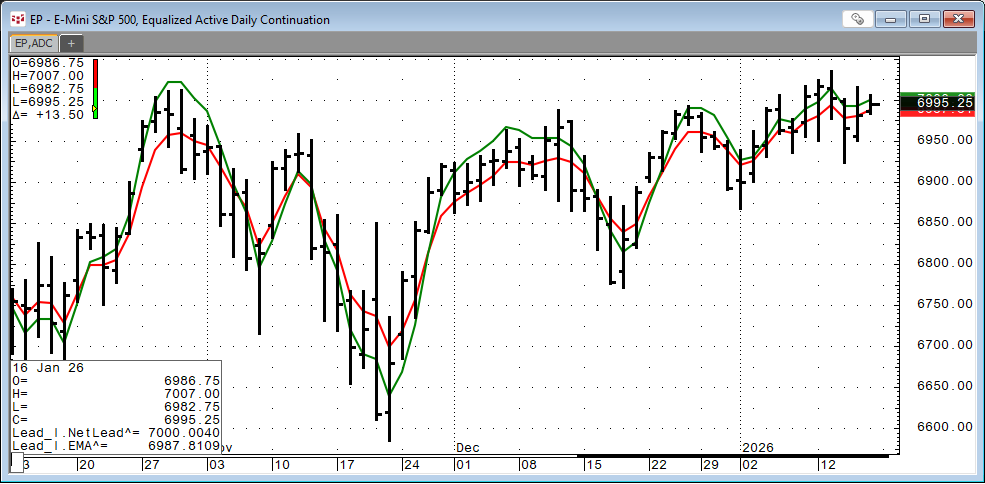

In Mr. Ehlers Book “Cybernetic Analysis for Stocks and Futures” the “Leading Indicator” was introduced. The goal of this study was to smooth the price action while not having the lag by the study that is inherent in typical moving averages. The chart below displays the NetLead study (the green line) and an exponential moving average (the red line).

Using CQG Formula Language (courtesy of CQG Product Specialist Valeriy Alekseyev) the calculations for the two studies are:

price:= ( High(@)+Low(@) )/2 ;

Lead:= 2*price + (alpha1-2)*price[-1] + (1-alpha1)*Lead[-1] ;

NetLead:= alpha2*Lead + (1- alpha2)*NetLead[-1] ;

and

price:= ( High(@)+Low(@) )/2 ;

EMA:= 0.5*price + 0.5*EMA[-1] ;

Where alpha1 = 0.25 and alpha2 – 0.50.

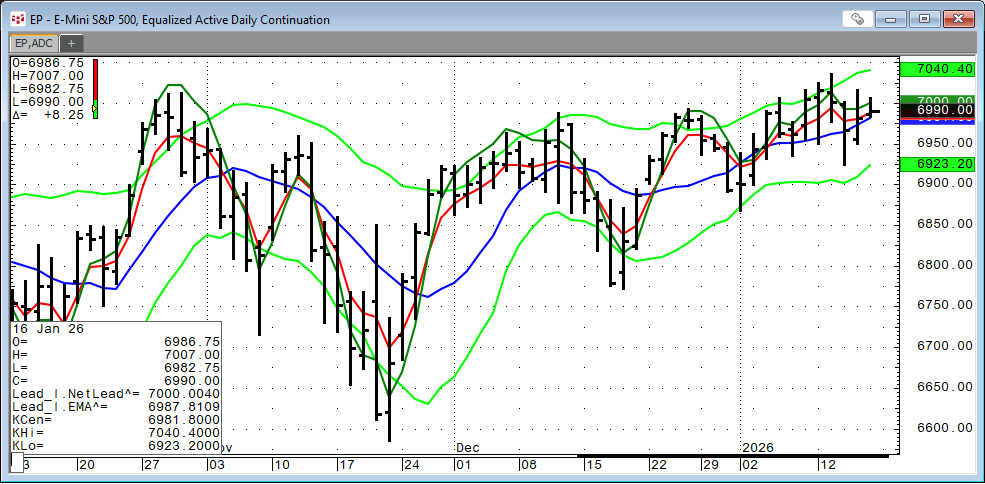

One possible application of the NetLead study is to use it in conjunction with a trading band study when the market is in a trading range. One example would be the Keltner Bands (set to 10 bars). If the price the price action is outside of the Keltner Bands and the NetLead study reverses direction, then the short term trend has reversed direction.

In Mr. Ehlers book he cites these characteristics of the study:

- Adding the difference between price and an exponential moving average to the price itself creates a leading indicator.

- The leading indicator always has noise gain.

- Smoothing the leading indicator with another exponential moving average can mitigate noise gain.

- Constants can be selected to provide a net lead for the indicator at low frequencies.

- The leading indicator has a lagging signal at price turning points

A CQG PAC which installs a page with four charts with the NetLead Study and Kelner Bands is available at the bottom of this post.

Requires CQG Integrated Client or CQG QTrader