This Microsoft Excel® dashboard scans the options on futures for the H-shares Index (HHI) and ranks the traded volume for each expiry out to nine expirations. The scan covers options traded… more

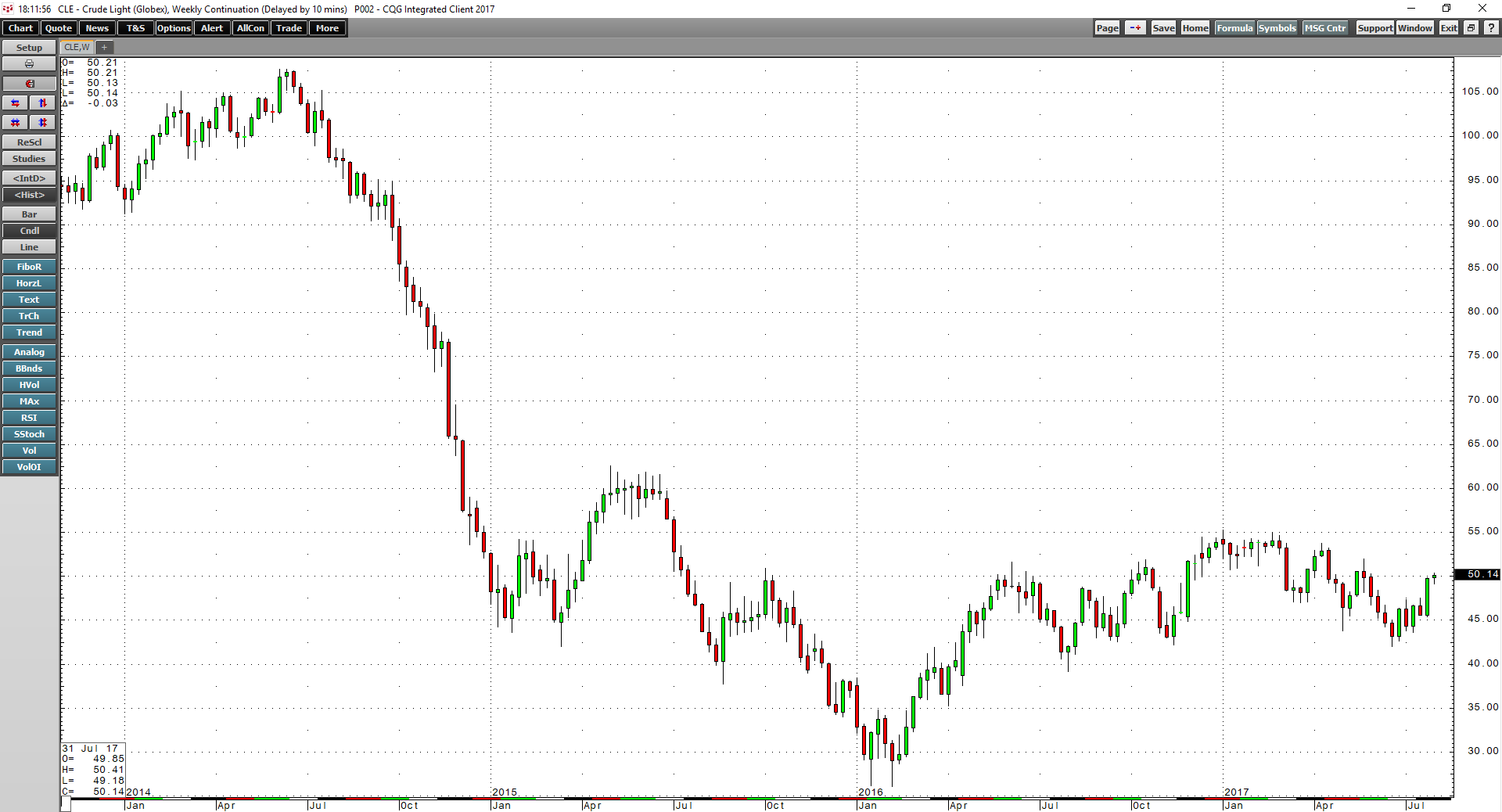

In the world of commodities futures, crude oil is the most closely watched and heavily traded market. We are all oil consumers in some form as we drive cars, heat our homes during the cold season… more

This Microsoft Excel® spreadsheet tracks the constituents of the DJIA Index (symbol: DJIA).

Throughout the trading session, the thirty individual stocks are dynamically ranked and displayed… more

This Microsoft Excel® dashboard scans the Hang Seng Index market options on futures and ranks the traded volume for each expiry out to eleven expirations. The scan covers options traded ten… more

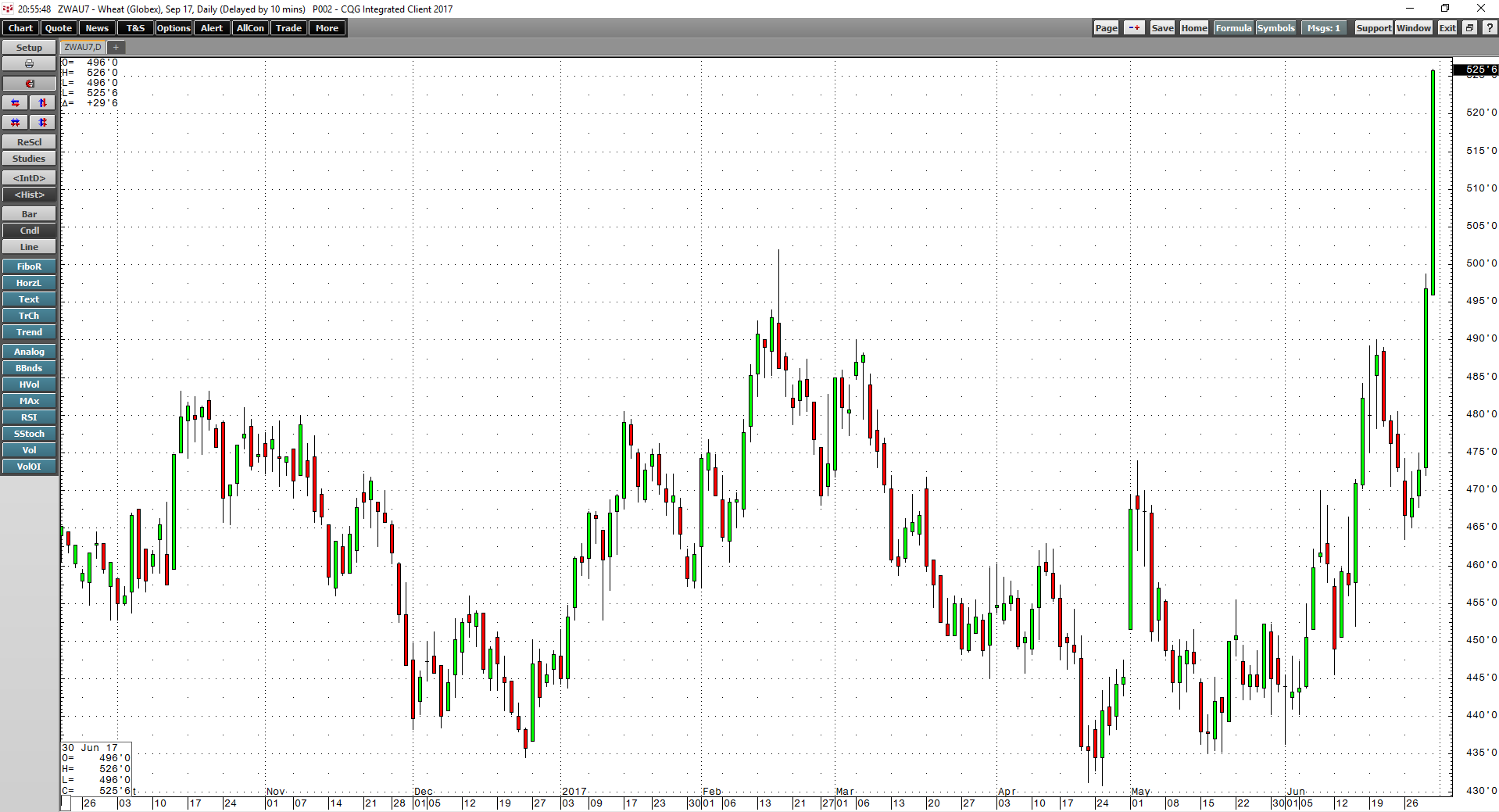

In this article, we outline how to pull historical market data into Excel while excluding data from days when the market was in a holiday session.

Holiday sessions are trading dates, but… more

Watch David Williams reveal visual methods that test the accuracy of trades before they're placed.

You will learn:

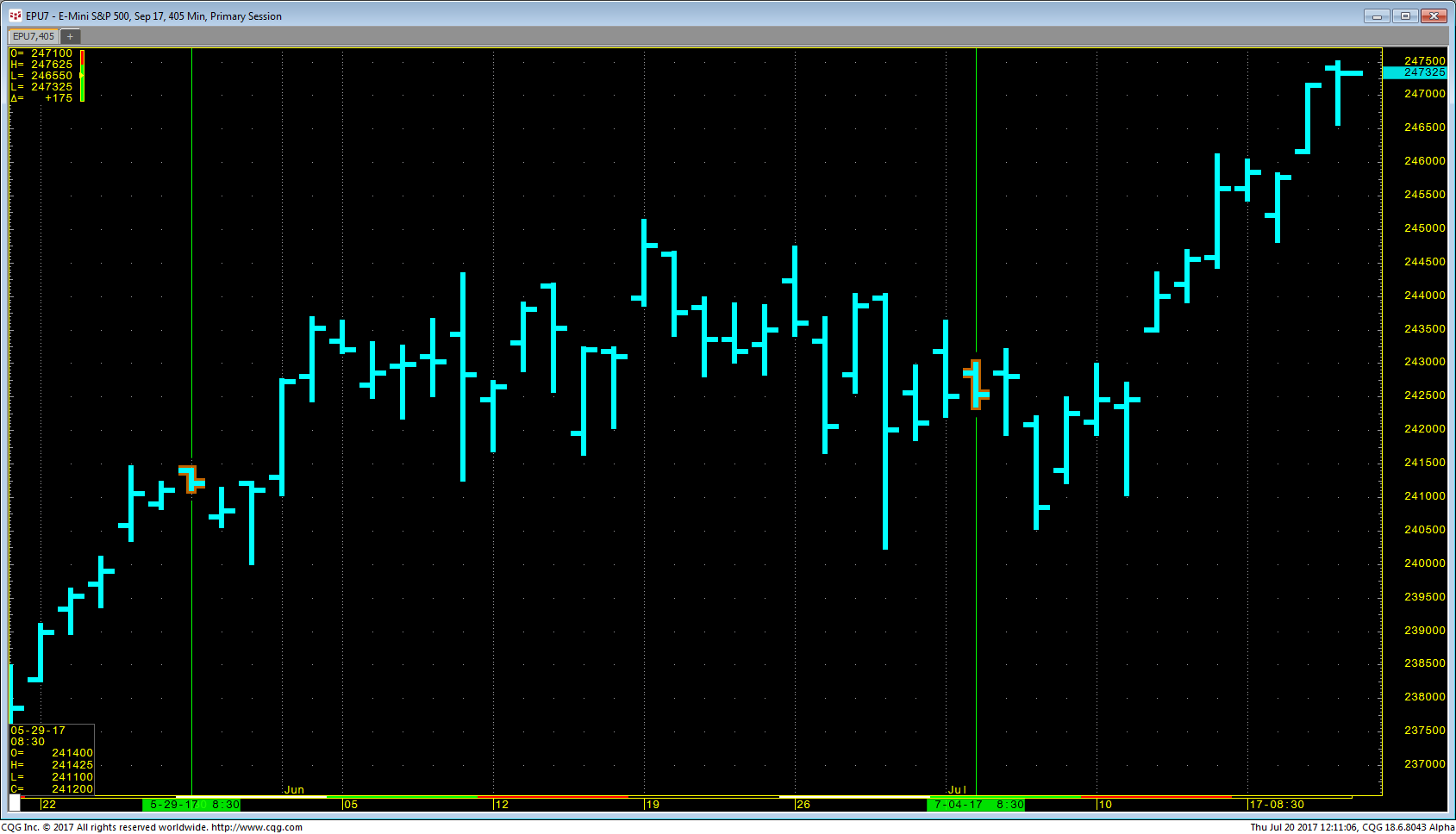

How to examine the market differently and make informed trading… moreThe dollar index moved lower by 4.79% in the second quarter of 2017. Out of the 29 commodities that I follow, 22 posted losses during the three-month period that ended last Friday, June 30.… more

Gateway version 5.6 is scheduled for the weekend of June 30, 2017.

This upgrade includes backend improvements and bug fixes.

RTD formulas for chart types and studies can include the same parameter settings used in your CQG continuation charts. In the RTD formula the continuation parameters are entered in the “time… more