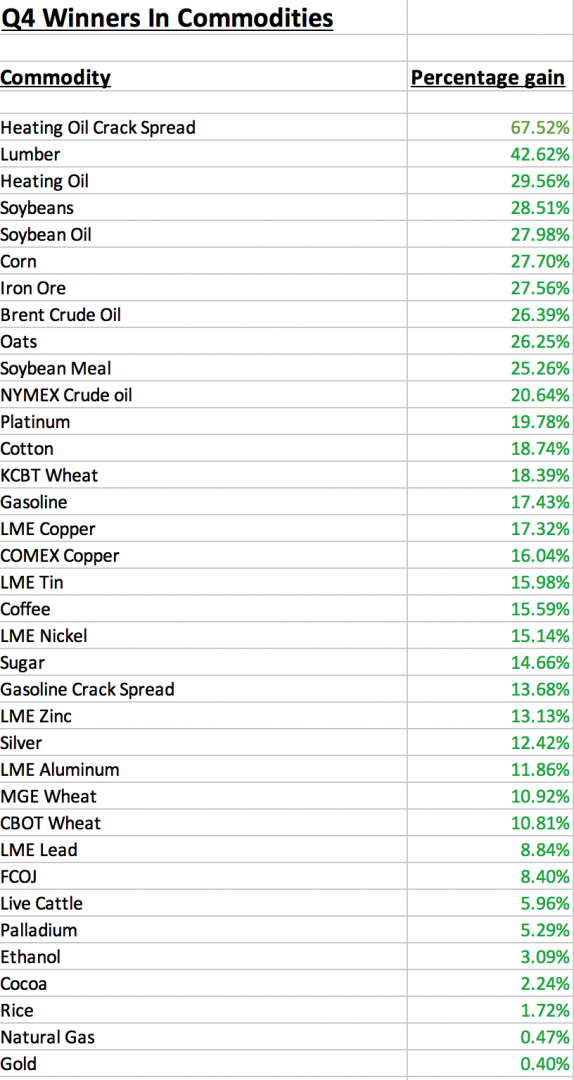

The raw material markets continued to make a comeback in the final quarter of 2020 after the global pandemic caused a deflationary spiral taking the prices of most assets to lows in March and… more

CQG Product Specialist, Anthony Cohen presented at FIA Asia V Conference 2020 on Arbitrage… more

CQG System Architect, Shane Pielli presented at FIA Asia V Conference 2020 on CQG’s OTC Marketplace Solution.

Please feel free to reach out to your account manager for any questions.

… moreCQG's Kevin Darby is interviewed by John Lothian about his Path to Electronic Trading. View interview here.

Presented by John Lothian News

… moreAndrew Sheng, distinguished Fellow of the Asia Global Institute at the University of Hong Kong, a member of the UNEP Advisory Council on Sustainable Finance, and a former… more

In late June 2020, the nearby natural gas futures price fell to its lowest level in twenty-five years when it reached $1.432 per MMBtu. Days after the low, Warren Buffett announced that Berkshire… more

This post expands on the use of Microsoft® Excel function “CountIF.” The CountIF functions was detailed in the post “Dynamic Ranking in Excel” as a method for dealing with ties when ranking… more