CQG's Formula Builder Toolbox gives you the ability to use parameters (variables) inside your CQG code in order to control studies, conditions, and trade systems externally without the need to… more

Backtesting

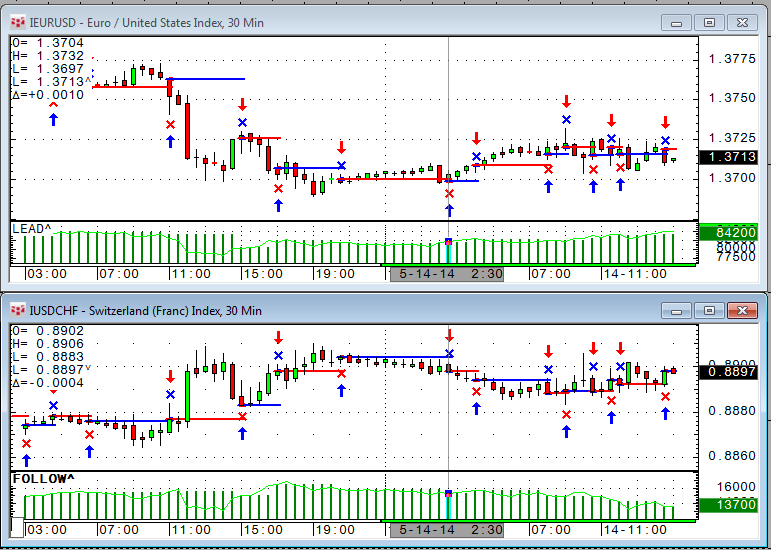

In this article we will look into different ways to use an event to set up a trading opportunity. We will review the differences between BarsSince, Happenedwithin, and Set/Reset.

… more

Take your trading skills to the next level with CQG Product Specialist Helmut Mueller.Building upon his extensive experience, Mueller presents a thorough explanation of the advanced tools… more

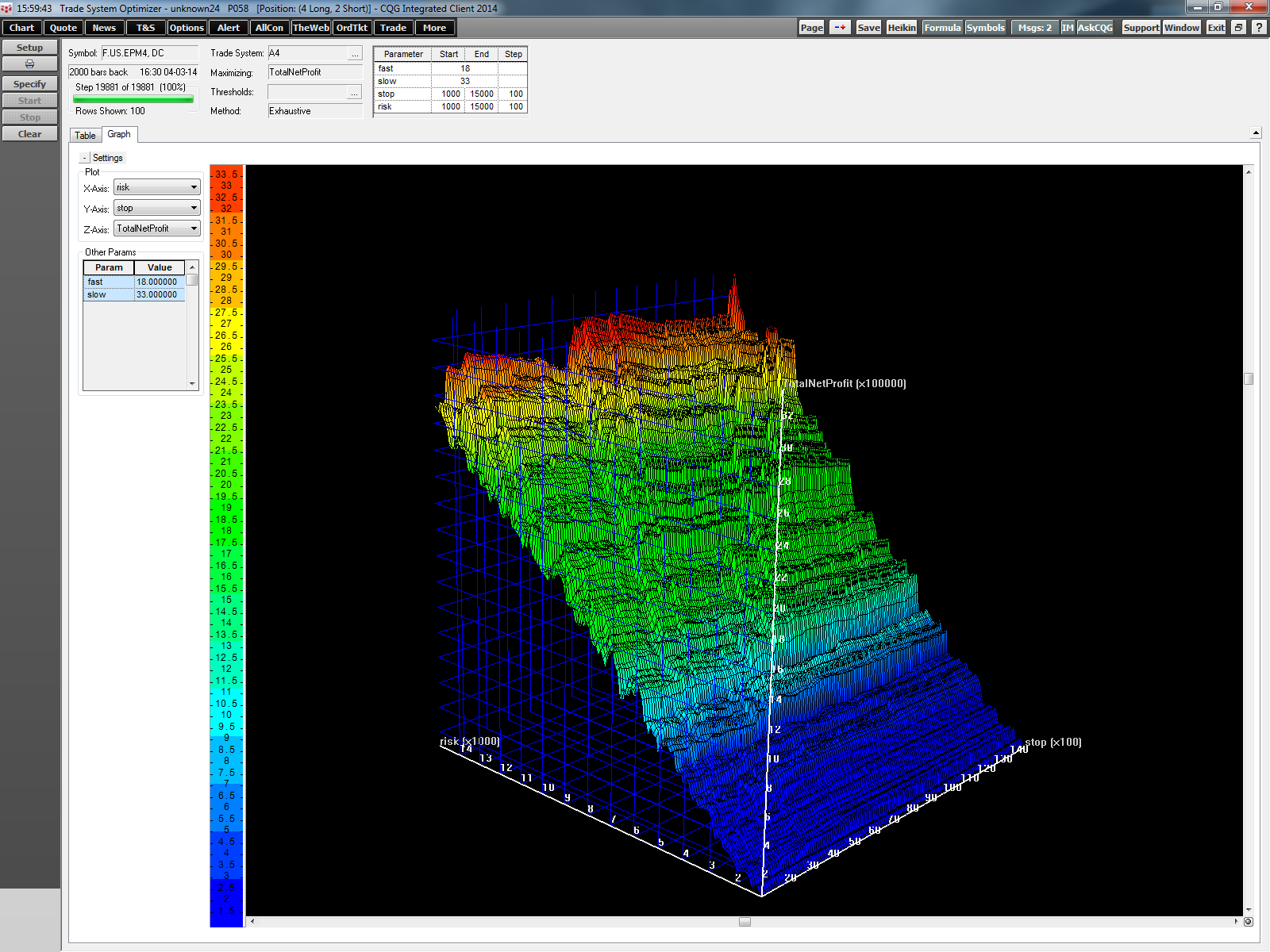

After we looked into some time frame considerations in my last article, the next logical question is to ask if CQG can "optimize time." CQG Trade System Optimizer (TSO) does not allow us to… more

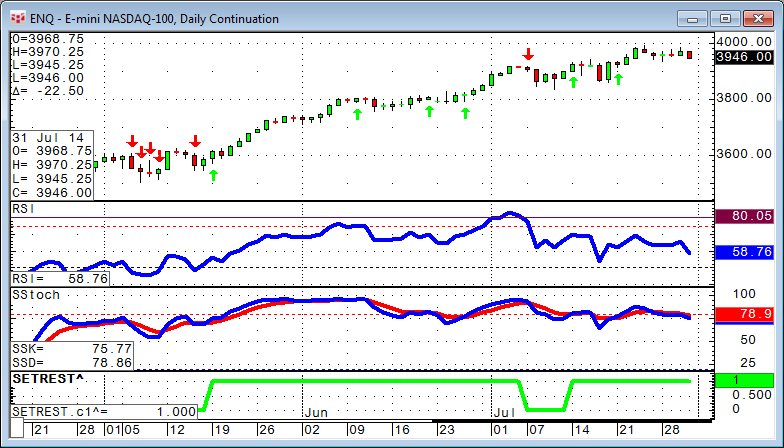

What is the right time frame for your trading?

Any data we analyze is more representative if we have a bigger number of samples. Asking ten people how the next elections will turn out will… more

One of my first backtesting tips featured a piece of code to limit a trading system only to one trade per day.

My colleague Doug came up with a smarter way to do this and even added the… more

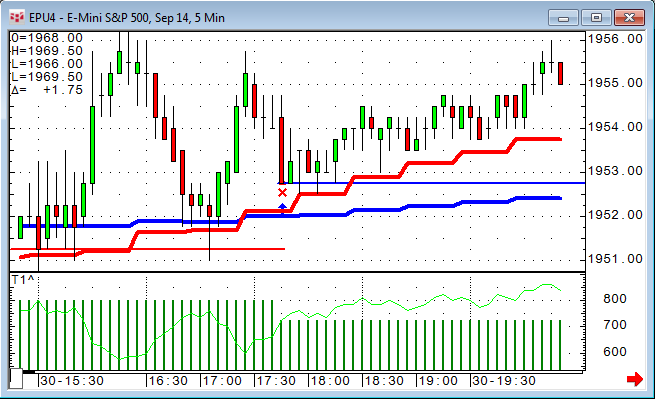

One of the questions we received recently was if it is possible to trigger a trade in a certain market based on another trading system trading a different market. The answer is yes. Here is how to… more

In my previous article, Backtesting Tip: Parameters inside CQG Code, I discussed the different parameter types and how to use them. This is important for all backtesting users because only values… more

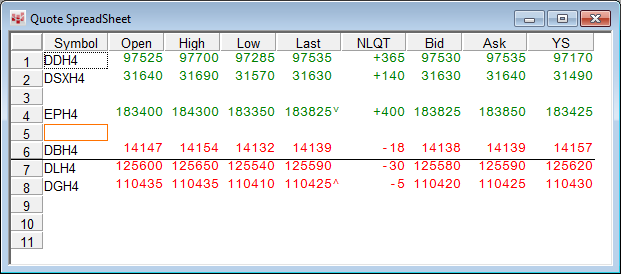

CQG Product Specialist Doug Janson covers two of the most underutilized features in CQG: DOM study values and Signal Evaluator.

DOM study values allow overlay study values to be placed into… more