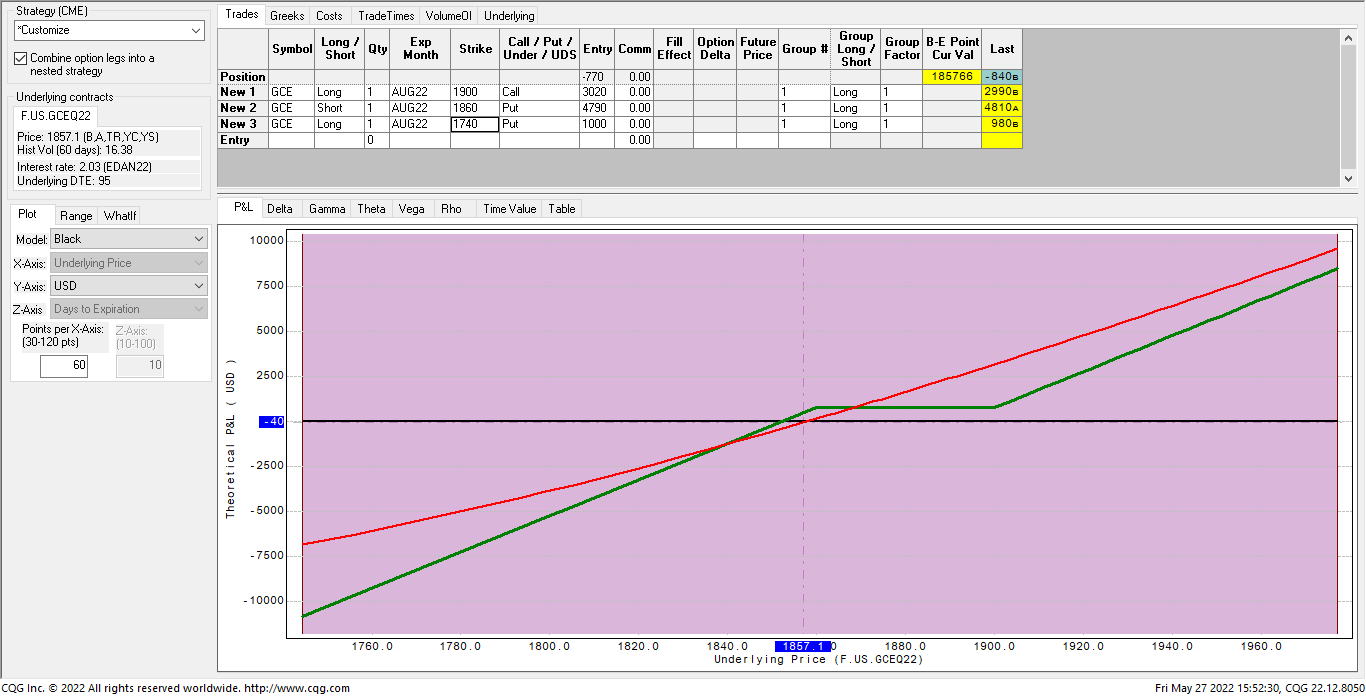

Over the past few weeks, I’ve asked several options pros with over forty years’ experience about a specific options strategy that I developed for speculators which has limited downside risk and… more

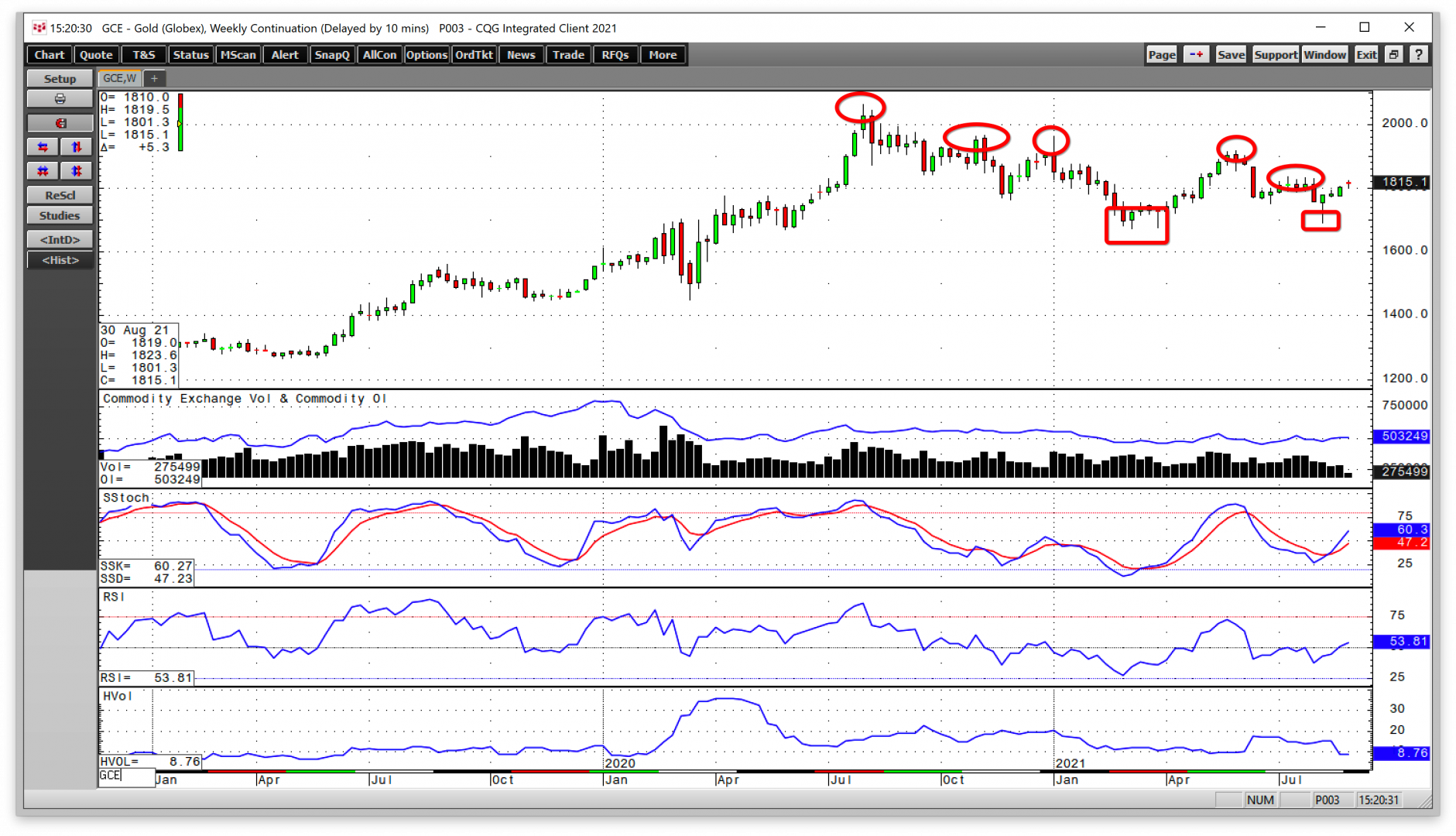

Gold

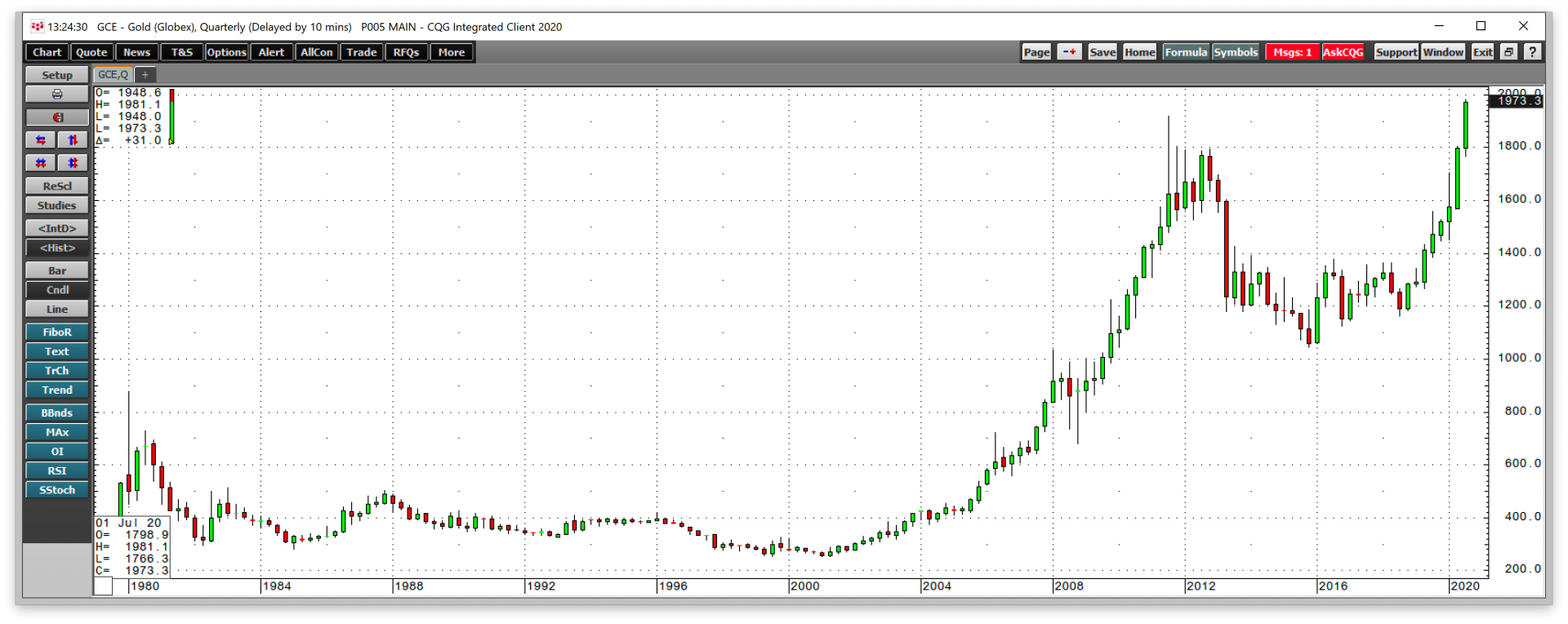

After soaring to an all-time peak in August 2020 in US dollar terms, gold has traded on either side of $1800 per ounce throughout 2021. The yellow precious metal reached a record level in nearly… more

July 2020 was a month where the prices of gold and silver posted significant gains. In what has been almost a perfect bullish storm for the two precious metals, a decline in the value of the US… more

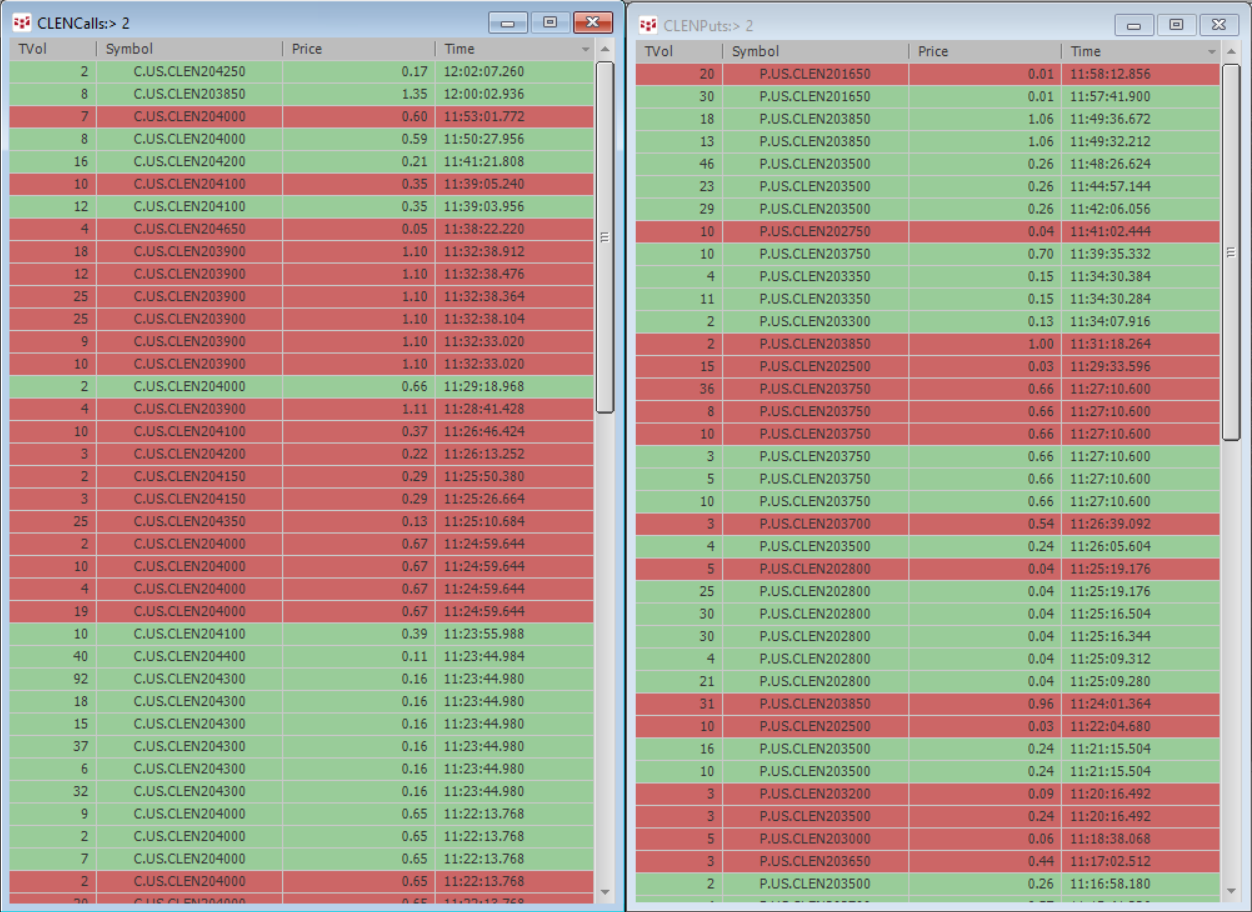

CQG’s Portfolio T&S Monitor displays trades using a time & sales format for a portfolio of instruments. The standard T&S display shows you trading activity for just one instrument.… more

The silver-gold ratio measures the price relationship between the two precious metals. Silver and gold are hybrid commodities as both have long histories as both metals with a myriad of… more

With fear and uncertainty mounting over the prospects of a global recession, interest rates have been falling. Even though the dollar index is in a bull market trend, the price action in the gold… more

February 2019 was an excellent month for the prices of two high-profile metals that trade on the futures exchanges. Gold is a metal that has many roles. The yellow metal is a go-to favorite when… more

Gold fell to a low at $1161.70 in mid-August, but silver waited until mid-November to find its bottom at $13.86 per ounce. Since the lows, the precious metals have been making higher lows and… more

It has been a bullish start to 2018 in the precious metals sector. Palladium began the year with a new record high, and the prices of gold, silver, and platinum have all appreciated after having… more

Customers using our flagship product, CQG Integrated Client (CQG IC), have access to a new study called Algo Orders. Using a proprietary algorithm, this indicator of trading activity detects and… more