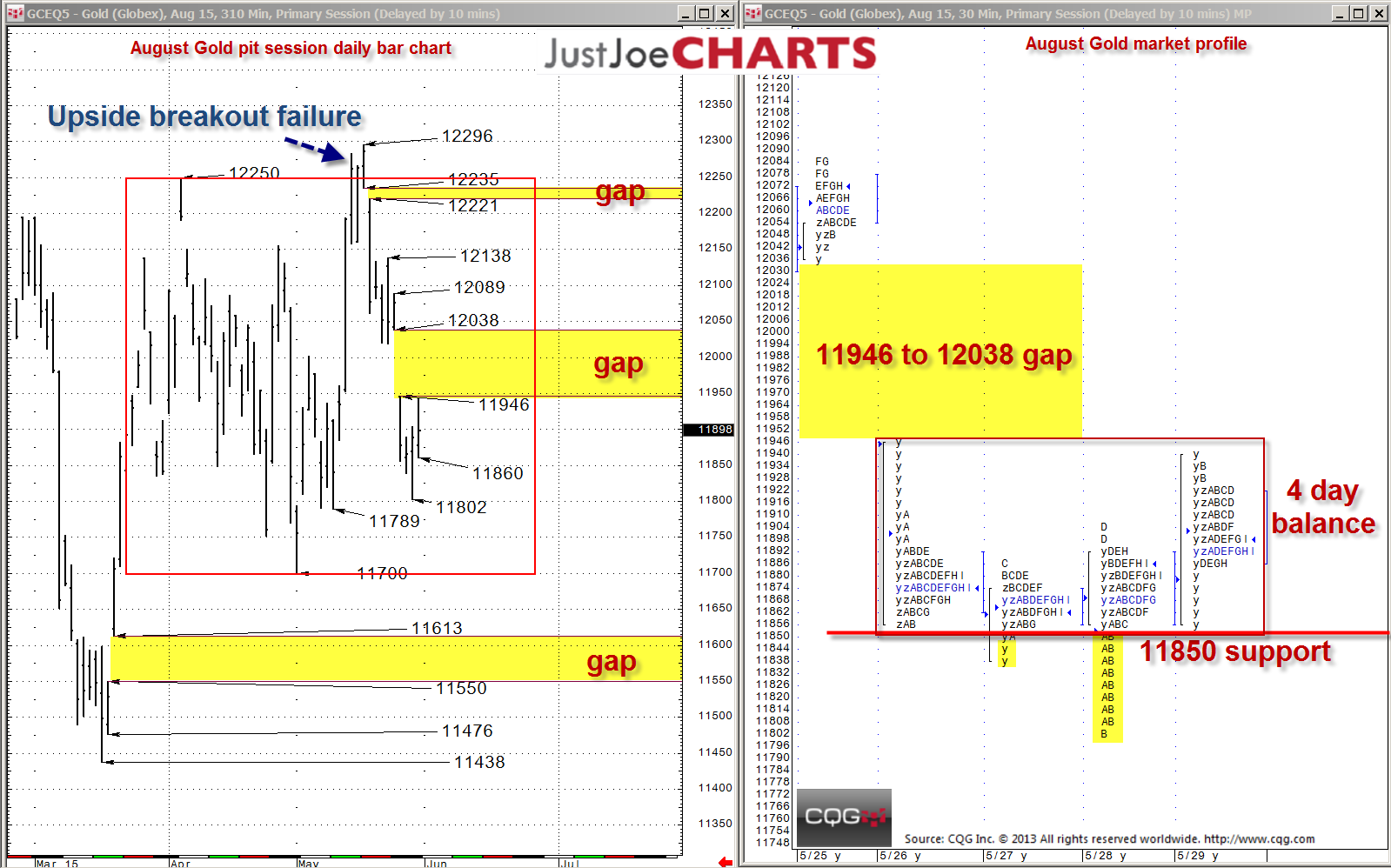

Over the past three months, August gold has been rotating within a balance range of 11700 to 12250. During that time, the market has made several extreme moves in both directions, however, a broader view of the market shows it is range bound and nothing has really changed at all. Three weeks ago, the market actually took out the 12250-balance high, trading slightly above it for three straight days. This is something I have written in many of my articles.

When a market trades outside a balance extreme, the two most likely scenarios are:

- Gaining acceptance outside the balance and acceleration

- Breakout failure followed by a rotation to the opposite end of that balance range

In this particular case, the breakout attempt failed and the market took out the previous day's low six of the next nine days, leaving a pretty large gap along the way.

The last four trading days, the market seems to have come into balance with the majority of trading taking place in between 11850 and 11950 during that time. Additionally, 11850 appears to be a pretty solid support reference from a day trader's perspective.

If the market gains acceptance below the 11850-support level, the next likely target is the 11789-daily bar chart reference followed by the 11700-balance-bracket low. If the market gains acceptance above the four-day balance, it will likely attempt to fill the 11946-to-12038 gap.