March and April 2025 were hair-raising rollercoaster months for the copper market. While the COMEX futures rose to new highs, eclipsing the May 2024 peak in March, the LME forwards did not follow the futures markets, remaining below the May 2024 record high.

In April, the futures plunged, falling nearly $1.25 per pound to just shy of the critical technical support level. Over three weeks, copper futures soared above technical resistance only to return to technical support.

In late April, the red nonferrous metal recovered and was once again approaching the $5 per pound level. While copper's price action has created incredible trading opportunities, it has not been for the faint of heart.

New record highs for futures in March

The copper market experienced some head-spinning price action in March and April 2025.

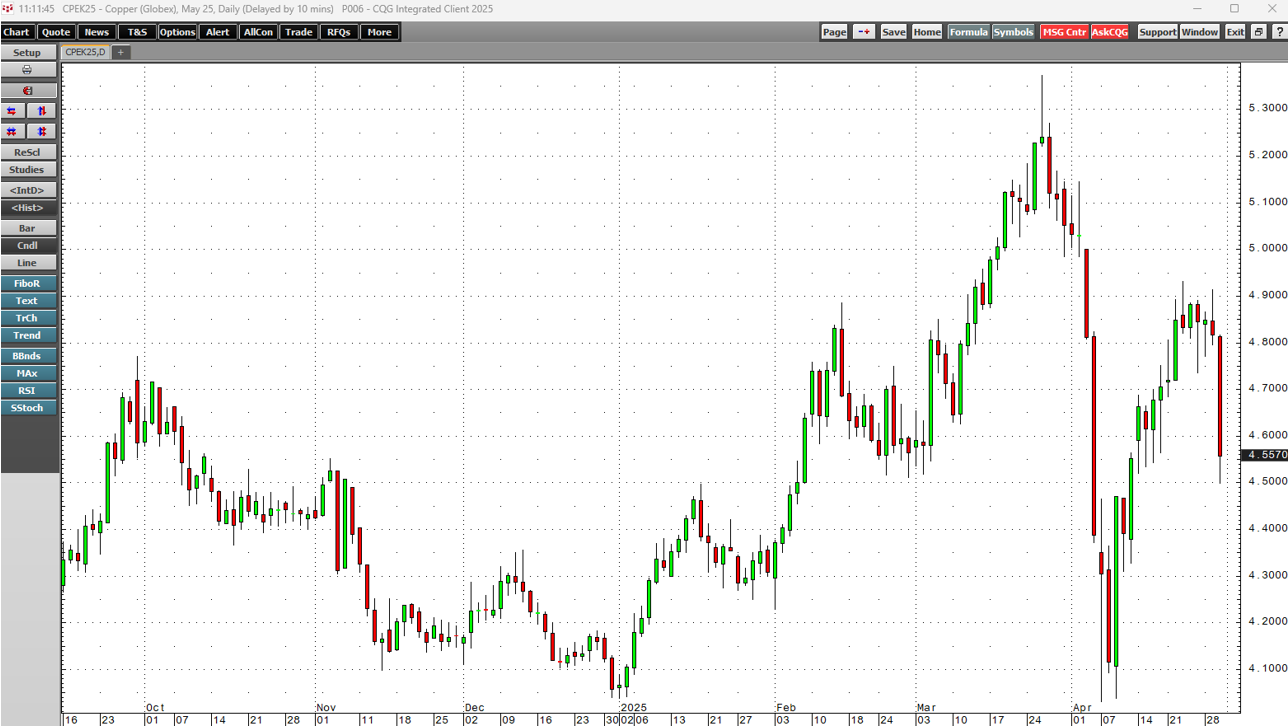

The daily chart highlights the rise of the COMEX May copper futures to a new record $5.3740 per pound high on March 26, eclipsing the May 2024 $5.1985 continuous contract peak.

Copper futures ran out of upside steam at the late March peak. Within three short weeks, the price dropped 25% to a $4.03 low on April 7.

A test of critical support in April

The spike low held critical support levels on the continuous copper futures contract.

The monthly chart shows copper futures held above the November and December 2024, and the January 2025 lows of just above $4 per pound. Copper's descent fell short of challenging the technical support, leading to a rally that took the red nonferrous metal back above $4.85 per pound in late April.

The divergence between forward and futures prices indicated the correction

The monthly chart highlights copper's long-term bullish trend since the January 2016 $1.9355 low. Copper has made higher lows and higher highs, respecting technical support levels for nearly a decade.

The quarterly chart reveals that copper futures have been in a bullish trend throughout this century since reaching a $0.6050 per pound low in 2001.

A significant sign that copper futures extended to unsustainable levels was the price action in the LME three-month copper forwards. The LME forwards reached a record $11,104.50 per metric ton peak in May 2024 when the COMEX futures rose to just below the $5.20 per pound level. Meanwhile, LME copper forwards only reached a lower $10,110.49 high in March 2024, when the COMEX futures reached a new record peak.

The potential for U.S. tariffs under the Trump administration caused the dislocation as they create trade barriers that distort prices and location spreads. The uncertainty of the tariffs caused copper to flow from LME warehouses in Europe and other regions to the United States, causing the U.S. futures prices to rise more than the LME forwards price. Meanwhile, the early April tariff announcement that excluded copper and other metals caused futures prices to plunge as the market corrected the trade-related distortions. Over the past months, LME warehouse stocks have declined, while COMEX warehouse inventories have increased.

The bottom line is the lack of a new high in the LME forwards was a sign that the price action in the futures market had become overdone and unsustainable.

The bullish case for copper as the price recovers

Copper's March ascent, early April plunge, and late April recovery reflect the ongoing bullish sentiment underpinning the base metal. The bullish case for copper includes the following:

- Production costs have increased, putting upward pressure on prices.

- New production requires higher prices as financing and other costs have increased.

- Increasing demand for copper has caused production to struggle to keep pace with the demand.

- Technological advances will require more copper in the coming years.

- China is the demand side of copper's fundamental equation, consuming over half the world's refined copper supplies each year.

- Many analysts, including Goldman Sachs , believe copper prices will reach $6 to $7 per pound.

- Copper remains in a long-term bullish trend, and the trend is always a trader or investor's best friend.

Despite the recent volatility, copper's bullish trend remains firmly intact in late April 2025.

The factors that could weigh on the red metal over the coming weeks and months

While copper's bullish path of least resistance continues, even the most aggressive bull markets rarely move in straight lines. Over the past quarter of a century, copper has experienced many downside corrections, but they have not negated the long-term bullish trend. The following factors could cause future downside price action:

- A continuing trade war between the U.S. and China could distort copper prices, increasing two-way price volatility.

- Weak Chinese economic growth would likely weigh on the global copper demand, causing price weakness.

- Any sudden rise in the U.S. dollar's value against other worldwide currencies could weigh on copper prices as the U.S. dollar is the nonferrous metal's pricing mechanism.

- A global recession could cause price weakness in copper, base metals, and many commodities.

Buying price corrections, leaving plenty of room to add on declines, has been optimal for copper since the turn of this century. Increasing demand and supplies that are struggling to keep pace provide the copper market's fundamental underpinning. However, the path of least resistance could be choppy with parabolic rallies, and implosive price plunges, as we have witnessed in March and April 2025.