As markets head into the final month of 2022, market participants continue to face uncertainty as the war in Ukraine continues, the Fed is battling the highest inflation in decades, gridlock in the US government is on the horizon in 2023, and cryptocurrencies have melted down as the FTX bankruptcy has caused the crypto winter to turn arctic.

Markets reflect the economic and geopolitical landscapes, which remain highly uncertain in December 2022, a prescription for volatility. Moreover, thin trading conditions with many market participants sitting on the sidelines only increase the potential for wide price variance during the 2022 holiday season. The current question facing markets is if the Fed will increase the short-term Fed Funds Rate by 50 or 75 basis points. The Fed Chairman’s latest speech seems to point to the lower increase. At the same time, OPEC will determine if the members increase or decrease crude oil output in early 2023. Expect lots of volatility in markets across all asset classes in December, and you will be prepared for the potential of a storm of wide price variance.

The crude oil decline will likely end

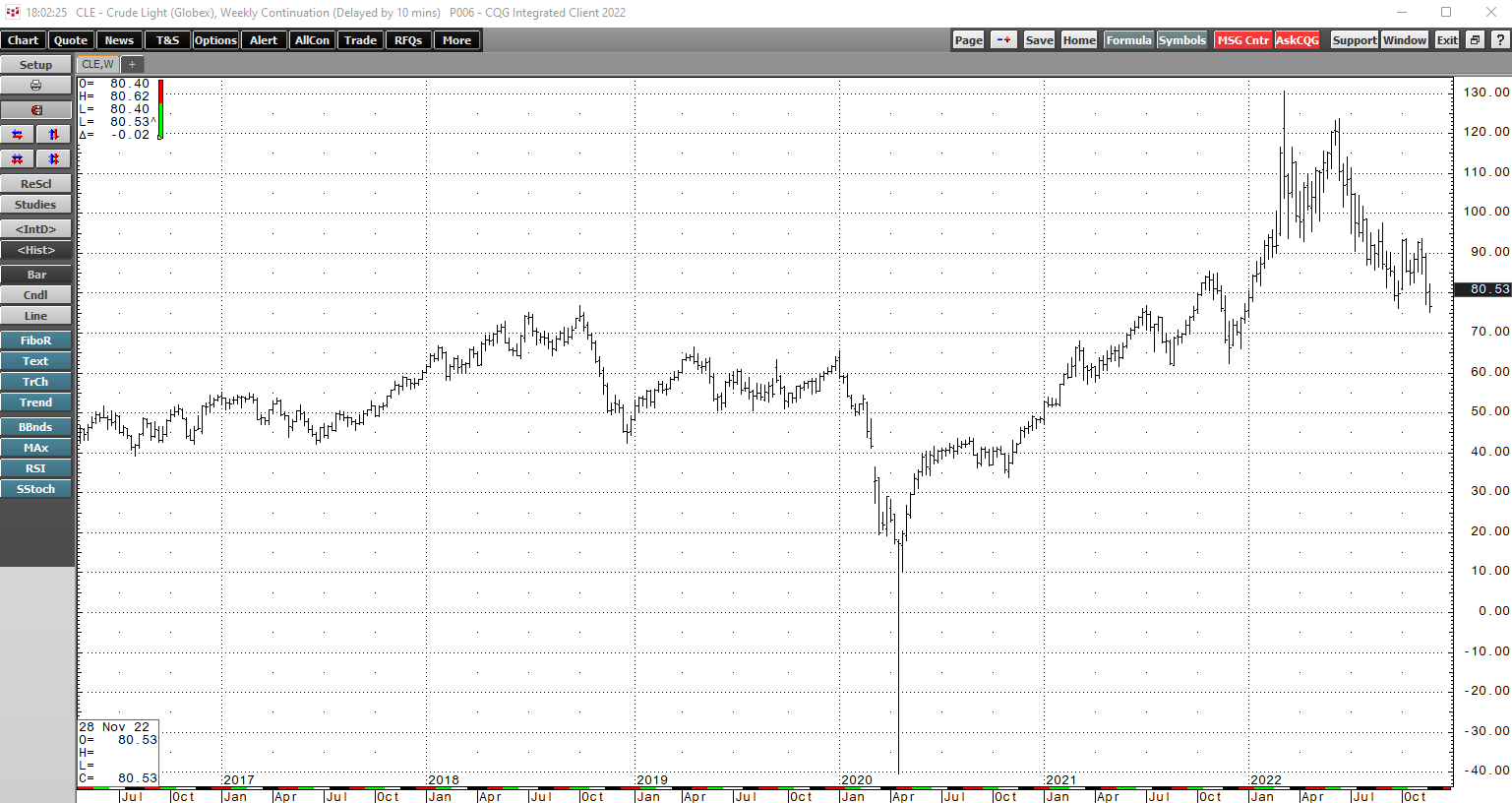

Crude oil futures have plunged from the March 2022 high.

The chart highlights the decline from the March 2022 fourteen-year high of $130.50 to $80.55 per barrel on November 30, a 38.3% drop.

The following factors will likely prevent oil from falling below the $70 per barrel level during the current correction:

- The US Strategy Petroleum Reserve stood at 389.1 million barrels for the week ending on November 25, 2022. At the end of 2021, the SPR was 594.7 million barrels, 52.8% above the current level. The Biden administration that approved the unprecedented sales has said it will look to replace the SPR at the $70 level.

- OPEC and Russia now control oil production policy because of the dramatic shift in US energy policy to a greener path. After the significant decline, the cartel is not likely to increase output, and production cuts could be on the horizon at the upcoming OPEC meeting in early December.

- Chinese COVID-19 lockdowns will likely end sooner rather than later, increasing the global petroleum demand.

- Russia continues to use traditional energy, crude oil, and natural gas as an economic weapon against “unfriendly” countries supporting Ukraine.

Crude oil prices appear to have limited downside potential at below $80 per barrel. As the market moves into 2023, the potential for rising prices is high.

Natural gas volatility - Wild days ahead

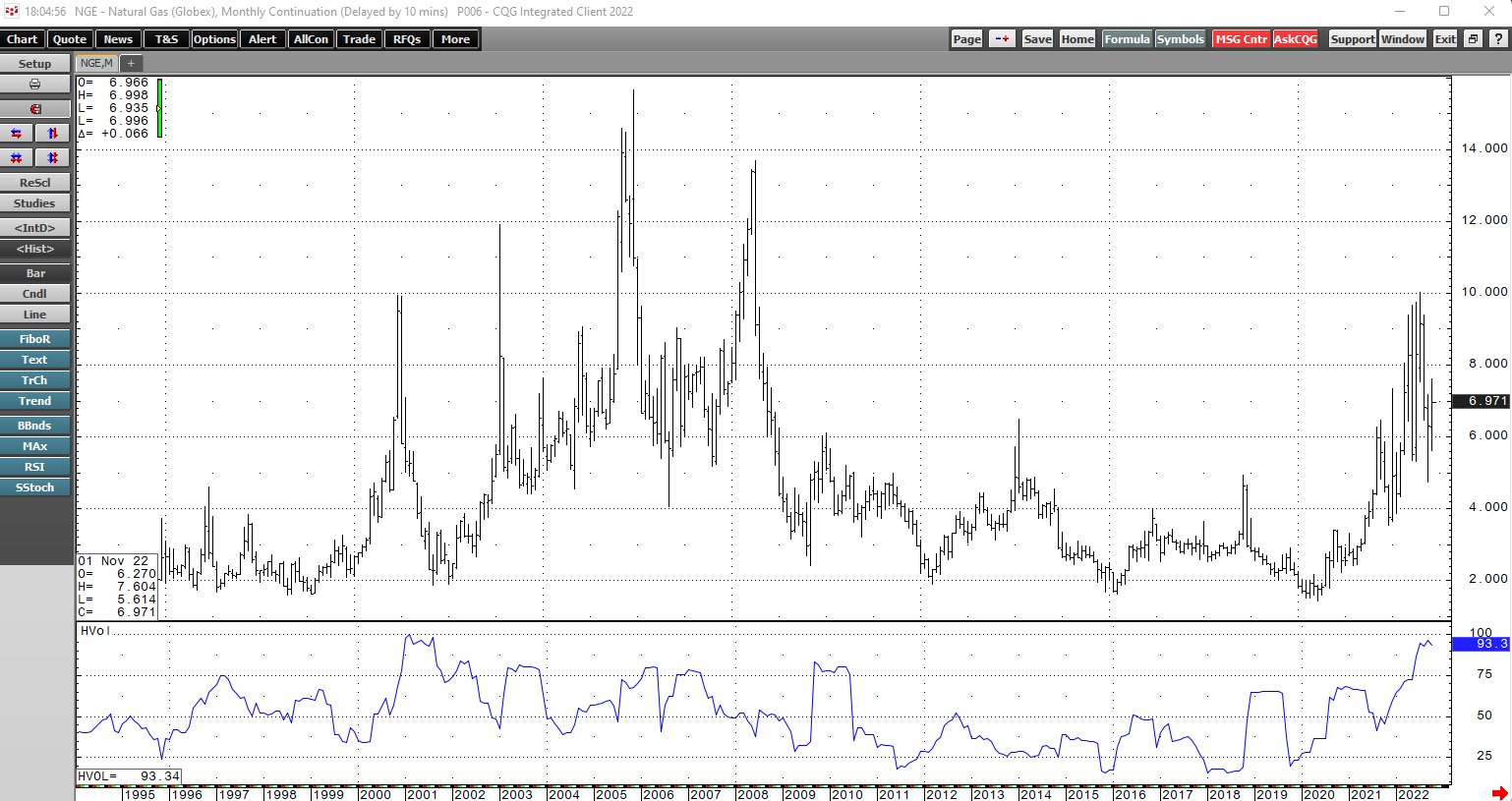

On the week ending on November 18, 2022, the EIA reported the first withdrawal from natural gas inventories, finishing the 2022 injection season. The inventories stood at 3.644 trillion cubic feet at the high, the same level as the end of the 2021 injection season. Natural gas price variance has been at the highest level in years in 2022.

The chart shows the $6.39 trading range in nearby NYMEX natural gas futures in 2022. Monthly historical volatility at 93.3% is at its highest level since 2001. The last time natural gas traded in a wider trading range was in 2008, which was also the last time the price probed above the $10 per MMBtu level. The midpoint for 2022 stands at $6.833 per MMBtu. Nearby January futures were near the $7.00 level on November 30.

The following factors support a continuation of wild price swings in the US natural gas futures arena:

- As LNG has increased the addressable market far beyond the US pipeline network, US natural gas has become a far more international commodity.

- European natural gas prices are at record highs. While they have come down from highs earlier in 2022, they remain in record territory as Russia uses gas as an economic weapon against the NATO countries supporting Ukraine.

- We are now at the heart of the most volatile US season in natural gas as the uncertainty of the weather over the winter causes supply concerns. Natural gas will move with the latest weather reports, and a cold winter will increase the price variance and push prices periodically higher.

Natural gas futures have not been for the faint of heart in 2022, which will likely continue through December and into early 2023.

Gold is sitting and waiting with bullish winds in its sails

Nearby COMEX gold futures were at the $1768 per ounce level on November 30.

The monthly chart highlights the pattern of higher lows and higher highs in gold since the precious metal reached a bottom of $252.50 in 1999. Gold traded to a new record peak of $2072 in March 2022, but the 14.7% pullback to the $1768 level has not violated the long-term bullish trend in place for over two decades. The following factors favor gold for the coming months:

- Inflation remains at a four-decade high. The rise in interest rates and the strongest dollar index since 2002 has not caused gold to plunge. In 2002, the last time the dollar index was near the 106 level, gold’s high was below $330 per ounce. Gold has held up well in the current environment.

- In Q3 2022, central banks purchased nearly 400 metric tons, a 300% increase from the same period in 2021 and a record high. Official sector buying validates gold’s role in the global financial system.

- Earlier this year, Russia declared that 5,000 rubles are exchangeable for one gram of gold, putting the Russian currency on a gold standard. If China follows its Russian ally, gold’s role will rise.

- In 2022, gold was 3.4% lower than the closing price on December 31, 2021. Gold has outperformed stocks, bonds, cryptocurrencies, and many other assets in 2022, as the precious metal has provided investors with a more secure store of value.

Gold rose to a new record high in 2022, and the potential for another leg to the upside in gold is compelling. Bull markets rarely move in straight lines, and the gold bull may have aged, but it remains strong as we head toward the end of this year.

Copper is the new oil

Copper is the red base metal with a Ph.D. in economics as it diagnoses the health and well-being of the global economy. Nearby NYMEX copper futures rose to a record $5.01 per pound high in March 2022 before correcting.

The monthly chart shows the decline from the March 2022 high to $3.15 per pound in July. At around $3.60 per pound level on November 30, copper continues to digest the 2022 price volatility. Copper fell because of rising US interest rates, the strongest dollar in two decades, and Chinese economic weakness, and China is the leading copper consumer. Meanwhile, the following factors point to a compelling bullish long-term potential for the red metal:

- Goldman Sachs calls copper the “new oil” because “decarbonization does not occur without copper.” Copper is the leading base metal required for electric vehicles, wind turbines, and other green energy initiatives.

- Copper fundamentals remain tight. LME stocks have made lower highs over the past five years and were below the 100,000 metric ton level at the end of November. It takes the better part of a decade to bring new copper production online.

- Goldman Sachs forecasts that copper prices could rise to the $15,000 per ton level in 2025, translating to a COMEX price of over $6.80 per pound. At the $3.7755 level on November 30, the potential is for an over 80% rally over the coming years.

- When China emerges from its COVID-19 protocols, copper demand will likely rise, pushing the price higher.

Copper fundamentals provide a compelling case for higher prices over the coming years.

Stocks and bonds - Expect more price variance in December

2022 has been an ugly year for the US stock and bond markets. The S&P 500, the most diversified US stock market index, was down 14.4% from the December 31, 2021, closing price on November 30. The bond market has plunged since the end of last year. Thirty-year conventional fixed-rate mortgages below the 3% level in late 2021 moved to over 7% over the past weeks.

As we head towards the end of the year, the potential for tax-loss selling will increase, causing elevated volatility in the stock and fixed-income arenas. Meanwhile, cryptocurrencies remain near the recent lows after the FTX bankruptcy. As the market digests the potential for related issues, cryptos remain toxic as of November 30. In November 2021, the asset class’s market cap was over $3 trillion; on November 30, it was just below the $860 billion level.

Thin trading conditions during the 2022 holiday season may only exacerbate market volatility over the coming weeks. Approach markets with a risk-reward plan and stick to the program. December could be a wild month in markets across all asset classes.