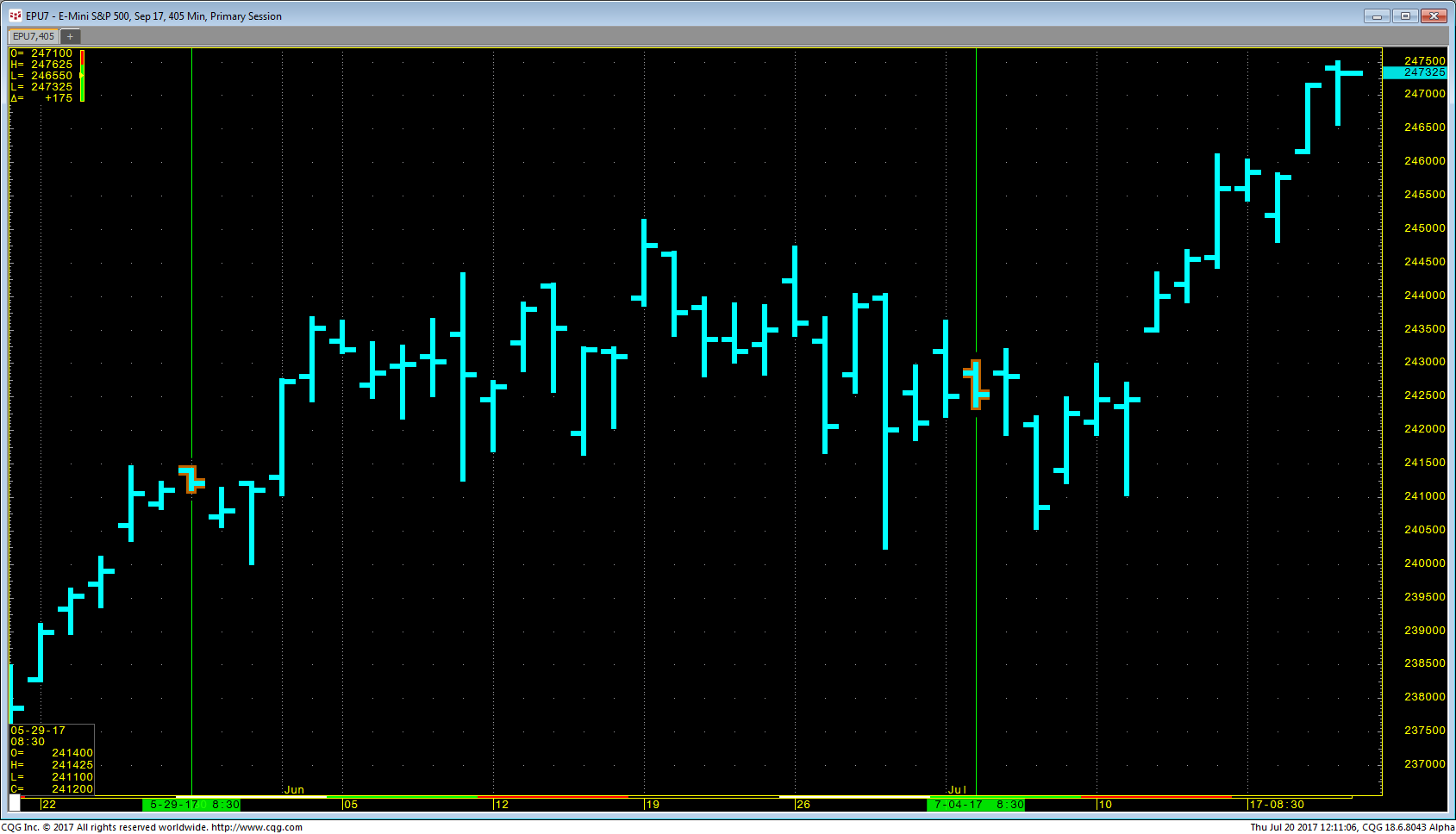

These two Microsoft Excel® dashboard display market quotes for tradable UDS for the crude oil contract and the E-mini S&P 500 traded on Globex. There is also a quote display with at-… more

Thom Hartle

This Microsoft Excel® dashboard provides a drop-down menu where you can select the underlying market, such as E-mini S&P 500. The display will then show all front contract option symbols… more

This Microsoft Excel® dashboard scans the VIX (CBOE) options market for volume and displays the strikes ranked by the volume traded for each expiry listed. The scan covers options traded 15… more

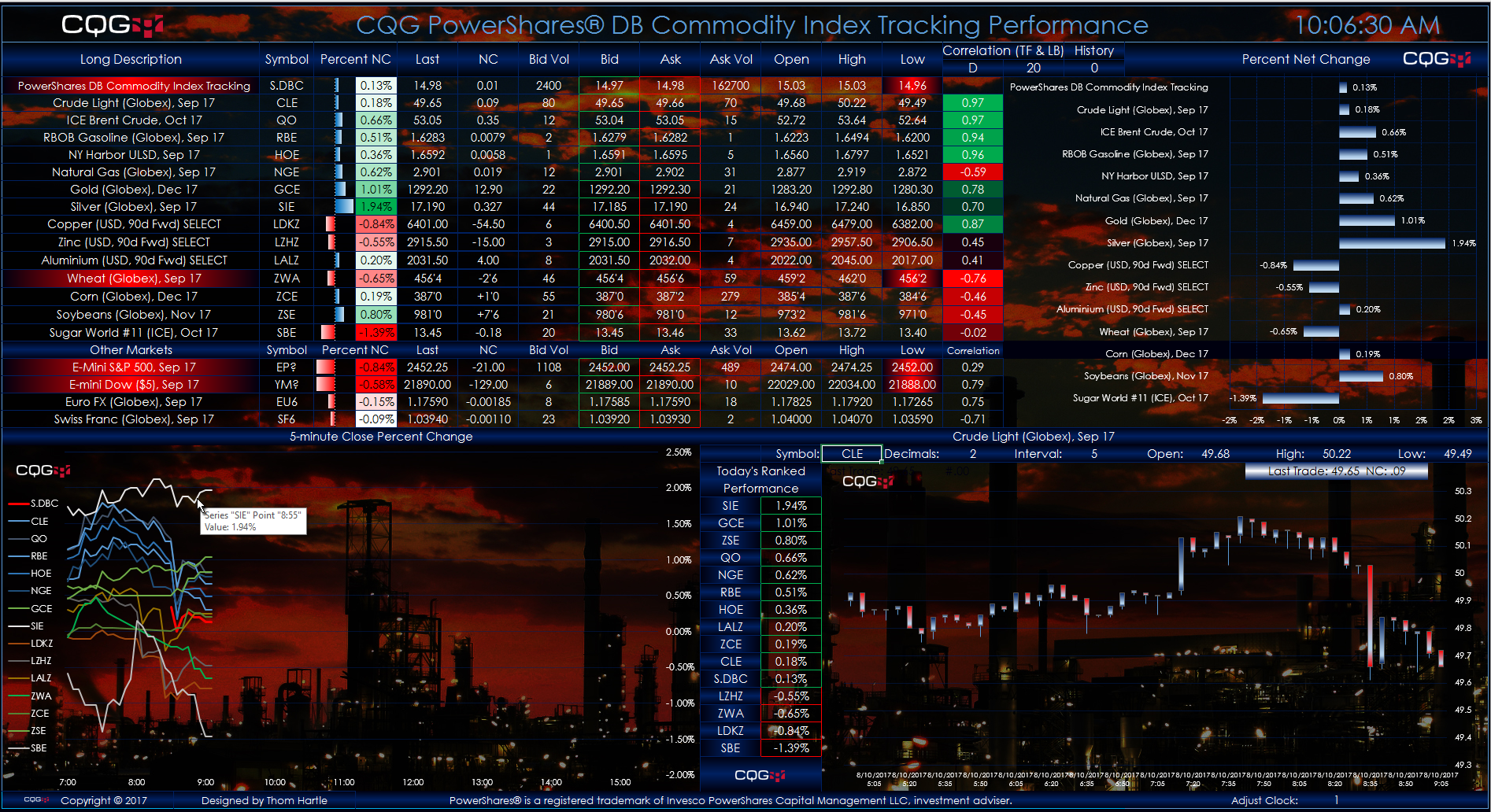

This Microsoft Excel® spreadsheet tracks the front month contracts of the PowerShares® DB Commodity Index (symbol: DBC) holdings. The actual ETF holds deferred contracts. More information about… more

This Microsoft Excel® dashboard displays the cash indices available from the Hang Seng Indexes Company.

The quote displays are divided into four sections. The first section is the cash Hang… more

This Microsoft Excel® dashboard scans the options on futures for the H-shares Index (HHI) and ranks the traded volume for each expiry out to nine expirations. The scan covers options traded… more

This Microsoft Excel® spreadsheet tracks the constituents of the DJIA Index (symbol: DJIA).

Throughout the trading session, the thirty individual stocks are dynamically ranked and displayed… more

This Microsoft Excel® dashboard scans the Hang Seng Index market options on futures and ranks the traded volume for each expiry out to eleven expirations. The scan covers options traded ten… more

In this article, we outline how to pull historical market data into Excel while excluding data from days when the market was in a holiday session.

Holiday sessions are trading dates, but… more

RTD formulas for chart types and studies can include the same parameter settings used in your CQG continuation charts. In the RTD formula the continuation parameters are entered in the “time… more