This post, DEMA Based MACD Oscillator, introduced using the Double Exponential Moving Average Study for smoothing the data to create an MACD study that would have less lag than the classic MACD study, which uses Exponential Moving Averages (EMA).

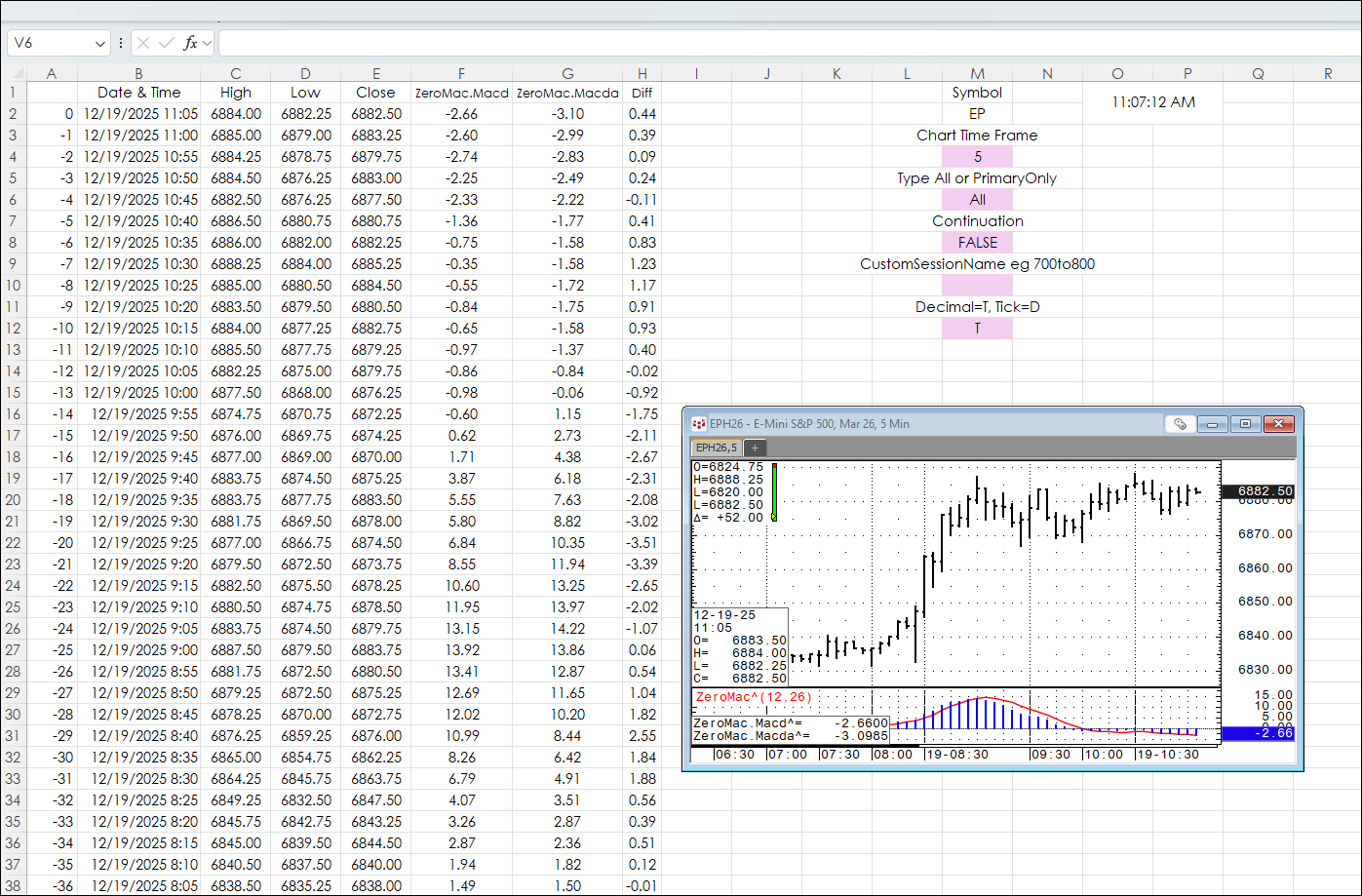

This post offers an Excel sample pulling in O, H, L, and C data along with the data for the ZeroMac study detailed in the post mentioned at the start of this post.

The two RTD formulas are:

=RTD("cqg.rtd",,"StudyData",$M$2, "ZeroMac^","", "Macd", $M$4, $A2, $M$6,$M$10,,$M$8,$M$12)=RTD("cqg.rtd",,"StudyData",$M$2, "ZeroMac^","", "Macda", $M$4, $A2, $M$6,$M$10,,$M$8,$M$12)The two studies use the symbol in cell M2 and the time frame in cell M4.

The ZeroMac study was developed by CQG Product Specialist Jim Stavros and a sample CQG PAC was included in the post mentioned at the start of this post. For this spreadsheet to work you have to download and install the PAC from that post.

Requires CQG Integrated Client or CQG QTrader, and Excel 365 or more recent locally installed, not in the cloud.