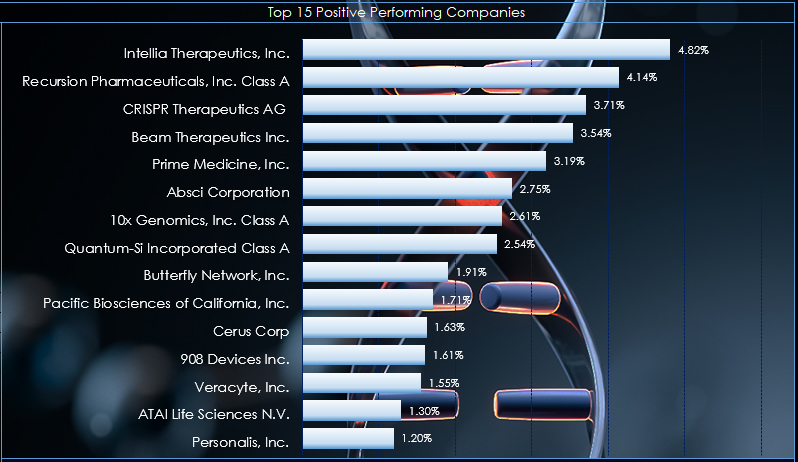

From the ARK website: "Companies within ARKG are focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating… more

Workspaces

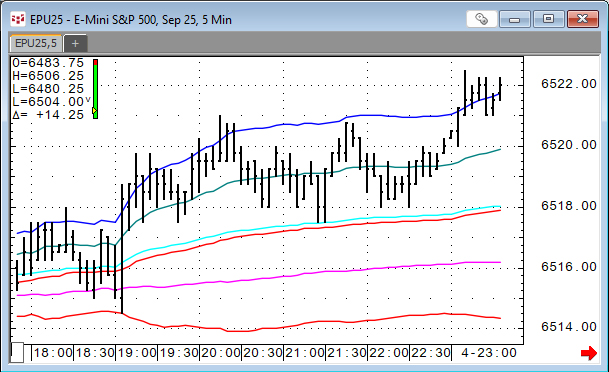

VWAP is the volume weighted average price for a futures contract plotted as a line on the price chart. The calculation is the sum of traded volume times the price divided by the sum of the traded… more

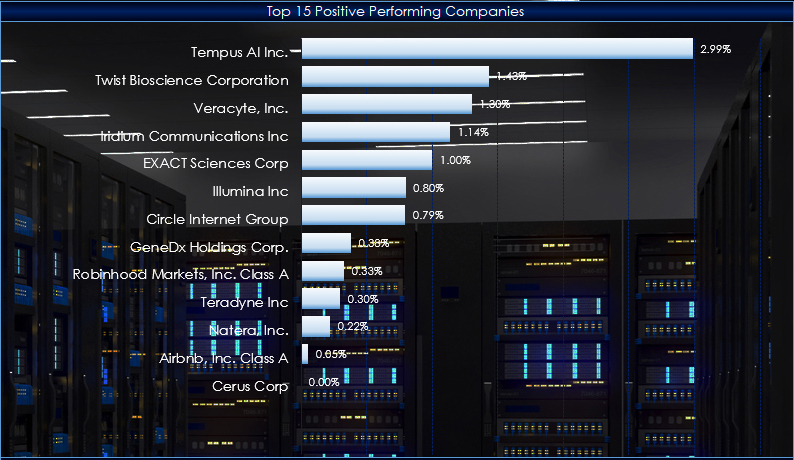

The Ark Innovation ETF (symbol: ARKK) goal is to deliver long-term capital appreciation with low correlation to traditional investment strategies. They invest in the leaders, enablers and… more

1. What is CQG Workspaces?

CQG Workspaces is a public content hub hosting tutorials, downloadable PAC files, Excel dashboards, and workflow guides to help users get the most out of… more

The Invesco QQQ is an exchange-traded fund based on the Nasdaq-100 Index®. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market… more

A recent YouTube post from the All-In Podcast interviewed NVDIA's Jensen Huang, Advanced Micro Devices' Lisa Su, MP Materials' Jim Litinsky, and Crusoe's Chase Lochmiller.

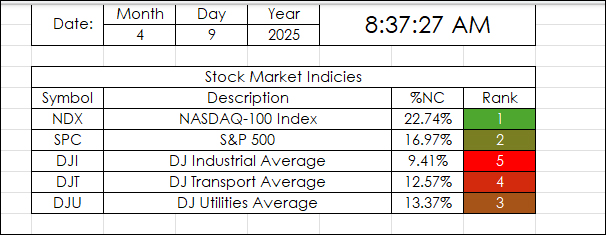

… moreThis Excel Dashboard uses RTD Calls to pull in the Net Percent Change of a collection of markets by a particular date.

For example, April 9, 2025:

"Markets News, April 9, 2025: Dow… more

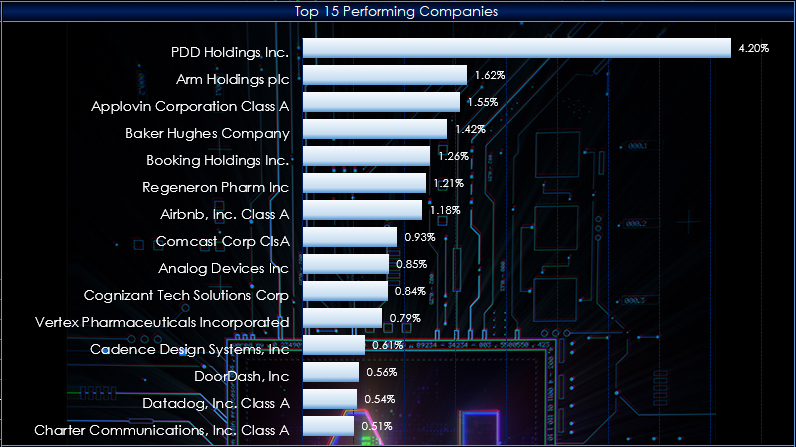

This post presents an Excel dashboard for tracking the constituents of the S&P 500 SPYDR ETF.

The S&P 500 is one of the most cited U.S. stock market indices by the medial and… more

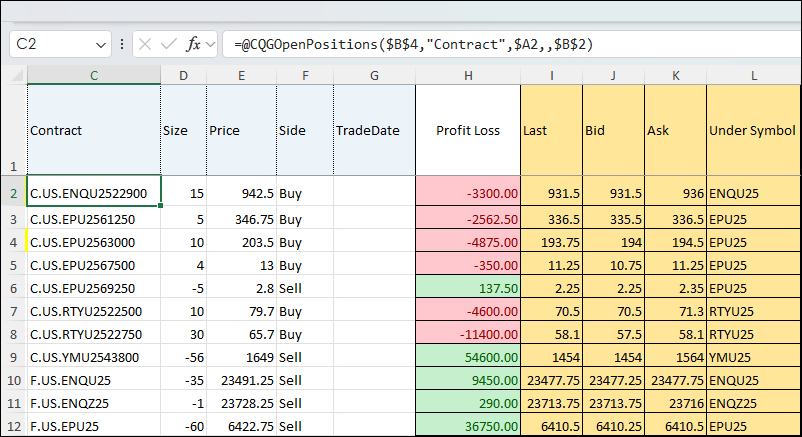

This spreadsheet built by CQG Product Specialist Jim Stavro uses RTD calls to pull in open futures and options positions as well as "Greeks" using RTD formulas.

To use the spreadsheet, CQG… more

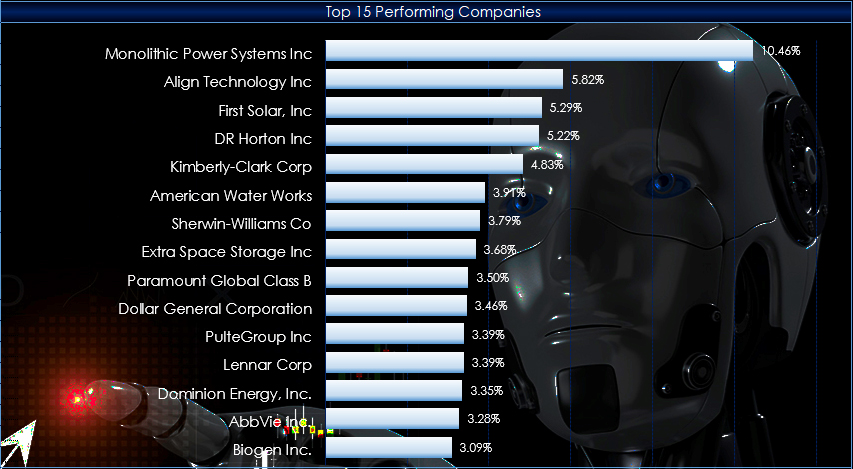

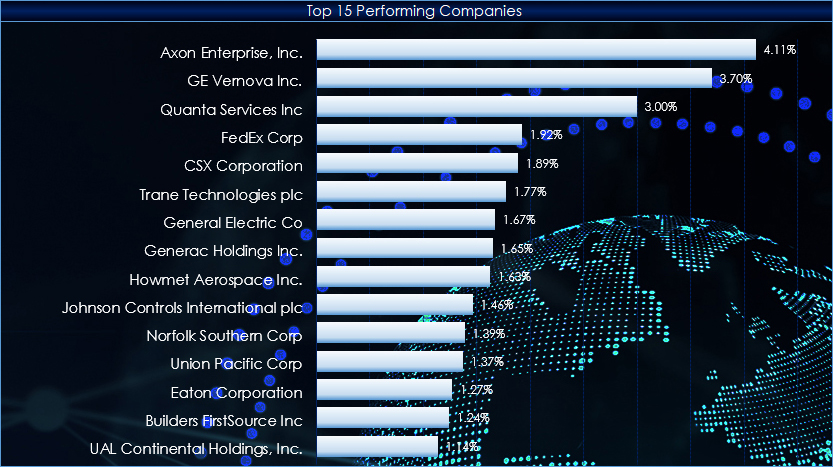

This post presents an Excel dashboard for tracking the constituents of the Industrial Select Sector SPDR® Fund. So far, during 2025 the top performing sector is the Industrials Sector (up 17.63%)… more