This Microsoft Excel® dashboard displays all of the Globex-traded Eurodollar three-month calendar contracts. The volume column includes a red highlight if today's traded volume exceeds the… more

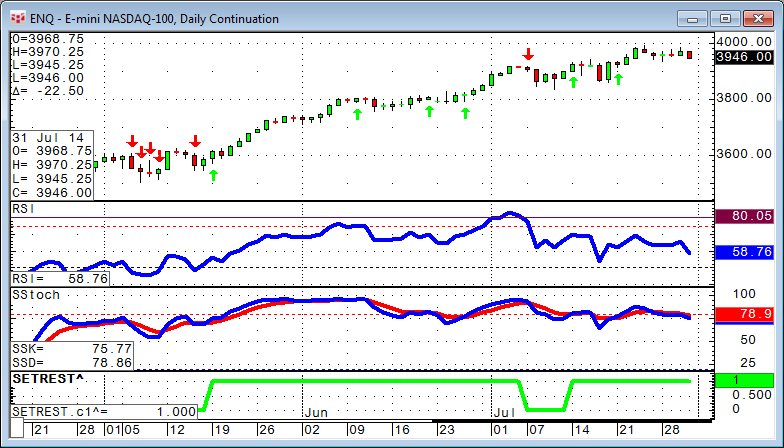

In this article we will look into different ways to use an event to set up a trading opportunity. We will review the differences between BarsSince, Happenedwithin, and Set/Reset.

… more

Customers worldwide use CQG to deliver data to Microsoft Excel® via RTD calls. Operating System (OS) localization translates the application into another language. Some Excel syntax is different… more

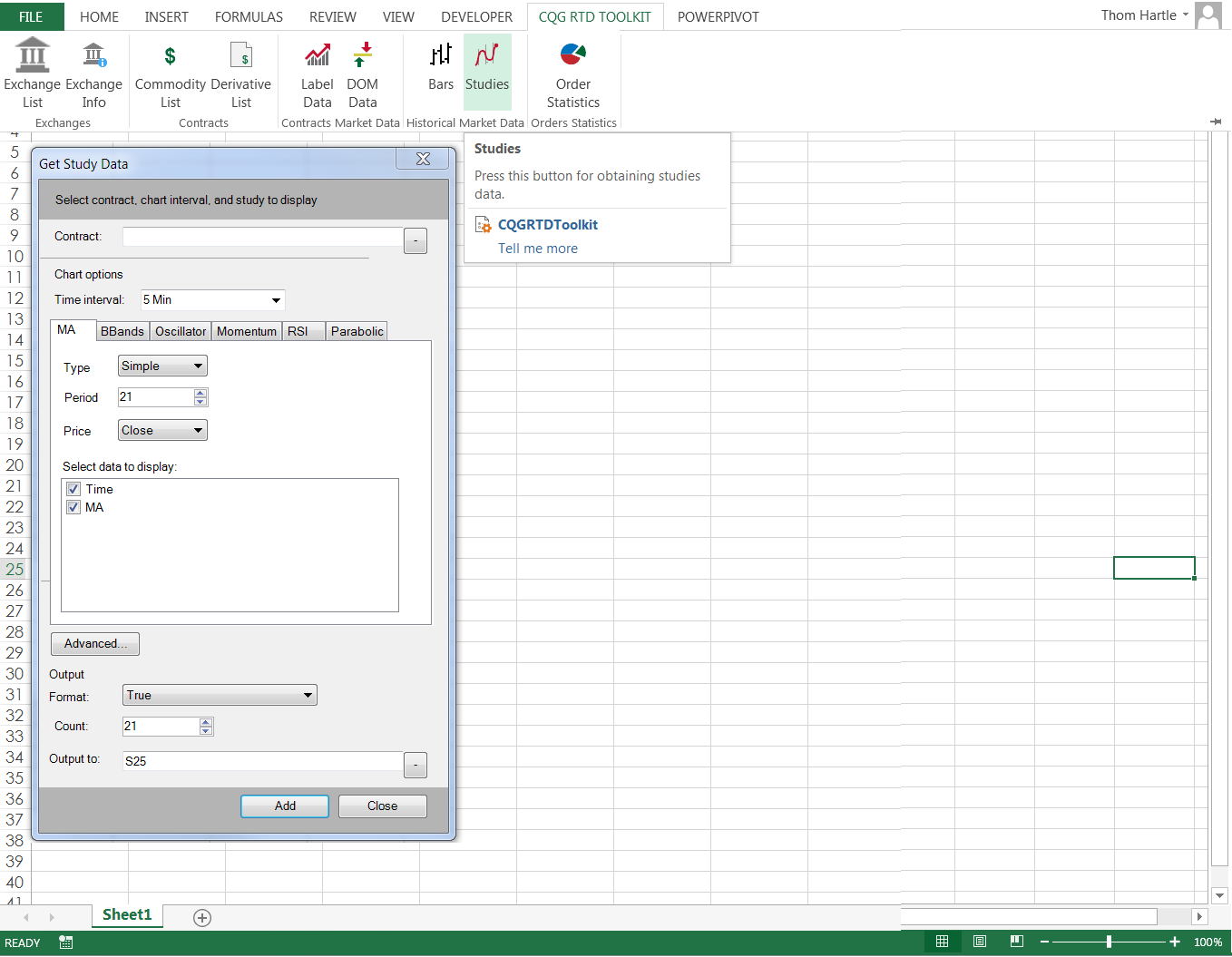

CQG offers a Microsoft Excel® add-in to make your workflow easier when using CQG, RealTimeData (RTD), and 32-bit or 64-bit Excel. The CQG Excel RTD Add-in is installed when you install CQG IC or… more

Take your trading skills to the next level with CQG Product Specialist Helmut Mueller.Building upon his extensive experience, Mueller presents a thorough explanation of the advanced tools… more

This Microsoft Excel® dashboard displays the current crude oil options market ranked by the time of the last trade. It has two columns for two different expiry months. There are two tabs where you… more

This Microsoft Excel® dashboard displays all of the Globex-traded Eurodollar contracts. The volume column highlights in gold the contract that has the largest twelve-day moving average. You can… more

For this month's Traders' Tips, we provide CQG code for the Early-Onset Trend Indicator, described in the August 2014 Stocks and Commodities Magazine article, The Quotient… more

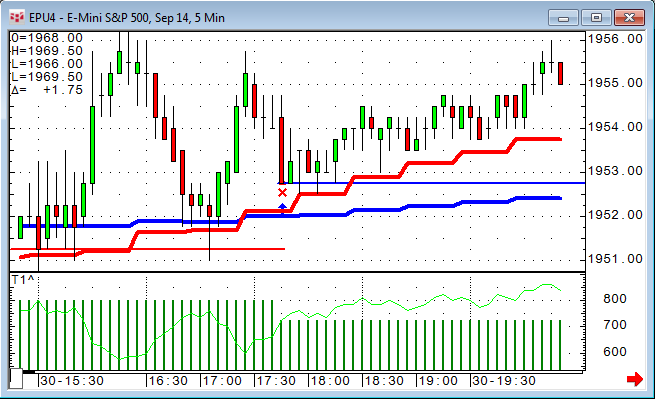

After we looked into some time frame considerations in my last article, the next logical question is to ask if CQG can "optimize time." CQG Trade System Optimizer (TSO) does not allow us to… more

This webinar offers insight into some of Thom Hartle's latest creations in Microsoft Excel® using CQG and the RealTimeData function. Learn tips for designing your own Excel dashboards by viewing… more