In systematic trading, the word robust is often used loosely. Yet robustness has a precise meaning to professional traders: a strategy's ability to survive regime change, parameter variation,… more

Richard Weissman

The big picture is that markets trend. Not all the time and those trends don't last forever. That stated, catching the trend should still be the goal of the successful speculator and should… more

It's not things that upset us, but our judgments about things.

Epictetus

This ancient Stoic insight reveals a timeless truth: suffering comes not from uncertainty itself, but from our… more

In Schwager's "Market Wizards" he interviewed Larry Hite who came up with the gold standard for position sizing, which is to limit risk to 1% of total assets under management per position. In… more

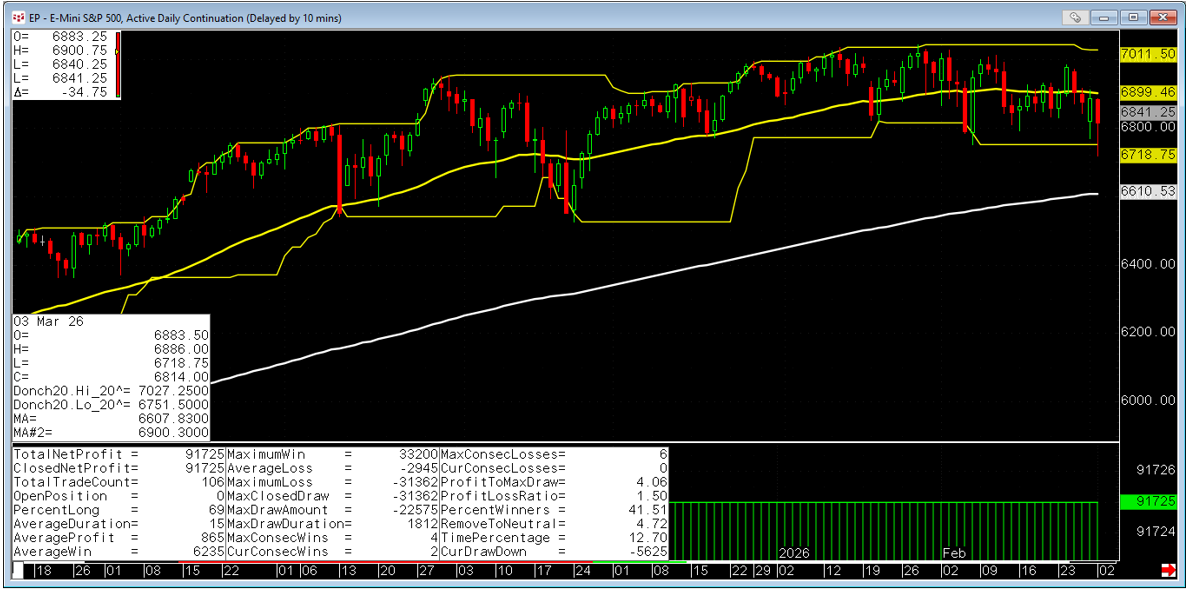

One of the most frustrating aspects of long-term trend following systems is drawdowns from unrealized mark to market peaks in equity. Let’s look at an example:

Figure 1… more

In April of this year, Live Cattle futures broke 2014 all-time highs at $171.975. In prior articles and books, I've named this phenomenon, "blue sky", which occurs whenever an asset makes new all-… more

Larry Hite famously posited the 1% rule in Schwager's, "Market Wizards". This risk management rule suggests risking no more than 100 basis points of total assets under management on any… more

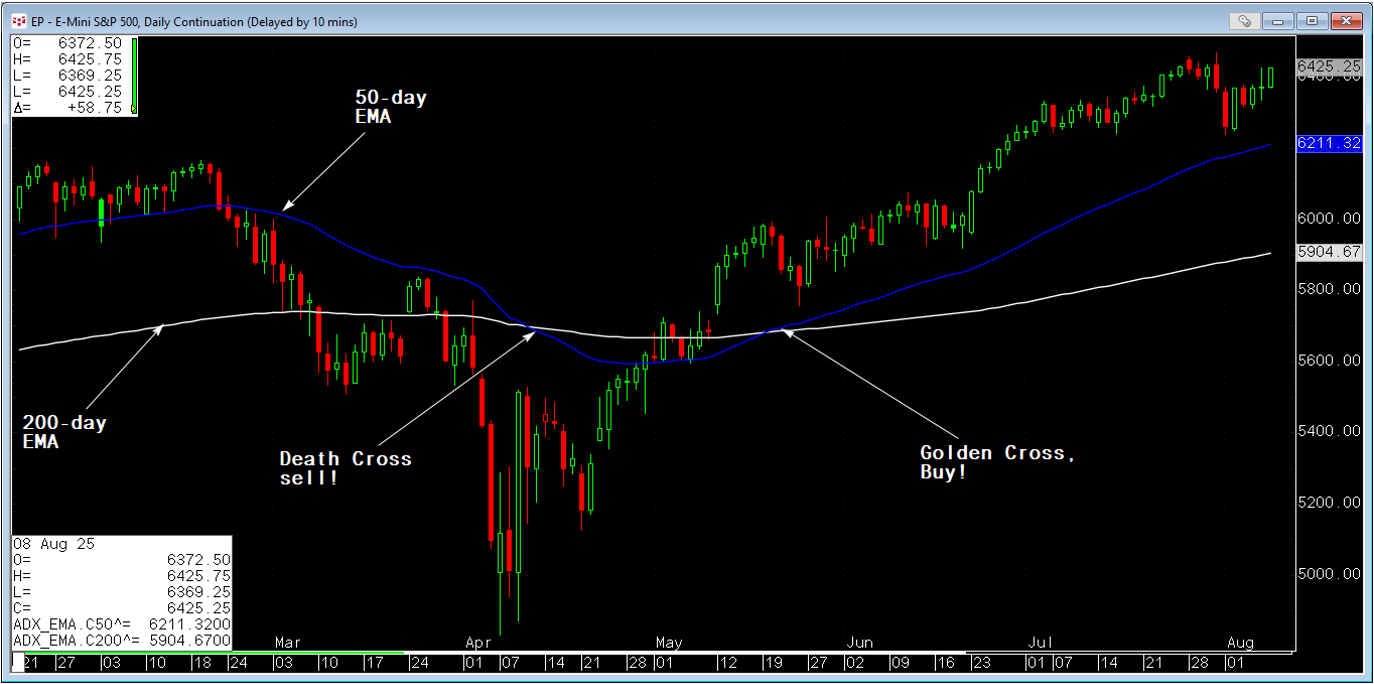

First things first, I freely admit that there are potentially hundreds of views of technical analysis. Nevertheless, in this article I hope to clearly outline what I feel are two of the most… more

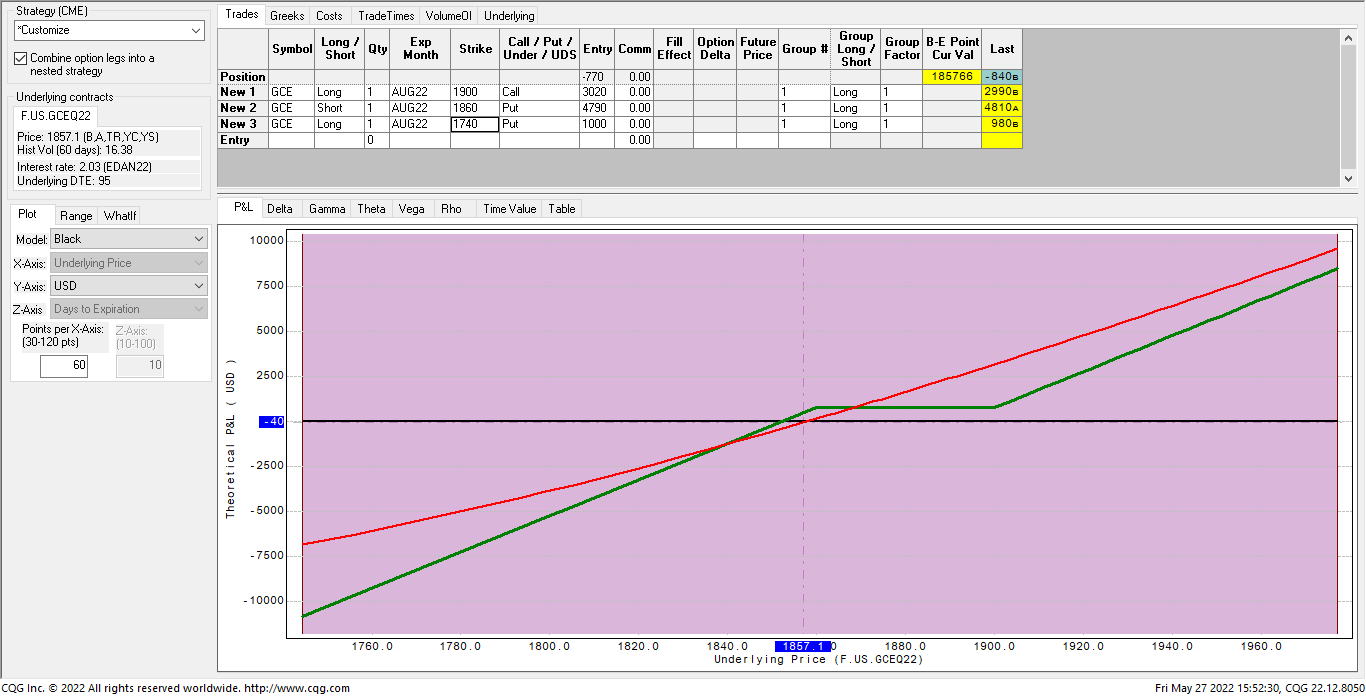

Over the past few weeks, I’ve asked several options pros with over forty years’ experience about a specific options strategy that I developed for speculators which has limited downside risk and… more

I have always believed that every active hedge strategy needs to answer the following three-part question:

Percentage hedged Duration of the hedge Derivative instrument(s) used to hedge… more