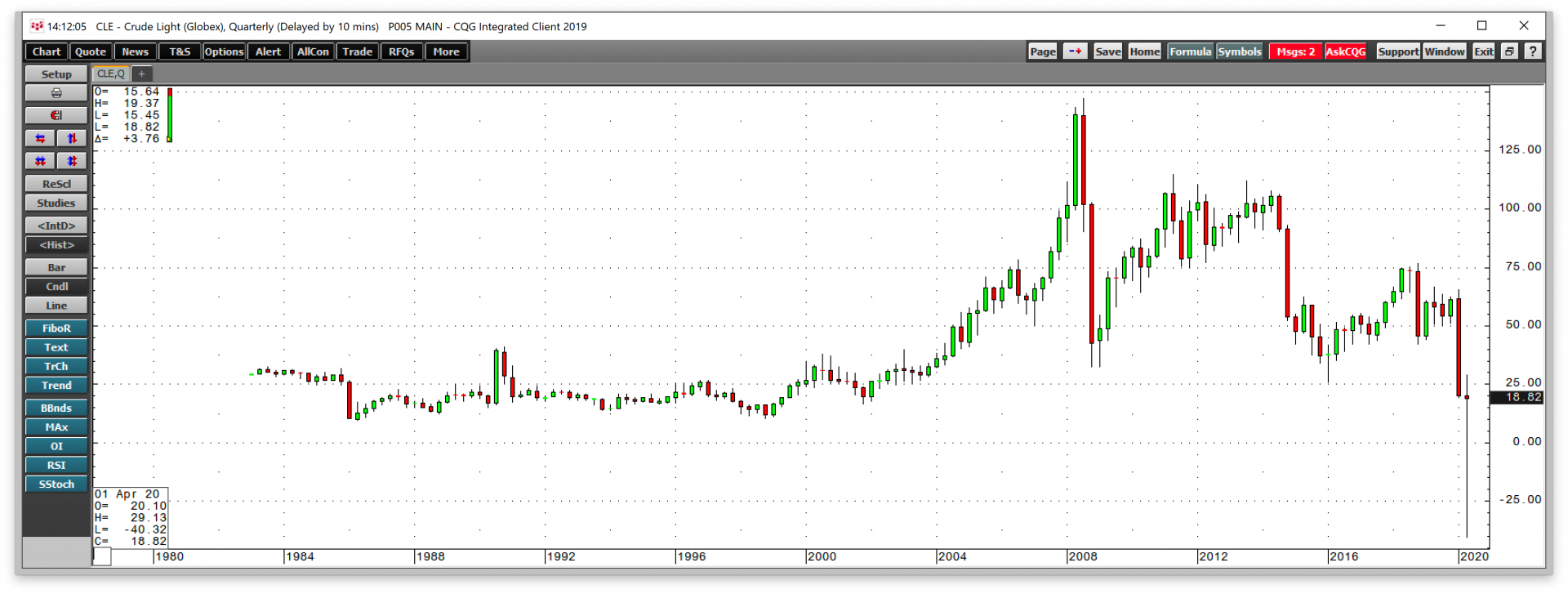

April 2020 will go down in history as the month that the price of crude oil fell to a low that most market participants did not believe possible. West Texas Intermediate crude oil began trading on the NYMEX division of the Chicago Mercantile Exchange in 1983. Until April 20, 2020, the lowest price the energy commodity ever reached on the nearby futures contract was $9.75 per barrel.

A negative price for one of the most liquid commodities that trade in the futures markets and powers the lives of people around the globe was unthinkable for many. I learned early in my career expect the unexpected and never to say never. The price action in the oil market last month will serve as a lesson for traders, investors, and all market participants, requiring them to alter their future assumptions when it comes to price projections and risk management.

A decline to an incredible price level

Few market participants believed that the price of crude oil could fall into negative territory.

As the quarterly chart highlights, the price of the nearby crude oil futures contract fell below the record low from 1986 at $9.75 per barrel, moved under zero, and traded to a new astonishing low of negative $40.32 per barrel. The price came storming back, and the new active month June contract settled at $18.84 per barrel on April 30, down only 6.3% from the end of March. Crude oil taught us four critical lessons during April.

Lesson one - Storage is critical in futures markets

A lack of storage caused the bearish hot potato on April 20 during a period where demand fell off the side of a cliff. The contango or forward premium for crude oil for future delivery rose to a level where traders with access to capital bought nearby crude oil, put it in storage and sold the energy commodity for future delivery. Some traders synthesized the trade without taking delivery, making a wager that the contango would narrow. As the capacity to store petroleum evaporated, longs were left holding the bag, and those who could not take delivery had to sell at any price, which drove the price to under negative $40 per barrel.

The lesson is that the ability to store a commodity is crucial for those that purchase the nearby contract as the delivery period approaches.

Lesson two - Zero is not a bottom

Free oil turned out to be a costly proposition on April 20. The old expression that there is no free lunch came to pass on the day that crude oil fell below zero. Those market participants who believed that the price of a commodity could never fall below zero learned an expensive lesson.

Crude oil was not the first commodity or asset to experience a negative value. Onions in the 1950s, electricity, and natural gas have all declined to prices below zero at times. Interest rates in some parts of the world are negative. A negative price in the physical markets is not the norm, but it happens and should be part of any trader or investor’s risk assessment when it comes to commodities.

Lesson three - Caution for options

In the world of options, many traders assess a slight skew to call over put options as they assume the upside potential of a price is infinity, and the downside’s limit is zero. The action in crude oil taught us that the risk of a short put option could be a lot more than zero in the world of commodities.

Options traders in the raw material markets and those administrators that hedge ETF and ETN products are adjusting their assumptions courtesy of crude oil after the move on April 20.

Lesson four - Expect the unexpected and never say never

When I began trading in the early 1980s, my boss told me that I should always expect the unexpected in the commodities markets as they can be a lot more volatile than any other asset class.

Whenever an analyst or market participant utters the world “never,” I have always challenged the opinion as I have learned never to say never in the commodities asset class.

April 20 turned out to be an advanced lesson in risk management in the commodities asset class. The black swan event in the oil market was a microcosm of the black swan in markets across all asset classes. Albert Einstein once said that the definition of insanity is doing the same thing over and over again and expecting a different result. The price action in crude oil in April taught us never to say never again.