While the U.S. energy policy embraces alternative and renewable fuels and inhibits hydrocarbons, crude oil remains the energy commodity that powers the world. In 2022, the war in Ukraine and U.S. energy policy caused oil prices to spike to the highest level since 2008. The Biden administration kept a lid on oil’s price by unprecedented selling from the U.S. Strategic Petroleum Reserve. The average sale was at $96 per barrel.

In October 2022, the administration told markets the target for repurchasing the sold barrels was $67 to $72 per barrel.

As of late May 2023, the U.S. SPR continued to decline, even though the price fell to the target levels twice in 2023.

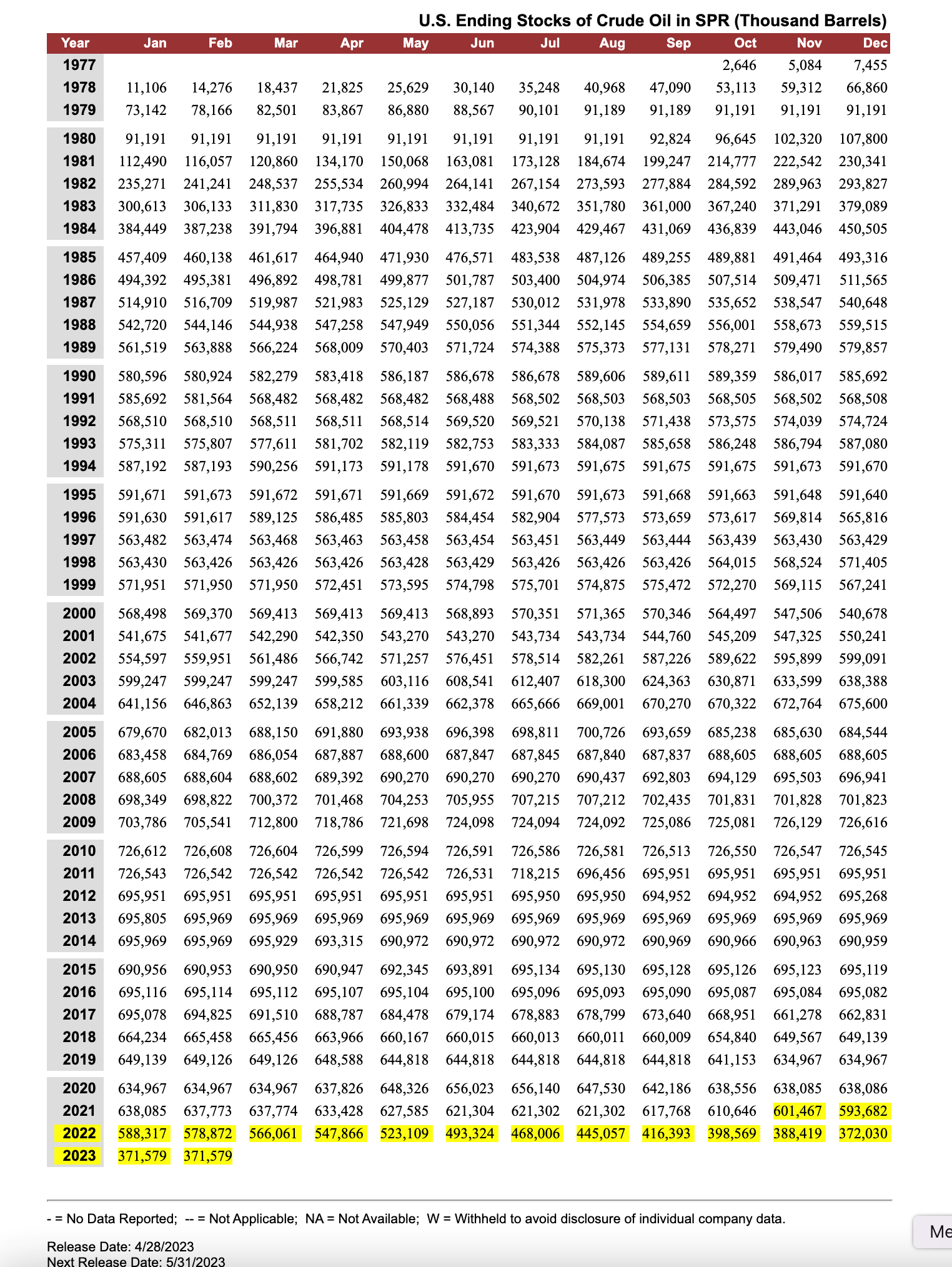

The lowest U.S. reserves in four decades

According to oilprice.com, the U.S. Strategic Petroleum Reserve stood at 355.4 million barrels for the week ending on May 26, 2023. The SPR was at the lowest level since August 1983, in nearly four decades.

Source: EIA

The chart shows the steep decline in the U.S. SPR, which stood at over 600 million barrels in November 2021 and has dropped over 40% as of May 26, 2023.

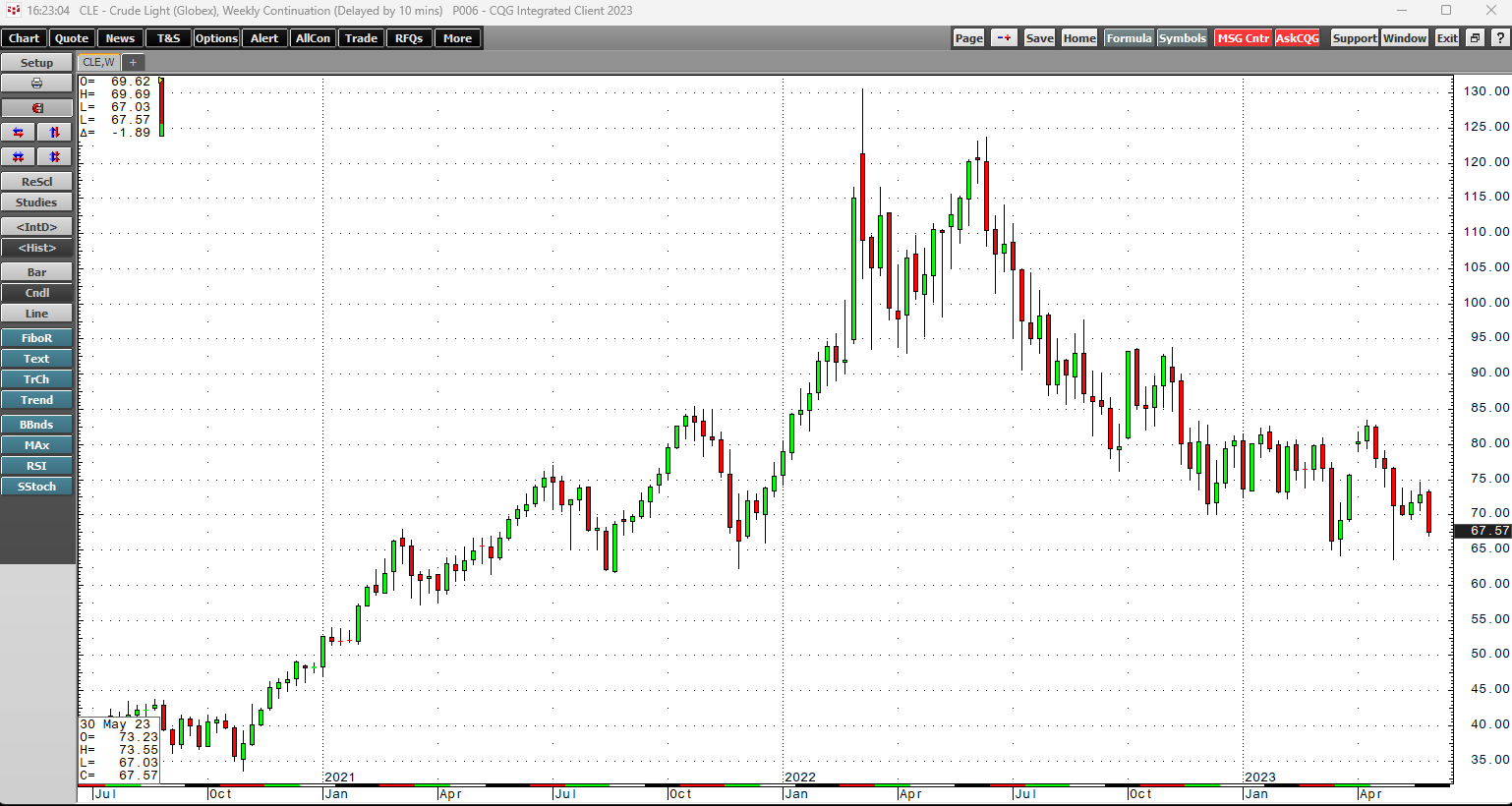

In 2022, crude oil prices rose to over $130 per barrel, the highest level since 2008, while gasoline and distillate fuels rose to record highs. The war in Ukraine caused significant supply concerns, lifting prices. The Biden administration sold unprecedented crude oil from the U.S. SPR to keep a lid on traditional fuel prices.

Two missed opportunities

The average SPR sales price was around $96 per barrel. In October 2022, the administration issued a FACT SHEET, stating, “The administration intends to repurchase crude oil for the SPR when prices are at or below about $67 - $72 per barrel, adding to global demand when prices are around that range.”

The weekly chart highlights NYMEX crude oil traded within the administration’s buying zone during the weeks of December 5 and December 12, 2022. In 2023, the price was below $72 per barrel during the weeks of March 13, March 20, March 27, May 1, May 8, May 15, May 22, and May 29. Moreover, it was under the bottom of the buying range below $67 per barrel in March and May. Meanwhile, the administration continued to sell crude oil from the SPR despite the plans to purchase and replace the sold barrels.

Brent crude oil trades at a premium to NYMEX WTI petroleum, but even the Brent futures dropped below the $72 per barrel level in March and May. On May 31, 2023, nearby NYMEX futures were just over $68, with the August Brent futures around $72.60 per barrel. Based on its prior statements, the U.S. administration missed several opportunities to repurchase oil to increase the SPR.

The administration says it will buy in June - OPEC signals another cut

On May 15, 2023, the U.S. Department of Energy announced plans for a three-million-barrel SPR purchase of sour crude oil in June. The DoE revealed that the recent sales at low prices caused the average sale price to decline $1 to $95 per barrel.

Meanwhile, OPEC and its cohorts will meet at its biannual gathering in Vienna, Austria, on June 4. Saudi Arabia is the leading cartel member, and over the past years, Russia has cooperated with production quotas to balance the global supply and demand favorably for world producers. Therefore, production policy has been a function of decisions from Riyadh and Moscow. In April, Saudi Arabia surprised the oil market when it cut production. On May 23, the Saudi Oil Minister warned oil market speculators of another surprise, saying, “Speculators, like in any market they are there to stay, I keep advising them that they will be ouching, they did ouch in April, I don't have to show my cards I'm not a poker player... but I would just tell them watch out.” The following factors favor another OPEC+ production cut to boost prices:

- Balancing the Saudi budget requires Brent crude oil prices to exceed the $80 per barrel level.

- Moscow depends on petroleum revenues to fund its war efforts in Ukraine.

- Moscow and Riyadh are not likely to make any favorable concessions for the U.S., given the deterioration of relations and bifurcation of the world’s nuclear powers.

- China’s economy continues to falter, giving OPEC+ reasons for cutting petroleum output.

Moreover, the shift in the U.S. energy policy to favor alternative and renewable fuels and inhibit fossil fuel production and consumption has handed pricing power to the cartel.

Another opportunity may not be in the cards

OPEC+’s mission is to reach the highest possible oil price that balances worldwide supply and demand fundamentals. The cartel’s policy determines the fundamentals, making it a chicken-and-egg situation that favors higher prices.

Time will tell if the Biden administration gets another chance to buy crude oil below the $72 level or if it will look back at March and May as a missed opportunity. Riyadh and Moscow will likely pursue output quotas that ensure the DoE does not have the chance to buy at its target prices. However, the downside risk is if Russian discounts create a gulf with the Saudis who decide to flood the market with crude oil to force Russian cooperation.

Buying on dips could be the optimal approach- China and OPEC+ hold the key

Despite economic weakness in China, I remain bullish on crude oil and believe the path of least resistance over the coming months will be higher for Brent and WTI futures. However, if China’s economy rebounds, it could cause another spike higher in the crude oil futures market.

I am a buyer of crude oil, oil products, and related petroleum equities on price weaknesses. Since oil is a highly volatile energy commodity, I will leave lots of room to add on further and unexpected price weakness. The May 2023 continuous contract $63.64 low on nearby NYMEX crude oil and $68.20 low on the continuous Brent contract could be levels the U.S. administration looks back at with regrets over the coming months. The $60 to $70 level could be a significant floor for oil prices in 2023 and 2024 if the war in Ukraine continues. Moreover, U.S. energy policy that does not support domestic crude oil production allows the international cartel to control prices of the energy commodity that still powers the world.