Since 1450, there have been six reserve currencies. Portugal, Spain, the Netherlands, Great Britain, and the United States have held the top spot in the international economy. Each dominant period lasted around a century, with the dollar's current term celebrating its one-hundredth anniversary this decade.

A 2022 handshake between Chinese President Xi and Russian leader Vladimir Putin and the recent geopolitical events threaten the dollar's continued leadership role. De-dollarization has significant implications for global assets, commodities. Raw materials transcend borders as they provide food, energy, and shelter for people worldwide. A change in the international financial system that alters the U.S. currency's position could cause dollar-based commodity prices to rise, perhaps dramatically. The dollar index does not reflect the value of the U.S. currency in the worldwide economy as it only measures the dollar against other allied foreign exchange instruments.

The dollar index is a mirage - Not an objective measure of the reserve currency's value

The dollar index measures the U.S. currency against a basket of other allied foreign exchange instruments. The index has the most significant exposure to the euro at 57.6%. The index includes the Japanese yen (13.6%), the British pound (11.9%), the Canadian dollar (9.1%), the Swedish Krona (4.2), and the Swiss franc (3.6). Therefore, the dollar index is the asset that monitors the U.S. currency against similar fiat foreign currencies.

The most significant factor in the path of least resistance of the dollar index is interest rate differentials between the dollar and the allied currency basket. Over the past weeks, the index has declined on the back of the prospects for falling U.S. rates.

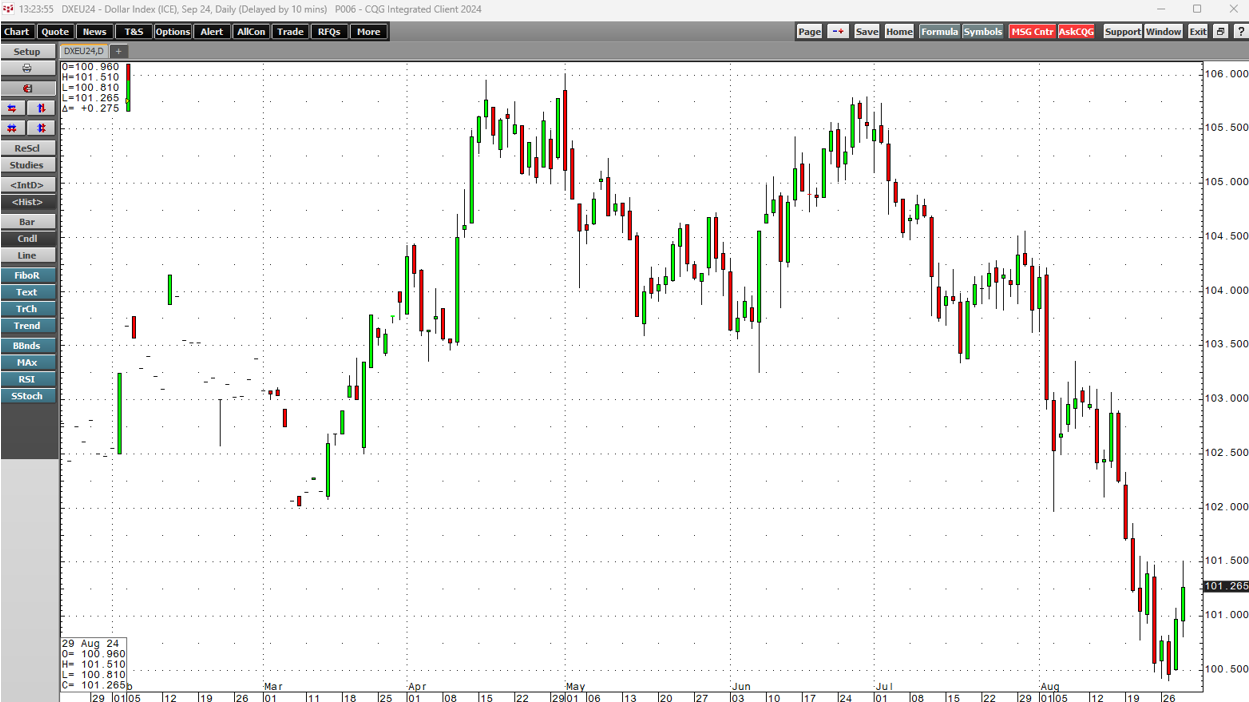

The daily chart highlights the September dollar index futures contracts decline from 105.800 on June 28 to the most recent 101.700 low on August 19.

While the dollar index declined, it may not reflect the underlying weakness in the U.S. currency on the world stage.

De-dollarization reflects the bifurcation of the world's nuclear powers

When China's President Xi shook hands with Russian leader Vladimir Putin in February 2022, creating a "no-limits" alliance, it was a watershed event. Less than one month later, Russian troops invaded Ukraine. U.S. and NATO sanctions on Russia have caused Russia and China to circumvent the dollar and euro for cross-border transactions. De-dollarization has begun to take hold, with the Saudis selling oil to China in yuan and India in rupee. China and Russia have reduced dollar and U.S. government bond holdings, have increased gold holdings, and have led an effort to create a BRICS currency with some gold backing to challenge the dollar's dominant role.

The handshake creating the China-Russia alliance began an era of de-dollarization. The dollar index has moved lower since June, but the world's reserve currency has faced lots of global headwinds over the past years.

The dollar has been the pricing mechanism for global assets - Commodities

As the world's top currency, the dollar has been the pricing instrument for raw materials for the past century. Since central banks and governments held dollars as the main foreign exchange reserves, cross-border transactions were primarily settled in U.S. dollars.

The relationship between the dollar and commodity prices caused raw material prices to rally when the dollar lost value and decline when the dollar strengthened. However, the dollar's declining position on the world stage could be causing the relationship to collapse. A strong dollar has not weighed on raw material prices over the past years.

The dollar index traded in a mostly stable range from 99.22 to 107.05 in 2023 and so far in 2024. However, we have seen gold, copper, and many other commodity prices rise to all-time or multi-year highs. The dollar's position as the reserve currency has caused historical divergence.

A decline in the dollar's position is bullish for raw material prices

As the world begins to move away from dollar pricing mechanisms to bartering and other currencies, such as the Chinese yuan, the dollar's value will decline. A falling dollar eroding purchasing power is bullish for most raw material prices. Copper, gold, and crude oil are leading commodities.

The quarterly copper chart shows the rally that took the red nonferrous metal to a record high near the $5.20 per pound level in April 2024. The continuous dollar index futures contract traded between 103.480 and 106.380 in April 2024.

The quarterly chart of the continuous gold futures contract reached a record high of over $2,500 per ounce in August 2024, even though the dollar index remained within the range of the past two years.

The quarterly NYMEX crude oil futures chart shows the elevated $63.64 to $95.03 range in 2023 and 2024.

While many other technical and fundamental factors impact copper, gold, and crude oil prices, the dollar's declining position as the global reserve currency is supporting prices. If the U.S. currency continues to lose its international footprint, pricing power will erode, and dollar-based commodity prices could continue to move higher as they have over the past nearly two and one half decades.

A look at commodity prices since the beginning of this century reveals a significant trend

At the end of December 1999, the dollar index was at the 101.420 level, not far from the current level at the end of August at 101.731.

Since then, most continuous commodity futures prices have moved significantly higher:

- Gold: Up 775% from $289.60 to $2,534.50

- Silver: Up 441% from $5.455 to $29.515

- Platinum: Up 120% from $430.50 to $947.00

- Palladium: Up 117% from $449.80 to $976.00

- COMEX copper: Up 380% from $0.8630 to $4.1410

- NYMEX crude oil: Up 182% from $25.75 to $75.65

- NYMEX natural gas: Down 8.4% from $2.33 to $2.134

- Corn: Up 81% from $2.0475 to $3.7050

- Soybeans: Up 111% from $4.6100 to $9.7350

- CBOT wheat: Up 111% from $2.4875 to $5.2400

- Live cattle: Up 172% from $0.6792 to $1.8475

- Feeder cattle: Up 181% from $0.8535 to $2.3950

- Lean hogs: Up 51% from $0.54425 to $0.82250

- Sugar: Up 224% from $0.0612 to $0.1984

- Coffee: Up 99% from $1.2590 to $2.5070

- Cocoa: Up 1,057% from $836 to $9,671

- Cotton: Up 38% from $0.5075 to $0.7020

Even though the dollar index has remained steady since the end of the last century, higher commodity prices reflect the erosion of the dollar's purchasing power.

As the dollar loses its footing in the global financial system, dollar-based commodity prices could gain upside steam over the coming years as the quarter-of-a-century bull market in raw materials looks set to continue.