Each year brings new opportunities for flexible and nimble participants with their fingers on the pulse of markets. In 2023 and 2024, soft commodities were the leading raw materials sector. Adverse weather conditions and crop diseases pushed Arabica coffee, cocoa, and frozen concentrated orange juice futures to record highs. While world sugar and cotton futures lagged far behind coffee, cocoa, and FCOJ futures, they could recover in the coming year and keep the bullish price action in the soft agricultural sector going for a third consecutive year.

Markets reflect the economic and geopolitical landscapes, which could experience significant changes under the incoming Trump administration in 2025.

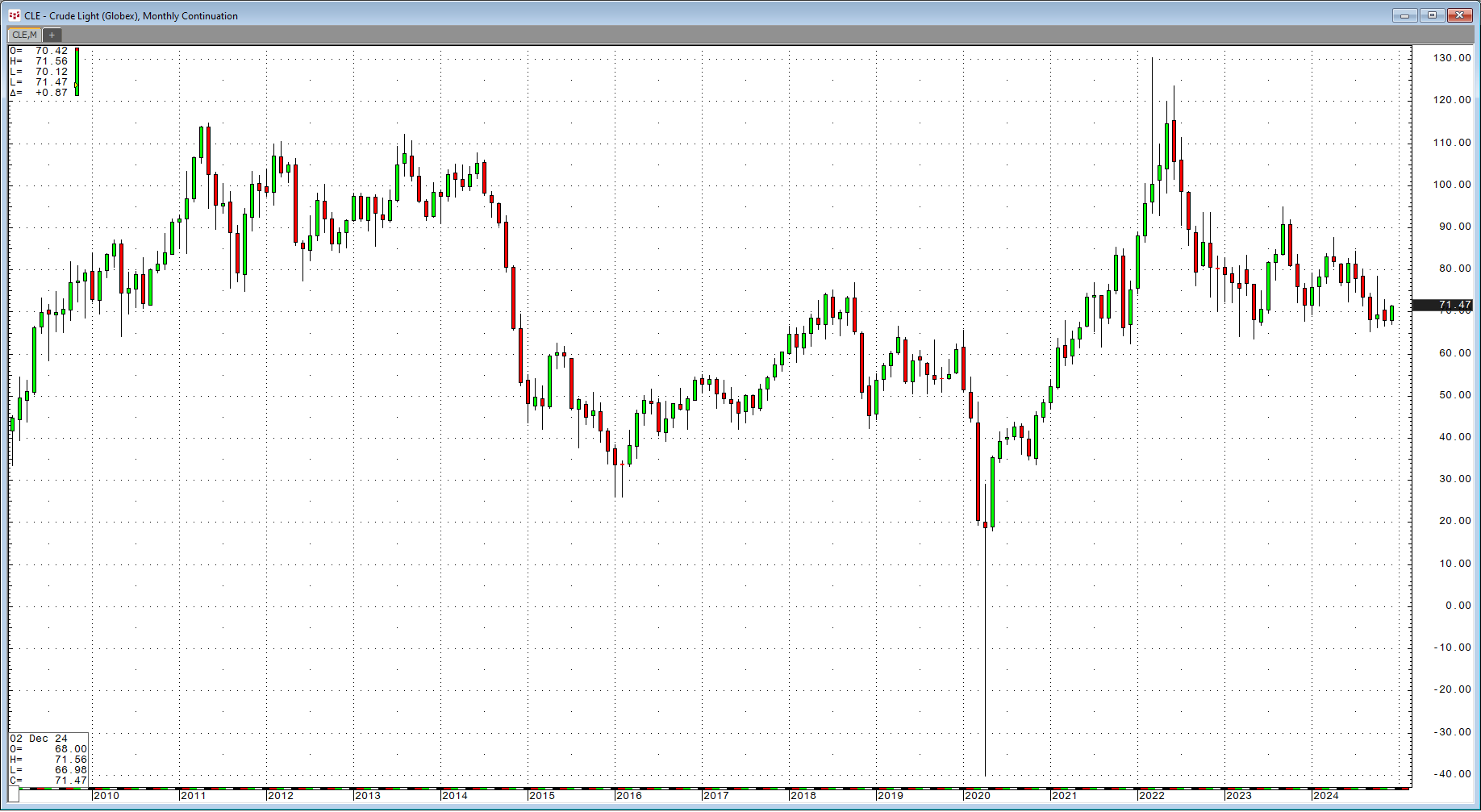

Lower oil prices on the horizon

President-elect Trump pledged to increase U.S. oil and gas production to achieve energy independence, lower prices and inflation, and increase revenues through exports throughout the 2024 U.S. election campaign. U.S. oil production stood at 13.604 million barrels per day as of mid-December. It will likely rise as the incoming administration told the world, "Promises made, promises kept," on election night.

At the late 2024 OPEC+ meeting, the international oil cartel extended production cuts, citing weak Chinese demand and increasing production from non-OPEC members, referring to the United States. Crude oil has been in a bearish trend since the 2022 high; lower prices are likely in 2025.

The monthly chart highlights the decline from $130.50 per barrel in March 2022 to the $63.64 low in May 2023. Meanwhile, nearby NYMEX futures traded in a $65.27 to $87.67 range in 2024. At below $72 per barrel in late December, crude oil prices are close to a challenge of critical technical support at the May 2023 low. If promises made are promises kept, increasing U.S. petroleum output under the incoming administration could push prices to $50 or lower in 2025.

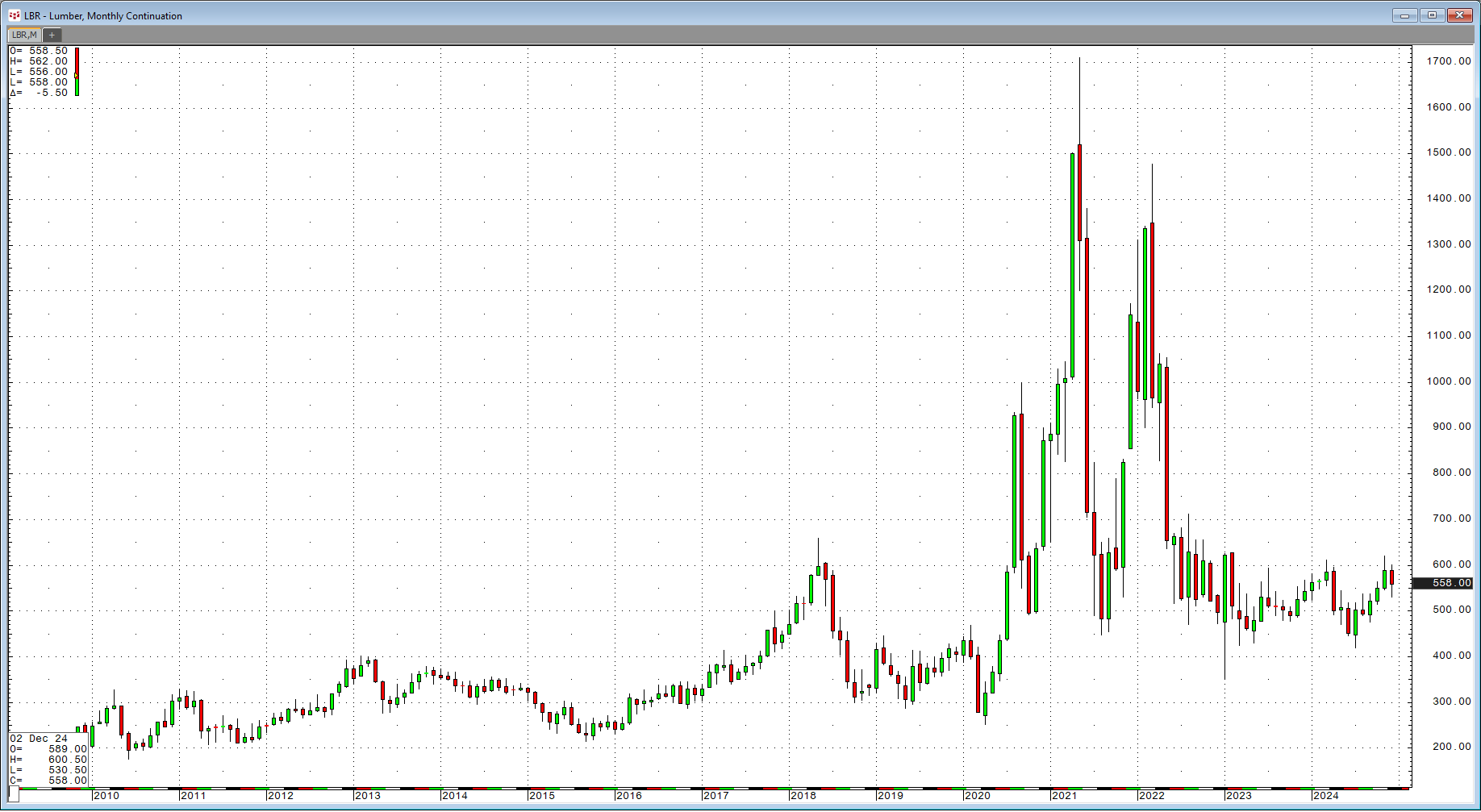

Lumber could get a boost

Lumber is a critical ingredient in new home construction. The lumber futures arena is highly illiquid, leading to the dramatic price explosions and implosions of the past years.

The chart shows the explosive rally that took nearby lumber futures to a record $1,711.20 high in 2021 and a lower $1,477.40 per 1,000 board feet peak in 2022 before falling to a $326.60 low in 2023. At below $570 per 1,000 board feet in late December 2024, lumber could have significant upside potential if mortgage rates decline, and new home demand increases in 2025 and beyond. Moreover, since Canada is a leading lumber producer, tariffs under the Trump administration could cause lumber prices to rise significantly.

Lumber is a highly liquid futures market with low daily volume and open interest. Low liquidity tends to translate to high price variance when markets move into bullish or bearish trends. Given the price action over the past years, lumber is likely closer to the low than the high.

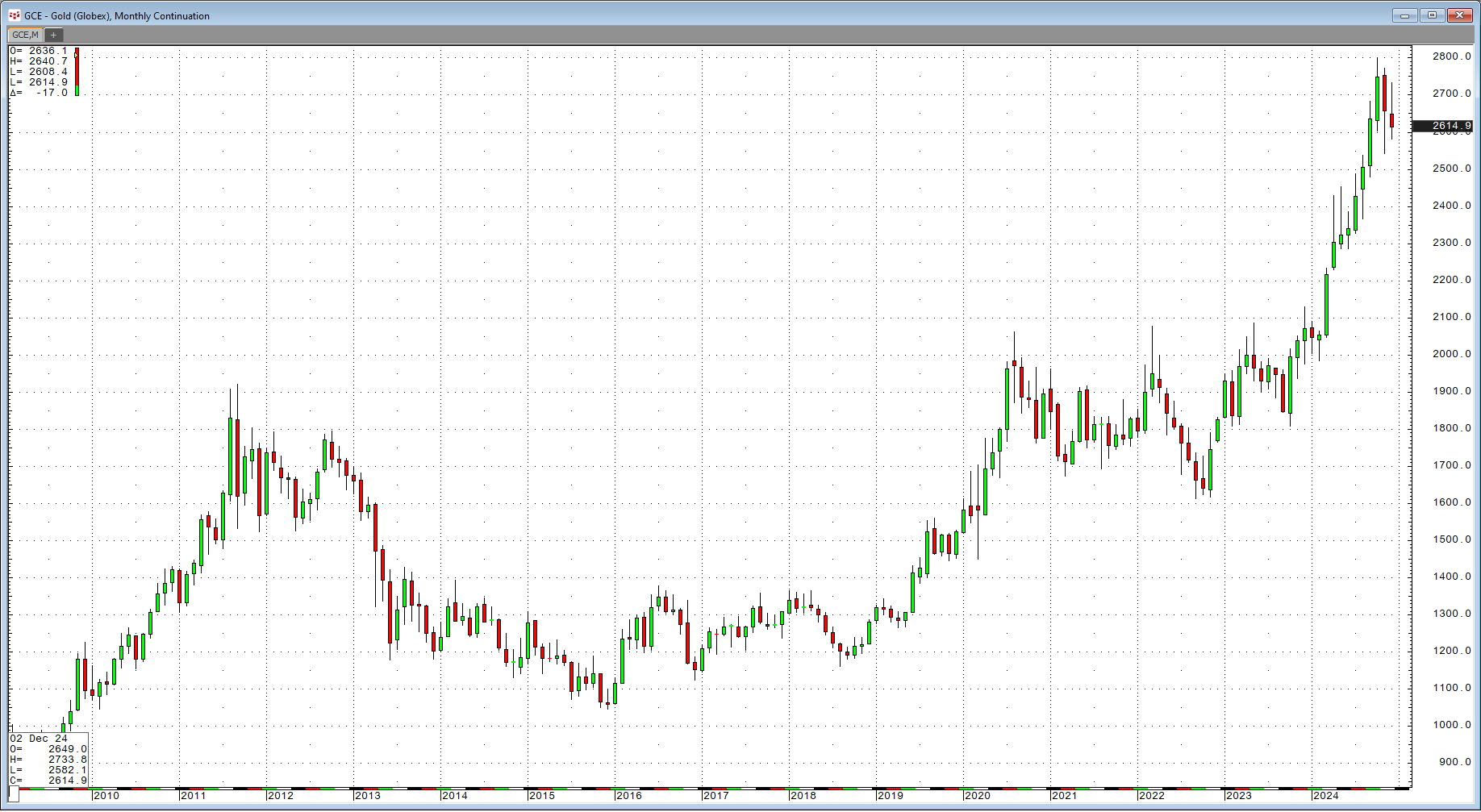

Gold and silver's bull market continues - Platinum and palladium offer value

Gold's bull market began in 1999 at $252.50 per ounce and continues in 2024, taking the yellow metal to a new record peak.

The quarterly chart highlights gold's rise to over $2,800 per ounce in late October 2024, an over tenfold increase from the 1999 low. At just over $2,600 per ounce in late 2024, gold's bullish trend remains firmly intact going into 2025, with central banks continuing to increase their gold reserves.

Silver's bullish trend began at the 2020 pandemic-inspired low. In 2024, silver futures prices rose to over $35 per ounce for the first time since 2012. Silver's price remains well below the 2011 and 1980 highs at around $50 per ounce, but its path of least resistance is bullish going into 2025.

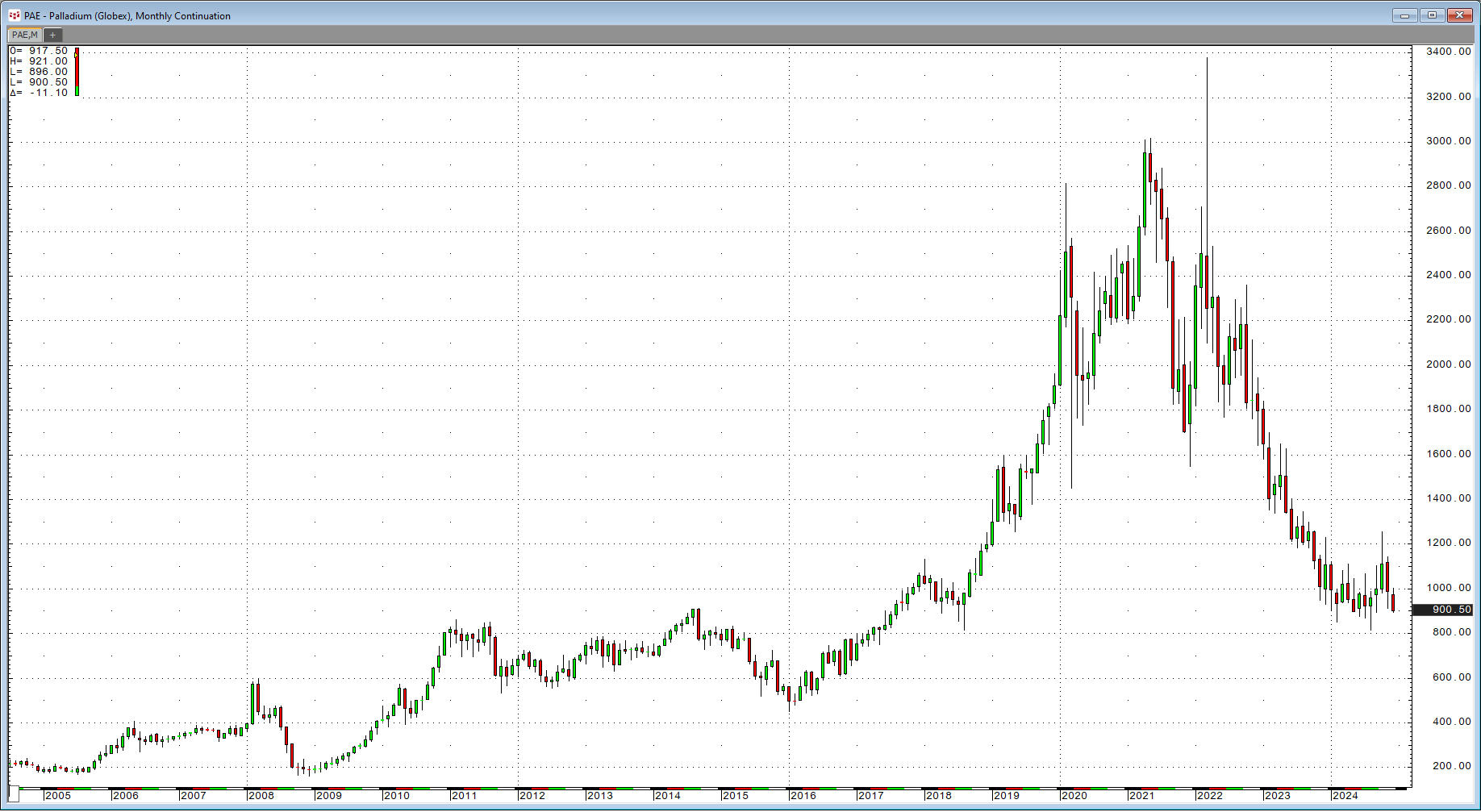

Meanwhile, platinum and palladium prices have been consolidating near the recent lows.

Nearby NYMEX platinum futures were in a bearish trend from the 2008 high to the 2020 low. Over the past years, platinum's price has consolidated around the $1,000 per ounce pivot point.

Platinum's sister metal, palladium, reached a record peak in 2022. Since then, the price has imploded, falling to less than one-third of the price level at around $900 per ounce in late 2024.

The bottom line is that gold and silver's performance could cause investors and traders to turn to platinum and palladium, as the metals offer significant value compared to their precious cousins.

Copper could be close to the bottom

Copper's bull market began in 2001 at 60.50 cents per pound.

The quarterly chart illustrates the pattern of higher lows and higher highs, taking copper futures to a new record peak of over $5 per pound in April 2024. While copper prices have corrected, they remain above the $4 level in late 2024, with critical technical support for the bullish trend at the $3.15 level.

Increasing copper demand and falling mine output are bullish for the red nonferrous metal. The copper market deficit could lead to new all-time highs over the coming years.

Discipline and a risk-reward plan are critical

While trends are our best friends, picking highs or lows in the volatile commodities asset class is virtually impossible. Prices can rise or fall to illogical, irrational, and unreasonable levels that defy fundamental and technical factors during bullish or bearish periods. Therefore, approaching these markets requires careful attention to risk-reward, a plan, and discipline.

The potential for rewards comes with commensurate risks. While adjusting stop and profit levels when prices move in the anticipated direction is appropriate, it is best to stick to stops when they move contrary to expectations.

As the commodities asset class moves into 2025, price action will continue to reflect the turbulent economic and geopolitical landscapes of late 2024.