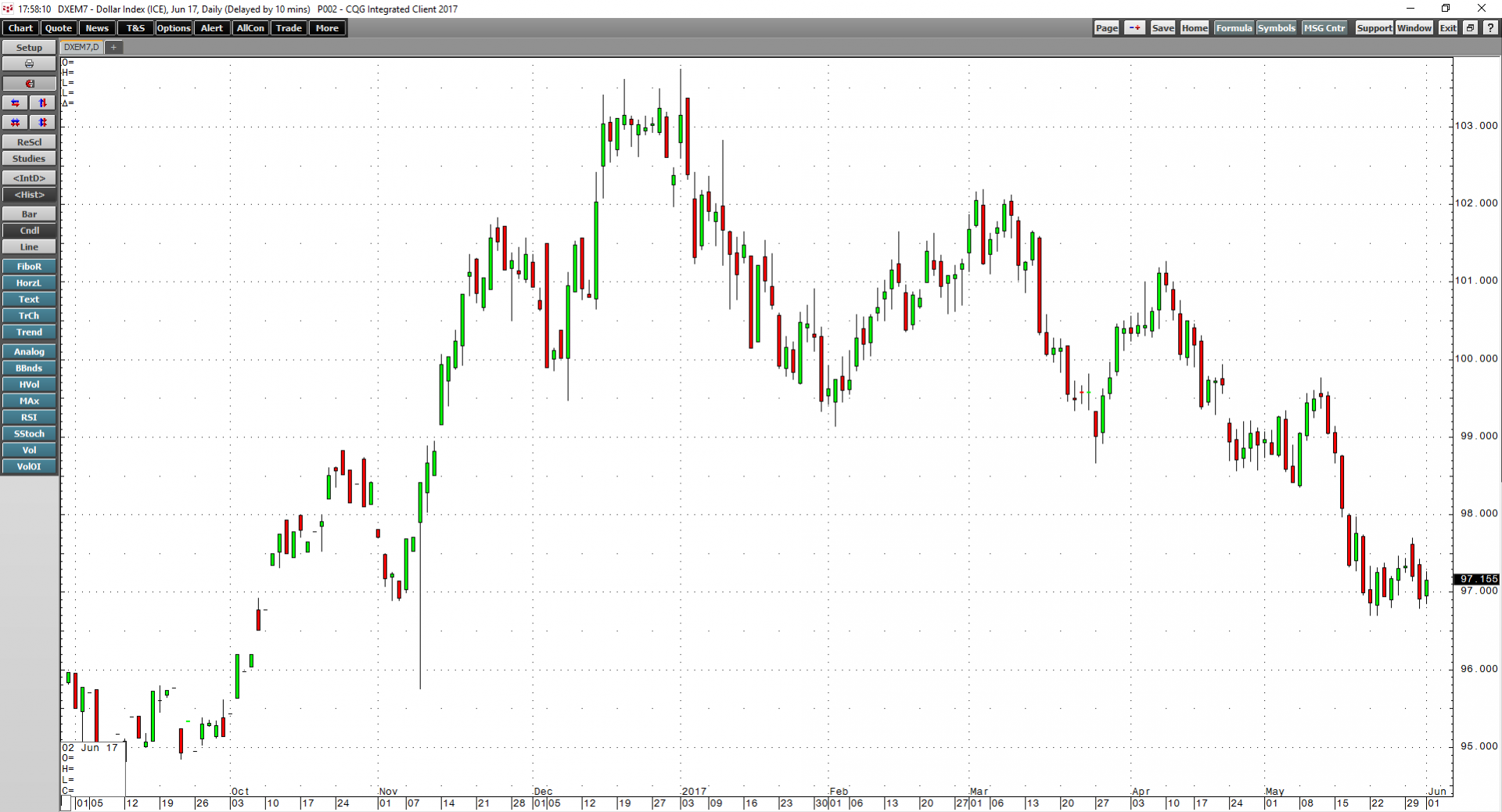

The US dollar is the reserve currency of the world, and it is also the benchmark pricing mechanism for most raw material prices. Typically, a weak dollar results in strong commodities prices and vice versa. However, the dollar has been moving lower since January 2017 when the dollar index futures contract traded to the highest level since 2002 at 103.815. Since then, it has been nothing but lower highs and lower lows for the US currency.

The Dollar is Sitting Near Lows

The dollar index has declined by over 6.5% since the January highs, which is a significant move for a currency.

As the daily chart shows, the most recent low in the dollar index has been at 96.70, but the greenback has not strayed far from that level as it consolidates near recent lows. If the pattern that has been in place for more than five months holds, the dollar could be sitting on the edge of a bearish cliff.

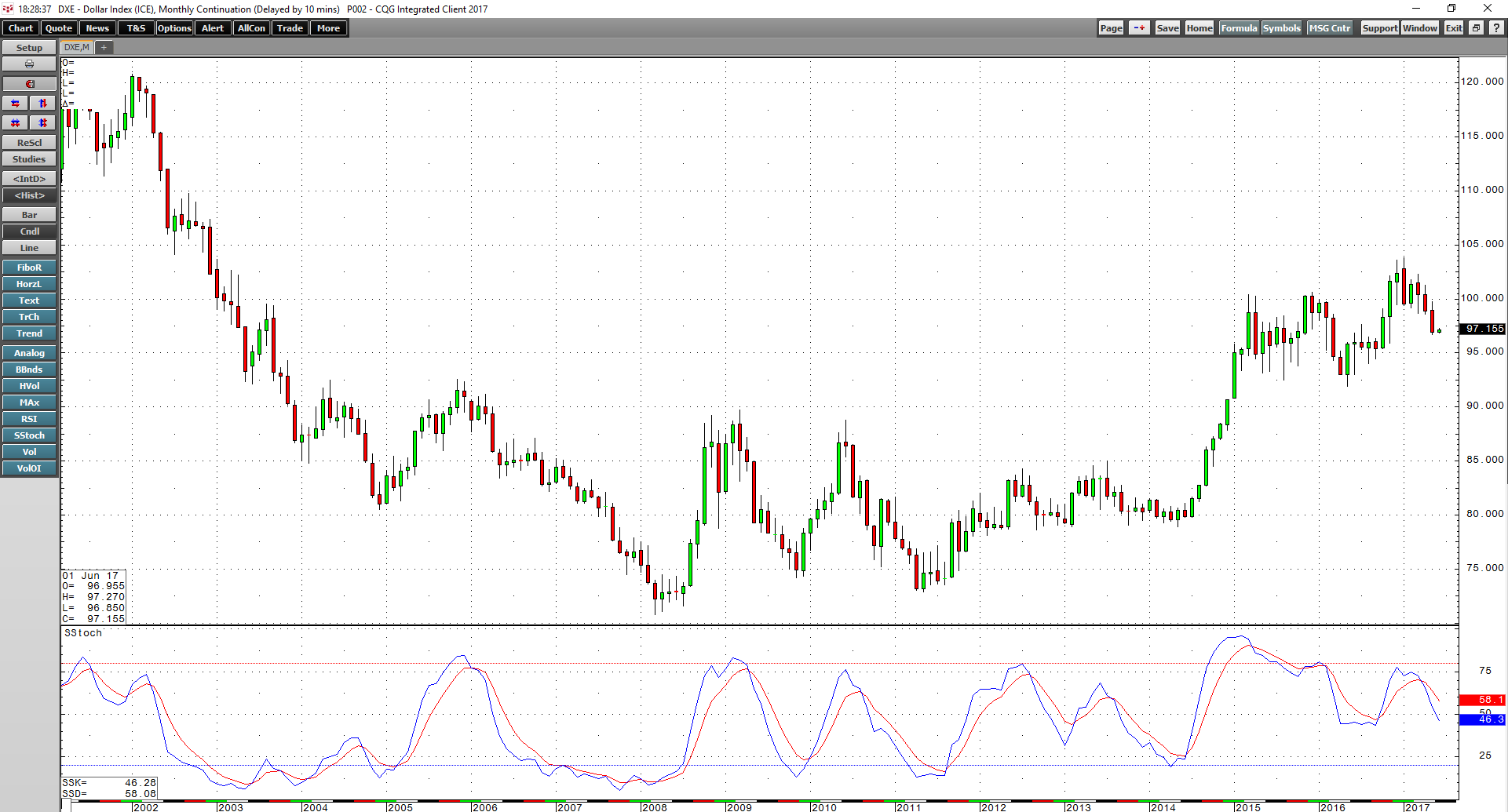

The weekly chart shows that the next area of technical support is just below the 96 level, the November 2016 lows. Below there, the currency could be facing a correction down to 91.88, the May 2016 lows, which stands as critical support for the bull market in the dollar that started back in May 2010 at under 79 on the index.

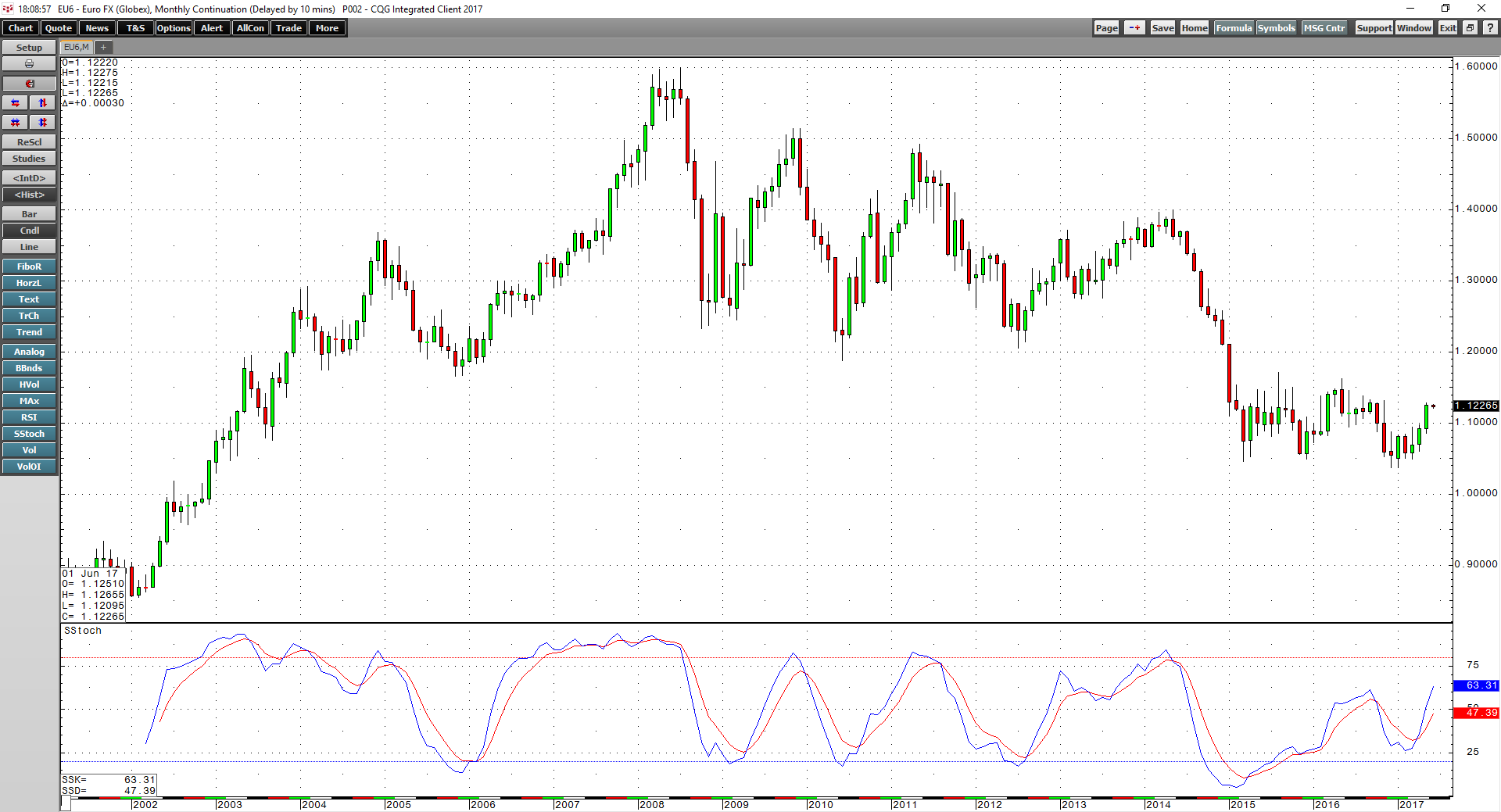

Strength in the Euro Could Mean a Lower Greenback in the Weeks ahead

Interest rate differentials between the dollar and the euro and yen remain supportive of a strong US currency. The current short-term differential is around 140 basis points and could be widening to 165 if the Fed hikes rates at their June meeting this month. However, the economic and political prospects in Europe have been looking a lot better over recent weeks after the election in France.

In many ways, the French election was a referendum for the futures of the European Union and the euro currency. The status quo won in a landslide, and the euro has been rallying since the contest.

As the monthly chart of the euro currency illustrates, the momentum indicator crossed to the upside back in April when the euro first recovered to just under the $1.10 level against the dollar. The trend is now higher for the European currency and with the potential for an end to QE, and maybe even an interest rate hike from negative 40 basis points on the horizon, it is possible that the euro is heading for the $1.20 level sooner rather than later.

Many commodities prices have been moving lower over recent weeks, and a stronger euro and weaker dollar could be the medicine they need to stem the fall.

Commodities are Weak

While most of the precious metals have recovered because of the weakness in the dollar, industrial commodities have had a rough time over recent weeks and even months. The price of iron ore has dropped from over $90 per ton in late February to just under $55 last week. Copper has moved from $2.84 earlier this year to under $2.60, and many other nonferrous metals that trade on the London Metals Exchange have moved lower alongside the red metal. The price of oil has dropped below the $50 per barrel level, and lumber futures have declined from $414 to $355 per 1,000 board feet since April.

Many industrial commodities prices have turned south as optimism about increased demand from infrastructure rebuilding in the US and the potential for a pickup in economic conditions in China has turned to pessimism. The prices for industrial commodities have moved to the downside as reality has replaced optimism.

The Inverse Relationship is Not Working Well

Industrial commodities prices began to fall in late February and early March of 2017. One of the best indicators of the health of global demand for raw materials is the price action in the Baltic Dry Index. The index peaked in late March at 1,388 and has since dropped to 850 as of June 1. The decline of 38.8% in a little over two months is representative of the weak demand for raw materials. Over the same period, the dollar index has dropped from 99.965 to the 97 level; the weaker dollar has done little to support commodities prices over the past two months.

A Move below Support on the Dollar Index Could Light a Fire under Some Commodities

The next test for the dollar index will come at just below the 96 level on the June futures contract.

The monthly chart shows a downtrend, and it may be just a matter of time before the dollar finds itself below support and moving to levels not seen before the Presidential election in the US last November. A breakdown in the dollar has the potential to ignite commodities price over coming weeks as many have declined into oversold conditions and are waiting for a reason to correct and consolidate.

The traditional relationship between the dollar and commodities prices has not been working in the case of industrial commodities since March. However, a new low in the greenback could lead many raw materials to stop in their bearish tracks over the weeks ahead.