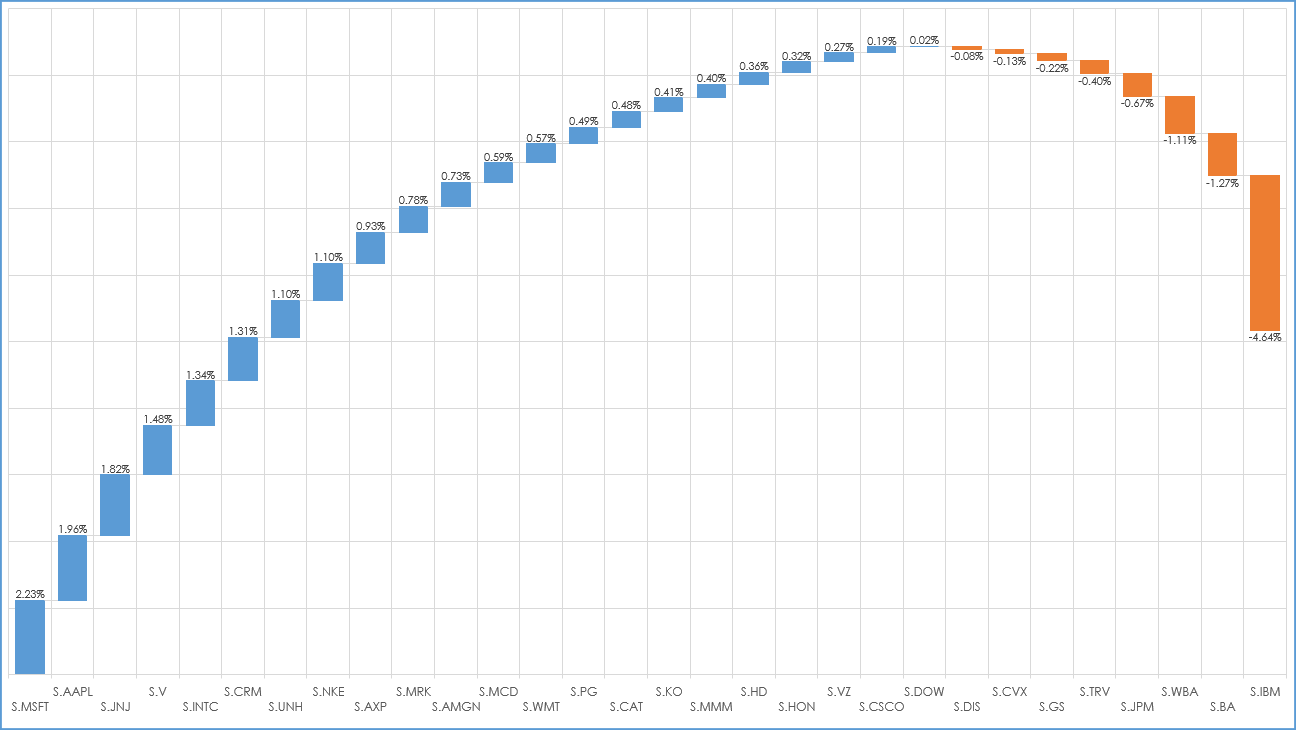

Microsoft® Excel 2016 and higher offers the Waterfall Chart. The Waterfall Chart is also known as a bridge chart or a cascade chart. Typically, this kind of chart is used to see how positive or… more

Thom Hartle

CQG comes with 74 functions such as Absolute Value (Abs), Accumulation (Accum), and Bars Since (BarsSince) to name a few. Functions are found in the Formula Toolbox for creating custom studies.… more

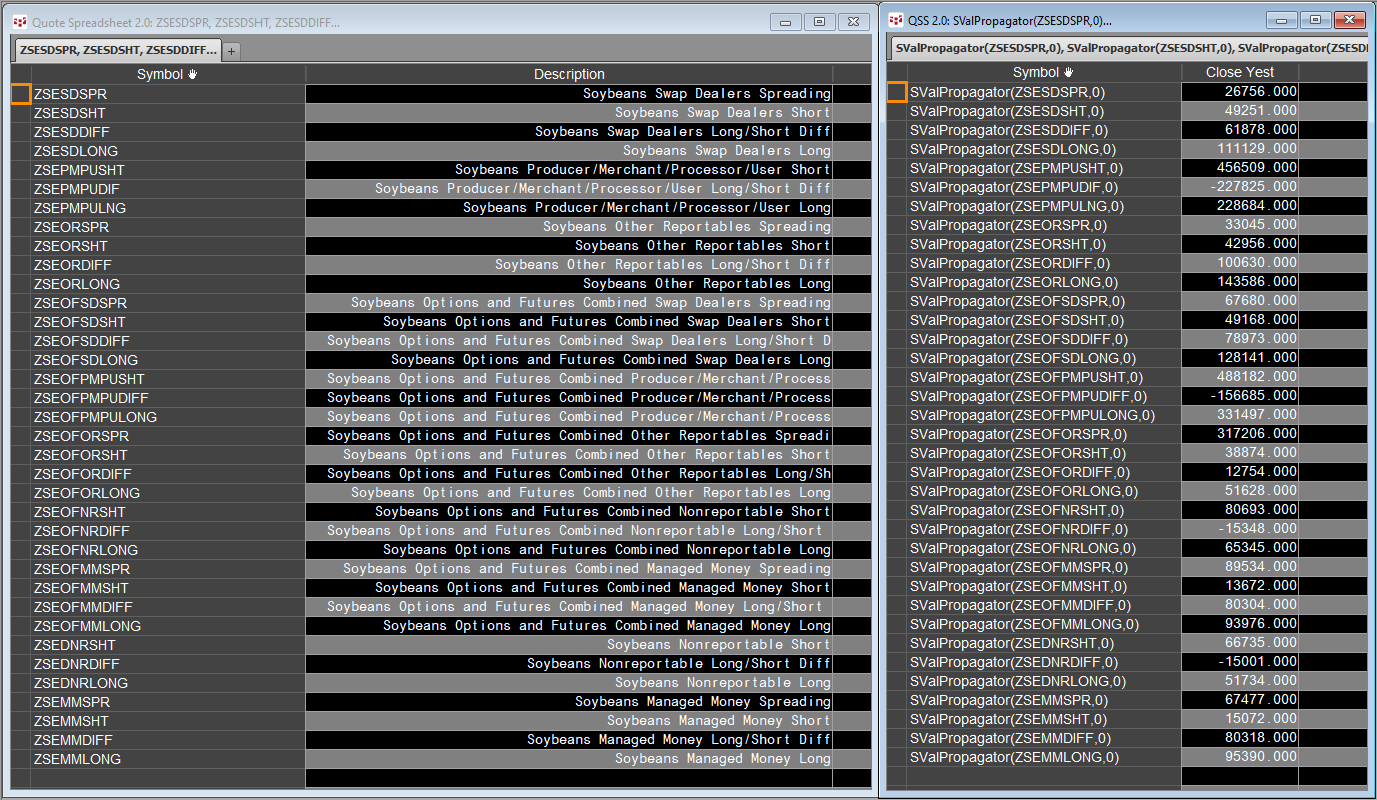

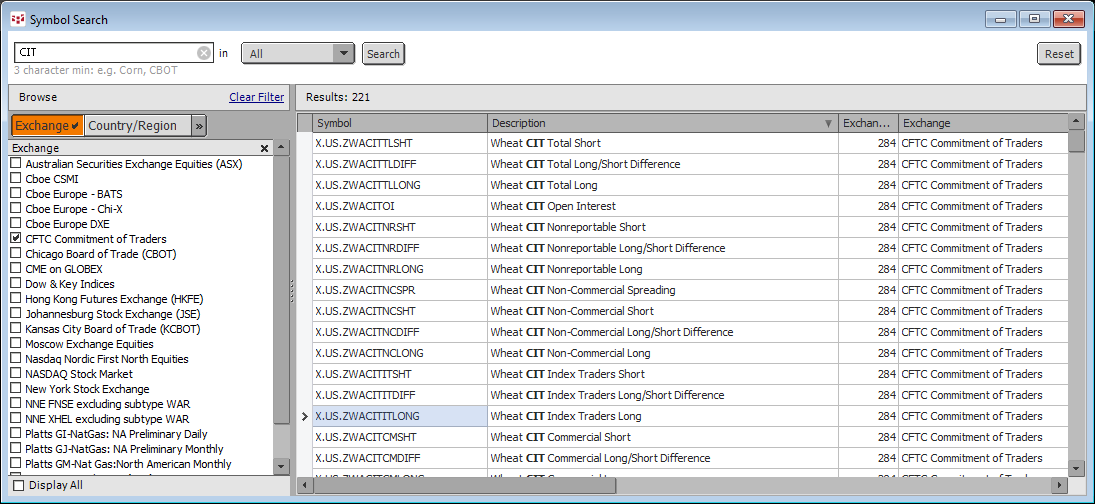

The Supplemental report is published for Futures-and-Options-Combined in selected agricultural markets and, in addition to showing all the information in the short format, shows positions of Index… more

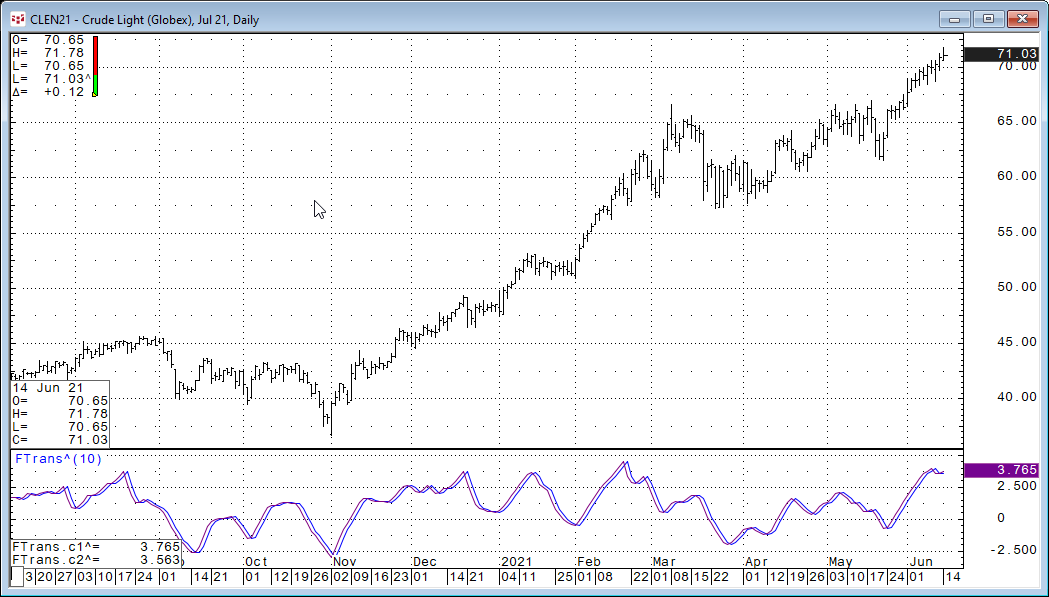

John Ehlers’, President of MESA Software (mesasoftware.com), goal is to bring the science of engineering and Digital Signal Processing to the art of trading. One such endeavor is his publishing of… more

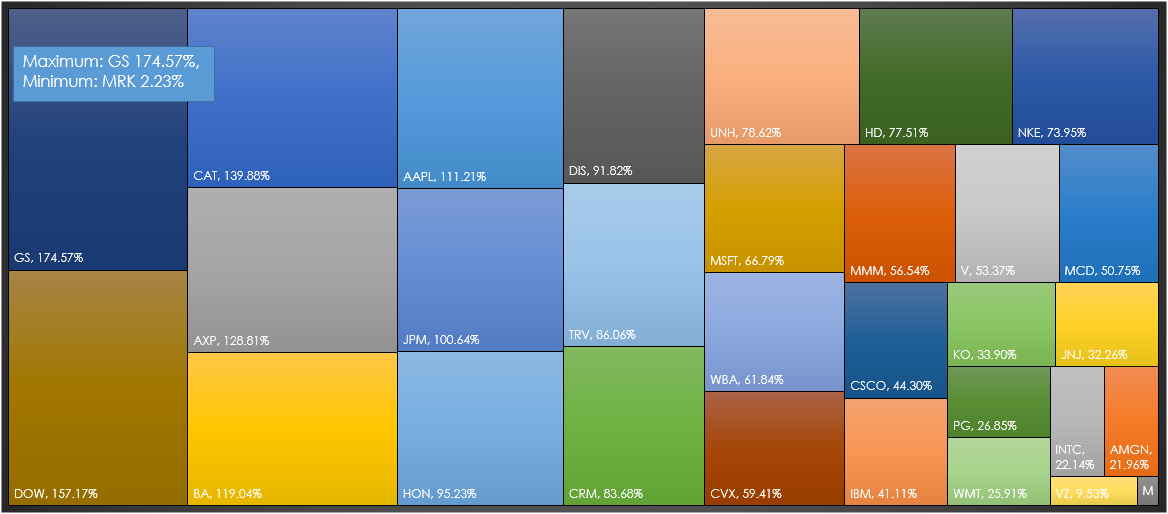

Microsoft® Excel 2016 and higher offer a new chart type: The Treemap. A treemap chart provides a hierarchical view of your data. This view makes it easy to spot patterns, such as which markets are… more

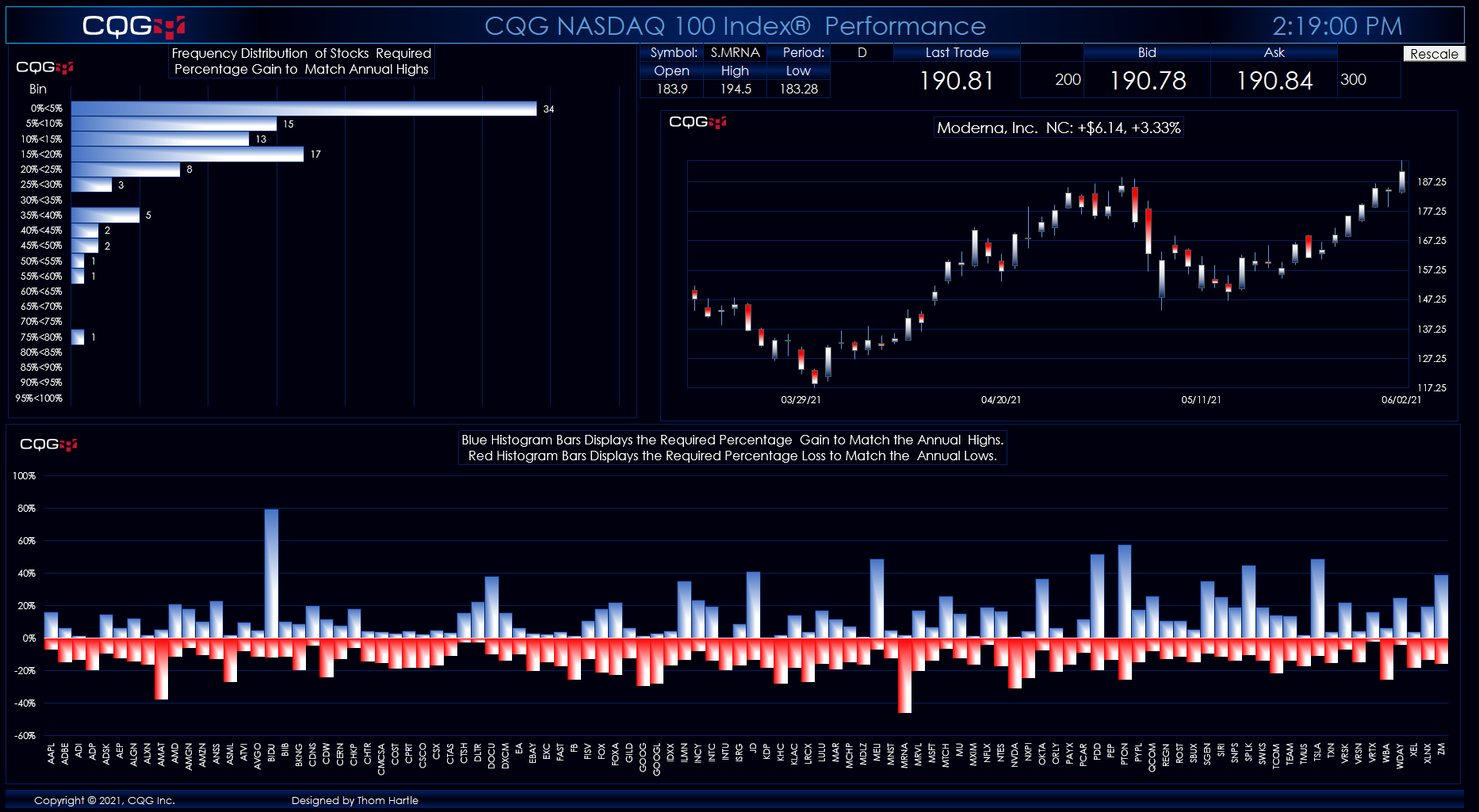

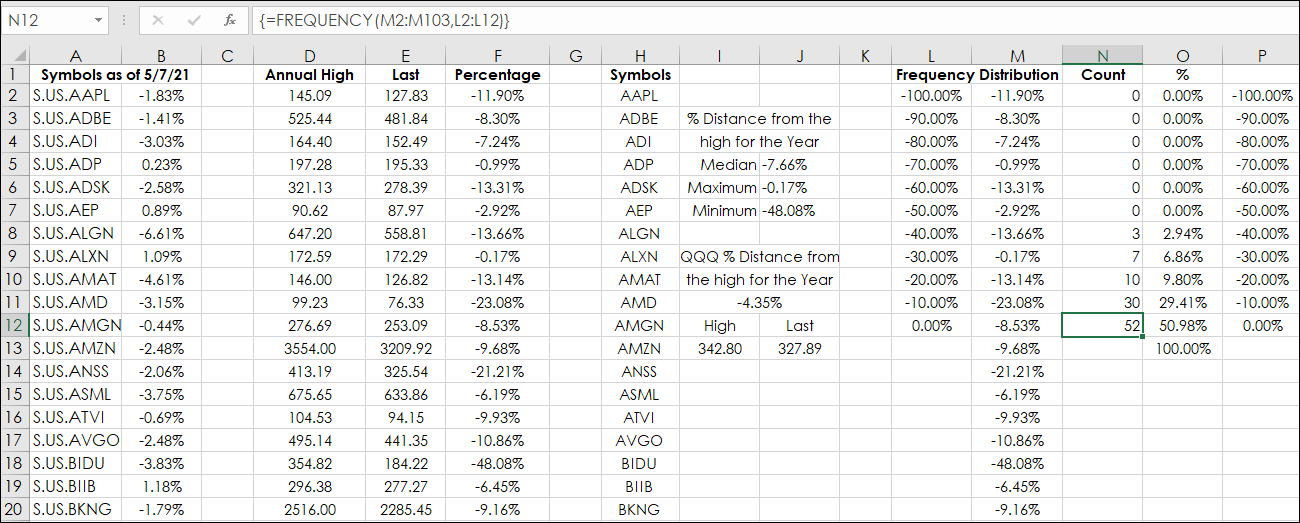

This article builds upon the post titled “Evaluate ETF Constituents Performance Using Excel” that detailed gauging the current price of a stock relative to the high as an indication of relative… more

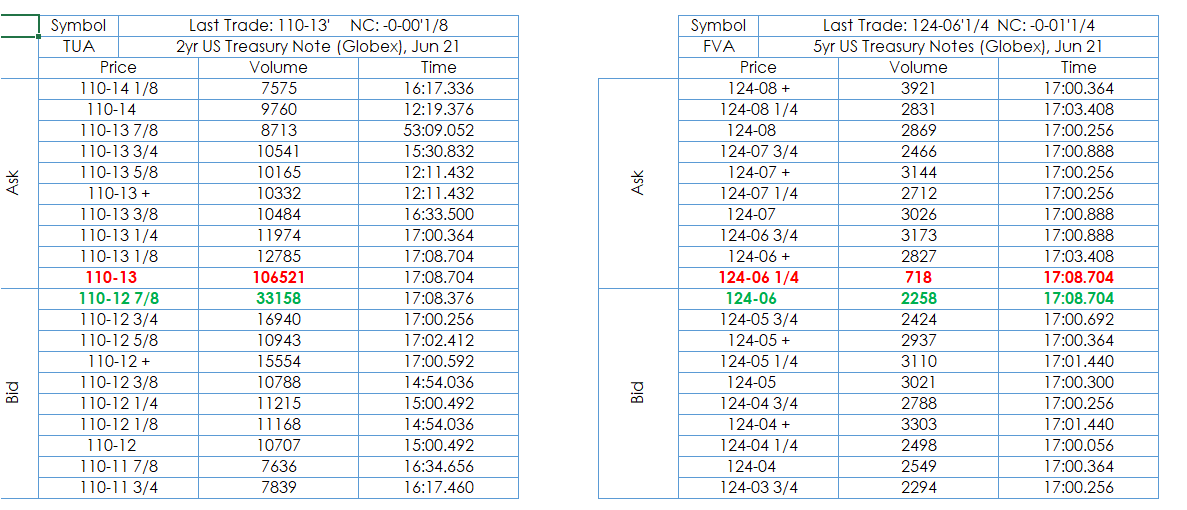

Fixed income traders may want to see fixed income futures prices for the book using a price format other than decimals or native. This article details the steps to converting decimal formatting to… more

If you track the performance of ETFs you may be interested in evaluating the performance of the stocks that are held by the ETF, such as the Invesco QQQ ETF, which tracks the Nasdaq-100 Index. Two… more

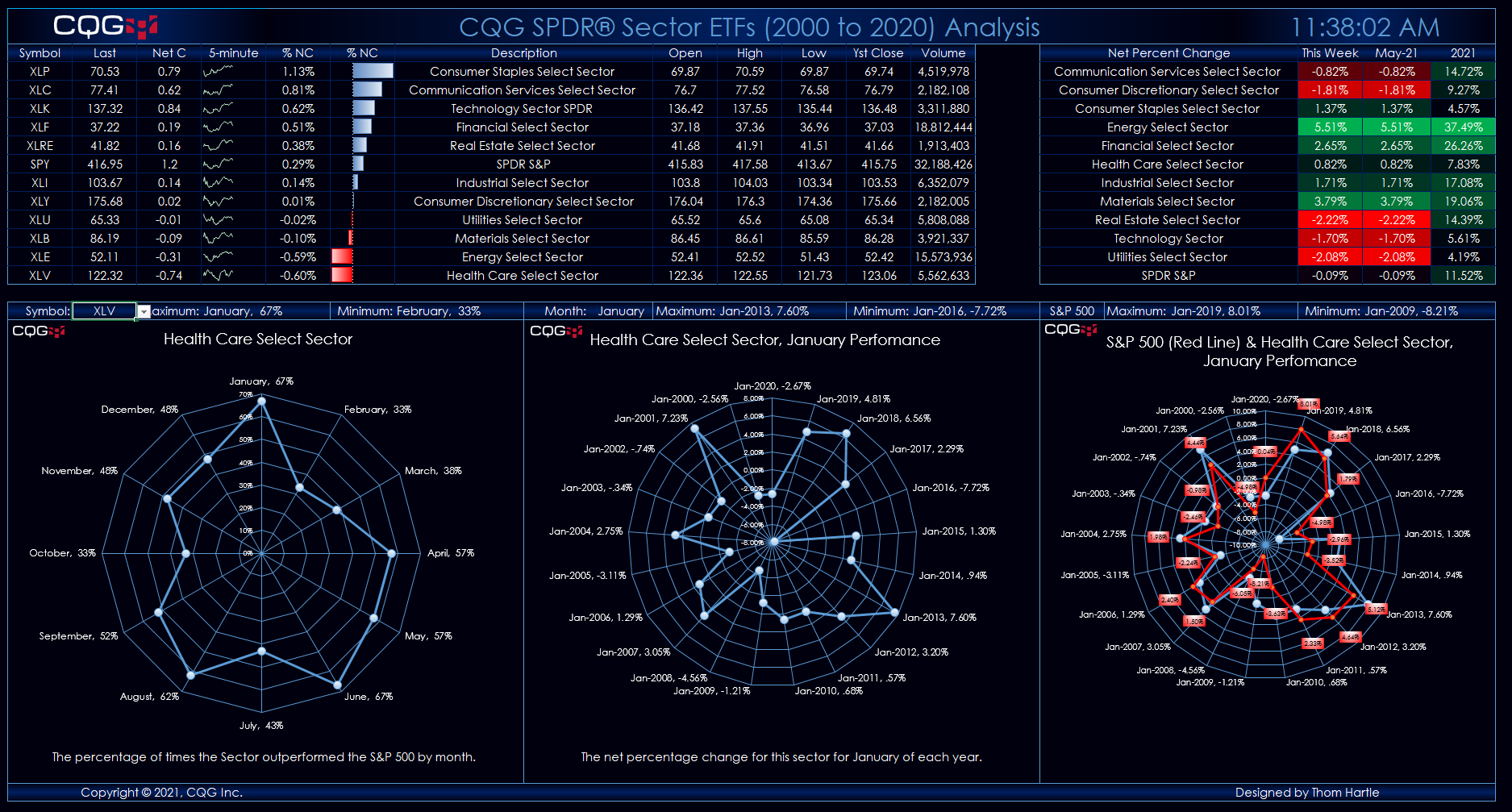

SPDR® Sector ETFs Analysis Dashboard This Microsoft® Excel dashboard provides analysis of S&P Sectors based on ETFs. The collection of ETFs are:

Symbol Description XLC Communication… moreMicrosoft® Excel offers the Radar Chart. This chart does not use the typical X-axis versus Y-axis. Instead, the radar chart is a graphic display of multivariate data in the form of a two-… more