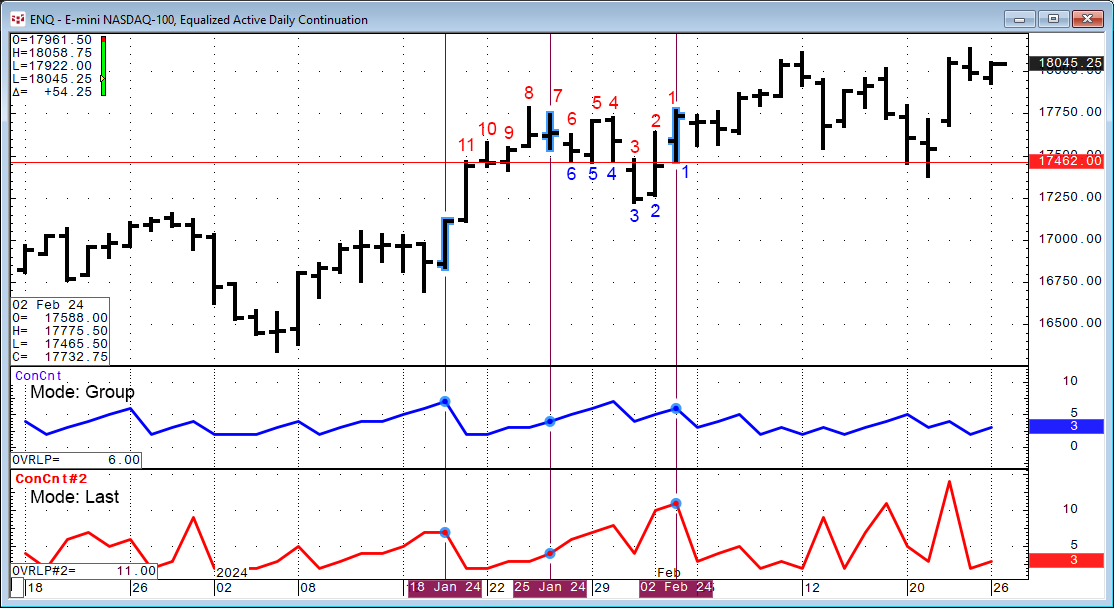

Markets tend to trend up, down, and sideways. Another name for trending sideways is congestion. A period of congestion is when the Open, High, Low, and Close price bars are overlapping. CQG IC and… more

Larry Mcdonald is a New York Times bestselling author, CNBC contributor, and Political Risk Expert. He is also the creator of The Bear Traps Report, a weekly independent Macro Research Platform… more

Judd Hirschberg is the Chief Global Strategist at WhiteWave Trading Strategies. He started as an Arbitrage Clerk on the CME in 1974, became a successful Proprietary Trader and has over 48 years of… more

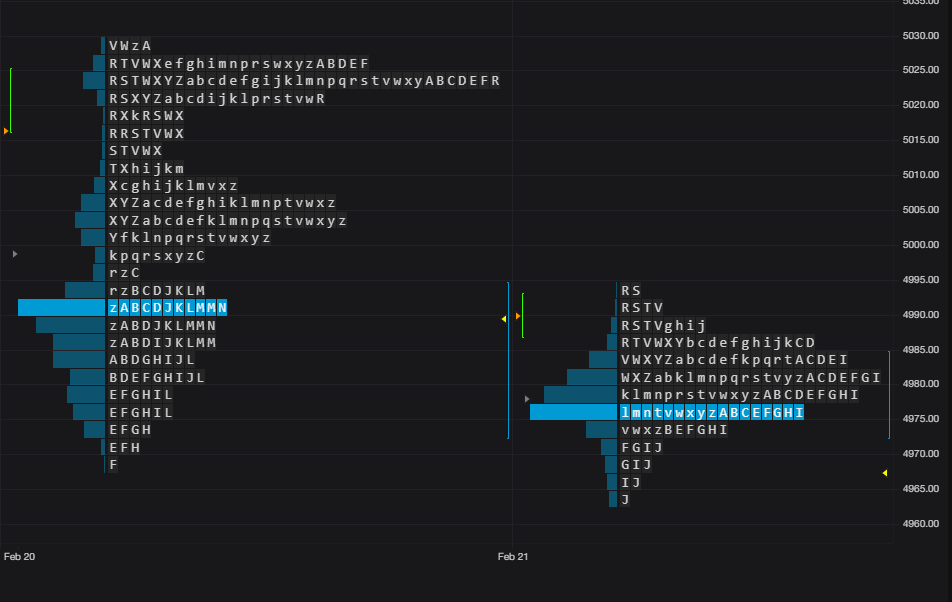

CQG One carries on the tradition of CQG product offerings with best-in-class market data visualization with the introduction in CQG One version 9.1.45025 the CQG Profile chart type and the CP… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

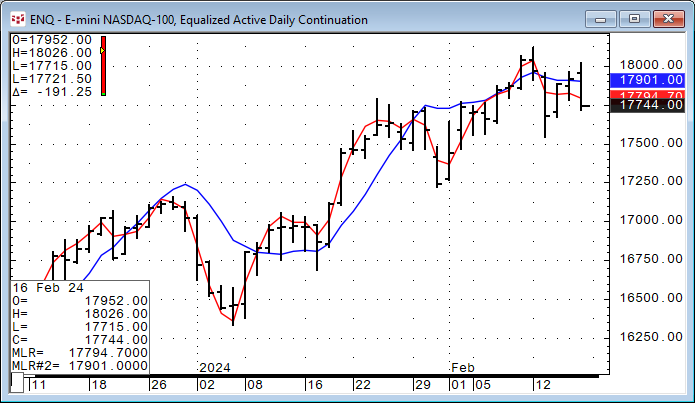

This study goes by a number of other names, including the end point moving average, least squares moving average, moving linear regression, and time series forecast.

To explain this study… more

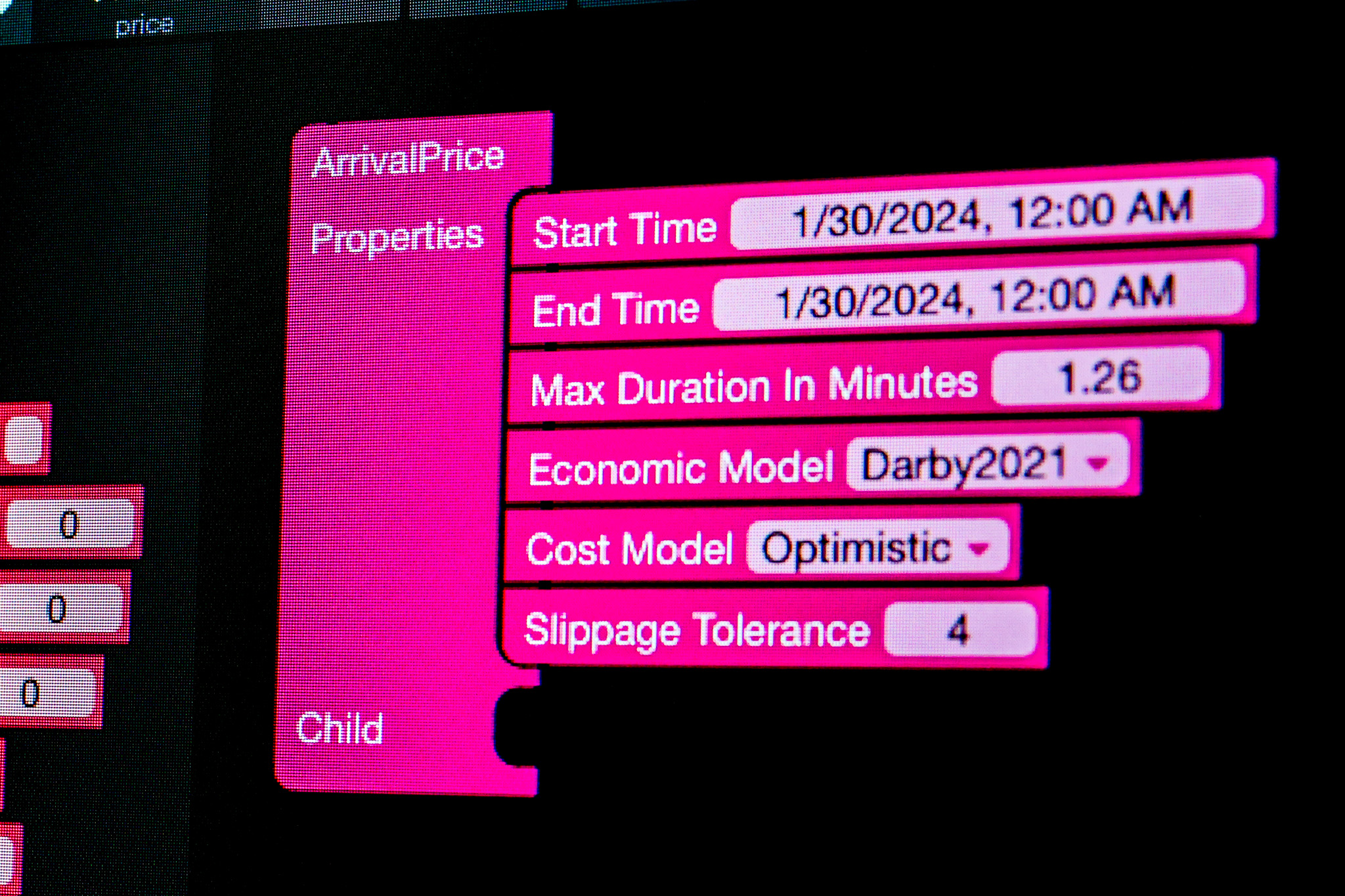

Various improvements and bug fixes.

GeneralNew right bar for Alerts and Symbol InfoInitial Margin added to Symbol InfoTradingOrder info transaction history now shows which user modified… moreEach Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

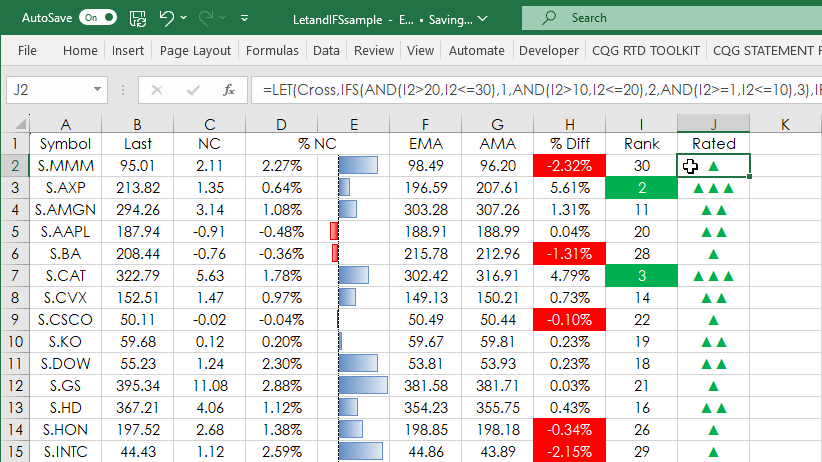

Microsoft Excel 365 introduced the LET Function. Excel 365 or Excel 2016 introduced the IFS function. This post details using the two functions for tracking the performance of the stocks… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more