On November 2, the US Fed did precisely what the market had expected and increased the Fed Funds Rate by 75 basis points for the fourth consecutive time. In March 2022, the Fed Funds Rate was at zero percent, and today it sits at 3.75% to 4.00%.

The rapid rise has caused thirty-year conventional fixed-rate mortgage rates to rise from below 3% in December 2021 to over 7% in November 2022. A monthly payment on a $400,000 mortgage has increased by over $1,300, putting home ownership out of reach for many people. Rising interest rates have also pushed the US dollar to the highest level in two decades, causing US multinational companies to experience reduced earnings as they compete for business with international firms.

Meanwhile, the explosive rise in rates and the rally in the dollar have weighed on commodity prices. Higher rates increase the cost of financing inventories and make fixed-income assets offering rising yields more attractive than stocks and commodities. Since the US dollar is the world’s reserve currency, a strong dollar tends to weigh on raw material prices as it causes them to rise in other currency terms as the dollar strengthens.

Gold has not done too badly, considering interest rates and the dollar

Gold is a commodity and a financial asset and is highly sensitive to the path of least resistance of interest rates and the dollar. Gold reached a record $2072 per ounce high in March 2022 on the back of Russia’s invasion of Ukraine and the highest inflation in over four decades. At the $1,650 level on November 2, gold corrected by just over 20%. However, the precious metal has not done poorly, considering where the price was trading the last time the bond market and the US dollar index were at the current levels.

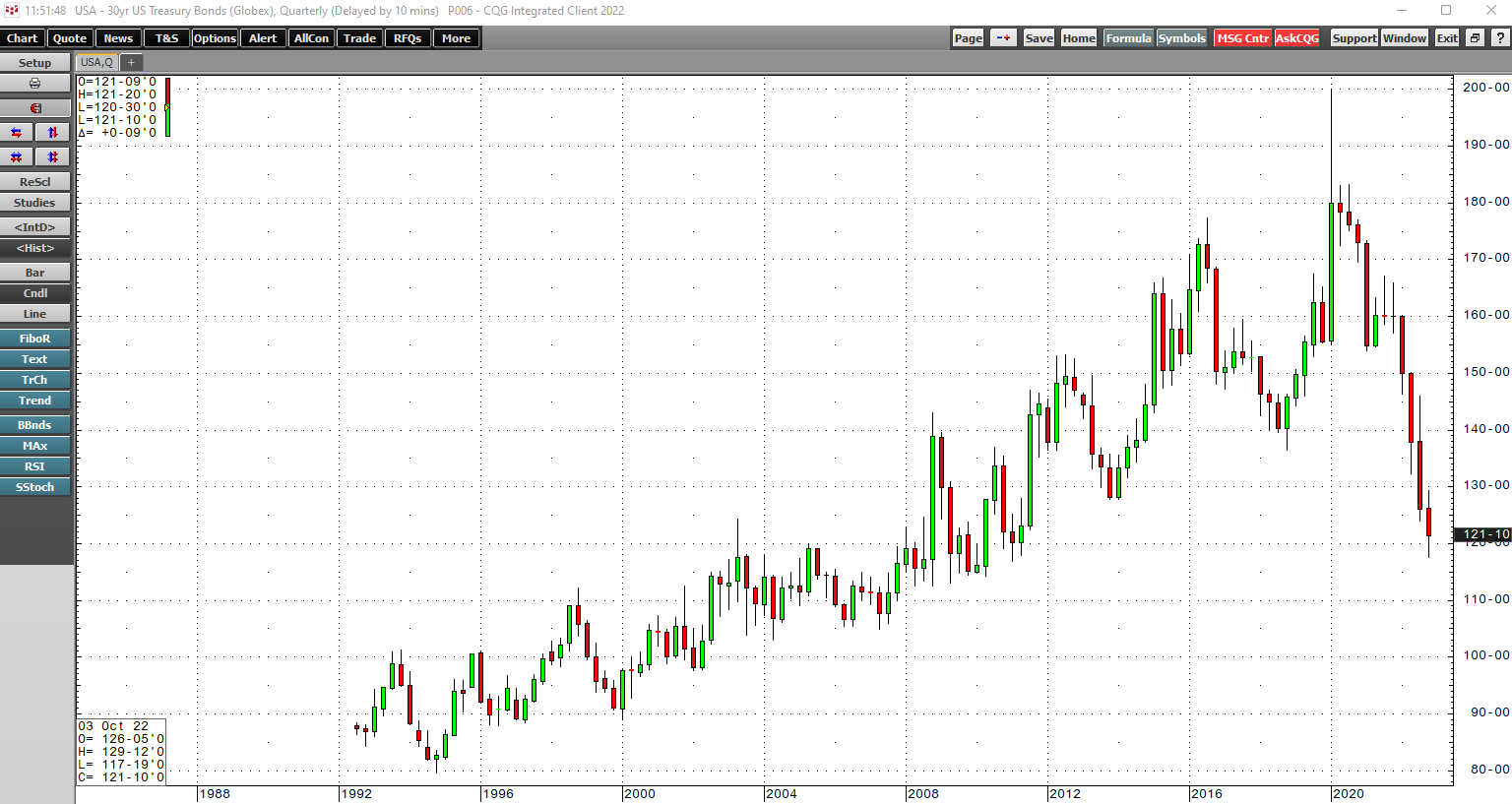

The quarterly chart show that the nearby December long bond futures recently fell to the 117-19 level, the lowest since February 2011. In February 2011, gold reached a high of $1,417 per ounce, below the current price level.

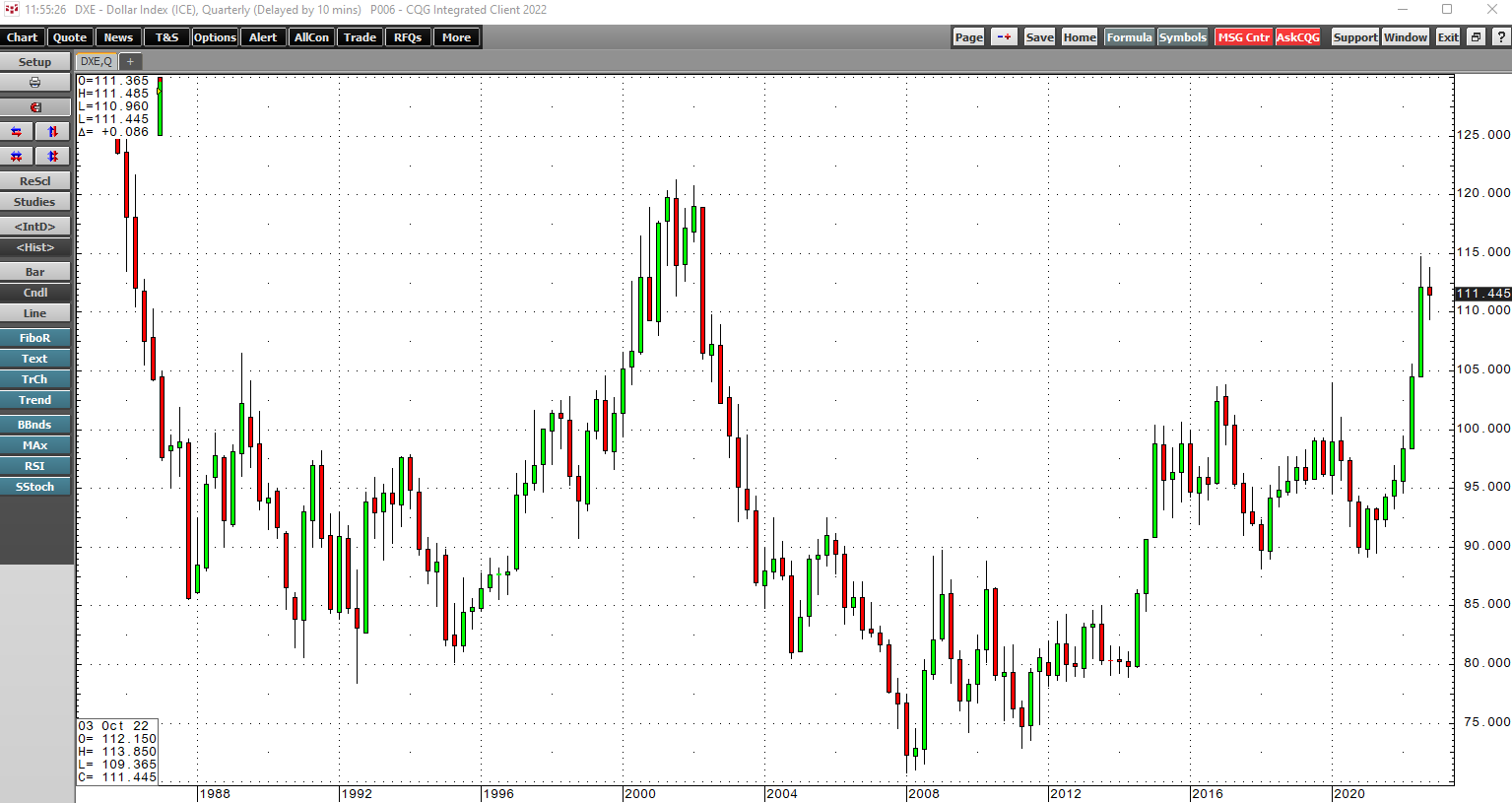

The US dollar indices’ quarterly chart illustrates the recent rise to 114.785 in September 2022, and at over the 111 level on November 2, the dollar remains at the highest level in two decades. In 2002, gold’s high was only $350.50 per ounce.

The bottom line is that gold at $1650 per ounce remains at a high level, given the price action in the bond market and the dollar index. The precious metal continues to have bullish winds in its sails. While gold could correct even lower, every correction this century has been a golden buying opportunity, and I do not expect that to change.

Official sector buying continues

After another 75-basis point rate hike on November 2, and the prospect for more increases over the coming months, the trend in financing costs is weighing on markets across all asset classes and supporting the US dollar. While gold may continue to decline, the geopolitical landscape continues to support the precious metal in November 2022.

Central banks validate gold’s role in the worldwide financial system, and they bought a record amount of the metal in Q3 2022. According to the latest report from the World Gold Council, “Central banks continued to accumulate gold, with purchases estimated at a quarterly record of nearly 400 tons.” Turkey, Uzbekistan, and Qatar were the most significant buyers. The year-to-date central bank purchases at the end of September was 673 tons, “surpassing all annual totals since 1967.”

Russia and China have been buying for years

Gold is a reserve asset, and Russian and Chinese holdings are state secrets, and a national security matter. Meanwhile, China is the world’s leading gold producer, with Russia third. In 2022, Chinese mine production will be 370 metric tons, with Russian output at the 300-ton level.

China and Russia have been diversifying their foreign currency reserves over the past years, vacuuming up domestic production, which does not show up in the World Gold Council data. Therefore, central bank and government buying is likely far higher because of China and Russia’s appetite for gold.

Russia makes a move- Will China follow?

Russia’s invasion of Ukraine caused the US, Europe, and their allies to levy severe sanctions on Moscow. Russia retaliated, which is causing lots of volatility in food and energy markets. One of the moves the Russian government made was to declare that 5,000 rubles are exchangeable for one gram of gold, essentially putting the Russian currency on a gold standard. The ruble has rallied against the US dollar since March 2022 post-invasion low. The ruble strength occurred even as the US dollar index reached the highest level since 2002.

China is about to become the world’s leading economy. The Chinese-Russian alliance and bifurcation of the world’s nuclear powers could cause Beijing to follow Moscow’s lead, shunning the US dollar as the reserve currency and turning to gold, the world’s oldest means of exchange. If China follows on Russia’s financial heels and adopts a gold standard to back the yuan, the yellow metals’ profile in the global financial system will rise, pushing the official sector demand for the metal and its price higher.

A sleeping giant that could lead commodities higher

Gold is a hybrid, as it has industrial, jewelry, and financial applications. Gold has been a hard currency since pre-biblical times and has been around a lot longer than any of the fiat currencies flowing around the world.

Since the turn of this century, every correction in gold has been a buying opportunity. The UK pushed gold’s price lower when it auctioned off one half of its national reserves in 1999 and 2000. Gold fell to a $252.50 low before taking off on the upside, with the latest peak this year at $2072.

Keep an eye on the gold market as it could be the commodity in the eye of a geopolitical and inflationary storm. Markets reflect the economic and geopolitical landscapes. Gold is an asset that could continue to thrive in an environment where the full faith and credit of governments issuing legal tender is declining.