Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Original article: https://market-news-insights-jpx.com/insights/article006875/

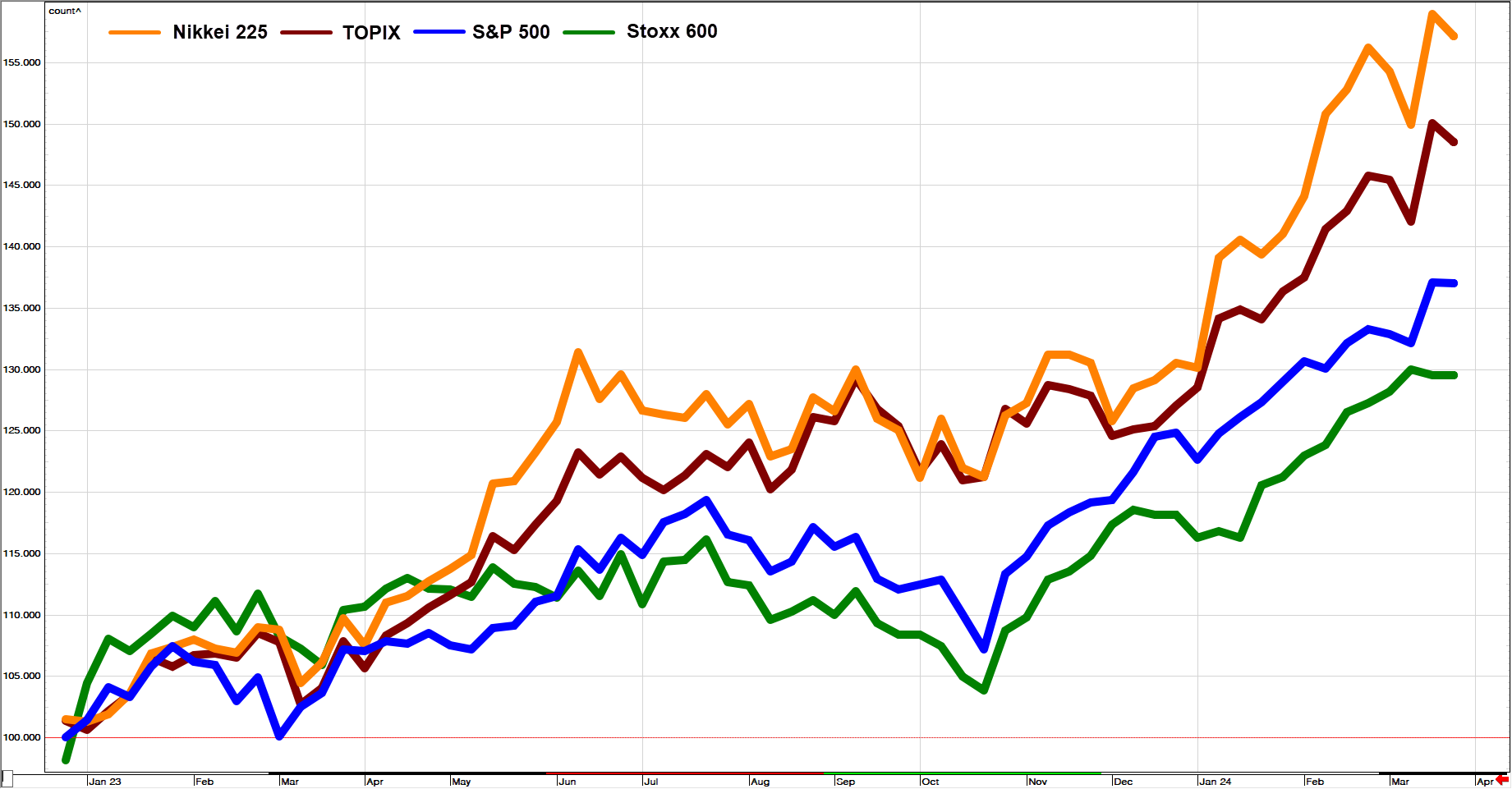

EQUITIES: Significant rise in 2023 to new highs in 2024

The Japanese stock market… more

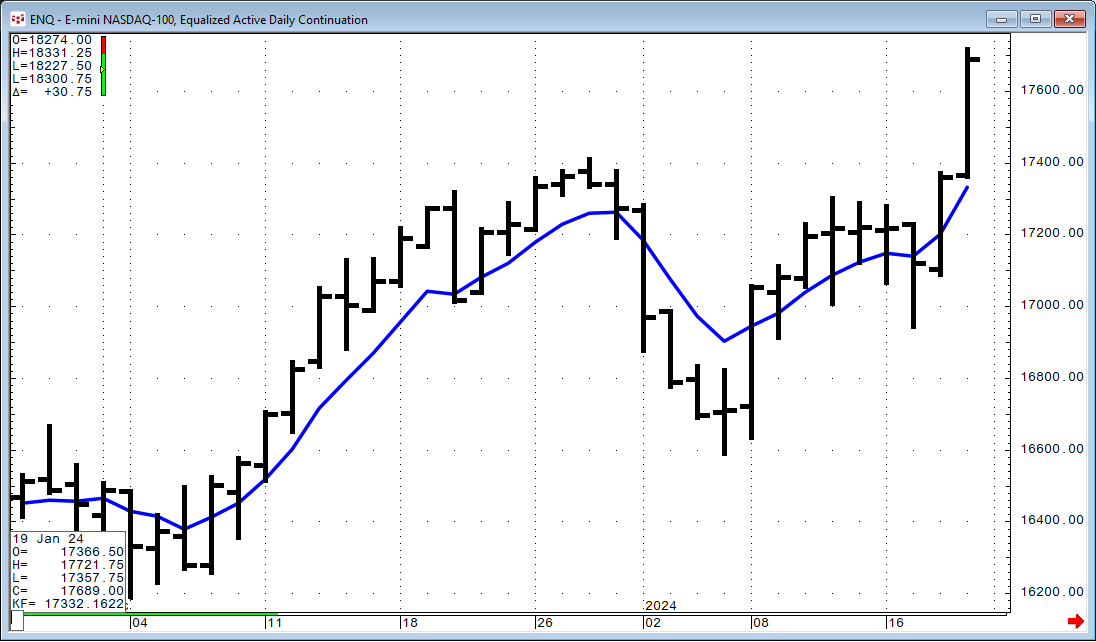

The Kalman Filter is a recursive algorithm invented in the 1960s to track a moving target from noisy measurements of its position and predict its future position. The Kalman filter is an optimal… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Various improvements and bug fixes.

GeneralAdded display of exchange close pricingImproved digit display for crypto currencies in various placesAbility to have multiple widgets open in the… moreEach Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

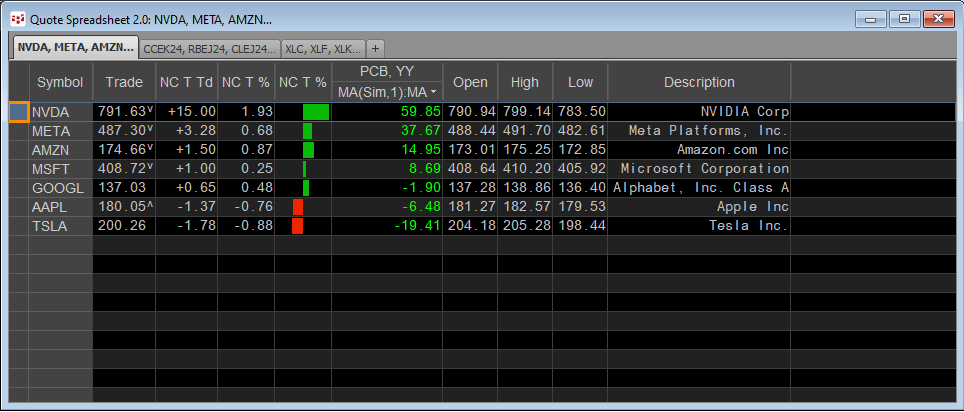

A popular form of market analysis is to maintain a real-time table of market performance based on an annualized basis. For example, the QSS 2.0 displayed below has a sorted column highlighted with… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Gold has a long history as an alternative asset, while Bitcoin and digital currencies only burst on the scene starting in 2010. Gold has been a low-volatility asset over the past few years, in a… more