Microsoft® Office 365 includes the latest version of Excel which comes with some new functions not available in Excel 2016 or Excel 2019. This post details the XLOOKUP function and its features.… more

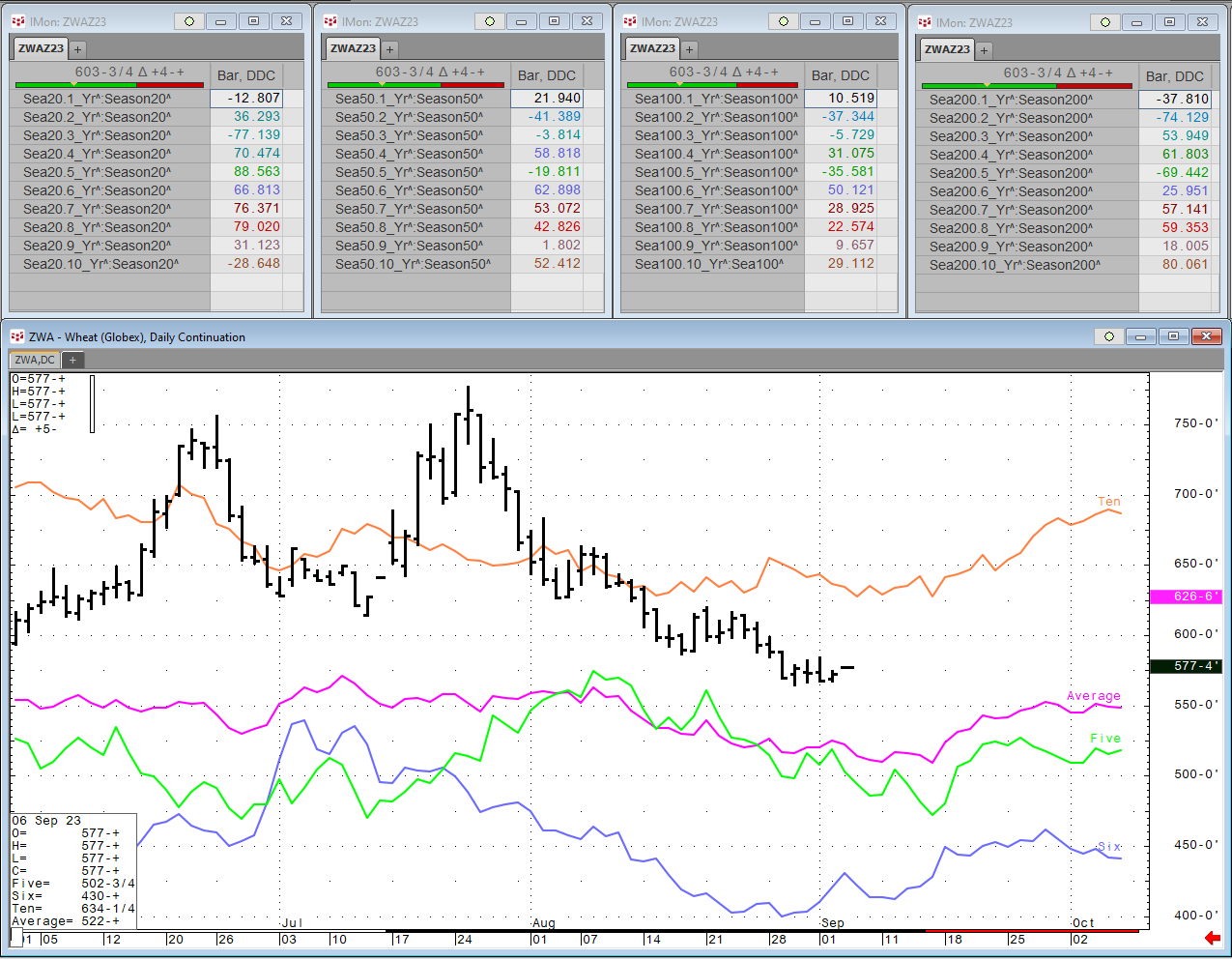

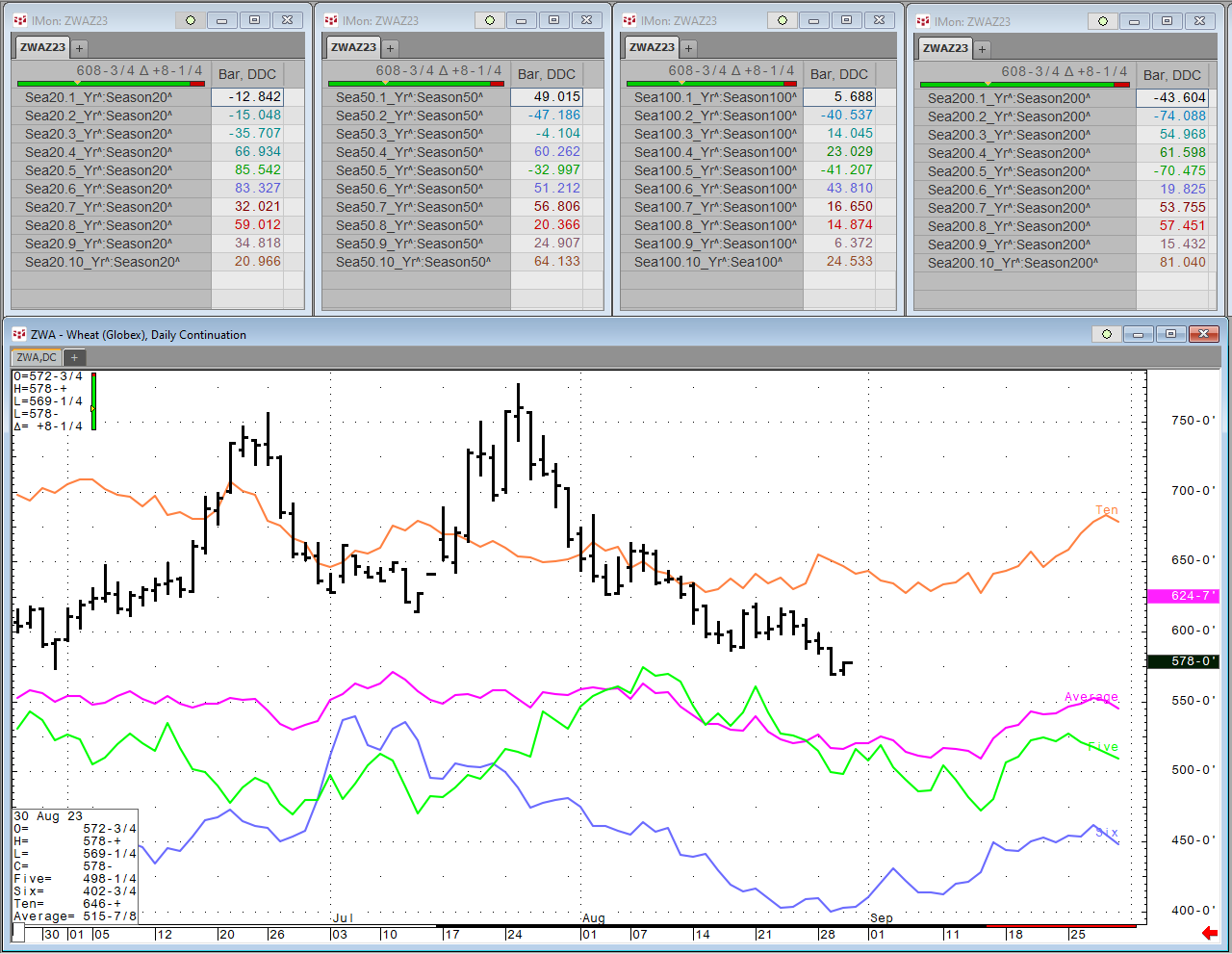

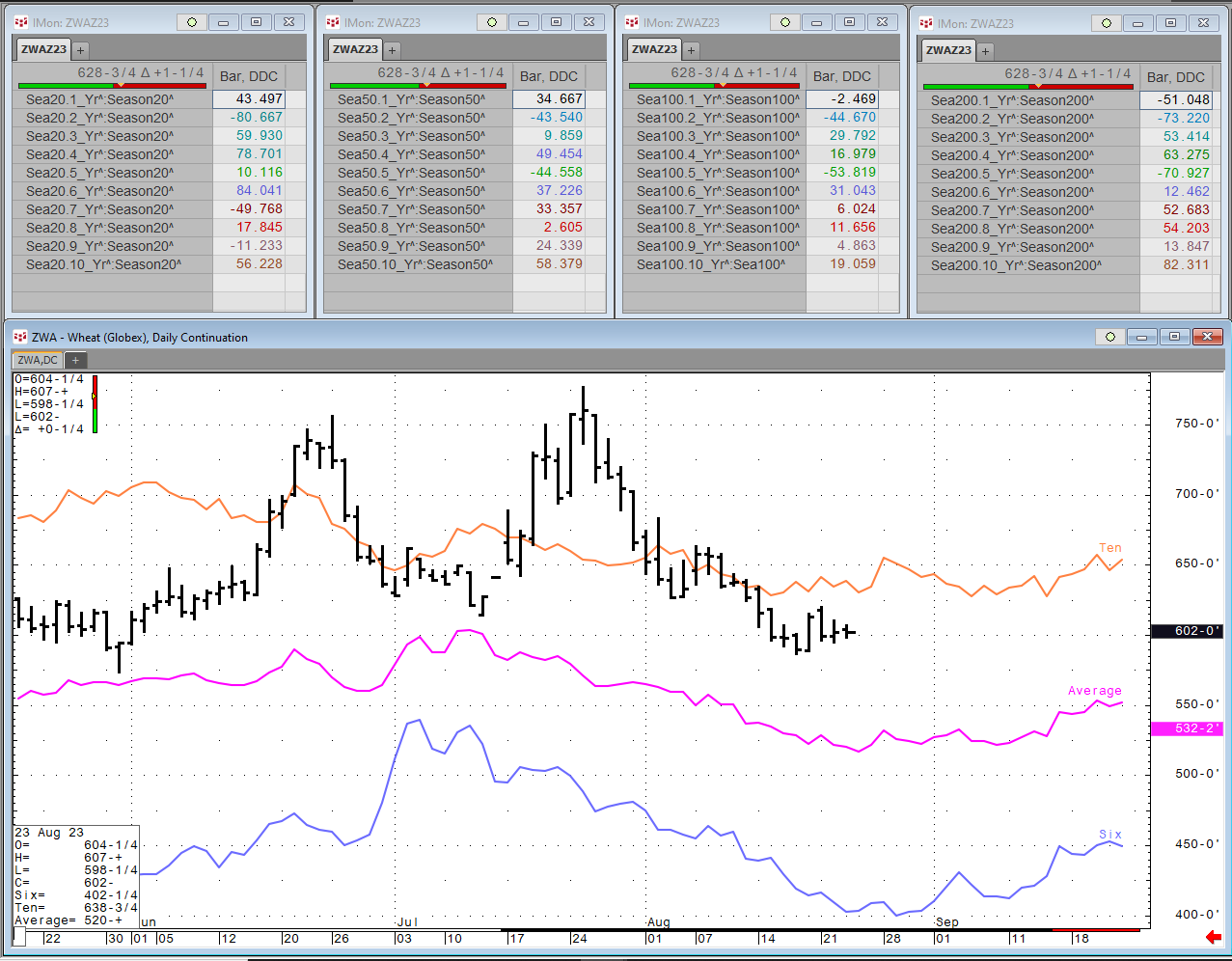

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Stocks compete with bonds for capital flows, and rising rates tend to weigh on the stock market. Meanwhile, high interest rates increase the cost of carrying commodity inventories, which tends to… more

CQG will be retiring CQG Trader later this year.

As of July 1, CQG Trader cannot be added for new users. Use CQG Desktop instead.

We will send more information regarding… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

We at Notes From Underground haven’t been publishing as frequently but we have been working more intensively than ever. The global financial situation is fraught with many areas of potential… more

Danielle DiMartino Booth is CEO & Chief Strategist for Quill Intelligence LLC, a research and analytics firm celebrating its one-year anniversary of launching The Daily Feather and the four-… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

This post details how to use Excel’s Index and Matching function to extract data from a table. The example (downloadable sample at the bottom of the post) uses the 30 stocks in the DJIA as a… more

This post details two pages with a general overview of the agriculture markets. These pages are to help you navigate all the possible underlying contracts and data points you may or may not know… more