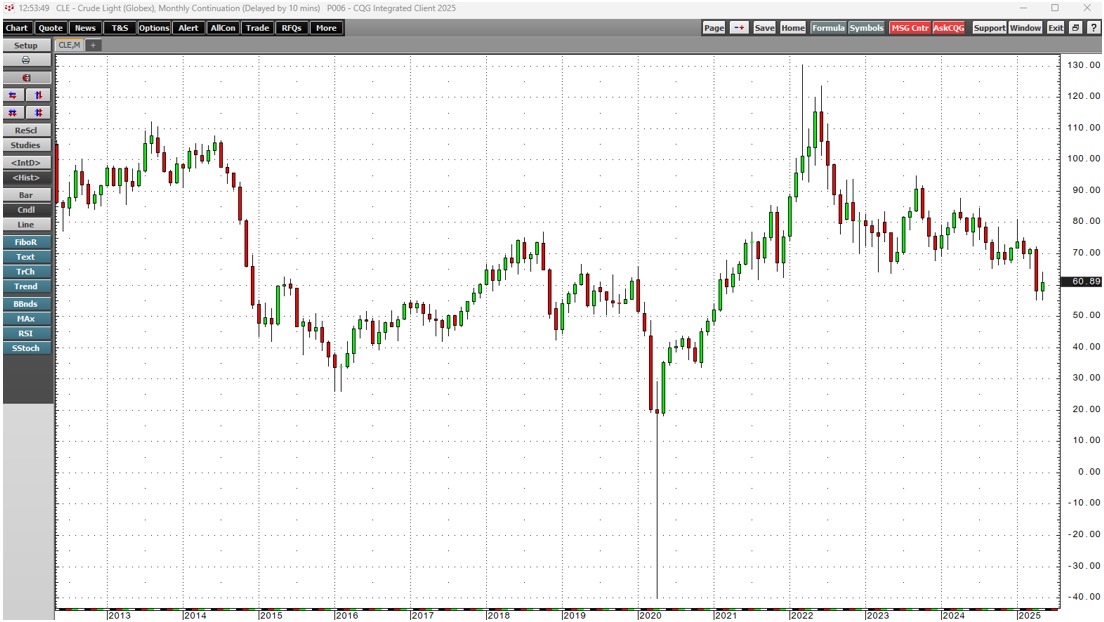

Crude oil prices have been falling since 2022, when they reached the highest price since 2008 at $130.50 on the nearby NYMEX WTI futures contract. Meanwhile, the energy commodity's pivot point has been dropping, trading around the $80 per barrel level from 2023 to mid-2024, around $70 from mid-2025 through early 2025, and around $60 from late March through May 2025.

The path of least resistance is lower in late May 2025, with the price trading above the current $60 per barrel pivot point.

The path of least resistance since the 2022 high remains lower

NYMEX WTI crude oil futures have been decreasing since the March 2022 $130.50 high.

The monthly chart highlights the decline to another lower low of $55.12 per barrel in April 2025. The energy commodity made a slightly higher $55.30 low in May 2025 before recovering to over the $62 level.

The bearish case for crude oil in June 2025- Rising open interest, U.S. and OPEC production policy, and China's economic weakness

The bearish case for crude oil in June 2025 includes:

- U.S. energy policy under the Trump administration supports increased crude oil production through regulatory reform and legislative initiatives. President Trump pledged to "drill-baby-drill" and "frack-baby-frack" on the campaign trail.

- OPEC+ has increased production over the past months.

- Chinese economic weakness continues to weigh on energy and crude oil demand.

- Crude oil's path of least resistance remains lower, and the trend is always a market's best friend and leading indicator.

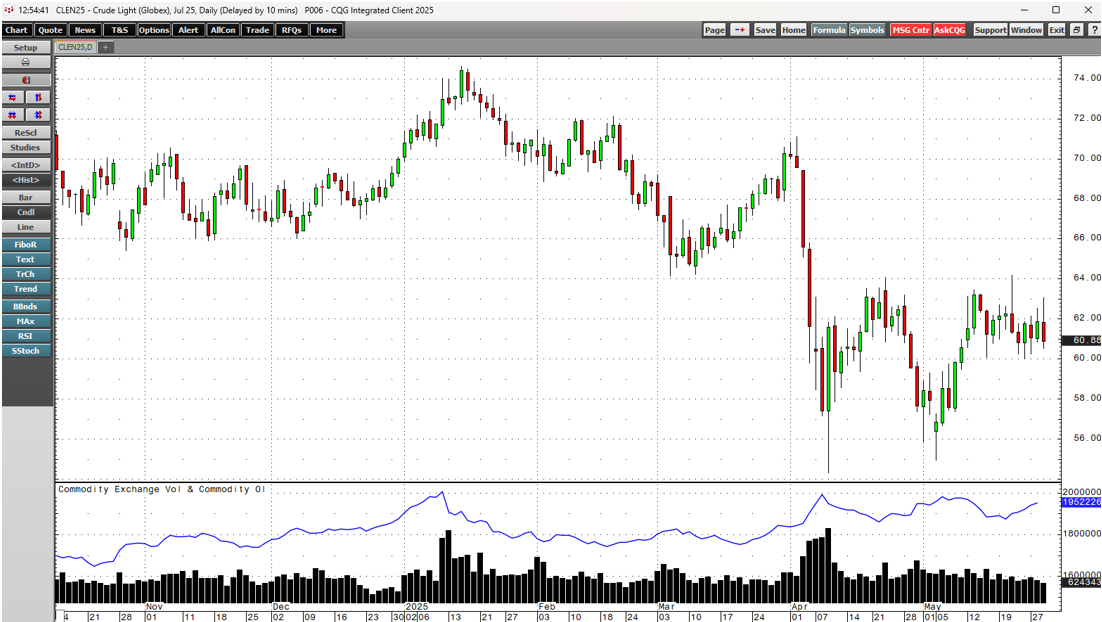

The chart shows that open interest, or the total number of open long and short positions in the NYMEX crude oil futures market, has moved from 1,751,834 contracts on March 20, 2025, when the futures were in a bullish short-term trend, to 1,952,226 contracts on May 19, 2025. Open interest increased by 11.4% from March 20 through May 28 while crude oil was in a primarily bearish trend. Falling prices and rising open interest tend to validate a bearish trend in the futures market.

The energy commodity's bullish case

The bullish case for crude oil includes:

- Geopolitical turmoil in the Middle East, Ukraine, and other regions threatens to boost crude oil prices if hostilities impact production, refining, or critical logistical routes.

- Improving conditions in the Chinese economy could boost energy demand and crude oil prices.

- Seasonality during the peak driving season in late spring and summer tends to increase gasoline demand as drivers put more mileage on vehicles due to vacations.

- Critical support is at April $55.12 low. A bullish trend could develop if nearby NYMEX futures hold above the April low. Technical resistance that would negate the bearish trend since 2022 is at the January 2025, $80.77 per barrel level.

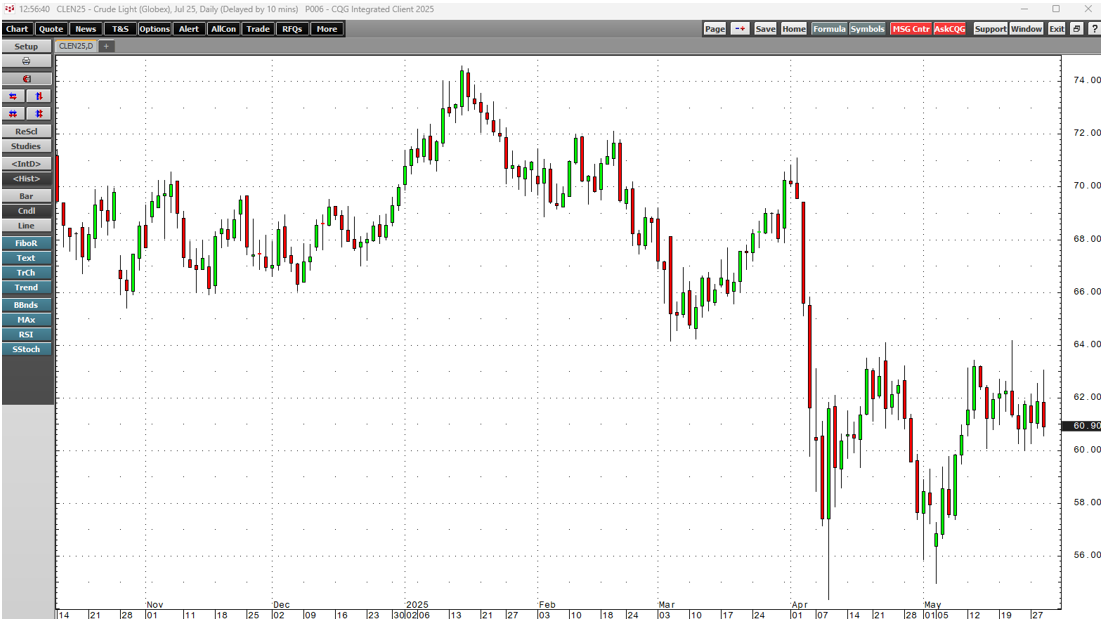

The short-term trend- $60 is the new pivot point

Crude oil has traded in a consolidation range since the April 9 low.

The daily chart of active-month July NYMEX WTI futures highlights higher lows and lower highs. After reaching an April 9 low of $54.33, the July contract fell to a higher $54.95 bottom on May 5, 2025. On the upside, the energy commodity reached $64.19 on May 21, slightly higher than the April 23 $64.09 peak. The May 21 high is short-term technical resistance.

After crude oil's pivot point was $80 from 2023 to mid-2024, and around $70 from mid-2025 through early 2025, it has declined to $60 from late March through May 2025.

The odds favor lower prices over the coming weeks and months, barring any unforeseen geopolitical surprises

While crude oil prices have been consolidating over the past weeks, $60 has become the new pivot point. The odds favor lower lows as the medium-term trend remains bearish. Rising U.S. and OPEC production could weigh on prices even if seasonal factors and an uptick in Chinese demand provide support.

However, sudden outbreaks of geopolitical turmoil could cause a sudden price spike as surprises tend to cause the most volatile moves.

I remain bearish on crude oil, as it is critical for the U.S. administration to reduce inflation and interest rates. I foresee a test of the $50 per barrel level that could become the next pivot point in the bear market. However, the lower crude oil falls over the coming weeks and months, the higher the odds of a sudden recovery that challenges the bearish trend firmly in place since the 2022 high.