Gold and silver are the oldest means of exchange, far outdating dollars, euros, pounds, and all current traditional fiat and cryptocurrencies. The Bible’s old testament makes many references to gold and silver as money and metals that reflect wealth.

Inflation erodes the value of money as it lessens its purchasing power. Governments can expand and contract the supply of fiat currencies with the push of a bottom these days. However, growing gold and silver supplies involves extracting more of the metals from the earth’s crust. Therefore, gold and silver tend to be inflation barometers. When fiat currency values decline, the metals tend to experience price appreciation. Governments, central banks, and monetary authorities validate gold’s role in the global financial system as they hold the precious metal as an integral part of their foreign exchange holdings. Over the past years, governments have been net buyers of gold, even as the price appreciated. Few central banks speak publicly about gold’s role in the financial system. However, their action speaks louder than any words as holdings have increased.

Jack Dorsey, the founder, and CEO of Twitter (TWTR) and Square (SQ), recently issued a frightening warning saying, “Hyperinflation is going to change everything. It’s happening. It will happen in the US soon, and so the world.” If Mr. Dorsey is correct, the bullish baton will pass back to gold and silver, and new highs could be on the horizon for the metals that are the ultimate stores of wealth and value.

Secretary Yellen and Chairman Powell remain in the “transitory” camp

In the wake of the global -pandemic, prices of all goods have been rising. In August 2020, gold was the first commodity to reach an all-time high in US dollar terms when the price rose to $2063 per ounce. In 2021, grain and other agricultural commodity prices rose to multi-year highs. In May, lumber, copper, and palladium rose to new record peaks. More recently, coffee, sugar, cotton, crude oil, natural gas, coal, and many other commodities reached the highest prices in many years. Freight rates have exploded because of rising energy prices, and a semiconductor shortage has caused automobile shortages and increasing costs for new and used cars. Wages are moving higher to attract workers back to jobs.

The US Federal Reserve and US Treasury insist that rising consumer prices are “transitory,” caused by supply chain bottlenecks and post-pandemic factors. However, neither has mentioned the tidal wave of liquidity caused by low interest rates and quantitative easing or the fiscal stimulus tsunami that has swept across the US and global economies.

Jack Dorsey, and others, say no way

Jack Dorsey’s tweets were short, sweet, and powerful:

Jack Dorsey responded to a tweet from Nigeria where inflation is the norm:

Jack is not the only high-profile person warning about inflation. Larry Summers, a Harvard economics professor and economist who served in senior positions during the Clinton and Obama administrations, recently said that 1970s-style inflation is on the horizon, “We’re in more danger than we’ve been during my career of losing control of inflation in the US.”

With Jerome and Janet on one side and Jack and Larry on the other, the debate over inflation continues. On Friday, October 29, the Bureau of Economic Analysis reported that the price index tracking consumer spending, the PCE price index, was up 4.3% over the twelve months ending in August 2021, higher than the 4.2% in July, and at the highest level since January 1991, a three-decade peak in the economic condition.

Inflation is a beast, transitory or not

Inflation is a nasty economic beast. In the late 1970s, rising prices were a factor that cost President Jimmy Carter the 1980 election. Paul Volker, the Fed Chair at the time, hiked interest rates aggressively to confront rising prices.

Throughout history, hyperinflation has caused massive political woes. The latest example is in Venezuela, where hyperinflation is running at nearly 10,000%. Hyperinflation in the Weimar Republic in Germany following WW I led to Adolf Hitler’s rise and the Nazi nightmare. Inflation is dangerous economically and politically. A recent article in Barron's compared inflation to the dinosaurs that roamed the earth millions of years ago. The author pointed out that dinosaurs were “transitory,” but they wreaked destructive havoc before becoming extinct.

Energy continued to hold the bullish baton in October

The rise of commodity prices has been nothing short of a bullish relay race that began in 2020 and continues in 2021. The latest markets to reach multi-year highs in October were the crude oil and natural gas arenas.

NYMEX crude oil futures rose to a new high of $85.41 in late October, the highest level since 2014 when the price was over the $100 per barrel level.

NYMEX natural gas futures rose to $6.466 per MMBtu in early October, only 2.7 cents below the February 2014 high. In Asia and Europe, natural gas prices moved to a record level that was many times the NYMEX Henry Hub benchmark price.

Energies were not the only commodities to take the bullish baton in October.

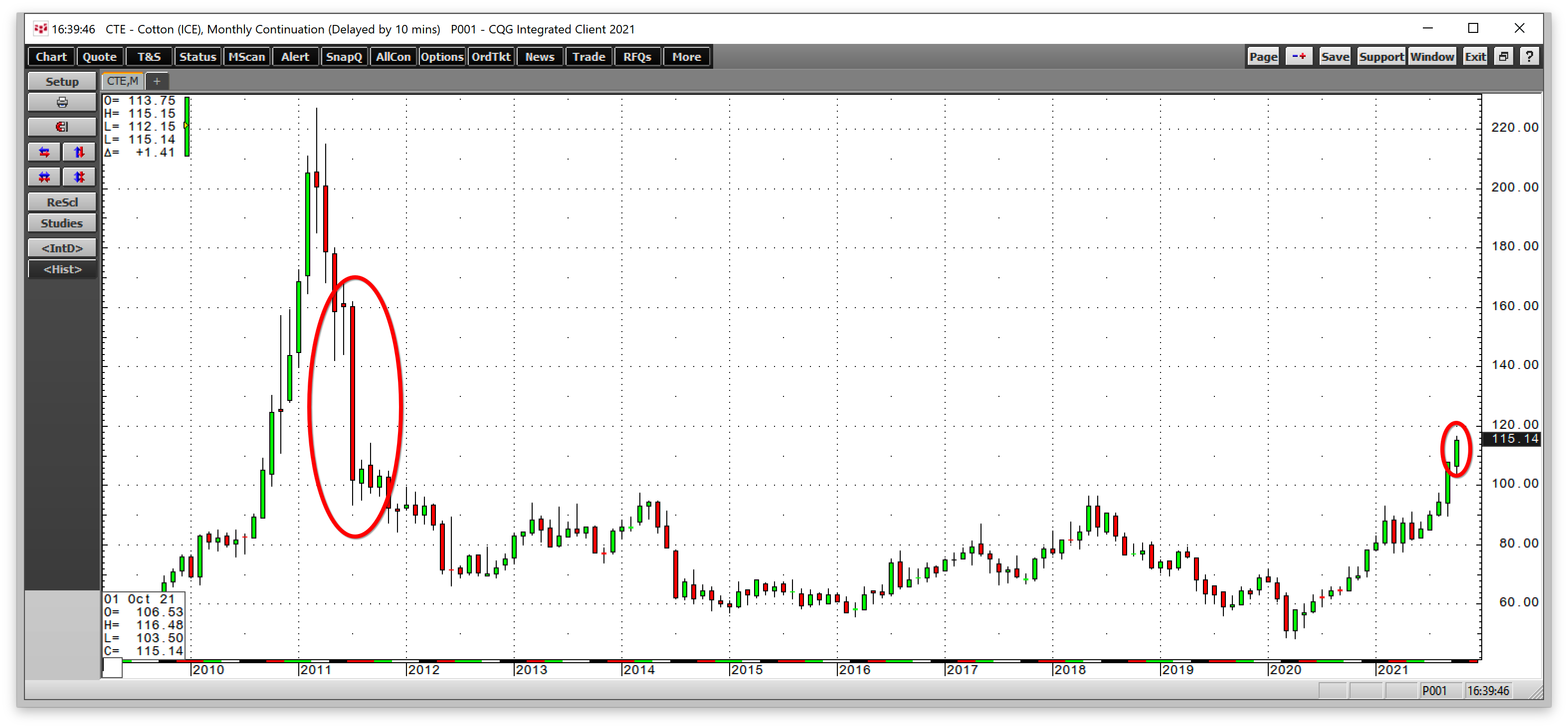

Cotton futures on the Intercontinental Exchange rose to nearly $1.1650 per pound, the highest price since 2011.

CBOT wheat futures rose to $7.80 per bushel, the highest price since February 2013. Other wheat futures also made multi-year highs and oat futures rose to record higher in October.

Inflationary pressures are also pushing cryptocurrencies higher.

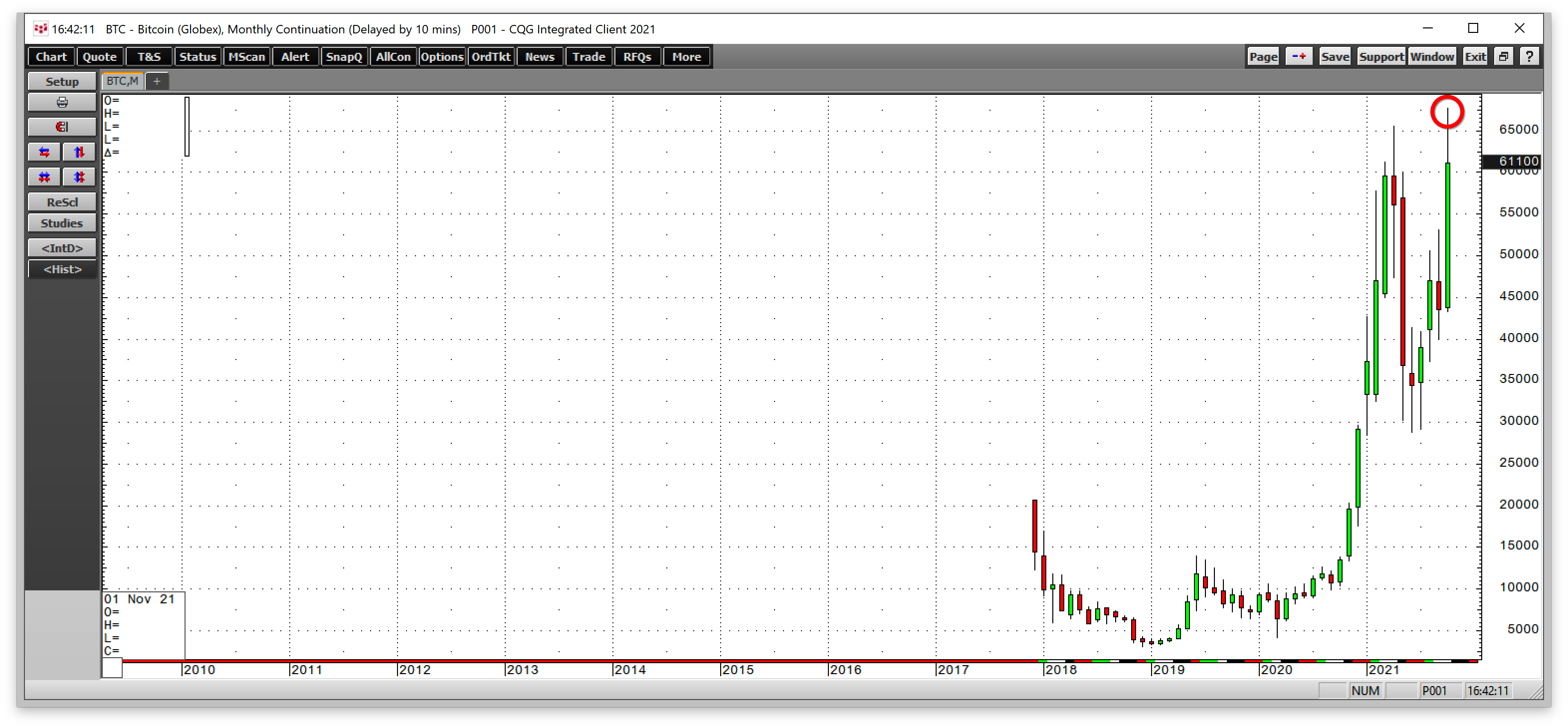

CME Bitcoin futures rose to a record $67,680 per token on October 20. On Friday, October 29, CME Ethereum futures rose to a high that was only $2.50 below the May record peak.

The bottom line is that inflationary pressures continue to push commodity prices higher. Bull markets rarely move in straight lines. Corrections can be swift and ugly. However, a continuation of rising inflation is likely to cause two of the metals, most sensitive to inflation, to make moves higher over the coming months and years.

A precious period in gold and silver on the horizon

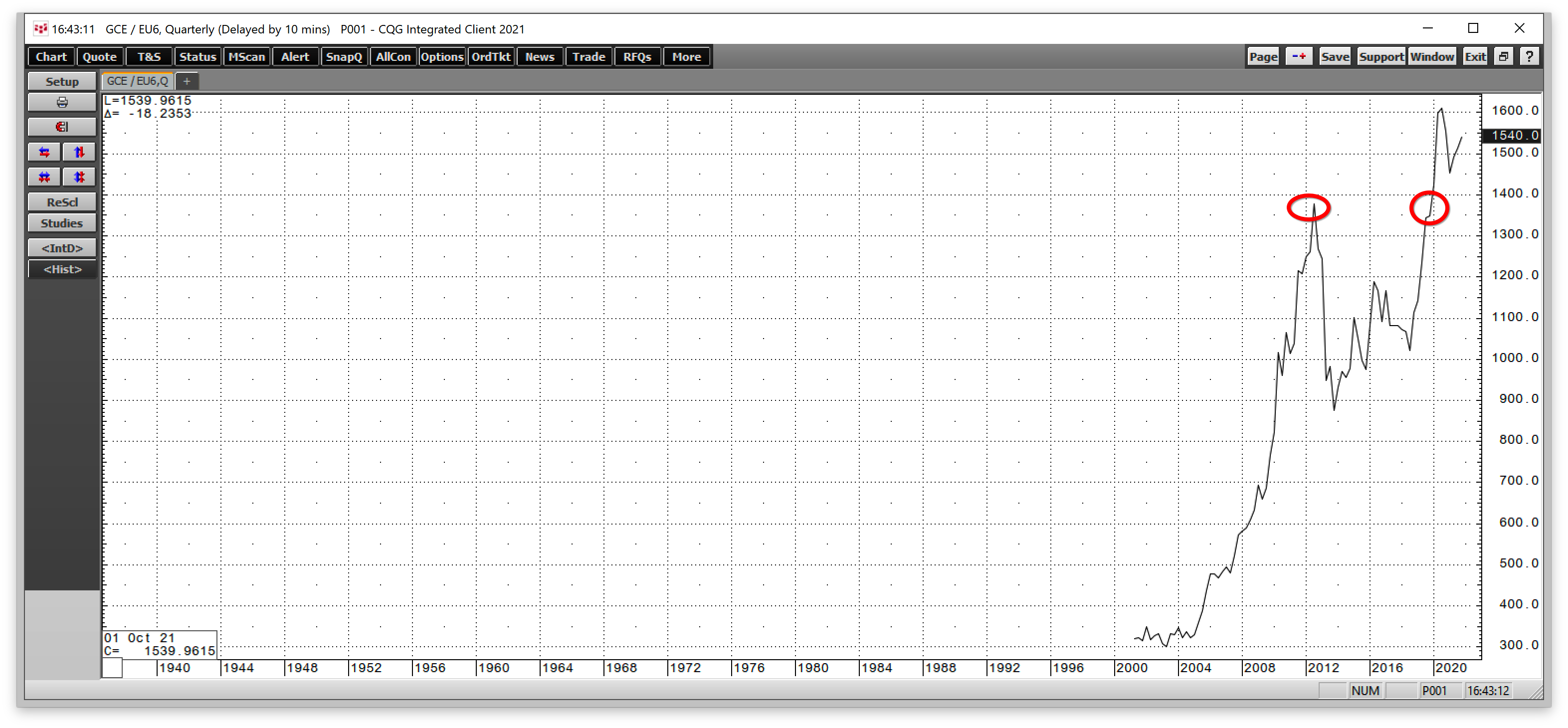

Gold and silver are inflation barometers. Gold was the first commodity to reach a record in August 2020. However, the precious yellow metal had been rallying before the pandemic, reaching highs in most other currencies in 2019.

The quarterly chart of gold in euros shows that the precious metal reached a record high in late 2019 before the pandemic spread worldwide. The same goes for gold in pounds, yen, and virtually all other currencies. It waited until July 2020 to do the same in dollars and peaked the next month.

Gold in dollar terms has corrected over the past months, making lower highs.

The weekly chart shows the pattern of lower highs. However, since March 2021, gold has made higher lows as the market consolidated and digests the August 2020 record high. As the wedge formation forms, the odds of a break higher or lower will increase.

Meanwhile, silver is a far more volatile precious metal. In 2020, the pandemic pushed silver prices from nearly $19 in late February to a low of $11.74 in March.

The monthly silver chart shows the rise to a high of $30.35 in February 2021. While silver pulled back to a new low for 2021 at $21.41 in late September, it did not challenge its critical technical support level at the July 2016 $21.095 high.

Nearby December gold and silver futures prices settled at $1783.90 and $23.949 per ounce, respectively, on Friday, October 29. If Larry Summers and Jack Dorsey are correct and Jerome Powell and Janet Yellen are wrong, it may not be long before gold and silver take back the bullish baton and resume their ascent that reflects the rising level of inflationary pressures.