Seasonality can be a significant factor for markets across all asset classes as it creates expectations and shapes sentiment. Markets move higher or lower when buyers dominate sellers or sellers overwhelm buyers. Therefore, the path of prices is a function of the collective opinions that give way to trends.

As we enter the fall season in 2022, commodities and stocks face seasonal factors that could create increased volatility. During typical years, seasonality can be a powerful force. However, 2022 is anything but an ordinary period. The geopolitical and economic landscapes present market challenges that could exacerbate price volatility.

The stock market tends to get nervous during the fall

In early September, memories of stock market crashes during the fall creates fear in the hearts of traders and investors. The 1907, 1929, and 1987 stock market carnage occurred in October.

The stock market is limping into the fall season with the Federal Reserve committed to battling inflation with hawkish monetary policy. After increasing the Fed Funds rate by 75 basis points in June and July, the market expects the central bank to push the short-term rate up by another 50-75 basis points at the September FOMC meeting. Some market participants had hoped two consecutive quarterly declines in US GDP, the textbook definition of a recession, would temper the Fed’s hawkish policies.

If there was any doubt, Chairman Powell dispelled them on August 26 when he said higher interest rates “are the unfortunate costs of reducing inflation.” Meanwhile, reducing the central banks’ swollen balance sheet continues to put pressure on interest rates further out along the yield curve. On Friday, August 26, the recent stock market rally ran out of steam just in time to enter the nervous fall season.

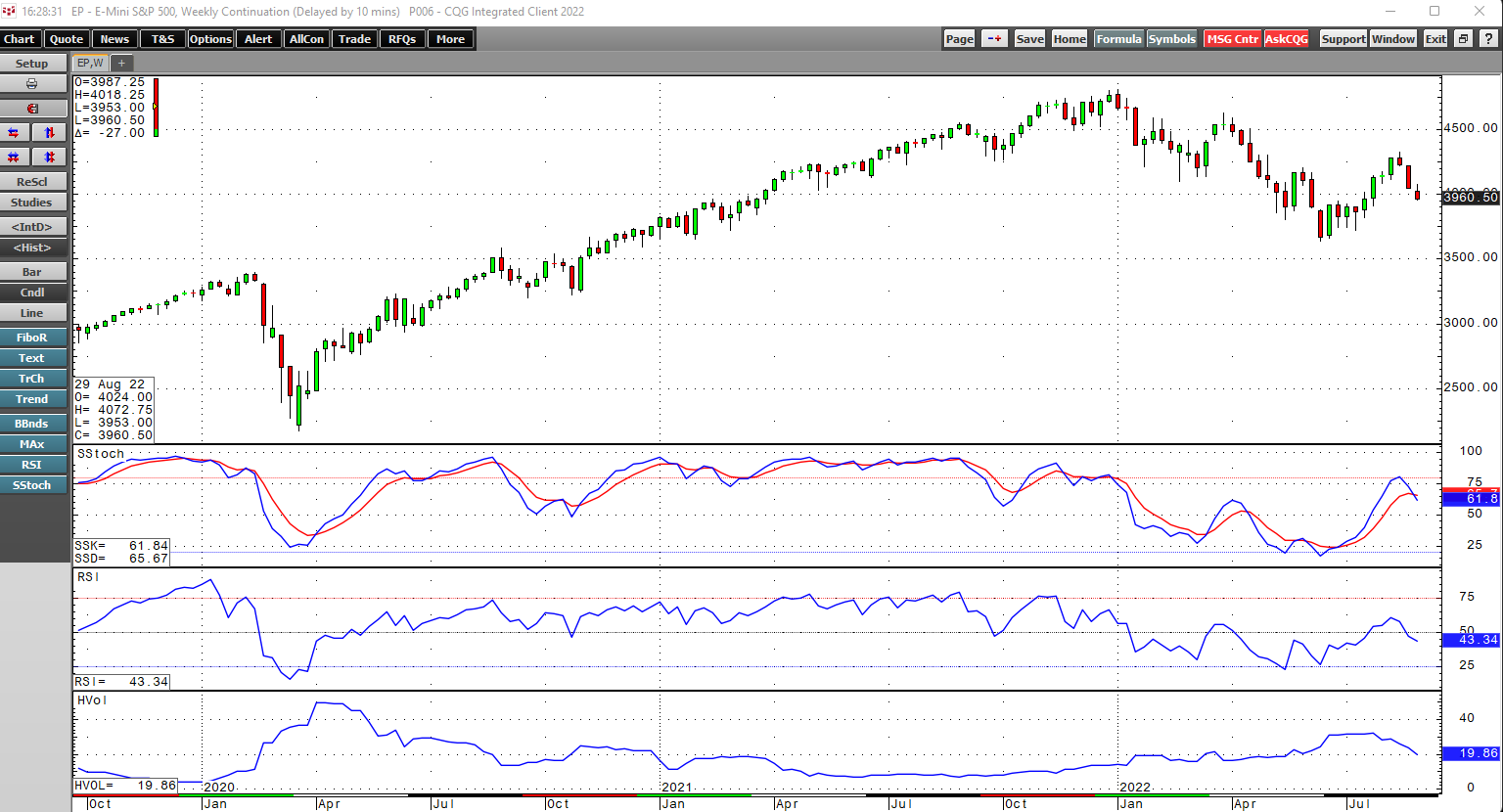

The weekly chart of the S&P 500 E-Mini futures contract highlights the bearish trend from early 2022 through the mid-June low. After a recovery, the futures turned lower in late August as higher interest rates tend to weigh on stocks. Price momentum and relative strength indicators have decreased, while weekly historical volatility remains elevated.

Capital tends to flow from stocks to fixed-income instruments when interest rates rise. As the market moves into the fall months, geopolitical tensions and the economic landscape could increase concerns that another crash is on the horizon, and 2022 will join 1907, 1929, and 1987 in the history books.

Meats enter the off-season for demand

Seasonality could weigh on the stock market, and it often tends to send animal protein prices lower during the fall months. The demand for beef and pork tends to peak during the annual grilling season that runs from the Memorial Day holiday in late May through the Labor Day weekend in early September when grills go back into storage. We have witnessed seasonal weakness in hog futures, and cattle could come under pressure over the coming days and weeks. While inflation has pushed input prices higher, seasonality will likely weigh on beef and pork in September and October if history is a guide.

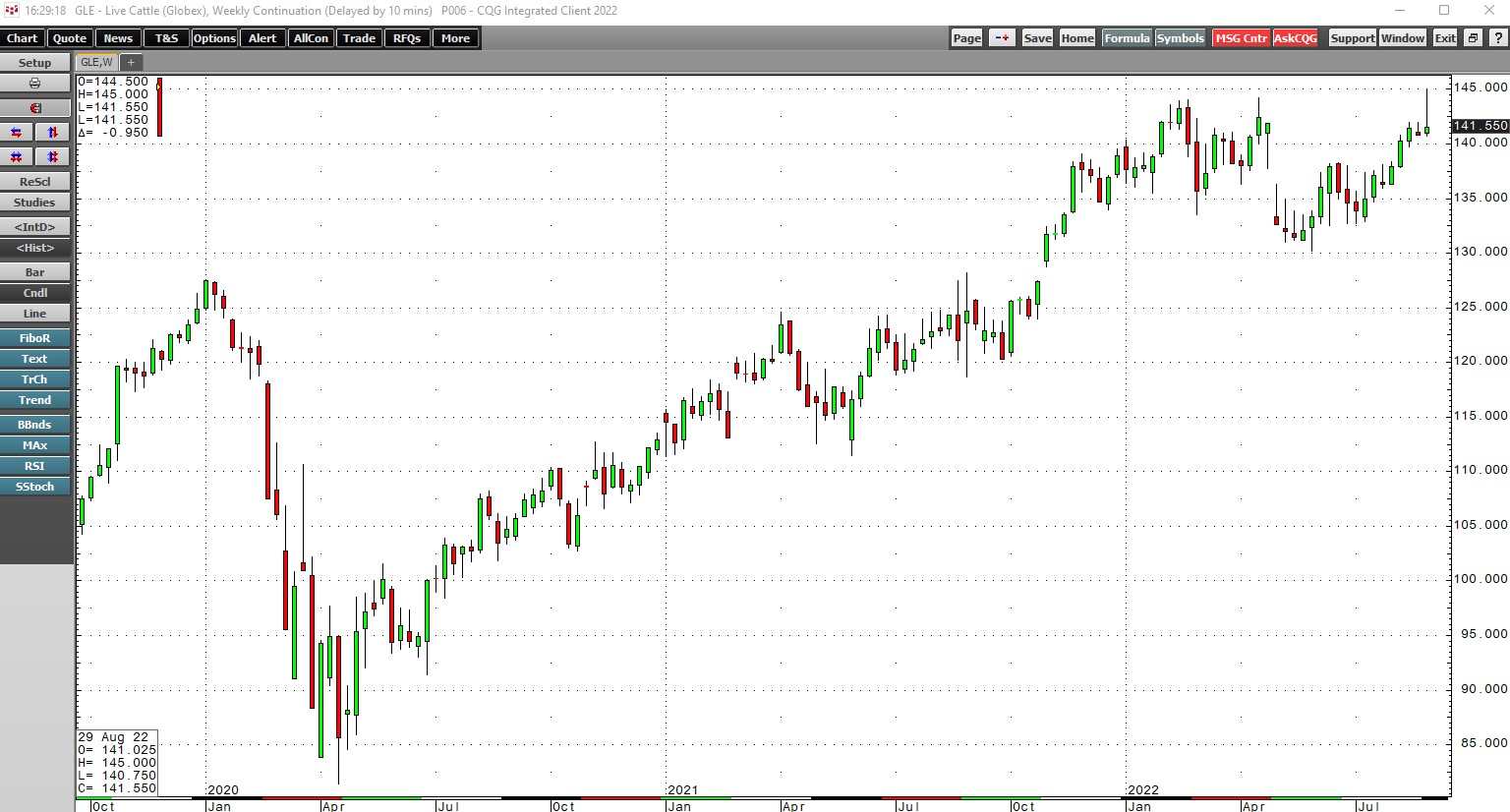

The weekly chart of the continuous live cattle futures contract shows a bullish trend of higher lows and higher highs from the March 2020 pandemic-inspired low to the mid-April 2022 high. Live cattle peaked as the 2022 grilling season was on the horizon and has remained below the April peak over the past months. Falling demand for beef could weigh on prices as the off-season begins in early September.

The weekly chart shows the feeder cattle futures display the same bullish trend. Feeders rose to the highest price since November 2015, while live cattle’s 2022 peak was the highest since September 2015. With both cattle futures contracts near multi-year highs in early September, the odds of a seasonal correction are elevated.

The weekly lean hog futures chart shows the seasonal adjustment that took prices of the continuous contract lower during the recent roll period. After trading to a high of $1.22525 per pound in early August, the price of nearby futures was at just over 90 cents per pound in late August. Over the coming weeks, the seasonal price action in hog futures could be an omen for the cattle contracts.

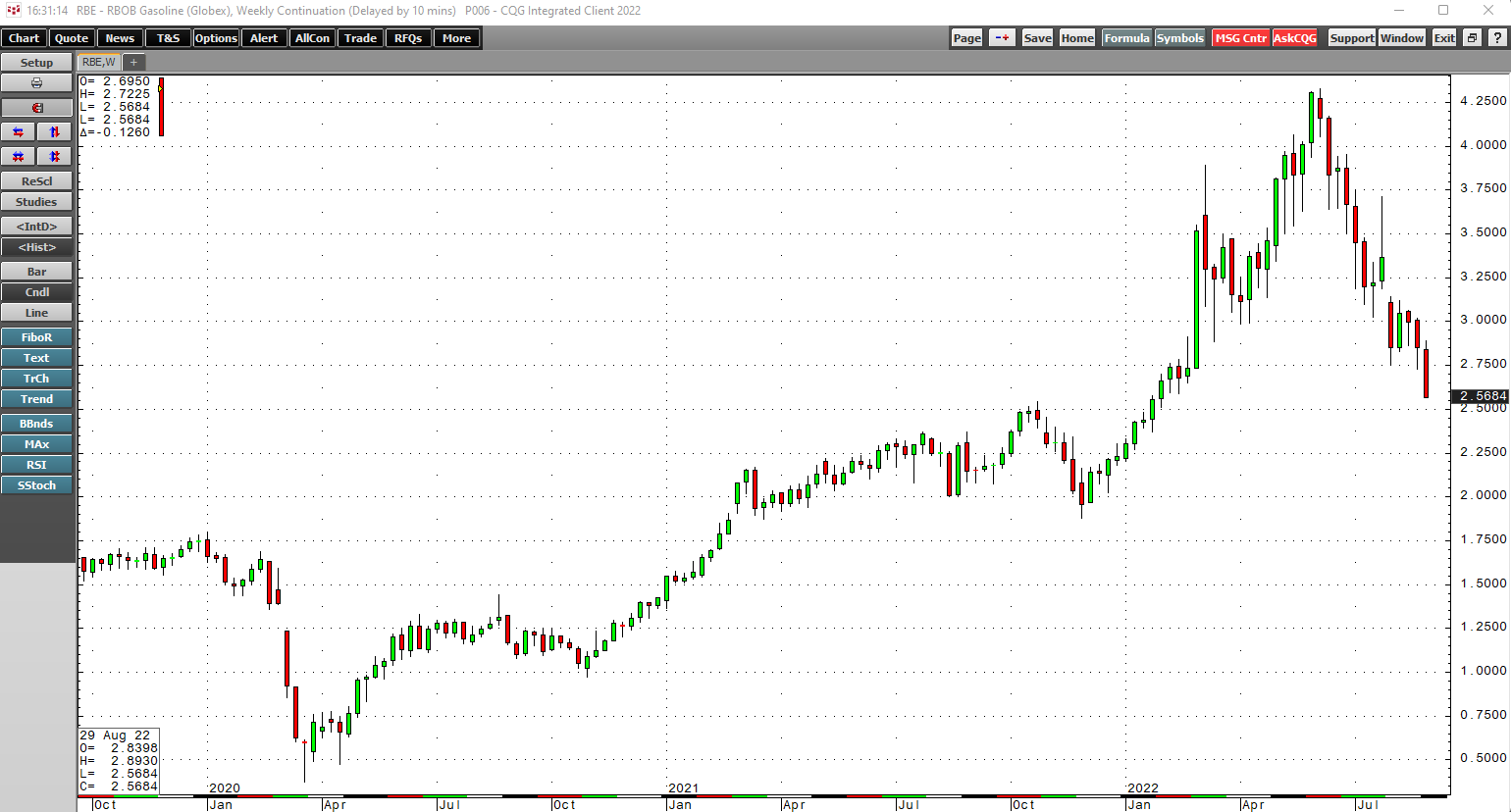

Crude oil products have significant seasonality that weighs on gasoline and supports distillates after the summer

Crude oil remains the energy commodity that powers the world. The war in Ukraine has increased supply concerns in the US and Europe as Russia is a leading producer and influential non-member of OPEC, the international oil cartel. Over the past years, the Russians have cooperated with the cartel’s production policy which has been a function of decisions in Riyadh, Saudi Arabia, and Moscow. Crude oil declined from the March highs that took the prices nearby of Brent and ETI futures over the $130 per barrel level, with Brent moving to nearly $140. When it comes to seasonality, gasoline prices tend to decline in the fall, while distillates are a more year-round fuel, displaying less seasonal influences.

The weekly chart shows the steep seasonal decline in gasoline prices, with the futures falling from a record $4.3260 per gallon wholesale high in June 2022 to below the $2.60 level.

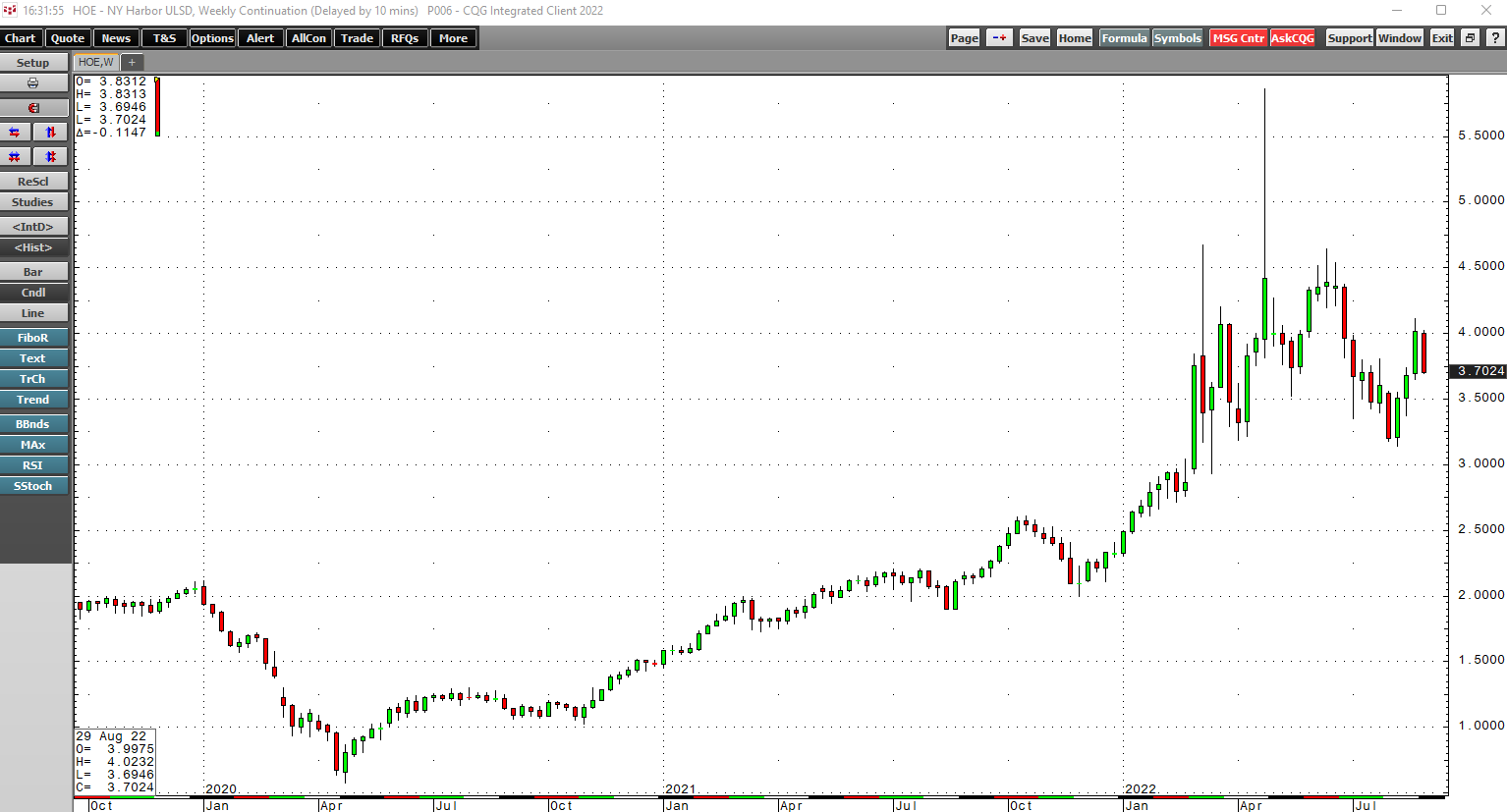

Distillates have also declined but have been far stronger than gasoline because of two compelling factors.

Heating oil futures are a proxy for distillates like jet and diesel fuels. The weekly chart illustrates the decline from the spike high that took the price to a record $5.8595 per gallon wholesale during the week of April 25 to around the $3.70 level in late August. Meanwhile, distillates remain strong as seasonality favors them over gasoline because of the steady year-round demand. Moreover, WTI crude oil is preferable for gasoline production, while Brent is the best petroleum grade for refining into distillates. Since OPEC and Russia significantly influence the Brent price, heating oil and other distillates remain at elevated prices. Sky-high natural gas prices also support heating oil as the 2022/2023 winter season approaches.

Natural gas moves toward the peak season at an unprecedented time

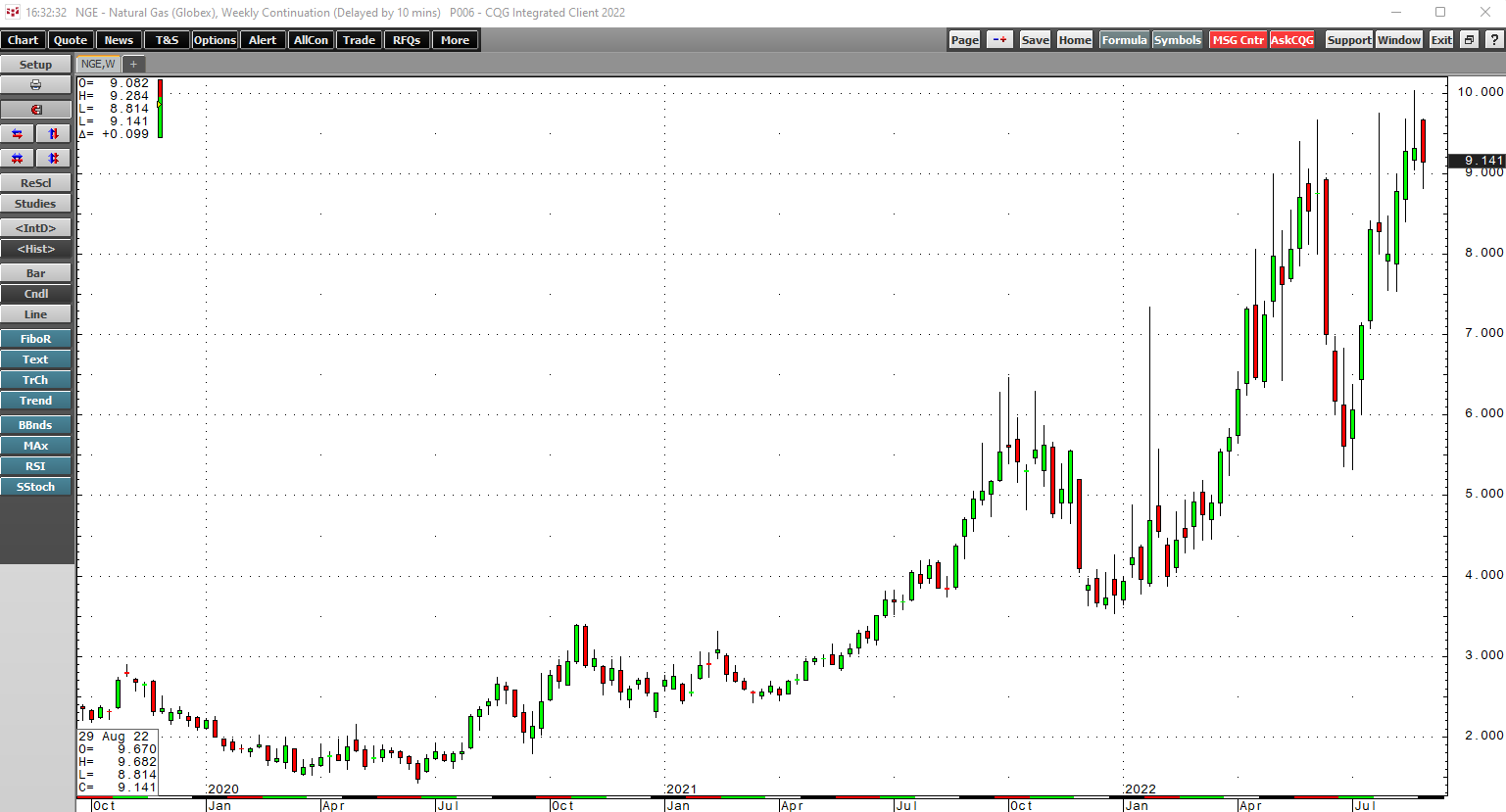

After falling to a twenty-five-year low in June 2020, the NYMEX US natural gas futures market has exploded higher.

The weekly chart shows the rise from the $1.432 per MMBtu June 2020 quarter-of-a-century low to over $10 per MMBtu in late August, the highest price in fourteen years. US natural gas futures reached $13.694 in 2008 and a record $15.65 per MMBtu high in 2005 when Hurricanes Rita and Katrina wreaked havoc with natural gas infrastructure along the US Gulf Coast. The delivery point for NYMEX natural gas futures is the Henry Hub in Erath, Louisiana. In 2022, the storm will be in Europe as it depends on Russia for natural gas supplies. European gas prices have risen to record highs and will likely continue to soar as Russia uses its energy domination as a weapon against NATO members supporting Ukraine.

Meanwhile, US natural gas now travels the world in liquid form as technological advances allow the energy commodity to fulfill requirements in Asia and Europe, where prices are much higher. Simultaneously, US energy policy supporting alternative and renewable fuels and inhibiting fossil fuel production and consumption has weighed on exploration and output. The US is going into the peak winter season when inventories tend to decline with less natural gas in storage than at the same time in 2021 and around 12% under the five-year average as of the week ending on August 19.

Natural gas is moving into the fall when the uncertainty of winter demand tends to cause the price to soar. With the nearby futures already probing above $10 per MMBtu in late August, a challenge of the 2005 and 2008 highs could be on the horizon over the coming months as European prices are already in record territory and climbing.

Higher natural gas prices will likely put additional upside pressure on heating oil and coal prices, substitutes for natural gas during the peak heating demand season.

Expect volatility, and you will not be disappointed

Seasonality can be a powerful force. In the stock market, memories of previous crashes in a rising interest rate environment with elevated geopolitical risks could be a recipe for substantial price variance. In commodities, energy and food prices remain supply-side economic issues created by the first major war in Europe since WW II.

While I covered meats and the potential for seasonal weakness, grain and oilseed futures are moving into the 2022 harvest season at the highest prices in years. On the continuous futures contracts, soybean futures were over $15 per bushel, corn was above $6.70, and CBOT wheat was sitting above $8 per bushel in late August. While the Fed is committed to battling inflation by increasing interest rates, the central bank cannot control the supply-side economic issues created by the war in Ukraine and geopolitical tensions.

Meanwhile, in the US, the mid-term elections pose another risk for markets as the world’s wealthiest country remains politically divided, and power in the House of Representatives and Senate could shift from Democratic to Republican control, rendering the Biden administration a lame duck until the 2024 Presidential contest.

The bottom line is to expect lots of volatility in markets across all asset classes over the coming weeks, and you will not be disappointed. Seasonality is one of many issues facing markets in early September.