VWAP is the volume weighted average price for a futures contract plotted as a line on the price chart. The calculation is the sum of traded volume times the price divided by the sum of the traded volume.

This study provides the current volume weighted average price for the trading day or the trading session. Traders can compare the current price action to the VWAP. In addition, the VWAP can be calculated using a set look back period and smooth the price data similar to a standard moving average.

Here is a link to the VWAP Help file.

VWAP = (Sum of traded volume*price)/(Sum of the traded volume)

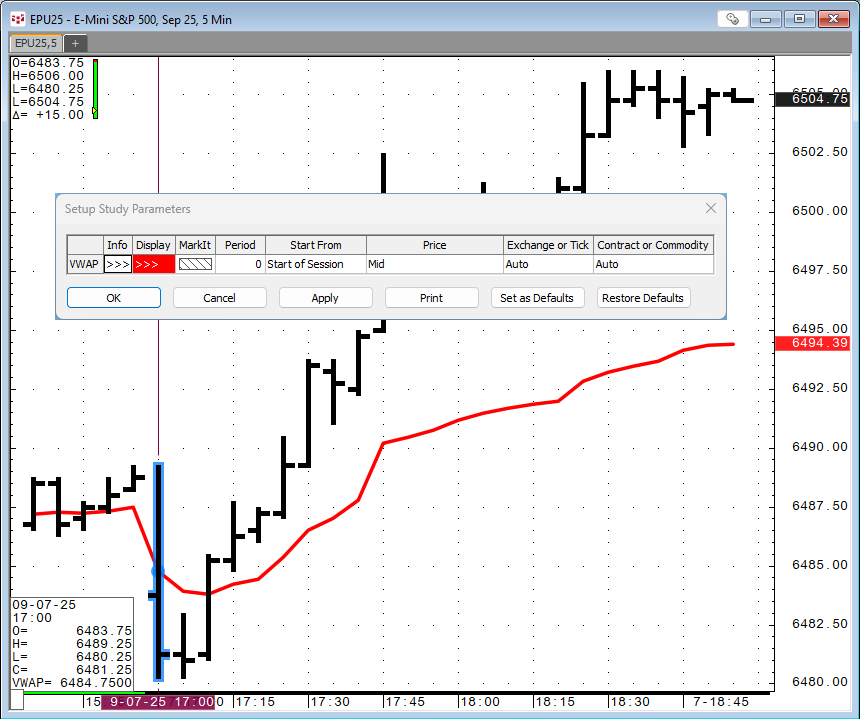

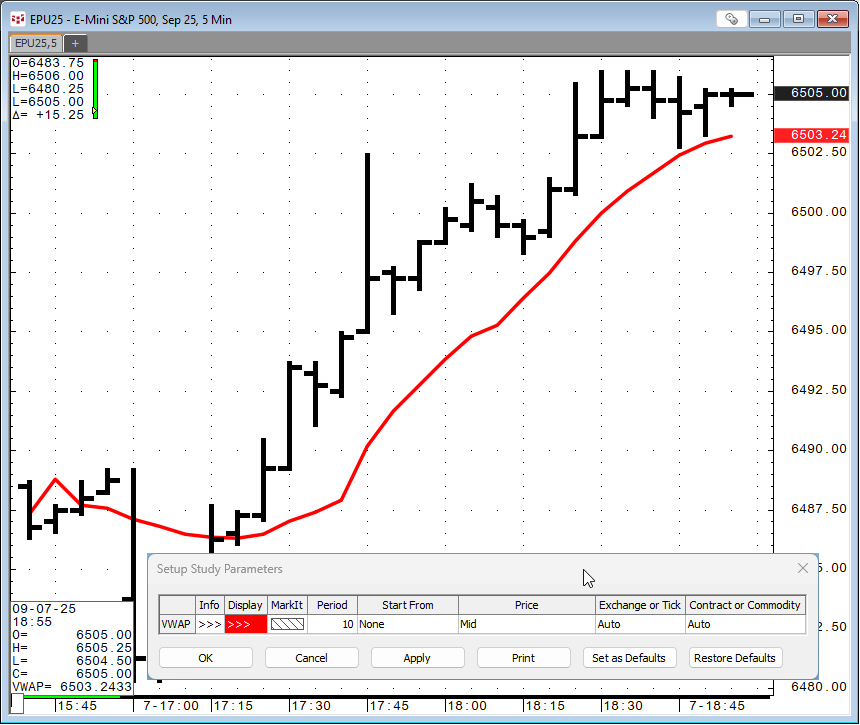

You have three choices for beginning the calculation:

- StartofDay

- StartofSession

- None = period used instead of start of.

If “None” is selected, then the values can be smoothed by the “Period”.

There is a dropdown menu to select the price to be used for the calculation. The midpoint price (Mid) of the bar is the default setting.

Finally, the choice for the volume for the calculation:

- Auto = existing volume type

- Contract

- Commodity

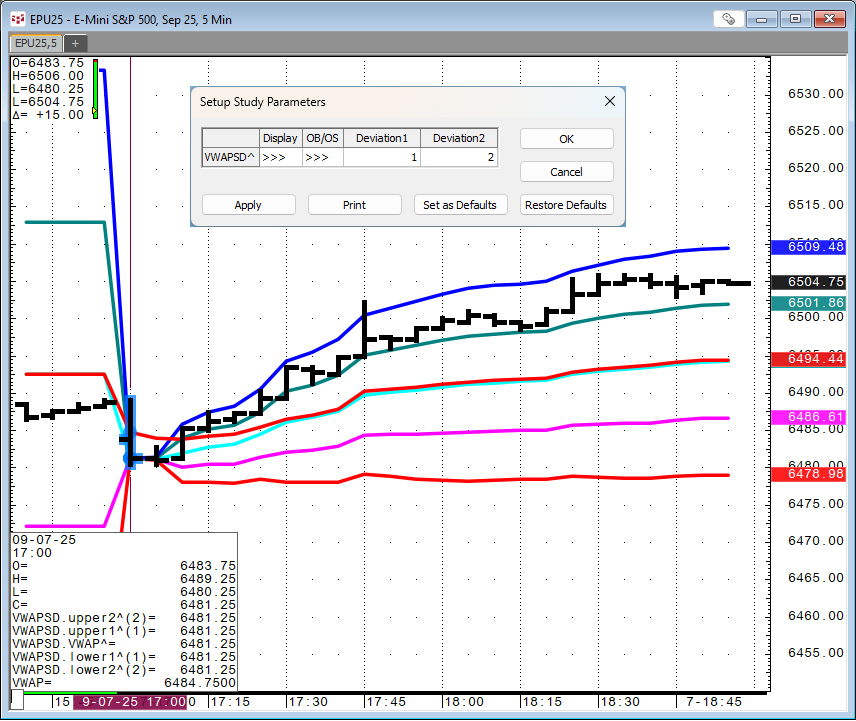

Two CQG PACs with custom versions of the VWAP study are available at the end of the post. The first is from CQG Product Specialist Anthony Cohen. The VWAPSD.pac installs a custom study that displays trading bands (standard deviations) around the VWAP.

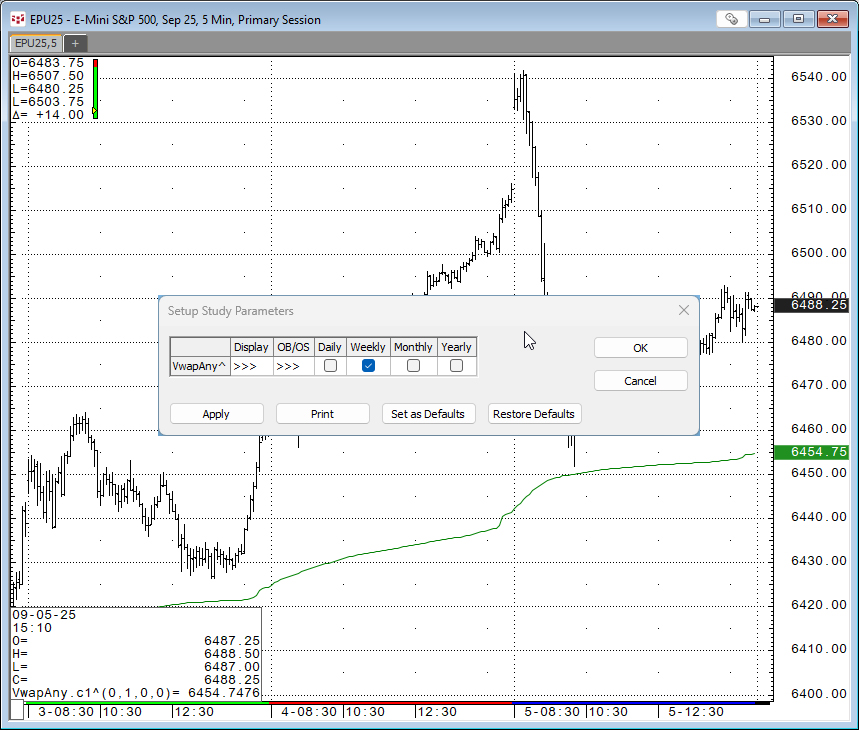

The second CQG PAC, VwapAny.pac was built by CQG Product Specialist Anthony J. Stavros and can anchor the VWAP study to start with the day, week, month, or year.

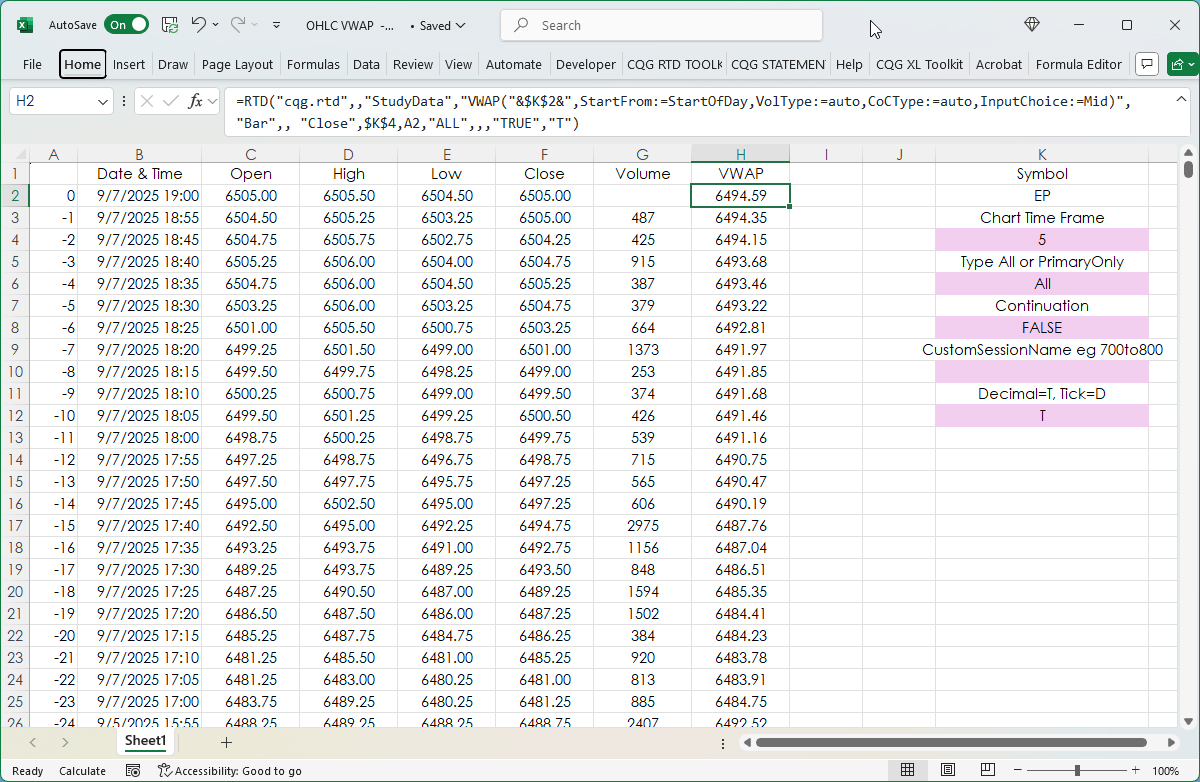

Also at the end of the post is an Excel spreadsheet that pulls in open, high, low and close data plus the VWAP study using this RTD formula:

=RTD("cqg.rtd",,"StudyData","VWAP("&$K$2&",StartFrom:=StartOfDay,VolType:=auto,CoCType:=auto,InputChoice:=Mid)","Bar",, "Close",$K$4,A2,"ALL",,,"TRUE","T")Where cell K2 is the symbol and cell K4 is the time frame.

Requires CQG Integrated Client or CQG QTrader. and Excel 2016 or more recent.