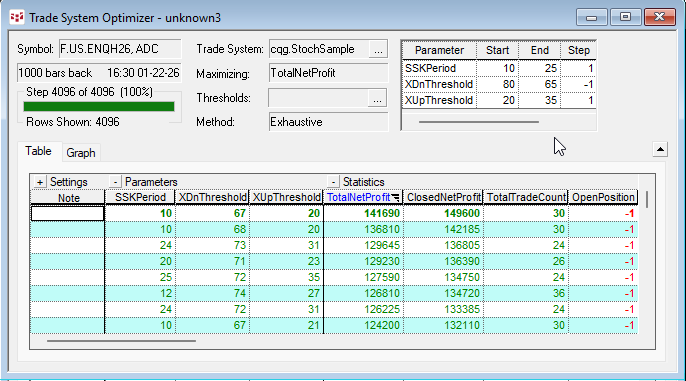

The CQG Trade System Optimizer (TSO) is a module that offers you a tool for testing different parameters of a trade systems and cataloging the results. All combinations of the parameters are… more

Workspaces

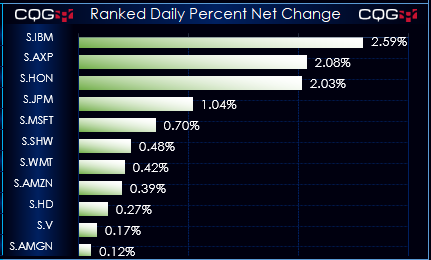

This Microsoft Excel® spreadsheet tracks the constituents of the DJIA Index (symbol: DJIA).

The standard market columns include Last, NC, 5-minute Sparkline charts, %NC, today's session… more

In Mr. Ehlers Book “Cybernetic Analysis for Stocks and Futures” the “Leading Indicator” was introduced. The goal of this study was to smooth the price action while not having the lag by the study… more

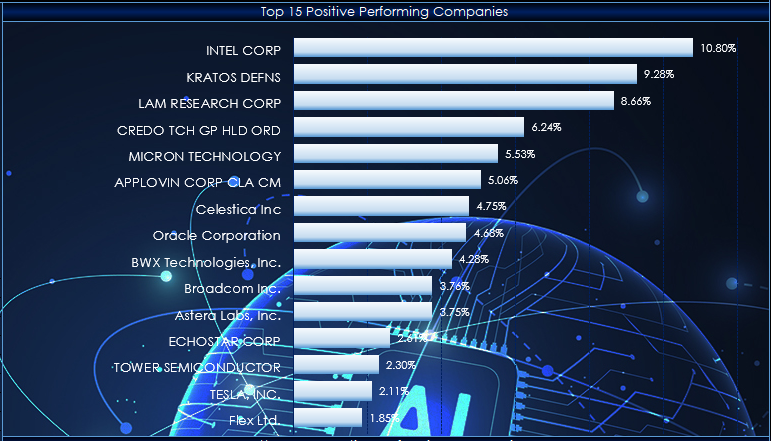

This post details a Microsoft Excel dashboard that tracks the day's performance of the holdings of the iShares A.I. Innovation and Tech Active ETF (Symbol: BAI).

From the iShares website as… more

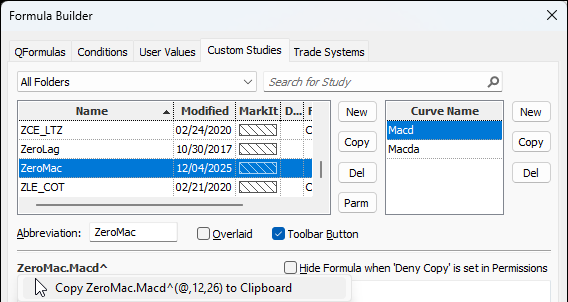

This post details the steps to pulling custom study values into Excel using RTD formulas. First, an overview of RTD formulas and parameters.

When CQG IC or QTrader are installed, a DLL… more

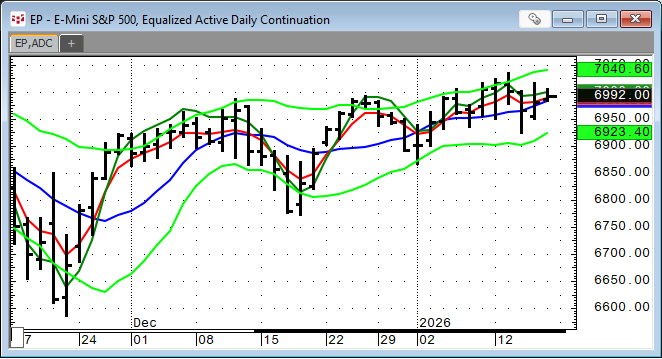

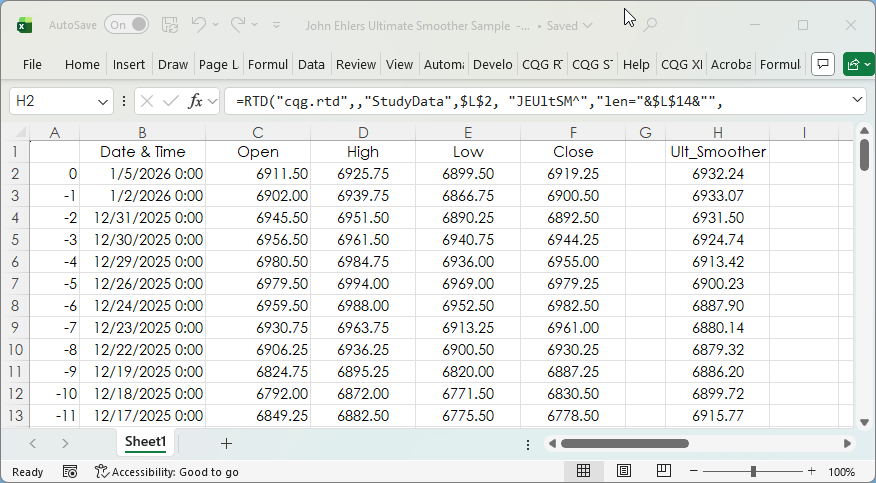

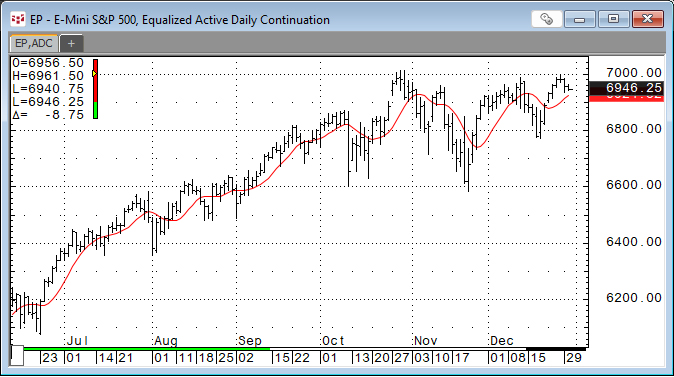

The post CQG Primer: The Ultimate Smoother detailed a study developed by John Ehlers. You can find a detailed description of the Ultimate Smoother on the MESA Software website.

This post… more

John Ehlers developed the Ultimate Smoother study. https://www.mesasoftware.com/TechnicalArticles.htm The study is a two-pole low-pass digital filter designed to smooth price data while… more

From the ARK website: "ARKF is an actively managed Exchange Traded Fund (ETF) that seeks long-term growth of capital. It seeks to achieve this investment objective by investing under normal… more

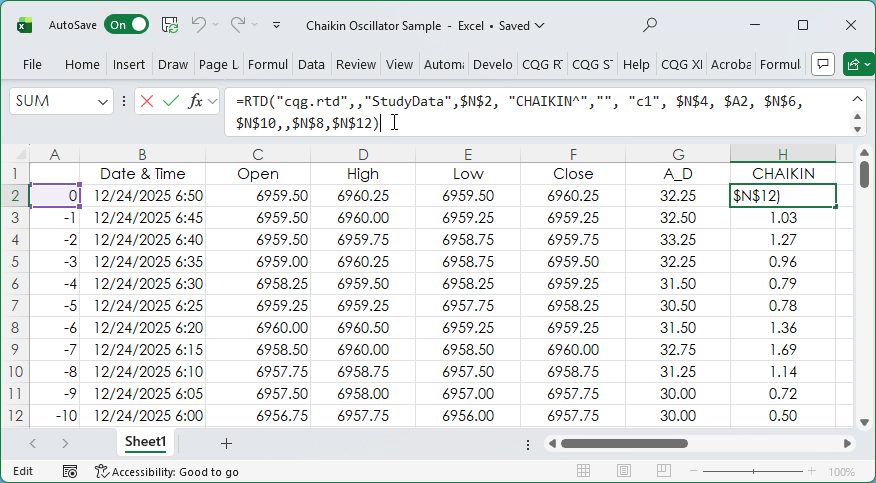

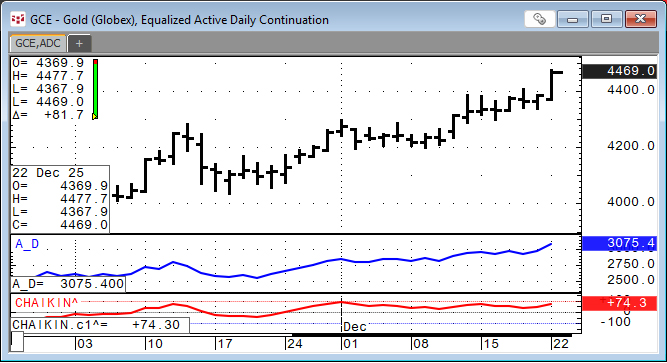

The Accumulation/Distribution Study and the Chaikin Oscillator were introduced in the post titled CQG Primer: The Chaikin Oscillator.

The Chaikin Oscillator is the difference between two… more

Developed by Marc Chaikin, the Chaikin Oscillator is a technical analysis tool traders and investors use to confirm trends and indicate possible trend reversals. The oscillator uses the… more