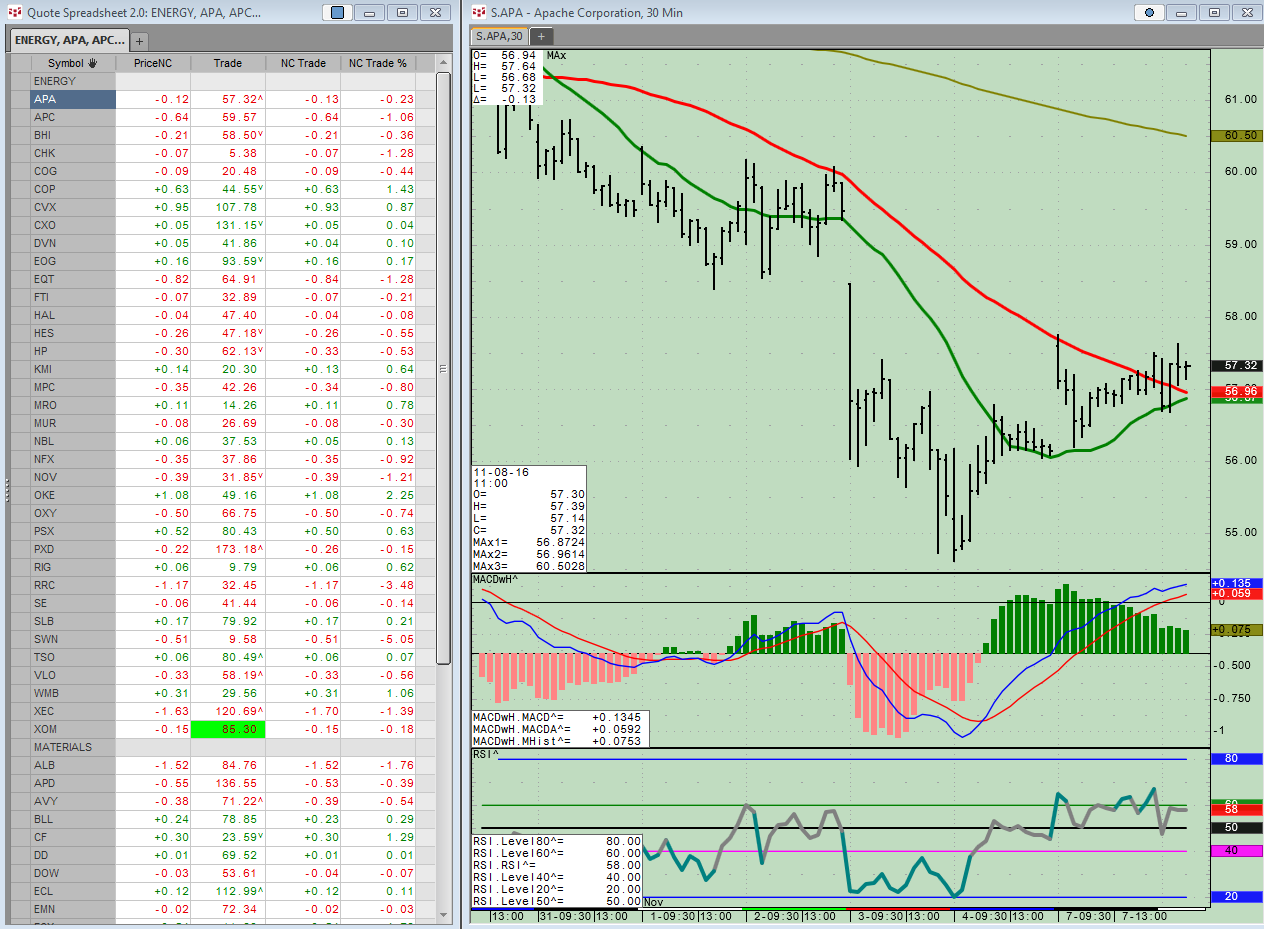

This CQG M dashboard layout displays a portfolio of symbols from the Americas (available with a subscription to the CME Globex feed on CQG) in a heat-map style. Tapping on a quote pushes the… more

Workspaces

CQG formulas include a crossover feature, and CQG can determine the number of completed bars back since a signal occurred. For example, using “Barssince(EP xabove Ma(EP,Sim,20),1,300)” as the… more

This Microsoft Excel® dashboard displays key market information for contracts traded on the CME Exchange and the Globex platform. The markets are grouped by these products:

Equity Indices… moreThis Microsoft Excel® dashboard scans the crude oil (GLOBEX) futures market options for volume and ranks the traded volume for each expiry out to sixteen months. The scan covers options… more

A common request is an RTD formula to pull historical settlement prices for a particular market. There is a “Contract Data” RTD formula for settlement:

=RTD("CQG.RTD", ,"ContractData", "CLE… more

CQG Integrated Client and CQG QTrader customers can pull the time the high and low occurred during today’s session into a Microsoft Excel® spreadsheet using these RTD formulas:… more

This Microsoft Excel® dashboard scans the options on the Eurodollar futures market for volume and ranks the traded volume for each expiry out to three years. The scan covers options traded ten… more

Pull historical CVB data into Microsoft Excel® using RTD formulas with this sample spreadsheet. It not only pulls open, high, low, and close values into Excel, but also a study, the Relative… more

Pull historical spread data into Microsoft Excel® using RTD formulas with this sample spreadsheet. It not only pulls open, high, low, and close values into Excel, but also a study, the… more

The component pac at the end of this article contains holdings or components of eleven SPDR ETF portfolios. You can use a portfolio to create a quote page… more