The raw material markets asset class moved higher in the first quarter of 2021 after a volatile 2020 when the pandemic caused a massive selloff early and a huge turnaround that pushed some prices to all-time or multi-year highs. The commodity asset class consisting of 29 of the primary commodities that trade on US and UK exchanges moved 8.30% higher in Q1 than the level at the end of the year that ended on December 31, 2020. In 2020, the asset class moved 9.89% higher. In 2019 it gained 10.98%, but in 2018 the asset class lost 6.82% of its value.

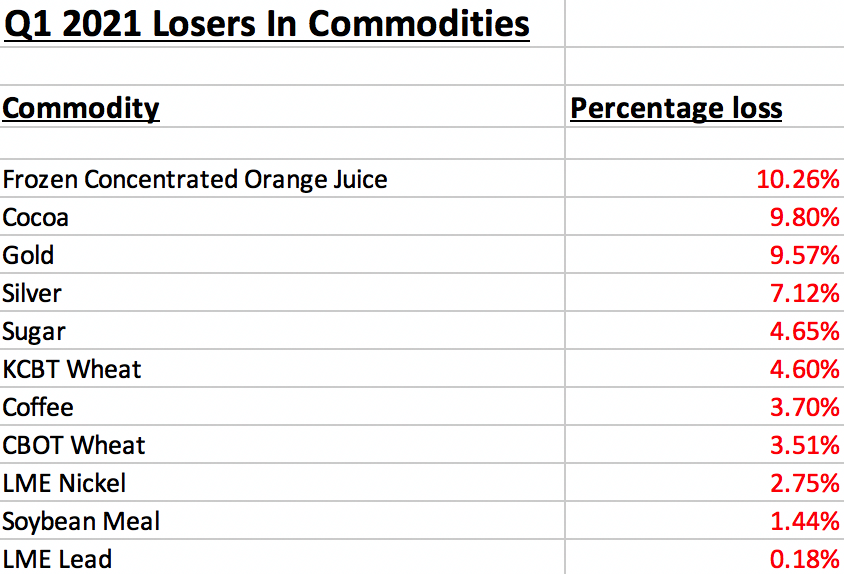

The overall winner of the 29 for the first quarter was the lean hog futures market that posted a gain of 43.79% in Q1, with NYMEX gasoline in second place with a 38.98% gain. The biggest loser for the quarter was the FCOJ market which corrected 10.26% lower, with cocoa futures in second place on the downside with a 9.80% loss in Q1. Gold fell 9.57% over the first three months of 2021.

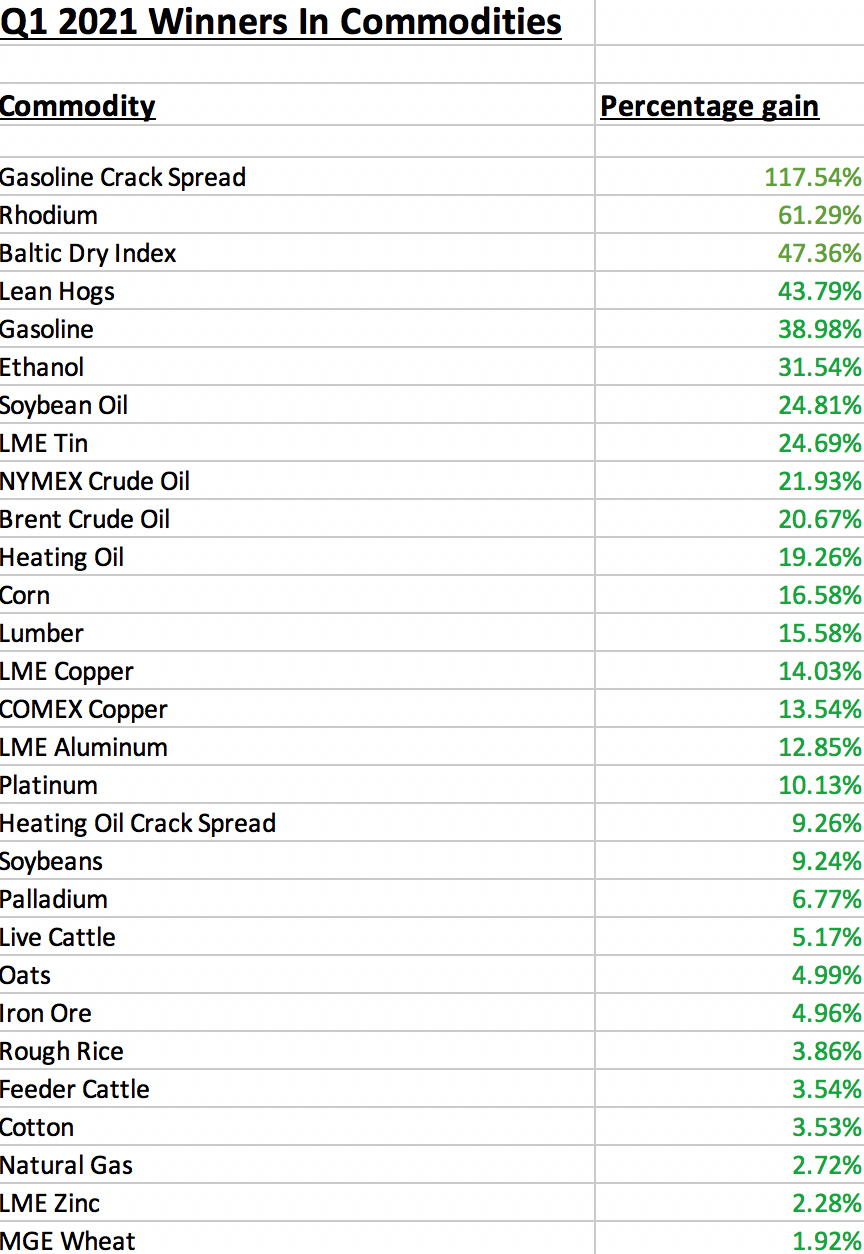

Rhodium was over 61% higher, and the Baltic Dry Index gained over 47%. Meanwhile, gasoline crack spreads moved over 117.5% higher over the past three months.

There were lots of double-digit percentage gains in Q1. While six markets were over 25% higher during the three months, seventeen were up over 10%. Only one market posted a double-digit percentage loss during the quarter. Winners outnumbered losers in the first quarter of 2021 by a margin of better than 2.6:1. In Q1, twenty-nine commodities posted gains compared to eleven products with prices below the level at the end of December 2020.

The US dollar is typically a significant factor for commodity prices, as it tends to have an inverse value relationship with raw material prices. The dollar index posted a 3.72% gain in Q1 after falling 6.42% in 2020. The dollar index was 0.34% higher in 2019 after moving 4.26% higher in 2018, which followed a 10.23% decline in 2017. The dollar rose in Q1 as the bond market fell steadily despite the tidal wave of central bank liquidity and government stimulus in a sign of rising inflationary pressures. US 30-Year Treasury bond futures fell 10.52% in Q1. As rates moved higher, the dollar index rallied.

All but one sector of the commodities market moves higher

Energy commodities led the way on the upside as the sector gained 22.52% in Q1. Crude oil, oil products, and ethanol posted double-digit percentage gains, with gasoline nearly 39% higher. Animal proteins were the second-best performing sector, moving 17.5% higher, led by lean hog futures, which gained almost 44%. Base metals were up 8.49%, with LME tin, copper, and aluminum posting double-digit percentage gains. Grains moved 6.23% higher, with the most substantial increases in soybean oil and corn futures markets.

Precious metals were only 0.05% high, but it was a tale of two subsectors as gold and silver prices fell while platinum group metals posted significant gains. Soft commodities were the only losing sector. Cotton posted a gain, but FCOJ, cocoa, sugar, and coffee prices moved lower. Meanwhile, before falling into negative territory at the end of March, sugar, and coffee moved to new multi-year highs since the end of 2020.

Winners in Q1

Twenty-nine commodity markets moved higher in Q1 2021.

Over half the markets posted over 10% gains in Q1. The overall trend in the asset class remained bullish after moving higher each quarter starting in Q2 2020.

Meanwhile, the stock market and dollar index moved higher in Q1. The DJIA was 7.76% higher, the S&P 500 gained 5.77%, and the NASDAQ moved 2.78% to the upside. The dollar index rallied 3.72% over the first three months of 2021, but that did not weigh on the overall commodity asset class during the period. Meanwhile, Bitcoin, Ethereum, and digital currencies experienced parabolic rallies in Q1 taking prices to all-time highs and the market cap to nearly the $2 trillion level.

Losers in Q1

Eleven markets moved lower in Q1.

There was only one commodity that lost just over 10%. Seven markets were down under 5% for the quarter. Winners outnumbered losers by over 2.6:1. The US 30-Year Treasury bond futures fell by 10.53% in Q1. Higher interest rates are a sign of inflationary pressure. While the decline in the bond market did not stop commodities from moving over 8% higher, it may have slowed the ascent of many prices over the past months.

Highlight on animal proteins as the grilling season approaches

As we move into 2021’s second quarter, the grilling season will begin in late May. The peak season for animal protein tends to support cattle and hog prices. The 2021 season will be a far cry from last year because of vaccines creating herd immunity to COVID-19. We will see many more gatherings during the 2021 barbecue season, lifting meat prices. Moreover, the substantial rallies in soybean and soybean meal prices have pushed the cost of producing animals higher, putting additional upward pressure on prices.

In April 2020, live and feeder cattle prices fell to lows of 81.45 cents and $1.0395 per pound, respectively. Beef prices hit the lowest level since 2009 and 2010. Lean hog futures reached a bottom at 37 cents last April, an eighteen-year low.

The chart shows that lean hog prices recovered to over $1 per pound at the end of Q1 2021, the highest price since 2014. Rising open interest since late 2020 is a technical validation of the bullish trend in the hog futures arena.

Meanwhile, live cattle were nearly $1.21 per pound at the end of Q1, with feeders near the $1.44 level. Last year, producers suffered from low prices as shutdowns at processing plants caused a supply glut. Consumers did not benefit from low prices as limited supplies drove retail prices higher, and stores put limits on purchases.

The rise in beef and pork prices is a reminder that low prices are the cure for low prices in the world of commodities. The trend in the meat markets as we head into Q2 remains higher.

Risks rise with prices but inflationary pressures on the horizon- Look at the bond market trend

Commodities rose 8.3% in Q1, and the long-bond futures fell 10.53%.

The US 30-Year Treasury bond futures fell from 183-06 in early August 2020 to a low of 153-29 at the end of March 2021. As the Fed continues to pump liquidity into the financial system and purchases $120 billion in debt securities each month, the bond market shows no respect for the central bank. Meanwhile, trillions in US government stimulus in 2020 and 2021 only exacerbate the inflationary pressures the bond market continues to signal. The Fed and government have ignored the bond market. The over 8% rise in commodity prices in Q1 when the dollar index rose by 3.72% is another warning for the overall economy.

Bonds and commodities are screaming that inflation has arrived. The Fed and government stimulus keep on feeding an inflationary fire that could turn from a smoldering pile to a raging inferno. Expect lots of volatility in markets across all asset classes in Q2 and beyond.