This is a quick-start guide to building your own trading system based on the Super Template. The Super Template comes pre-installed with CQG Integrated Client. As a basic example, we will create a… more

Coding

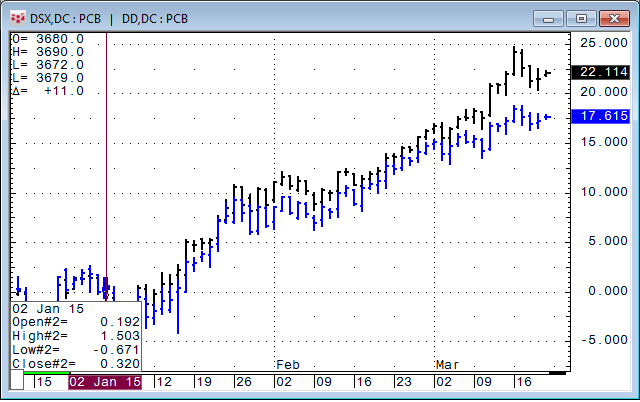

One of the questions that comes up every now and then is about measuring the performance between two markets. So far since January 2015, DAX and EURO STOXX futures have rallied very strong, but… more

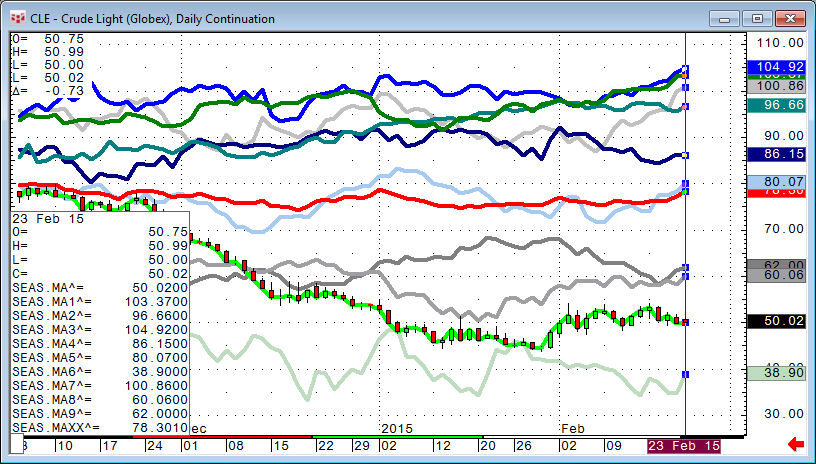

Quite some while ago I showed, in a very simple way, how to overlay 2011, 2012, 2013, and 2014 data in one chart. I created two very simple code snippets to accomplish that.

This time, I… more

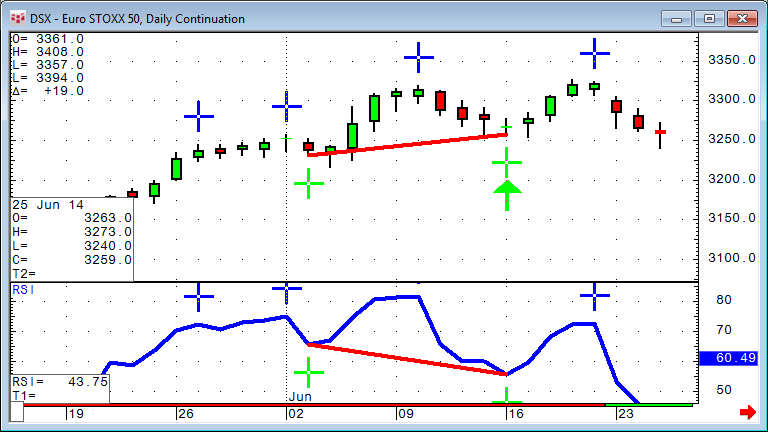

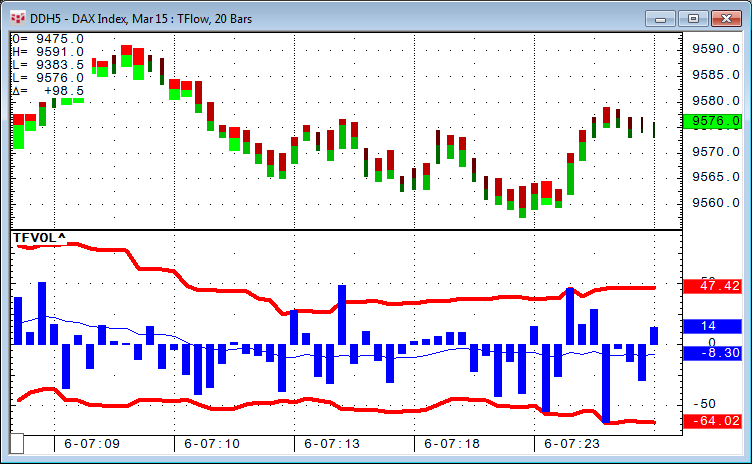

A couple of months ago we looked into CQG's built-in Divergence Index and how to use it.

Following up on this topic, I want to show a much simpler approach using the Formula Toolbox.

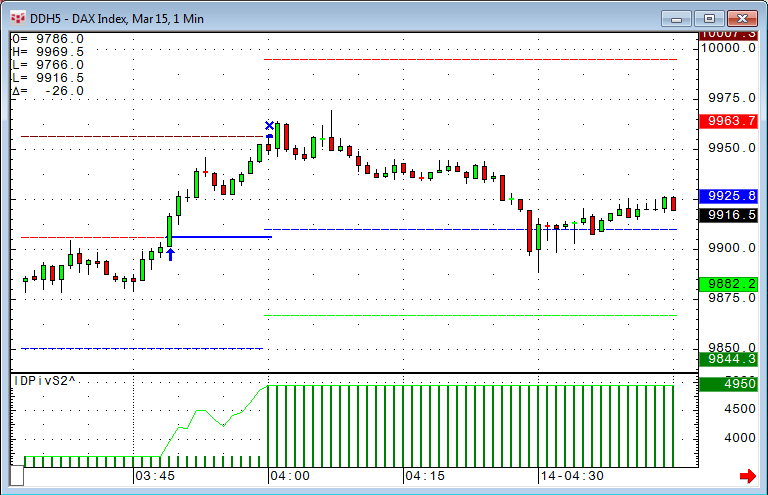

… moreOne of the theories behind Market Profile®* is the opening trading range. This is the high and the low from the first hour of trading. We want to create a trading system around that and use the… more

In this article we take a look at two examples where trades are placed on or around significant lines. The first idea is to change the classic daily pivot lines into intraday pivot lines and trade… more

Recently, we had a request to show, in real time, how many contracts are available on the buy and sell side in the order book. This can be accomplished with a very simple study: DOM Ask Volume (… more

In this article, we will review a CQG indicator that has been available for many years and is still very relevant. It is possible to find divergence using the CQG formula toolbox, but it usually… more

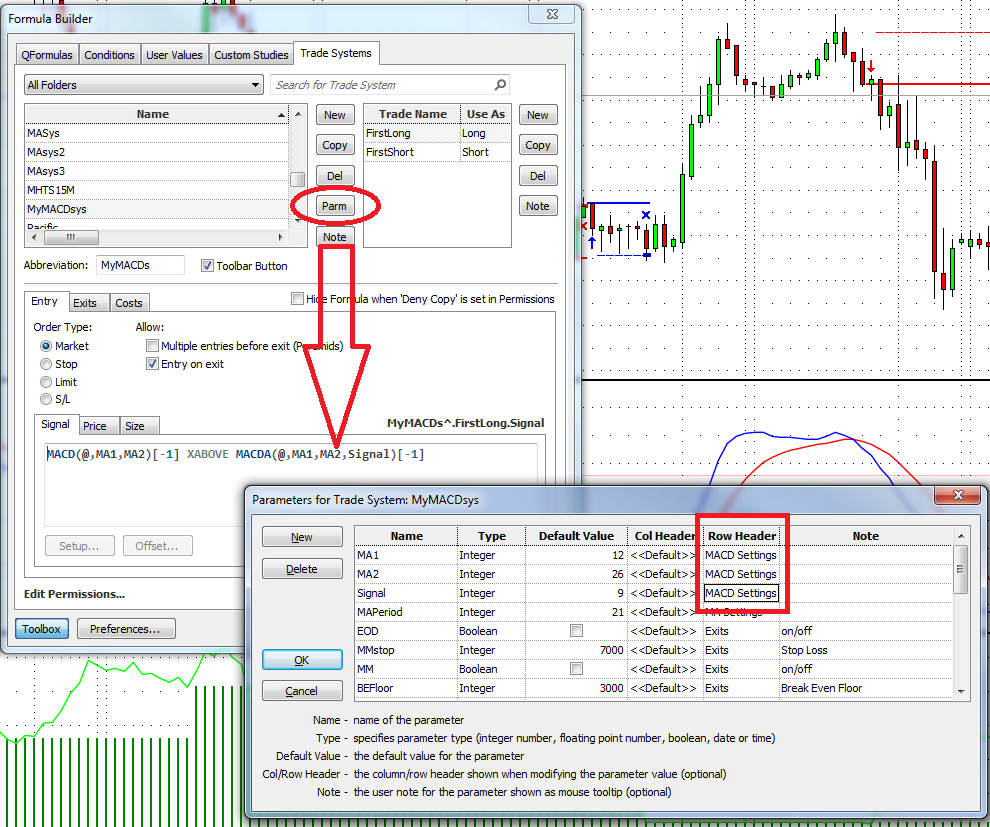

CQG's Formula Builder Toolbox gives you the ability to use parameters (variables) inside your CQG code in order to control studies, conditions, and trade systems externally without the need to… more

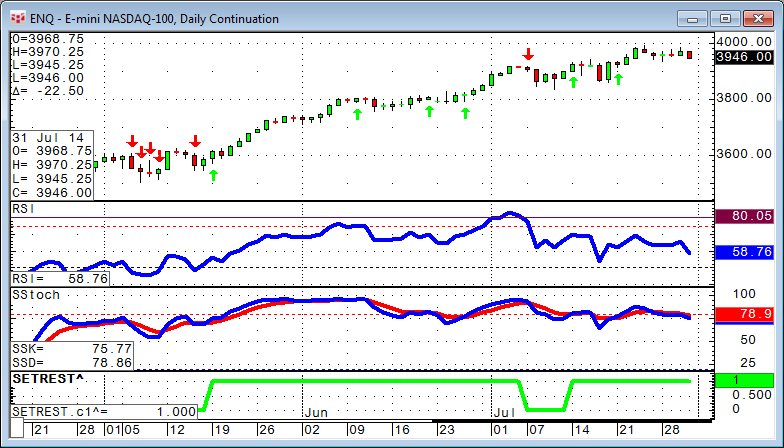

In this article we will look into different ways to use an event to set up a trading opportunity. We will review the differences between BarsSince, Happenedwithin, and Set/Reset.

… more