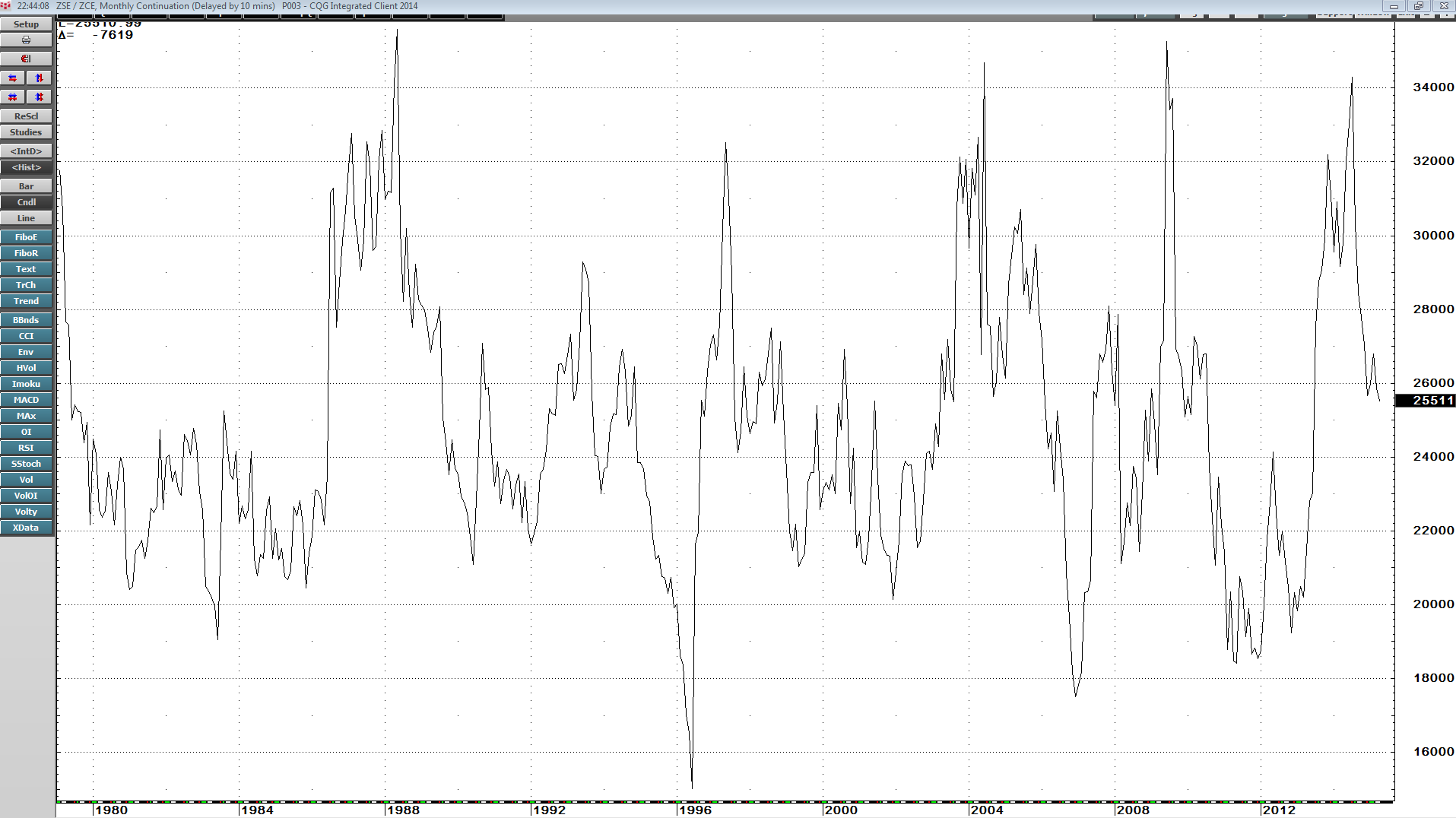

As it is now the beginning of March, the spring season is fast approaching. Across the fertile farmlands of the United States, farmers are preparing to seed their acreage for the 2016 crop year.… more

Commodities

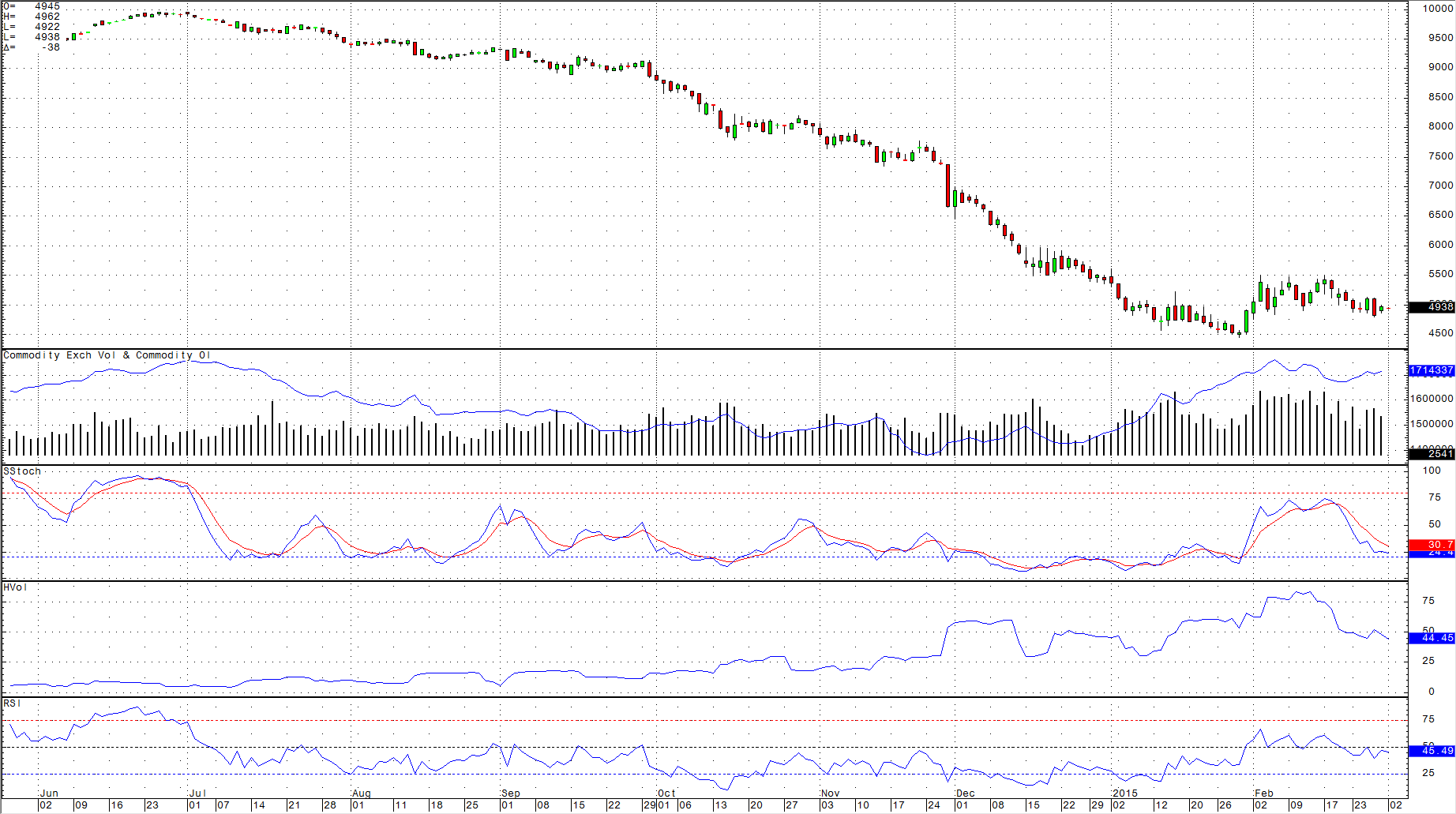

Third quarter of 2015 is now in the books, and the results were not pretty for commodity bulls. Overall, a composite of over thirty futures-market-traded commodities moved lower, making the last… more

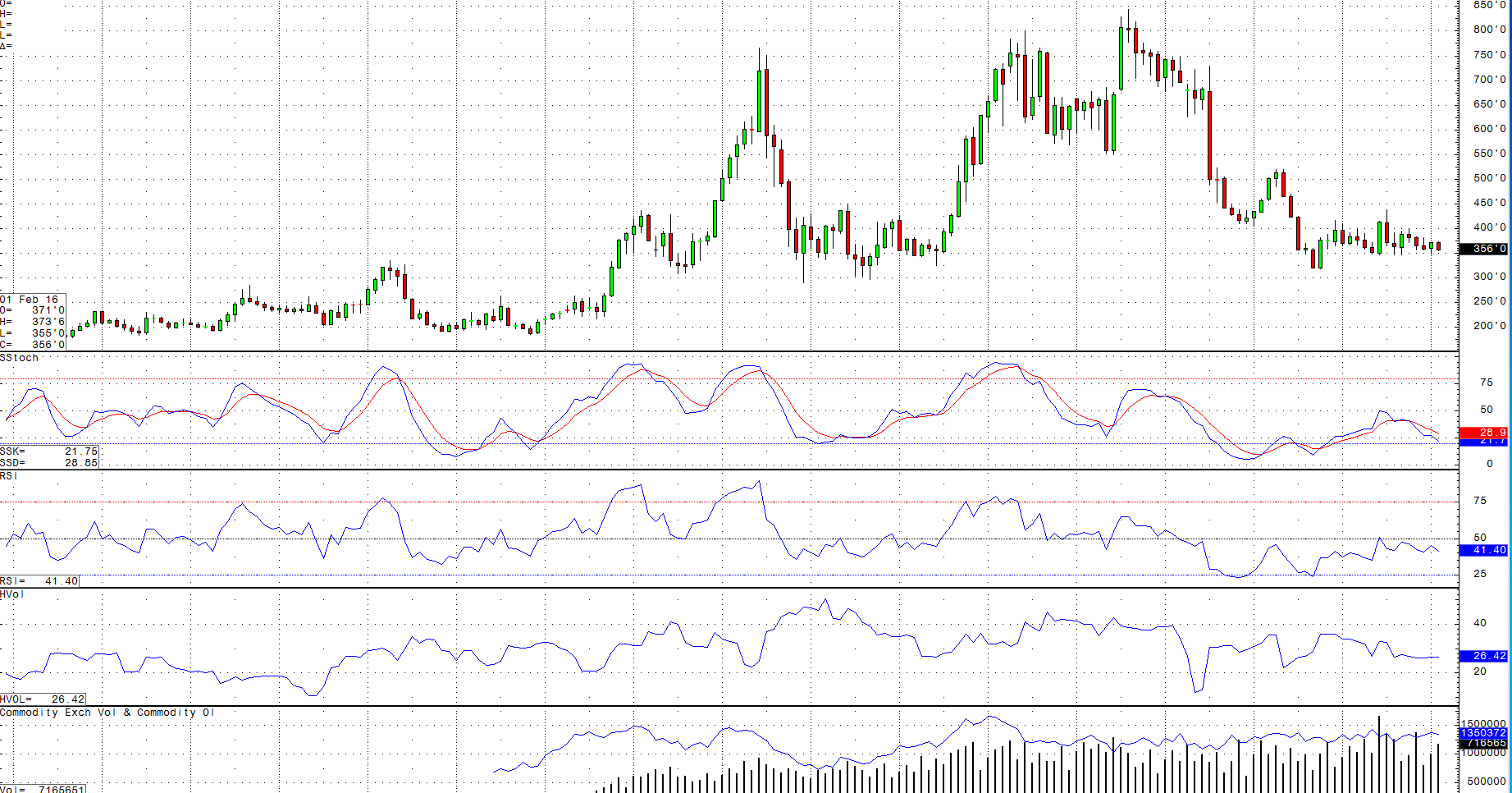

Soybean and corn prices have certainly turned around over the past few years. After reaching highs during the aftermath of the 2012 drought, prices have gone south. In 2012, corn traded to highs… more

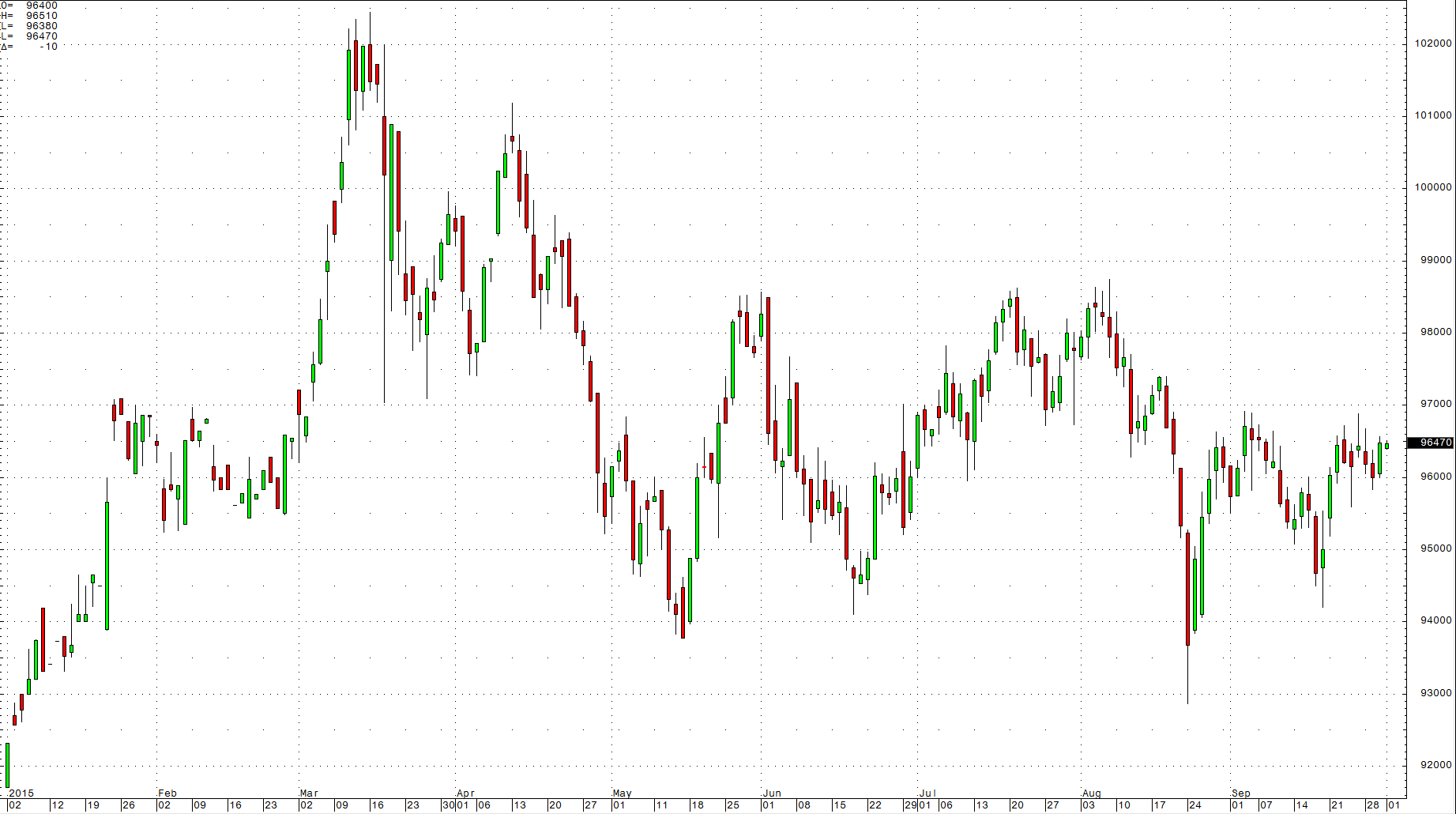

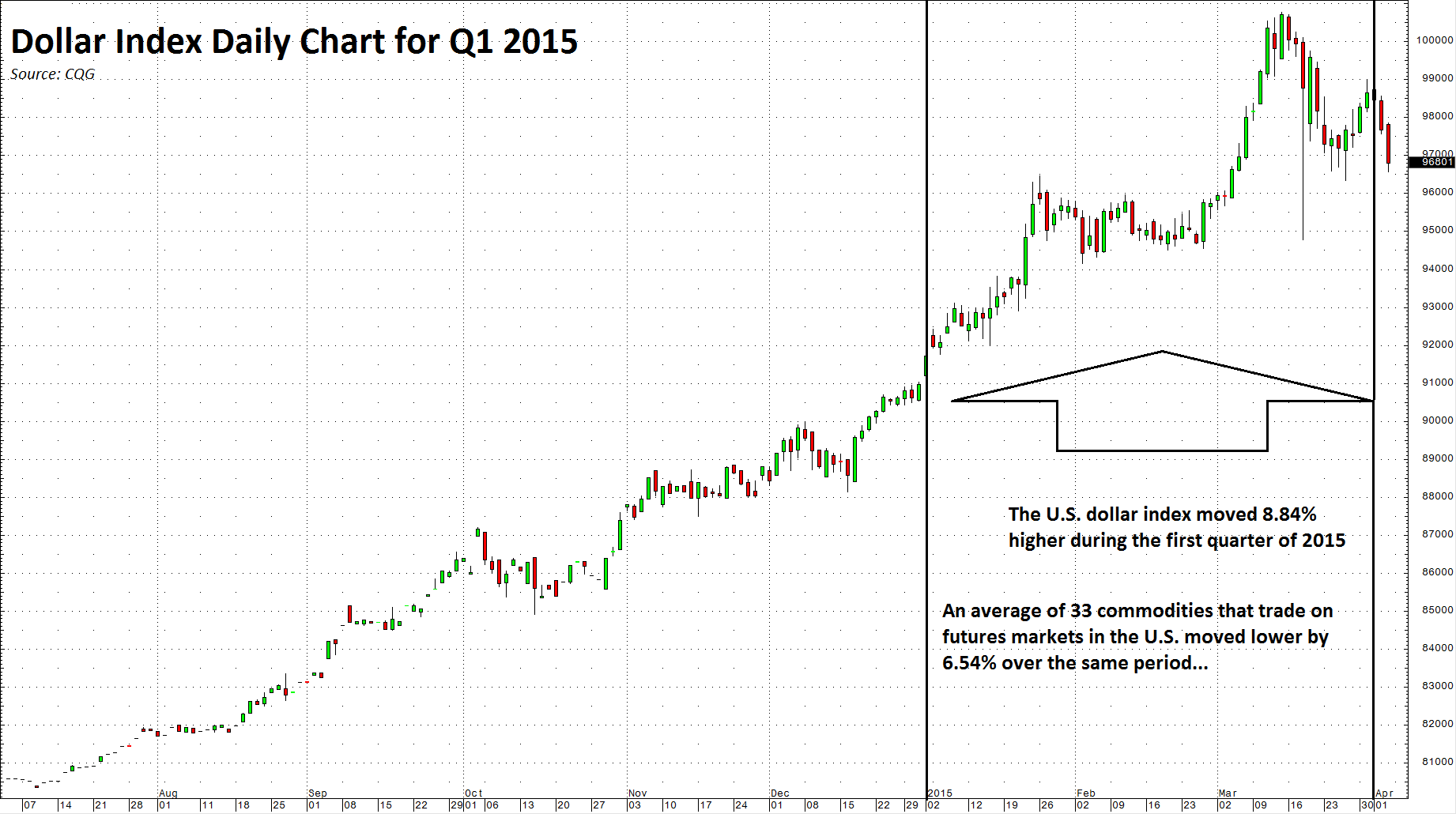

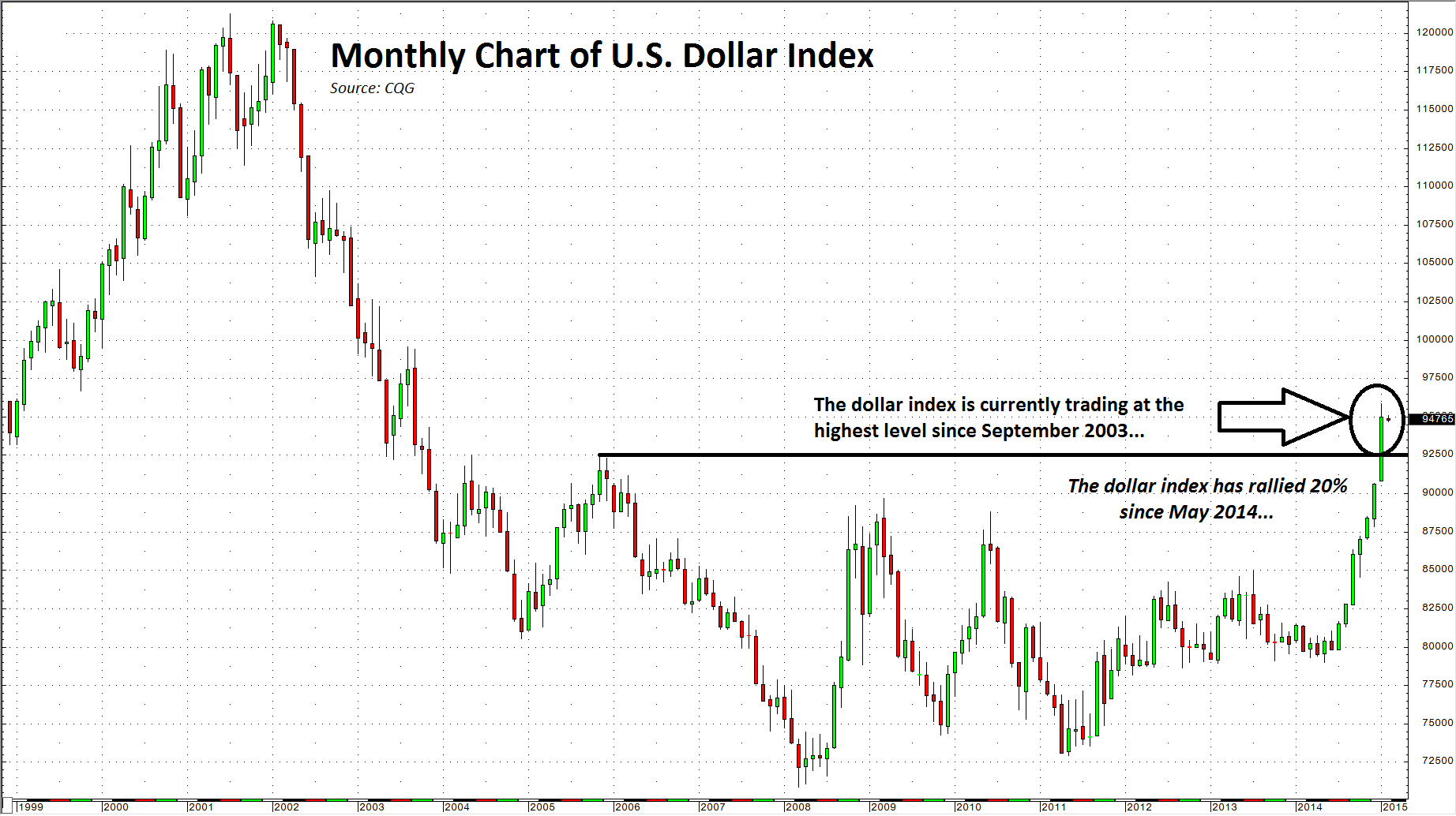

The rally in the US Dollar that commenced in May 2014 continued to gain steam throughout much of the first quarter of 2015. The reserve currency of the world has an inverse relationship with… more

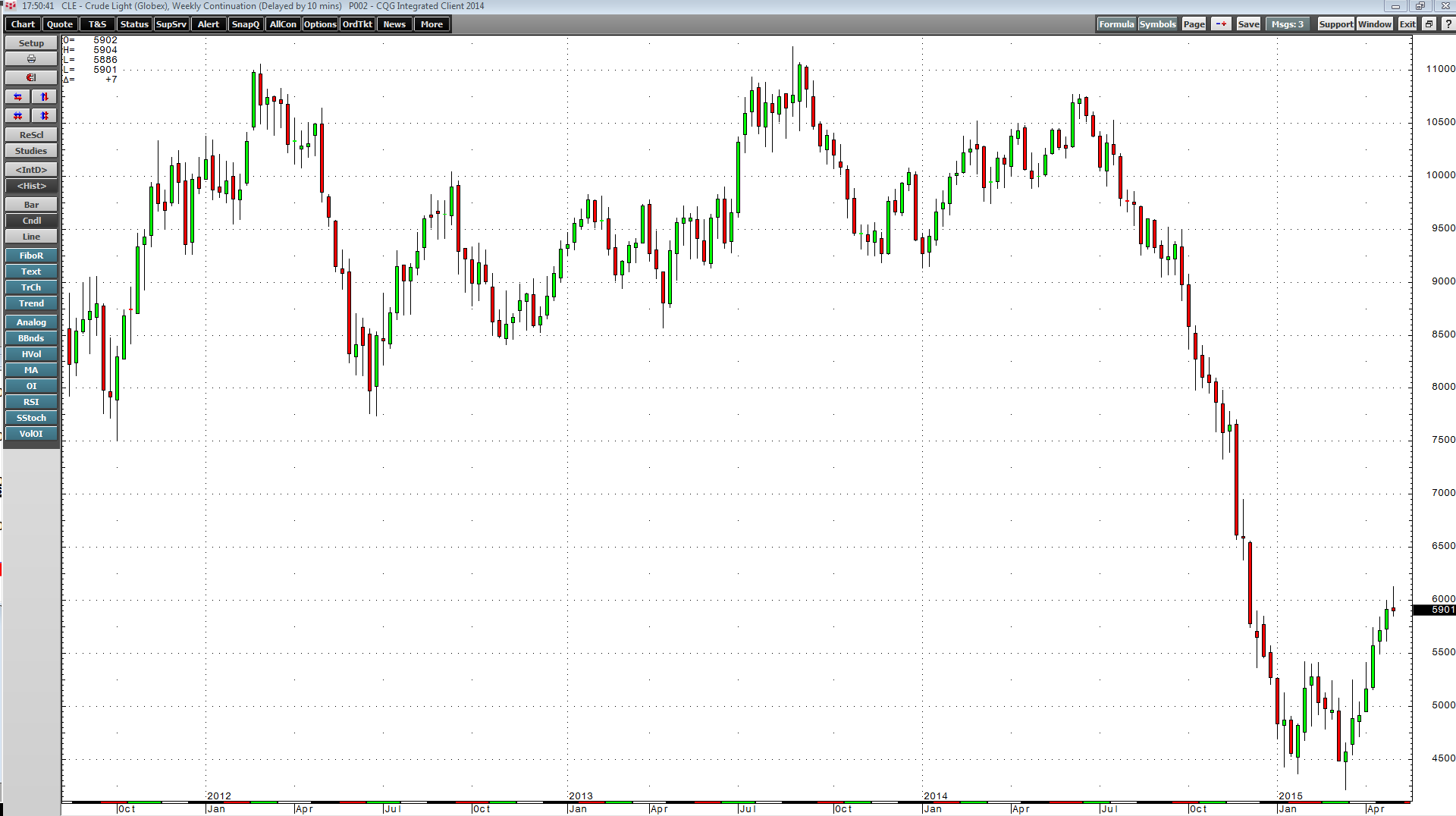

The price of active month NYMEX crude oil is what everyone is focusing on these days, but that price is only a view from thirty thousand feet of what is actually going on in the global oil patch.… more

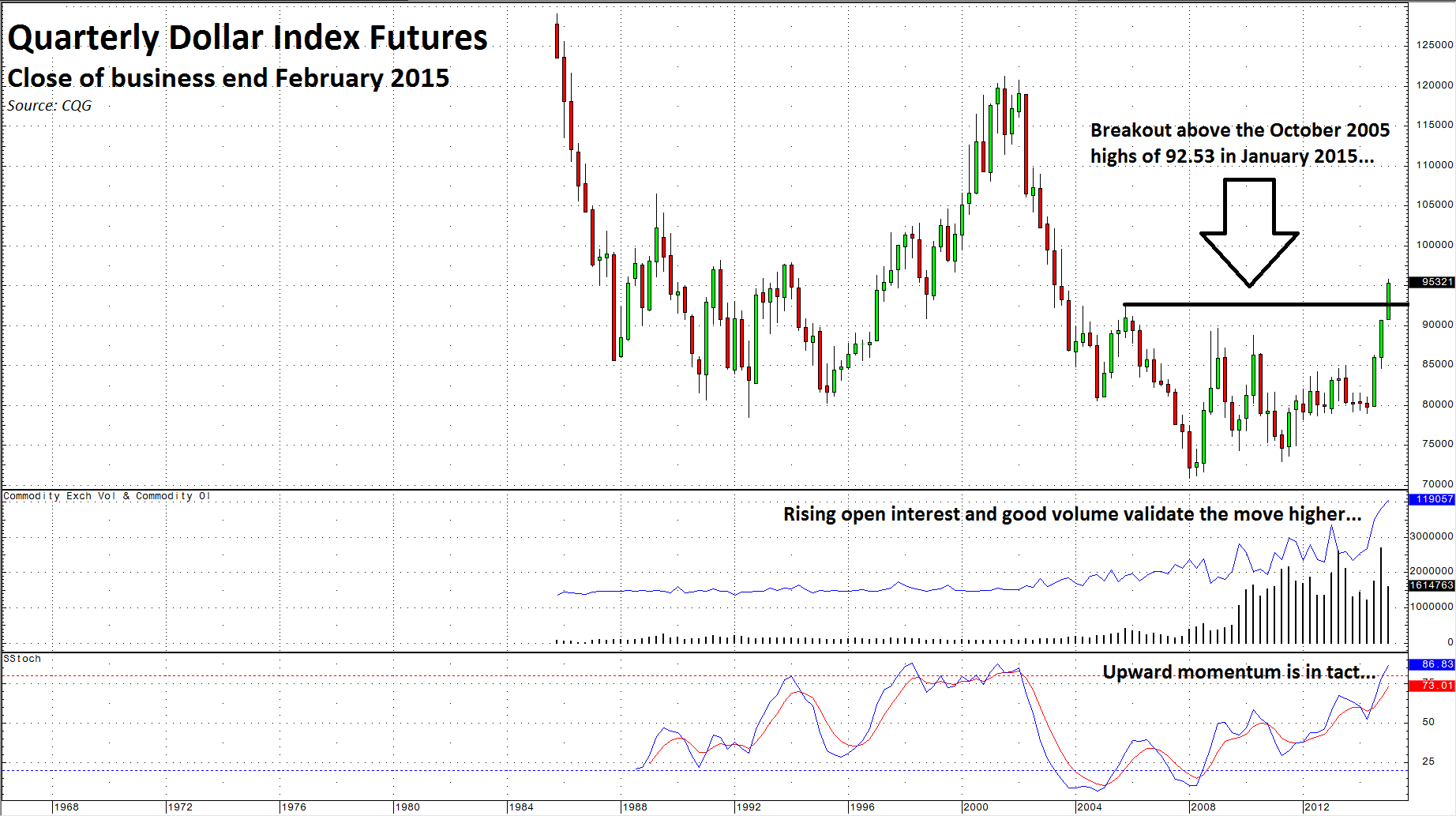

The bull market in the dollar continues to power forward. The US dollar index was up 11.97% in 2014. So far this year the greenback is up another 5.16%. The dollar is one of the strongest markets… more

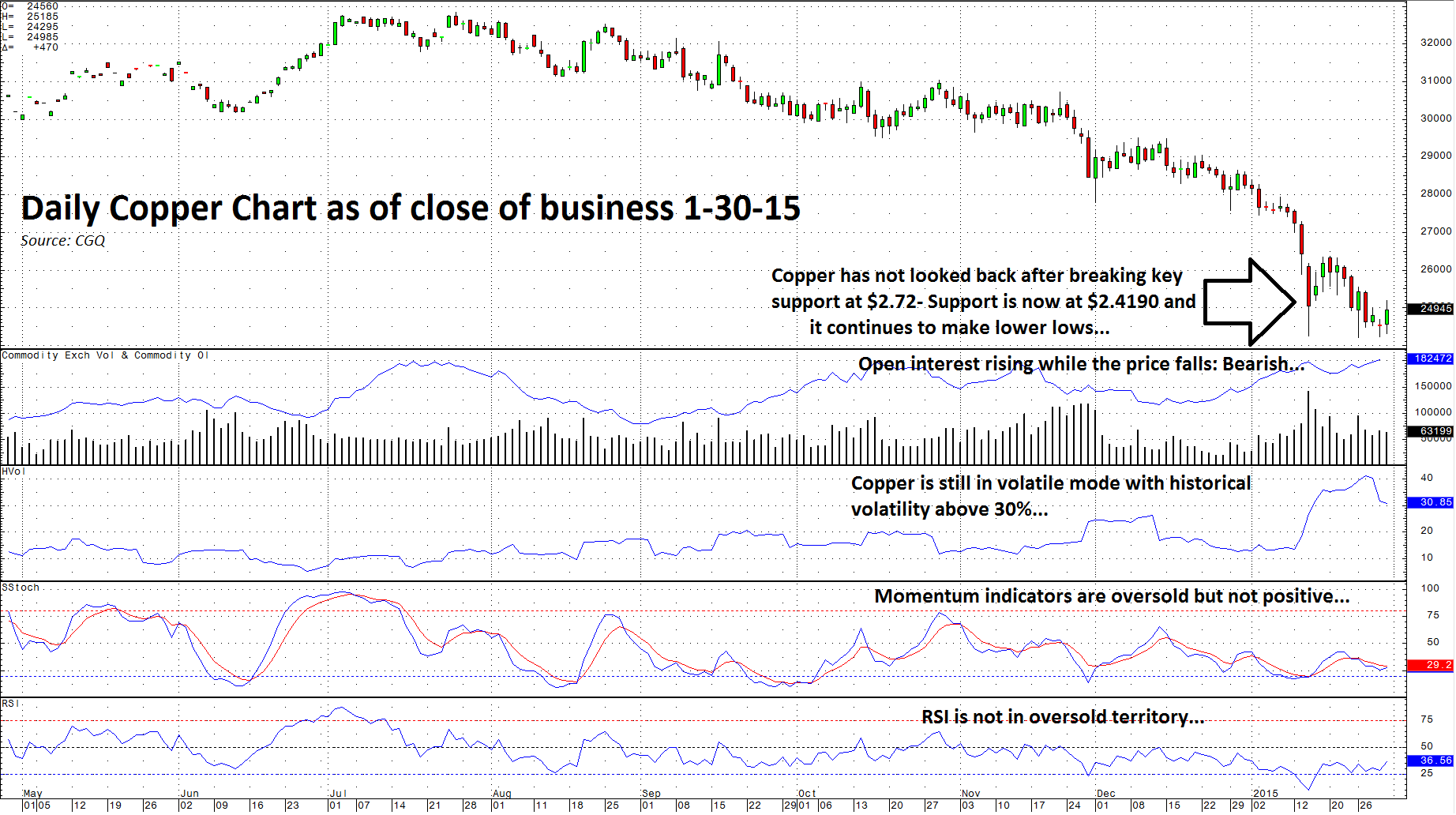

Commodity prices continue to be in a bear market. Industrial raw material prices have plunged over recent months. The price of crude oil halved since June. Iron ore prices have plummeted, and… more

In my January 13 article, A Look at the Copper Market, I wrote, "...the support level at $2.72 may become more and more distant in the market's rearview mirror." Since the day I made that… more

Today's Lows are Tomorrow's Highs

Copper fell 15.78% on COMEX and 14.59% on the London Metal Exchange in 2014. Copper has been making lower highs and lower lows since July 2014. The copper… more