Commodity prices continue to be in a bear market. Industrial raw material prices have plunged over recent months. The price of crude oil halved since June. Iron ore prices have plummeted, and recently the price of copper dropped below long-term support. Last week the Baltic Shipping Index fell to the lowest level since 1986.

Global interest rates are at very low levels as Central Banks seek to stimulate economies that are suffering from a global economic slowdown. Europe recently announced a policy of quantitative easing: the European Central Bank will purchase 60 billion Euros of sovereign debt each month out to September 2016. The program can be extended, if need be. The Euro Zone suffers from deflationary pressures as the economies of member nations have slowed and there have been few signs of growth. The Euro Zone economy is also suffering from sanctions on Russia, which is traditionally an important trading partner for the region.

Meanwhile, China, which is the world's largest consumer of commodities, has seen its economy slow. Growth in 2014 was 7.4%, which was below government targets of 7.5%. The Chinese government has been talking about a "new normal" of slower but consistent and sustainable growth. The stagnant growth in Europe and China has contributed to weaker commodity prices, but one economy in the world is growing and the strength of its currency could be the most bearish factor for many commodity prices.

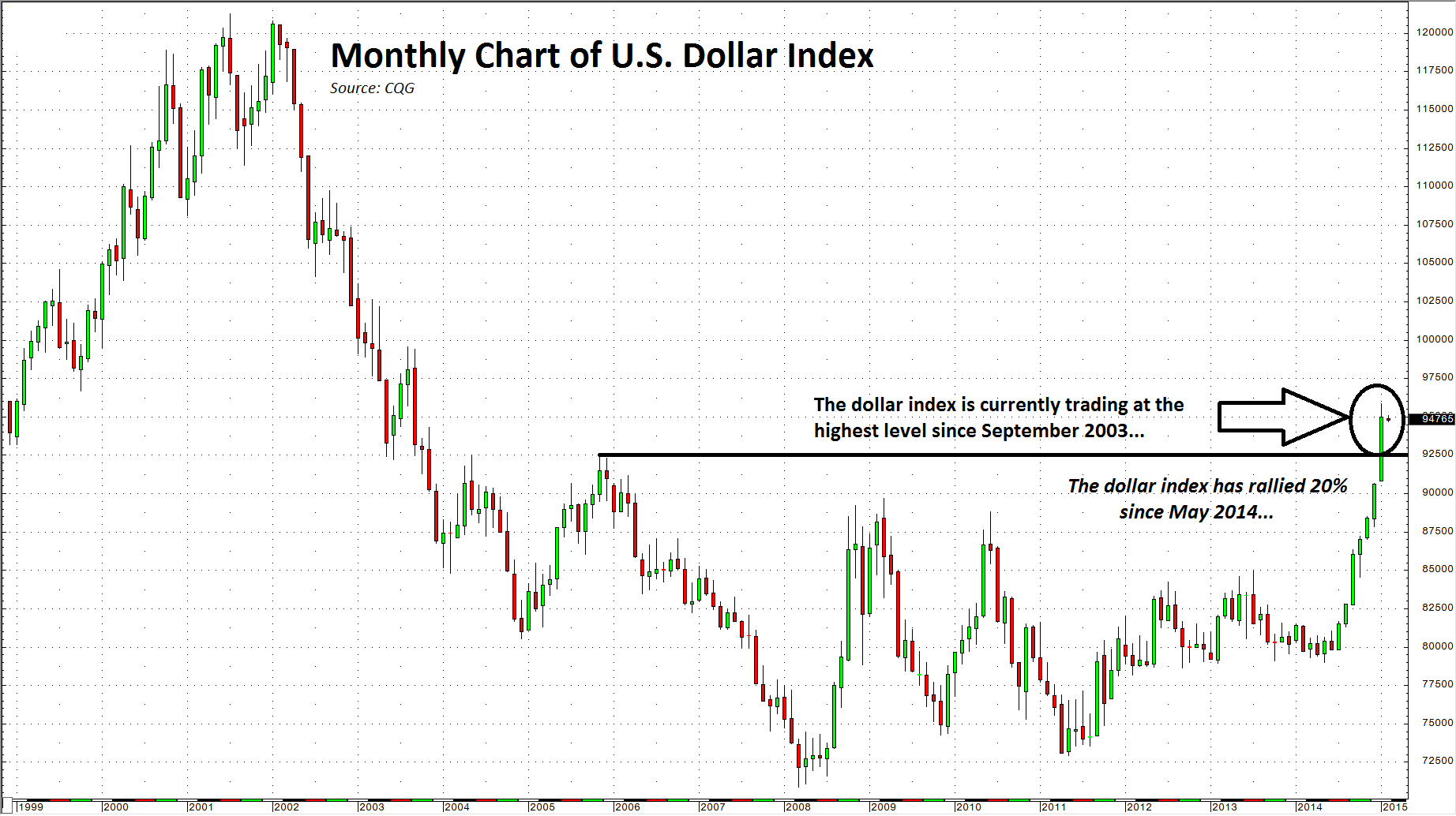

Growth in the US has been strong. The US dollar has been rallying sharply for almost nine months.

The broad-based rally in the US currency has taken the US dollar index 20% higher since May 2014. In January, it broke above long-term technical resistance at 92.53 - the November 2005 highs. The dollar has been strong against the weakening Euro, but it has also been strong against every major currency. Historically, there is an inverse relationship between the dollar and commodity prices. The technical strength of the dollar remains strong and fundamentals support higher levels in the greenback for the future.

While industrial commodities are moving lower, there is divergence in one commodity sector. So far, in 2015 both gold and silver prices have been strong. Gold is currently trading at $1280 per ounce, which is 8.1% higher than where it closed 2014. Gold was down 4.4% last year so it has already appreciated more than it was down in 2014. Silver is currently at the $17.25 level, which is 10.6% higher than its closing price in 2014. Silver was down almost 23% last year. Gold and silver have rallied this year even as the dollar continues to move higher. This divergence is the result of two major factors: First, low interest rates lower the cost of carry for the precious metals. Low interest rates make gold and silver attractive stores of value relative to paper currencies. Second, the combination of a rising dollar, deflationary pressures in the global economy, and terrorist concerns are causing volatility across many assets classes. Gold and silver have benefited from a flight to quality as market volatility has increased.

While I do not believe we are in for the kind of appreciation in gold and silver that we saw a number of years ago, I do believe that the current divergence is signaling volatility ahead for all markets. 2015 is shaping up to be a year for trading, not investing. Volatility equals opportunity, and all signs are that the rest of the year will yield great opportunities for nimble traders across many asset classes. Futures markets, where leverage is greatest, could make a comeback as volatility brings increasing volume and more market participants.