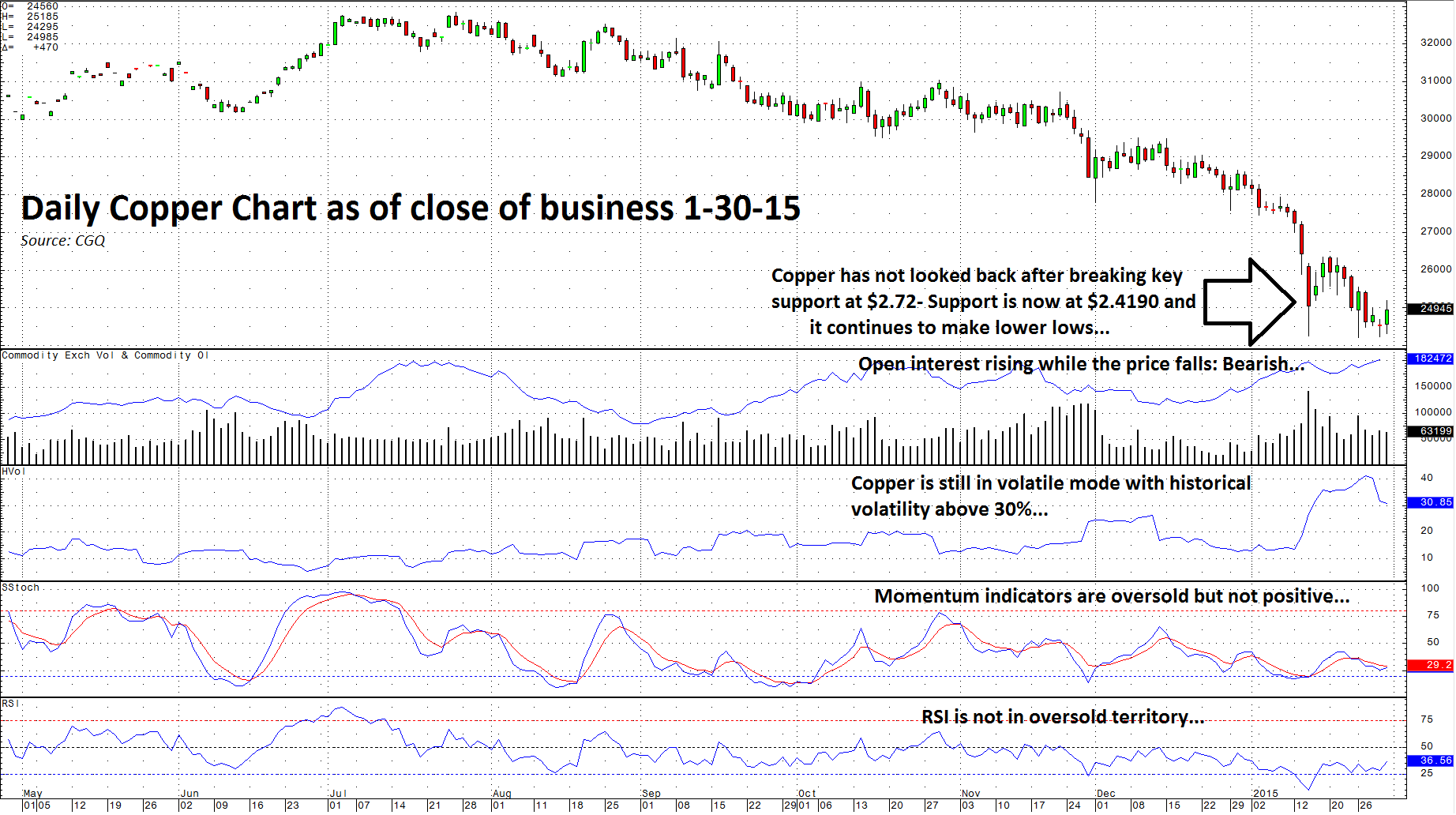

In my January 13 article, A Look at the Copper Market, I wrote, "...the support level at $2.72 may become more and more distant in the market's rearview mirror." Since the day I made that statement, the red metal has had a rough time.

Lower Lows Continue

The technical break was a continuation of lower lows for copper. Since July, the price of copper has moved considerably lower, and now it stands way below the $2.72 level, which is now technical resistance.

As the daily chart indicates, copper has moved down to lows of $2.4190 per pound where short-term support now stands. March copper futures closed on Friday, January 30 at $2.4985 - down over 8% since support was broken and 11.6% so far in 2015. Momentum indicators remain bearish, as does relative strength. In addition, open interest has been rising while the price falls. This is another bearish technical clue.

Low Interest Rates and Deflation

Copper is one of the most economically sensitive commodities. Copper is one of the key building blocks for infrastructure; therefore, its price reflects global economic growth. While low interest rates are generally supportive for commodity prices, deflationary pressures are not. We have witnessed what deflationary pressures have done to other commodity prices like crude oil and iron ore.

Copper is just the latest shoe to drop. Many market participants look to China for clues about the future path of copper.

Chinese Growth is Not Supportive

Chinese growth in 2014 was below the government target of 7.5%. Moreover, there is still a great deal of the metal tied to financing deals in China. The lower the price of the red metal goes, the higher the chance that selling will come into the market from these financing arrangements. The metal is the collateral and lower prices may lead to margin calls.

Additionally, non-existent growth in Europe is not supportive for the price of copper. The global economic condition, excluding the United States, provides a negative picture for the commodity.

The Future Outlook

I have watched the price of copper for decades. It was only in 2005 that the price broke above the $1.61 per pound level. For many years, back in the 1980s and 1990s, copper traded in a range between 80 cents and $1. Given fears of deflation, a bear market in industrial commodities, and a slowdown in China, the prospects for the price of copper would appear to be negative. Therefore, the recent break of support may just be the first leg down of a much larger move.