In this article we take a look at two examples where trades are placed on or around significant lines. The first idea is to change the classic daily pivot lines into intraday pivot lines and trade… more

CQG PAC Files

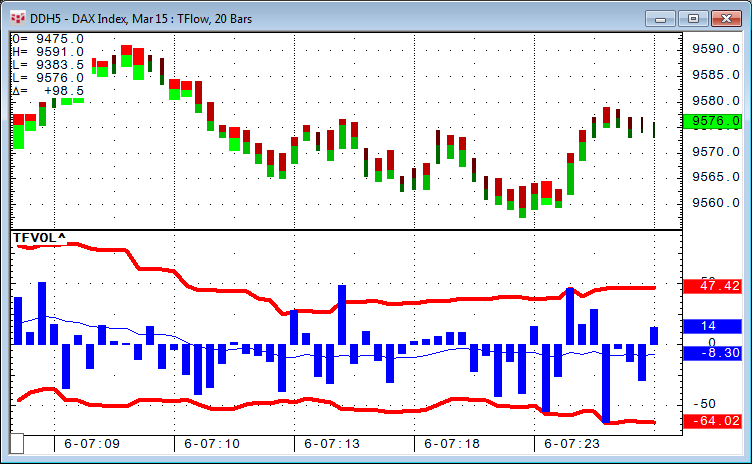

Recently, we had a request to show, in real time, how many contracts are available on the buy and sell side in the order book. This can be accomplished with a very simple study: DOM Ask Volume (… more

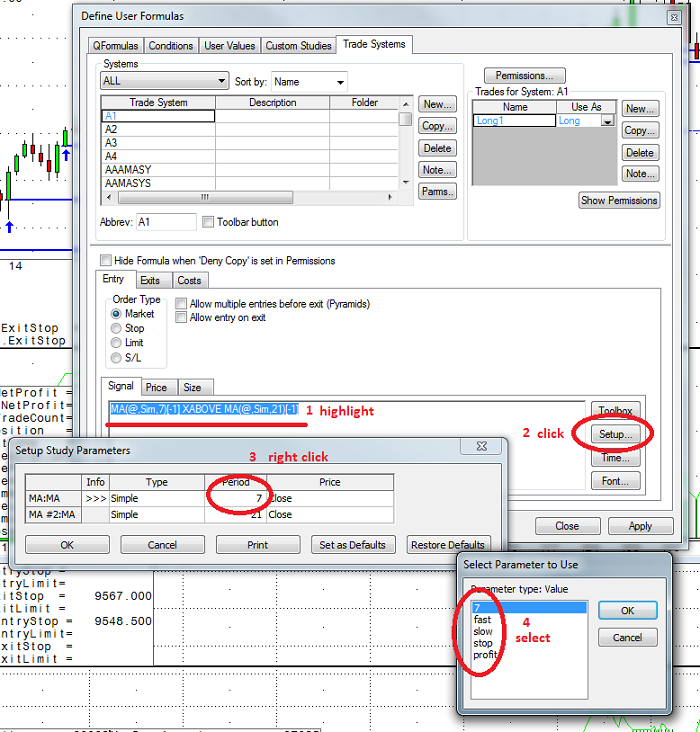

CQG's Formula Builder Toolbox gives you the ability to use parameters (variables) inside your CQG code in order to control studies, conditions, and trade systems externally without the need to… more

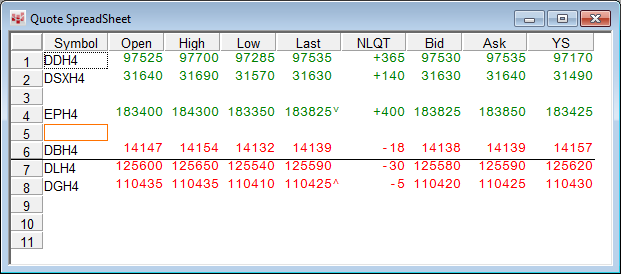

This component pac provides an overview of global market activity across multiple asset classes, grouped in separate Portfolio Monitor windows. Columns are intuitively color-coded to identify both… more

Powered by CQG FX, this Microsoft Excel® dashboard measures volatility by using the difference between the upper and lower Bollinger Bands and dividing the difference by the Moving Average. The… more

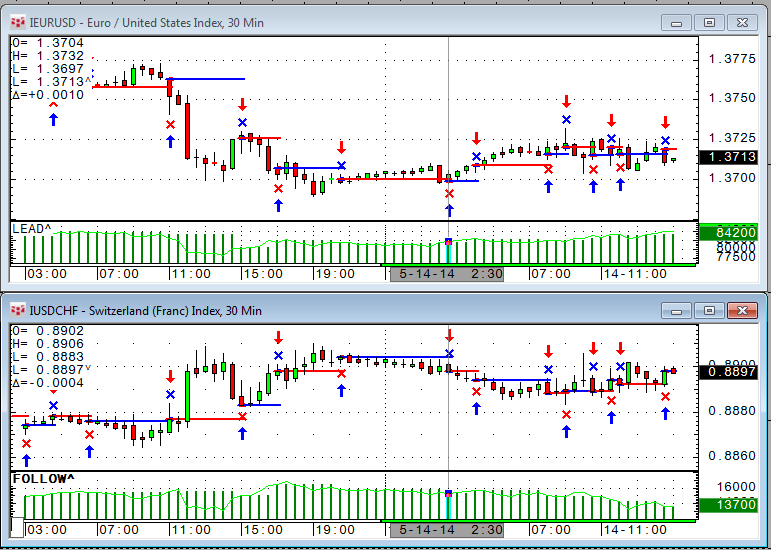

One of the questions we received recently was if it is possible to trigger a trade in a certain market based on another trading system trading a different market. The answer is yes. Here is how to… more

We are getting a lot of questions about CQG parameters (Parms). In CQG, parameters are used for everything that needs to be controlled from the user interface and only Parms can be optimized.… more

This Microsoft Excel dashboard measures volatility by using the difference between the upper and lower Bollinger Bands and dividing the difference by the Moving Average. The dashboard then sorts… more

This Microsoft Excel dashboard is used to track the performance of a collection of Exchange-Traded Funds (ETFs).

The market information displayed is the last price, net change, the… more