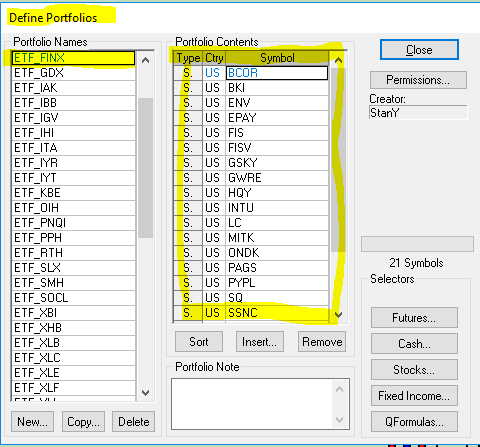

The pac files available below for download represent equity sectors. ;Each sector is composed of specific Exchange Traded Funds (ETF). Each EFT contains a portfolio of the individual equities that… more

CQG PAC Files

The Average True Range (ATR) study takes the moving average of the true range over the specified period.

Definitions:

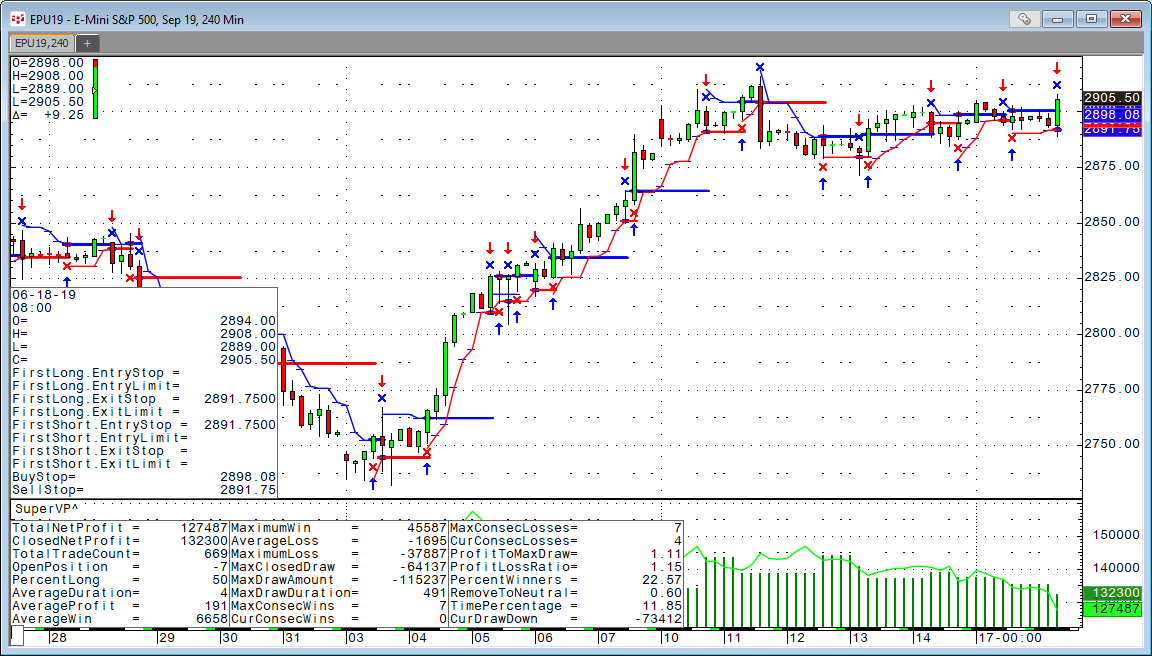

True Range = True High - True Low True High = The greater of the… moreHere are two more trading systems based on the Super Template that were recently created on a customers demand.

The idea is to have a few standard trading systems that have many… more

For this post we are looking at Larry Williams Ultimate Oscillator and the Marc Chaikin Oscillator.

Developed by Larry Williams the Ultimate Oscillator is a momentum oscillator designed to… more

Related: Using the Super Template

The idea is to have a few standard trading systems that have many customizable exits already built in:

EOD - End Of Day will exit any position… moreThis is a collection of frequently requested studies, which are not part of CQG’S standard offering. These studies are open source and detailed descriptions can be easily found on the internet.… more

Updated July 24, 2025

Bring Updating Time-Series Data from Microsoft Excel® Into CQGThe XL Real-Time study is included in CQGIC subscriptions enabled for CQG Trading, or Spreader, as well as… more

This Microsoft Excel® dashboard presents two charts of the Nasdaq-100 futures contract and market data for the one hundred stocks that are constituents of the Nasdaq 100 Index.

… moreCQG customers who create their own custom studies can easily use RTD to pull custom study values into Excel.

There are only two unique requirements in the RTD formula for a custom study:… more

Here is a special version of the Volume-Weighted Average Price (VWAP) study including standard deviation bands.

VWAP is the volume-weighted average price for a futures contract… more