If you build your own indicators, you may have been stuck feeding your own calculation back into a study parameter. The CQG front-end does not allow this directly, but we have a smart workaround… more

CQG PAC Files

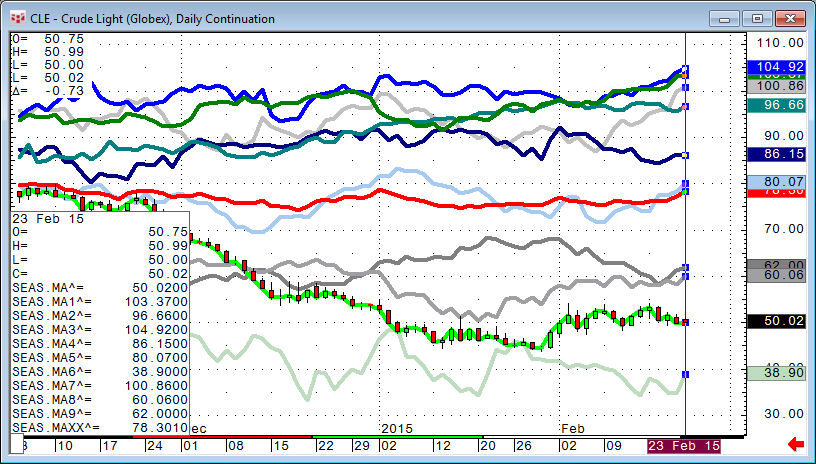

The Guppy is an indicator used in technical analysis to identify changing trends. The technique is based on combining two groups of moving averages with differing time periods.

One set of… more

Sometimes it is not necessary to write a complex trading system when you want to accomplish something minor in the trading environment. For example, CQG provides built-in trailing stop… more

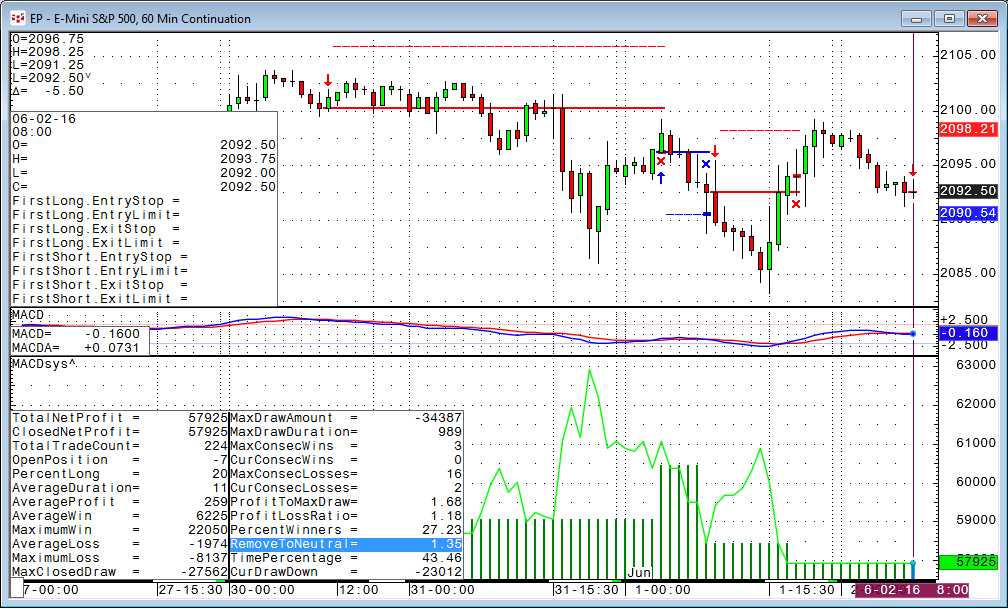

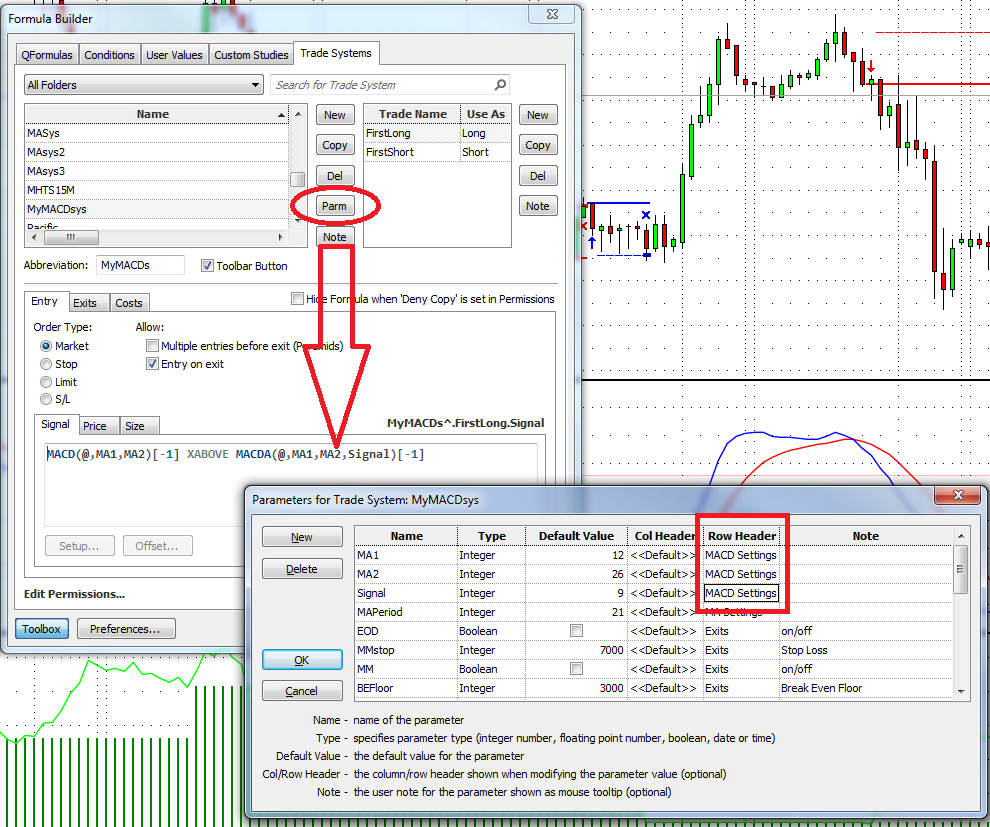

In my last blog post we turned the Super Template AMA trading system into a new trading system using MACD with a few steps. At first glance it seemed to be a losing system, but after we applied a… more

This Microsoft Excel® spreadsheet presents two views of the E-mini S&P contract. The left-hand view displays candlestick bars using CQG’s proprietary TFlow chart data. You can use the… more

This is a quick-start guide to building your own trading system based on the Super Template. The Super Template comes pre-installed with CQG Integrated Client. As a basic example, we will create a… more

CQG provides the ability to separate volume into trades executed at the best bid price and trades executed at the best ask price. This feature gives you more insight into market action because you… more

Quite some while ago I showed, in a very simple way, how to overlay 2011, 2012, 2013, and 2014 data in one chart. I created two very simple code snippets to accomplish that.

This time, I… more

A couple of months ago we looked into CQG's built-in Divergence Index and how to use it.

Following up on this topic, I want to show a much simpler approach using the Formula Toolbox.

… moreOne of the theories behind Market Profile®* is the opening trading range. This is the high and the low from the first hour of trading. We want to create a trading system around that and use the… more