The switch from my haven of Futures and Fx, to the world on USA equities and ETF's to run a Hedge Fund, presented a new set of challenges. My world had moved from 80 instruments to focus on to… more

Shaun Downey

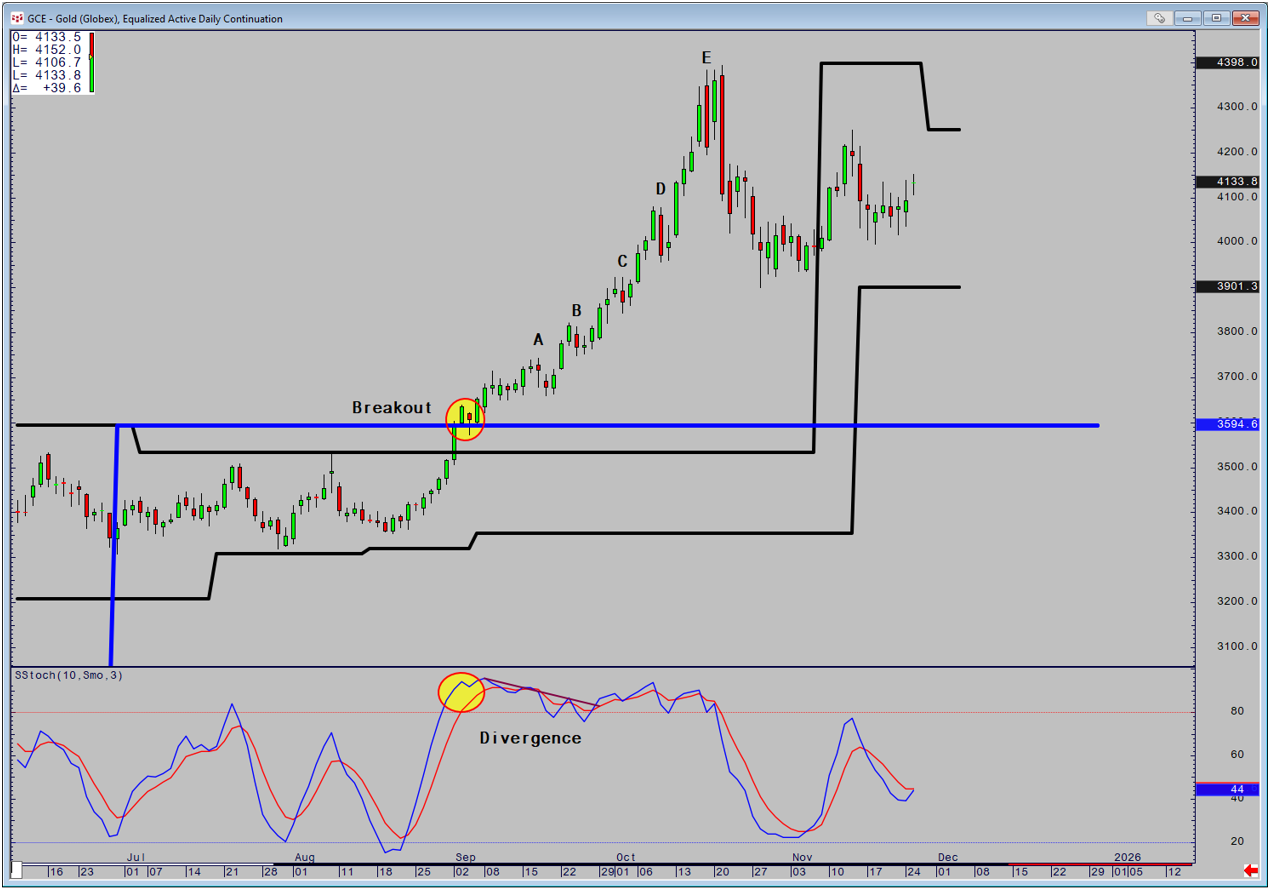

Traditionally, divergence is quantified by taking the relationship between the high in an uptrend and low in a downtrend and… more

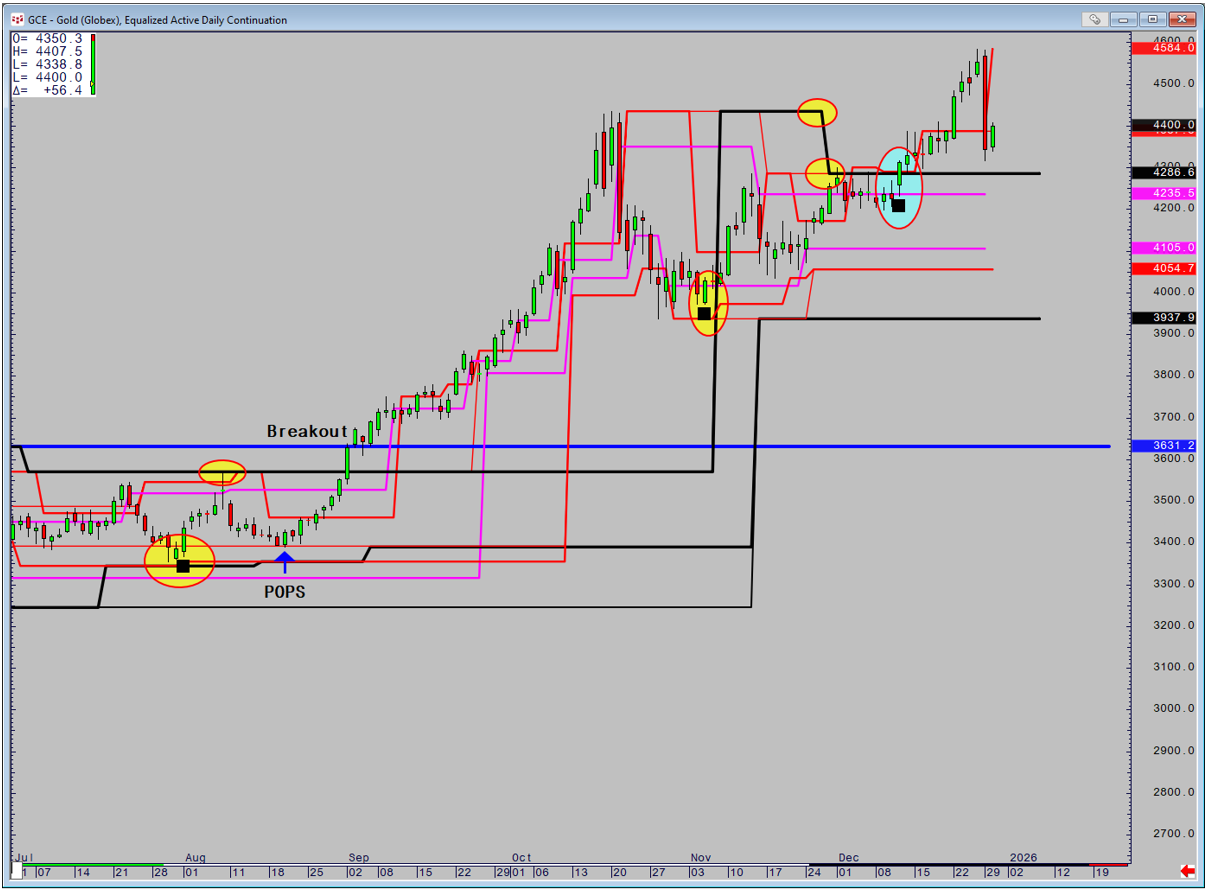

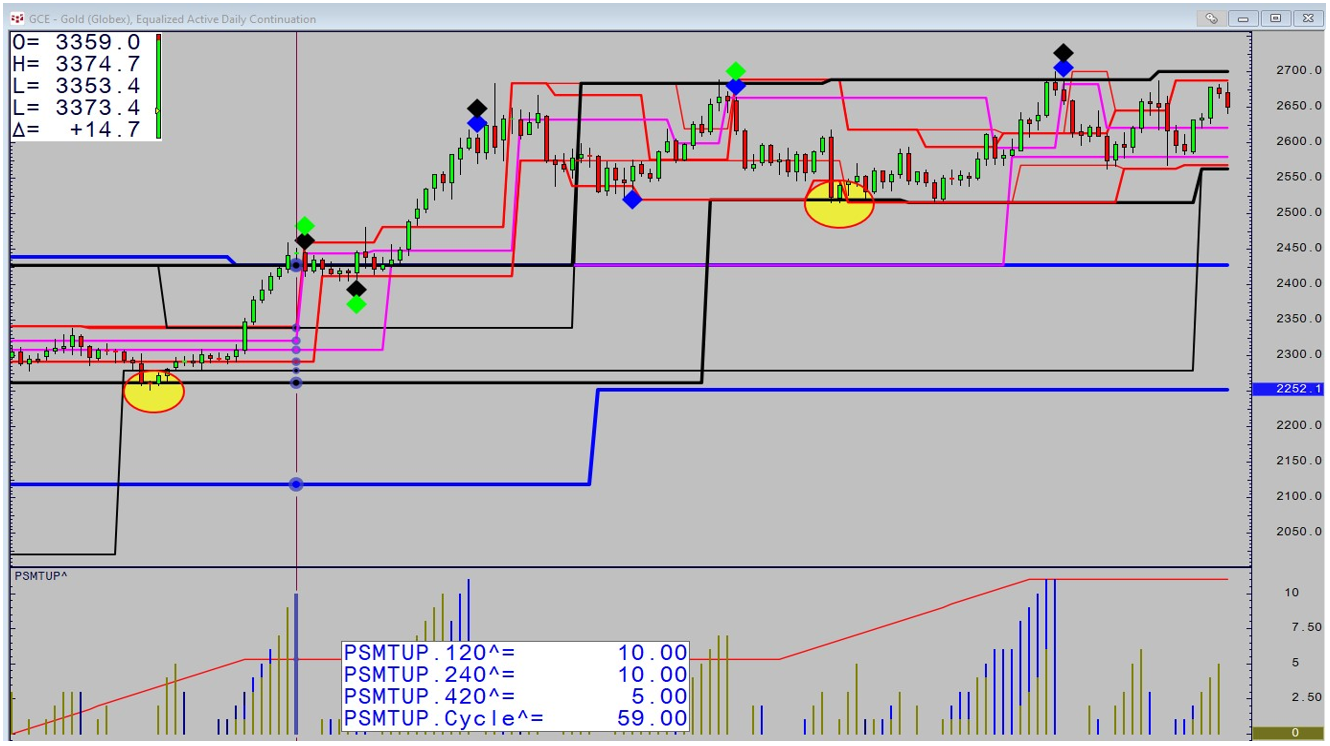

Whilst POPS (Price makes a nine-bar high, or low and the RSI makes a three-bar high or low) and UFO (Price makes a 9 Bar high… more

Divergence can be likened to being able to see an eel in clear water. It's highly visible but try picking it up and holding on.… more

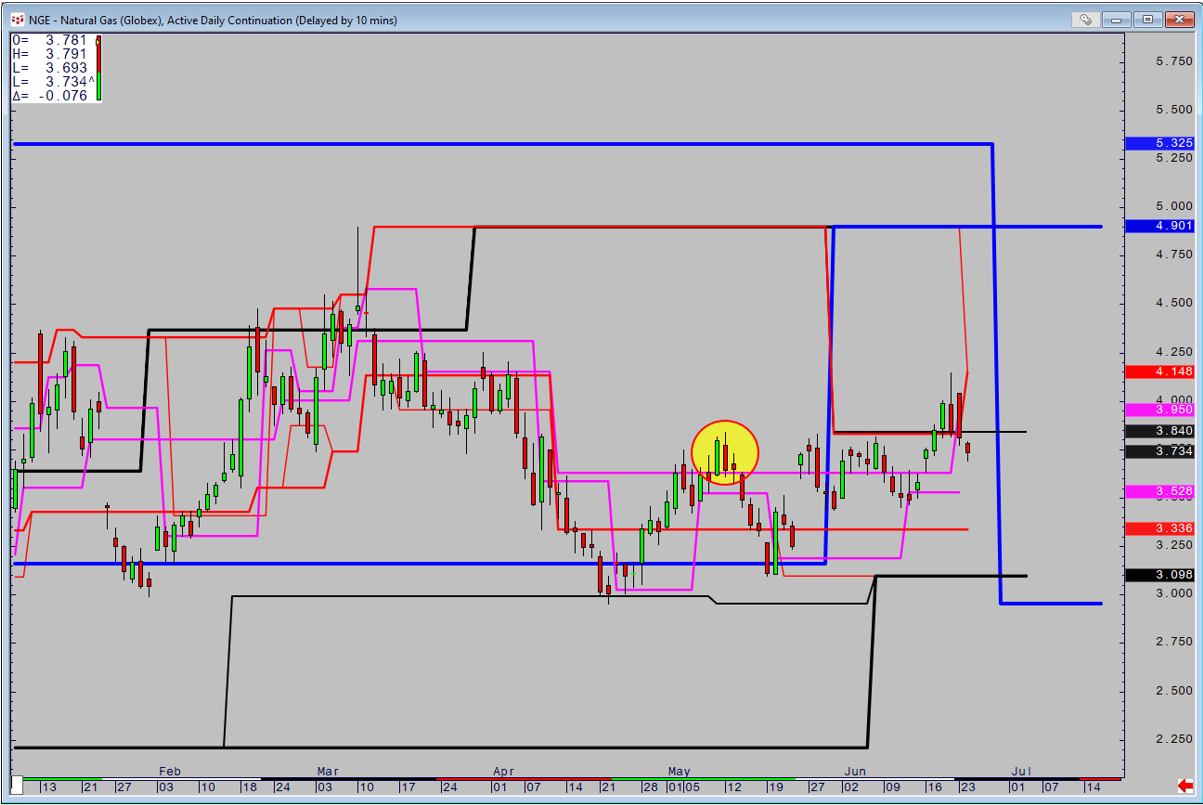

The average range for each bar's time of day is computed over a user-defined period. For example, on a 30-minute chart, the 12 p.m. bar has its range calculated over the last n days.… more

Volatility Time Bands looks at each specific time of day to previous days (22 days) and then places 1,2 and 3 standard deviations on the opening price around that average of range. This maintains… more

Chapter 3 of Trading Time called Concepts of Time, is for me the most important chapter of the book. It was the quantum leap in my thinking up to that point and was the first examples of the… more

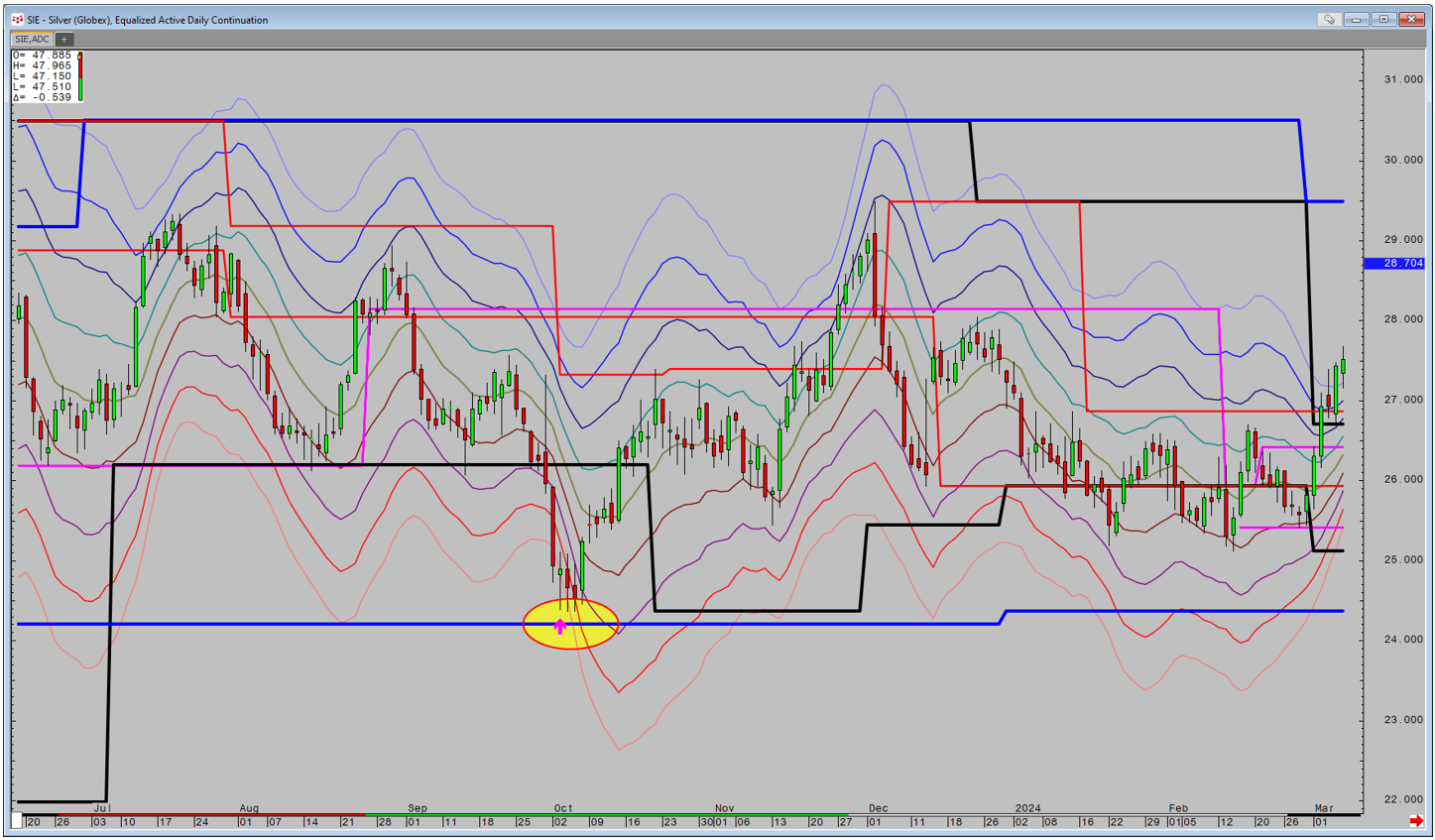

Range Deviation Pivots represent one of the core studies as part of the Fourth-Dimension suite. The calculation differs from standard Pivot theory in that they compute the range over the last 22… more

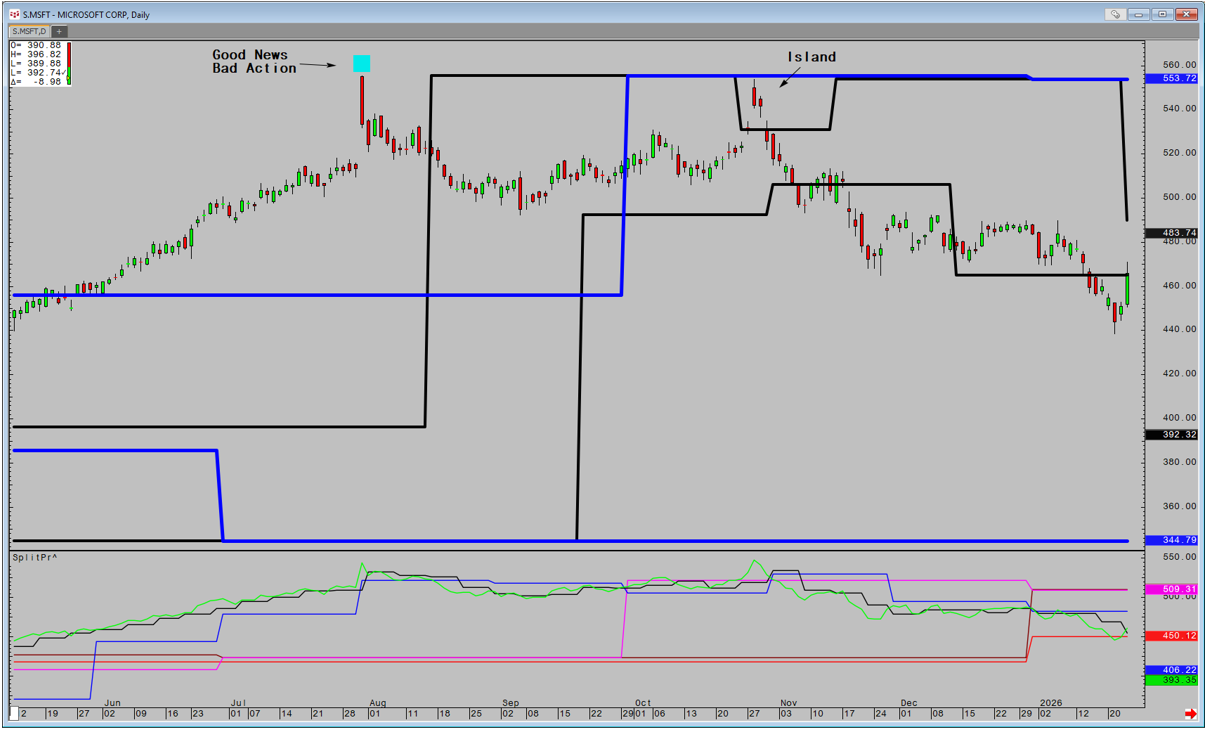

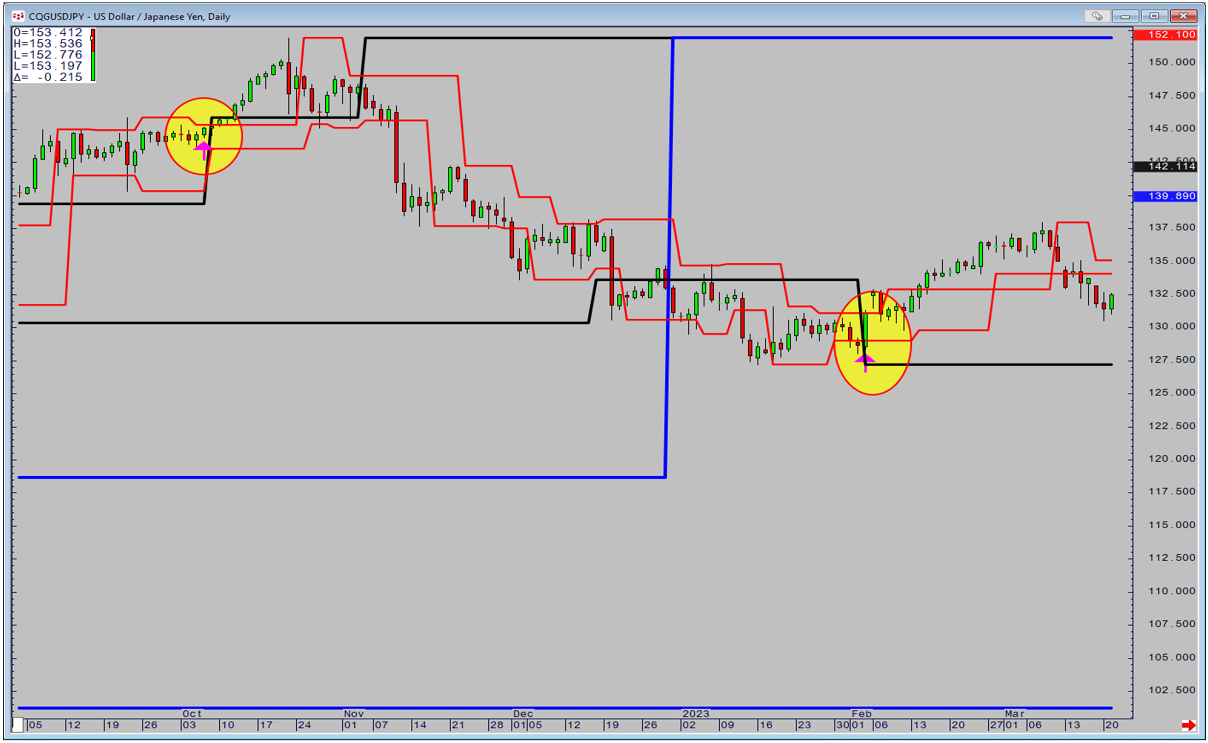

Whilst there a multitude of ways of analyzing markets the Fourth Dimension has one core philosophy that makes it unique. Namely, the creation of multiple timeframe analysis on one chart and the… more

When we step back for a moment to see what price action is telling us in the higher time frames, the fractal nature of markets is revealed and a much clearer picture can be garnered as to what may… more