The first month of 2021 was eventful. Bitcoin rose to a new all-time high. Digital currency is a rejection of government control of the money supply. The US swore in a new President. Many policies from the last administration are changing from executive orders and new legislation on the horizon. Last week, the stock market went wild as a herd of buyers ran in those holding short positions in GameStop. The stock that was trading below $10 per share in 2020 reached almost $500 this week.

Meanwhile, other than some of the stocks with substantial short interest, the market declined. The VIX volatility index surges from the 20-level to over 33 at the end of January. There are signs of more than a little bubblicious activity in markets across all asset classes.

Silver could be the next market that attracts more than its share of speculative activity. Silver tends to move more than gold on a percentage basis. In 2020, the price fell to its lowest level since 2009, when it traded to $11.74 in March. By July, only four short months later, silver exploded to a seven-year high and rose to a peak of $29.915 per ounce.

Silver broke out above its 2016 high and critical technical resistance level of $21.095. While the precious metal corrected since nearly reaching, it has not challenged the former resistance, which is now technical support. The action in GameStop during the final week of January could be a sign that silver could be the next target for a herd of traders and investors looking to hit critical inflection points that lead to monstrous price volatility on the upside.

Wild action in GME shares - A stampede tramples some hedge funds

GameStop shares had traded below $10 from April 2019 through September 2020. The stock got as low as $2.57 in March 2020 when risk-off conditions hit the overall stock market.

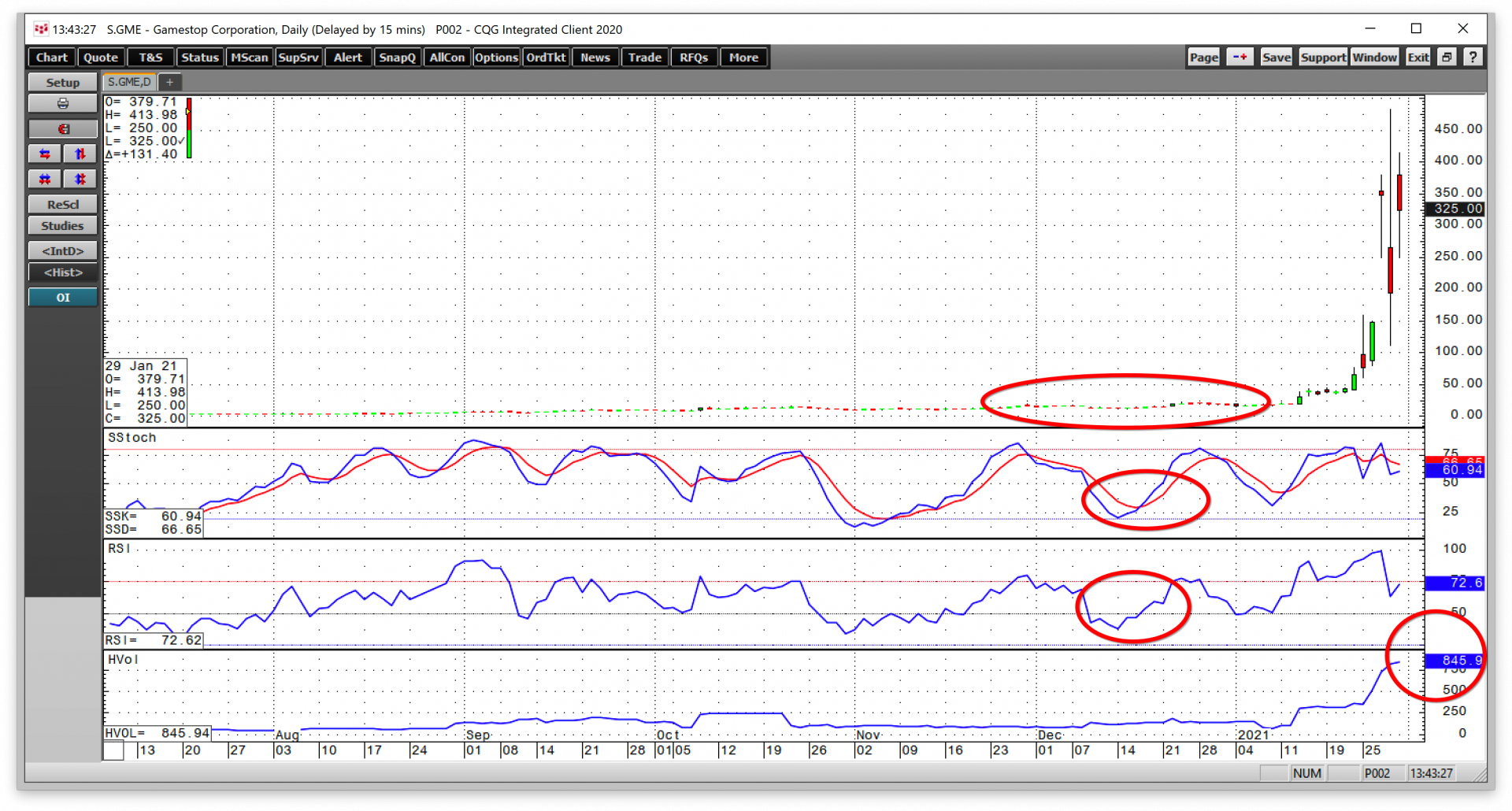

As the daily chart highlights, GME shares moved above $14 in late November. The price momentum indicator and relative strength index crossed higher in mid-December, sending a bullish technical signal.

Massive short interest in GME shares sent the stock flying on the upside. As shorts scrambled to cover, it rose to a high of $483 on January 28. In the pre-market, it traded above the $500 level. Option volatility went through the roof. At the end of January, the daily historic price variance metric was at an incredible 845.9%. Implied volatility on many options was even higher.

The rally in GME created financial carnage for shorts and a bonanza of profits for longs that cashed in on the price action. The event was another example of how markets tend to reach illogical, unreasonable, and irrational prices on the upside. In April 2020, expiring NYMEX crude oil futures reached a record low of negative $40.32 per barrel. The moves in GME shares and crude oil prove that irrational prices can come on the up or downside in markets.

Markets continue to teach that attempting to pick tops or bottoms is a fool’s game. All the fundamental analysis in the world can become useless when a trend takes on a life of its own.

Shorts have a new bullseye on their backs

In the aftermath of the latest events surrounding GameStop shares, other stocks and markets with significant actual or perceived short interest will be bullseyes. Traders and investors looking to replicate the GME experience will seek risk positions that cause others to scramble for an exit. GME was almost a textbook example of a ten standard deviation market event, a black swan, or whatever the market may decide is the right name. Meanwhile, it will encourage a new wave of “populist finance” that is likely to attempt to recreate the GME experience in other stocks and markets.

Silver’s long history as a highly speculative metal could make it a candidate for the herd over the coming days, weeks, and months. Moreover, many conspiracy theories surrounding silver supplies and risk positions at the leading financial institutions could make the metal a focal point for herd activity. In 1980, silver rose to a high of $50.36 per ounce. In 2011, it reached a lower peak of $49.82.

From a long-term technical perspective, silver is looking ripe for a substantial rally.

The annual chart illustrates that silver futures put in a bullish reversal in 2020 for the first time since trading began in 1971.

Silver is a market with more than a few conspiracy theories

Accounts of manipulation in the silver futures and OTC markets have been around for years, if not decades. The first significant manipulative move came in 1980, when governments, leading financial institutions, and the COMEX exchange changed the rules on the Hunt Brothers and imposed a liquidation only rule in the silver futures market. Ironically, the so-called “elite” in the markets manipulated the silver market against the Hunts. Meanwhile, the “elite” contended the Hunts were manipulating the metal’s price, causing it to rise to over $50 per ounce over four decades ago.

The silver market is rife with manipulation cases and fines on leading financial institutions and individual traders accused of price-fixing, spoofing, and other illegal actions. Moreover, more than a few analysts and market participants believe that there is not enough silver and gold to cover the slew of ETF and ETN products designed to replicate the price action.

The coming weeks and months could be a fascinating and volatile time for silver. Market participants may shift attention from GME and other stocks with high levels of short interest to the always volatile silver arena or silver-related derivative products and even mining shares.

The price action at the end of January is a sign that the herd is going after the silver market

Gold, the leader of the precious metal sector, fell from a settlement price of $1895.10 at the end of December 2020 to $1847.30 on January 29, 2021. Meanwhile, silver rose from $26.402 at the end of 2020 to $26.914 on the final trading day of the first month of 2021.

The levels to watch in the silver market are the 2020 continuous contract peak of $29.915, the highest price since 2013. Above there, the next level of long-term technical resistance stands at the 2012 highs of $35.445 and $37.48 per ounce. In 2011, silver reached $49.82, but the ultimate target is the 1980 $50.36 high.

If silver is going into GameStop mode, we could be in for a wild ride in the speculative metal.

Asset prices move higher when buyers become more aggressive than sellers. A herd of buyers that embrace “populist finance” could create a bullish storm in the silver market. Emboldened by the bullish stampede in GME shares, the next bullseye could be on silver, a metal with a long history of controversy, manipulation, and conspiracy.

GameStop and silver make strange bedfellows, but the precious metal fits a mold created by the recent action on GME shares. Silver moved over $29 per ounce as trading opened in February late Sunday.